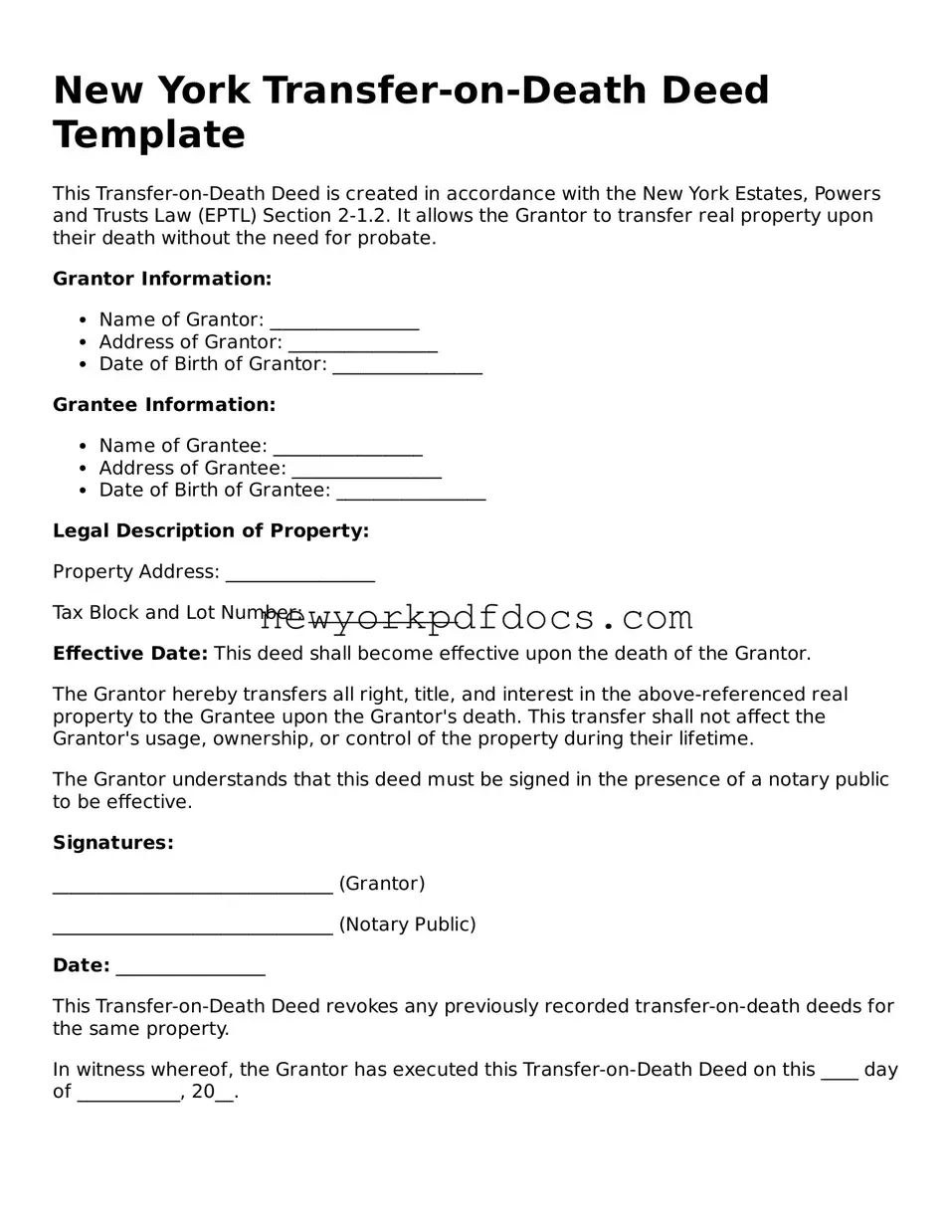

Valid Transfer-on-Death Deed Document for New York

The New York Transfer-on-Death Deed form allows property owners to transfer their real estate to designated beneficiaries upon their death, without the need for probate. This straightforward tool simplifies the estate planning process and ensures that assets are passed directly to loved ones. Understanding how to properly utilize this form can help avoid complications and delays in property transfer.

Open My Document Now

Valid Transfer-on-Death Deed Document for New York

Open My Document Now

Your form isn’t finalized yet

Edit, save, and download Transfer-on-Death Deed online with ease.

Open My Document Now

or

⇓ Transfer-on-Death Deed PDF