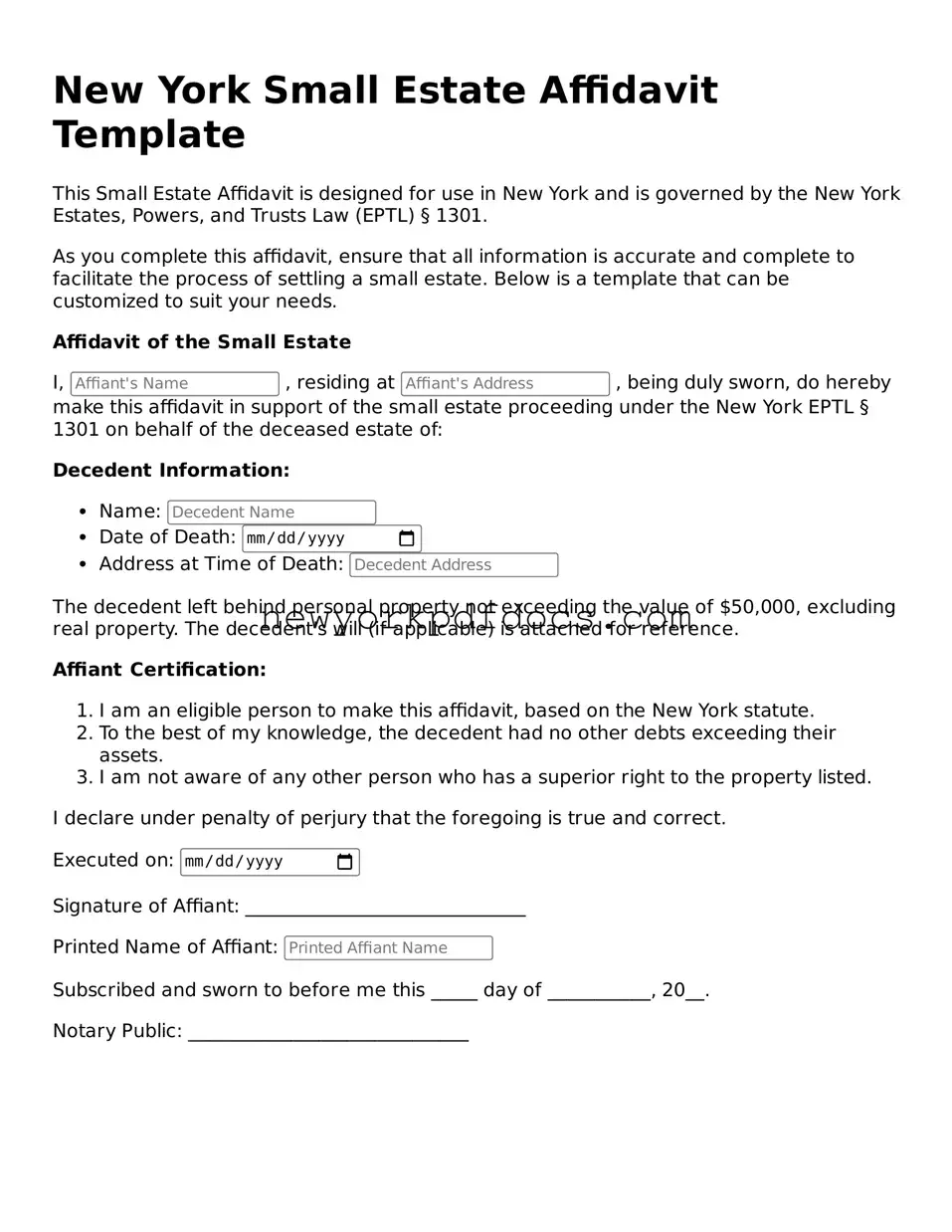

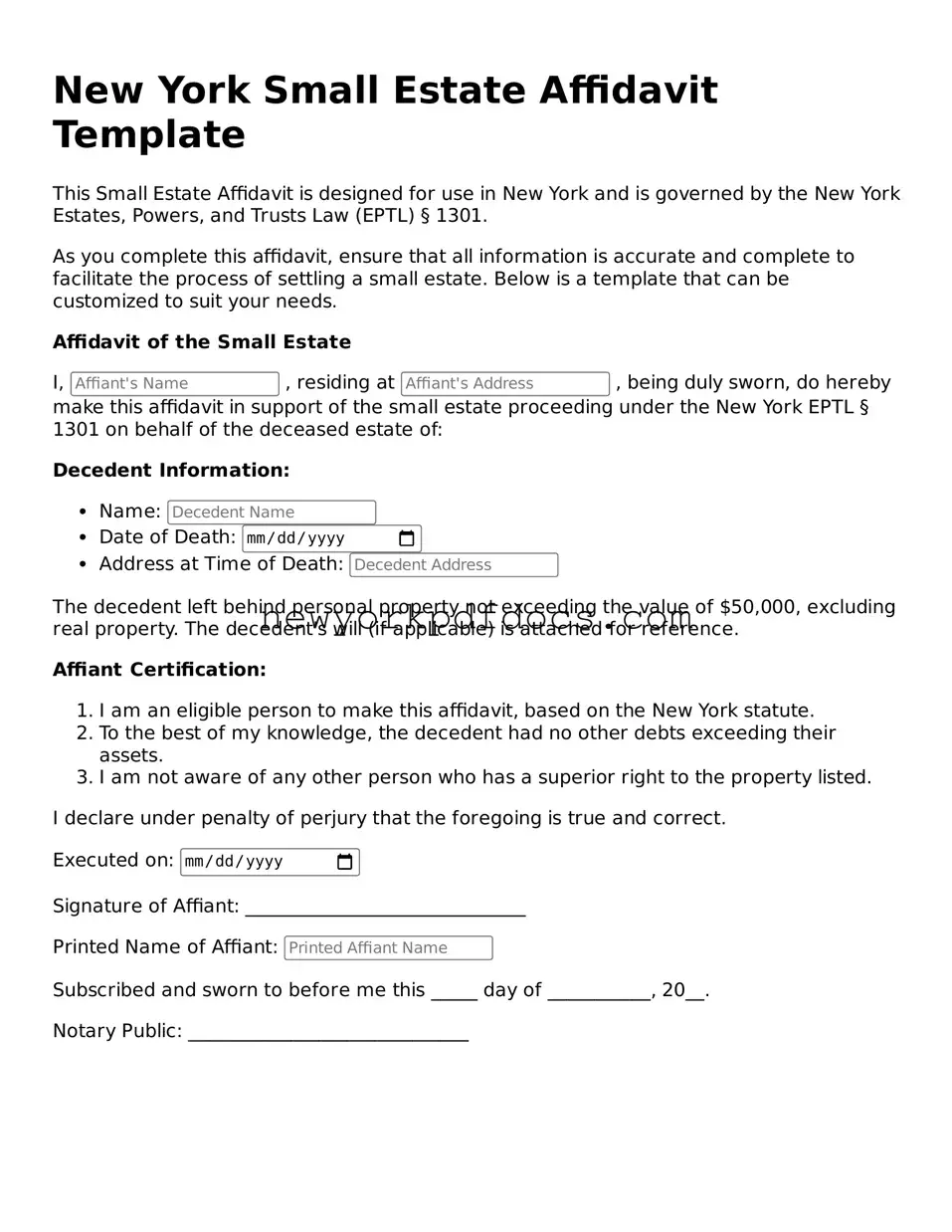

Valid Small Estate Affidavit Document for New York

The New York Small Estate Affidavit is a legal document that allows individuals to claim assets of a deceased person without going through the lengthy probate process. This form is particularly useful for estates that are valued below a certain threshold, making it easier for heirs to access their inheritance. Understanding how to properly use this affidavit can simplify the process of settling small estates in New York.

Open My Document Now

Valid Small Estate Affidavit Document for New York

Open My Document Now

Your form isn’t finalized yet

Edit, save, and download Small Estate Affidavit online with ease.

Open My Document Now

or

⇓ Small Estate Affidavit PDF