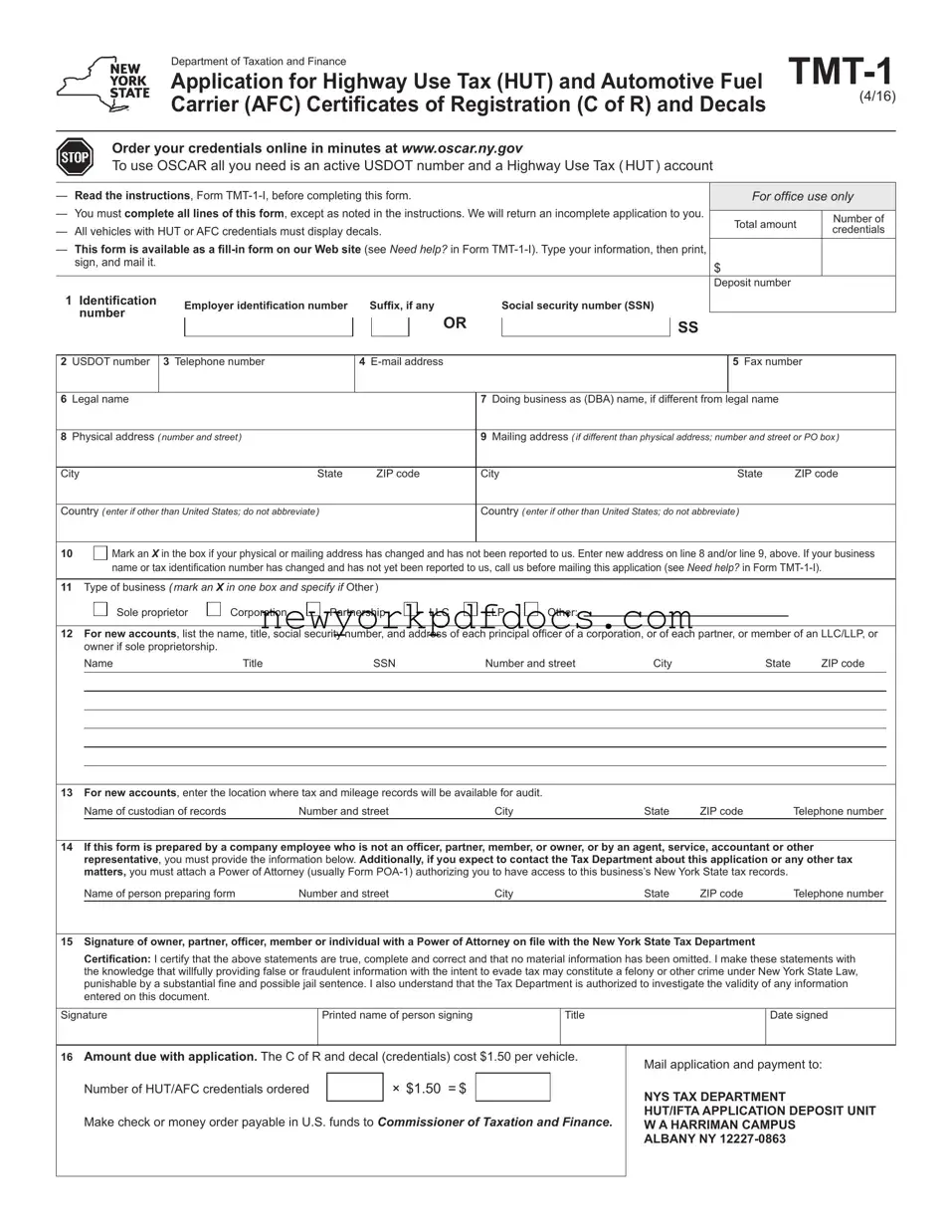

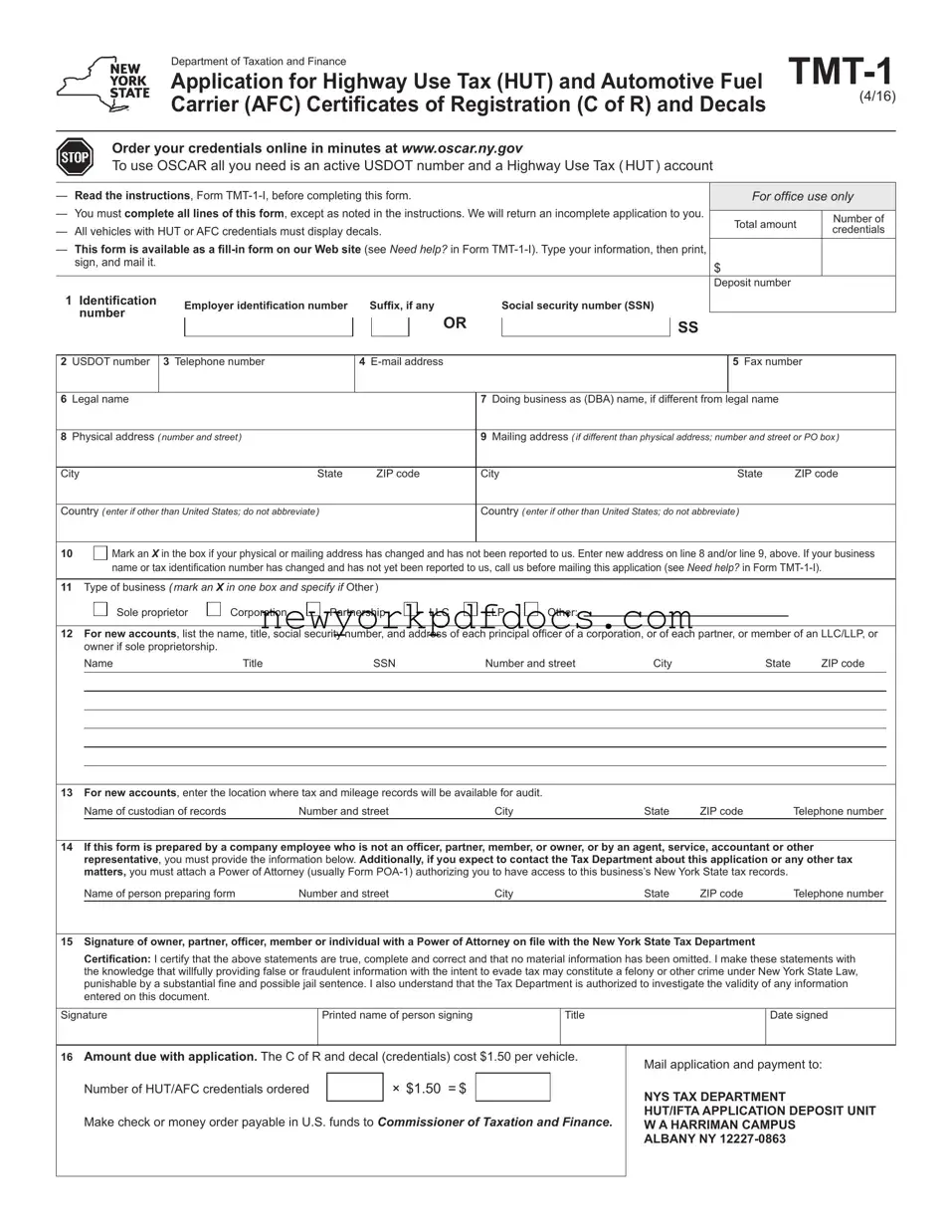

Filling out the TMT-1 form can be a straightforward process if you take your time and pay attention to detail. However, many individuals make common mistakes that can lead to delays or even rejection of their applications. Here are nine frequent errors to avoid.

First, many applicants forget to read the instructions provided in Form TMT-1-I. This document contains essential guidelines that help ensure the form is completed correctly. Skipping this step can lead to misunderstandings about what information is required.

Second, leaving sections of the form incomplete is another common mistake. The form clearly states that all lines must be filled out, except where indicated. If any part is left blank, the application will be returned, causing unnecessary delays.

Third, applicants often fail to provide accurate identification numbers. Whether it’s the Employer Identification Number (EIN) or the Social Security Number (SSN), any inaccuracies can create significant issues. Double-checking these numbers before submission is crucial.

Fourth, many people overlook the importance of updating their addresses. If your physical or mailing address has changed and is not reported, you risk complications. Always mark an X in the appropriate box if there has been a change and provide the new address as required.

Fifth, neglecting to specify the type of business can lead to confusion. The form requires you to mark the correct box for your business type. Failing to do so may result in the application being deemed incomplete.

Sixth, when listing vehicles, applicants sometimes forget to provide all necessary details. Each vehicle must be listed separately, and it is essential to include the correct vehicle identification number (VIN). Missing information can hinder the processing of your application.

Seventh, individuals often forget to sign the application. The signature serves as a certification that all provided information is true and complete. An unsigned form will not be processed, leading to further delays.

Eighth, applicants sometimes fail to calculate the total amount due accurately. The cost for credentials is $1.50 per vehicle, and any miscalculation can result in insufficient payment, which will also delay processing.

Ninth, lastly, many individuals do not attach a Power of Attorney when necessary. If someone other than the owner is preparing the form, this document is crucial for allowing access to tax records. Without it, the application may be rejected.

By avoiding these common pitfalls, you can streamline the process of obtaining your Highway Use Tax and Automotive Fuel Carrier credentials. Attention to detail and thoroughness will save you time and frustration.