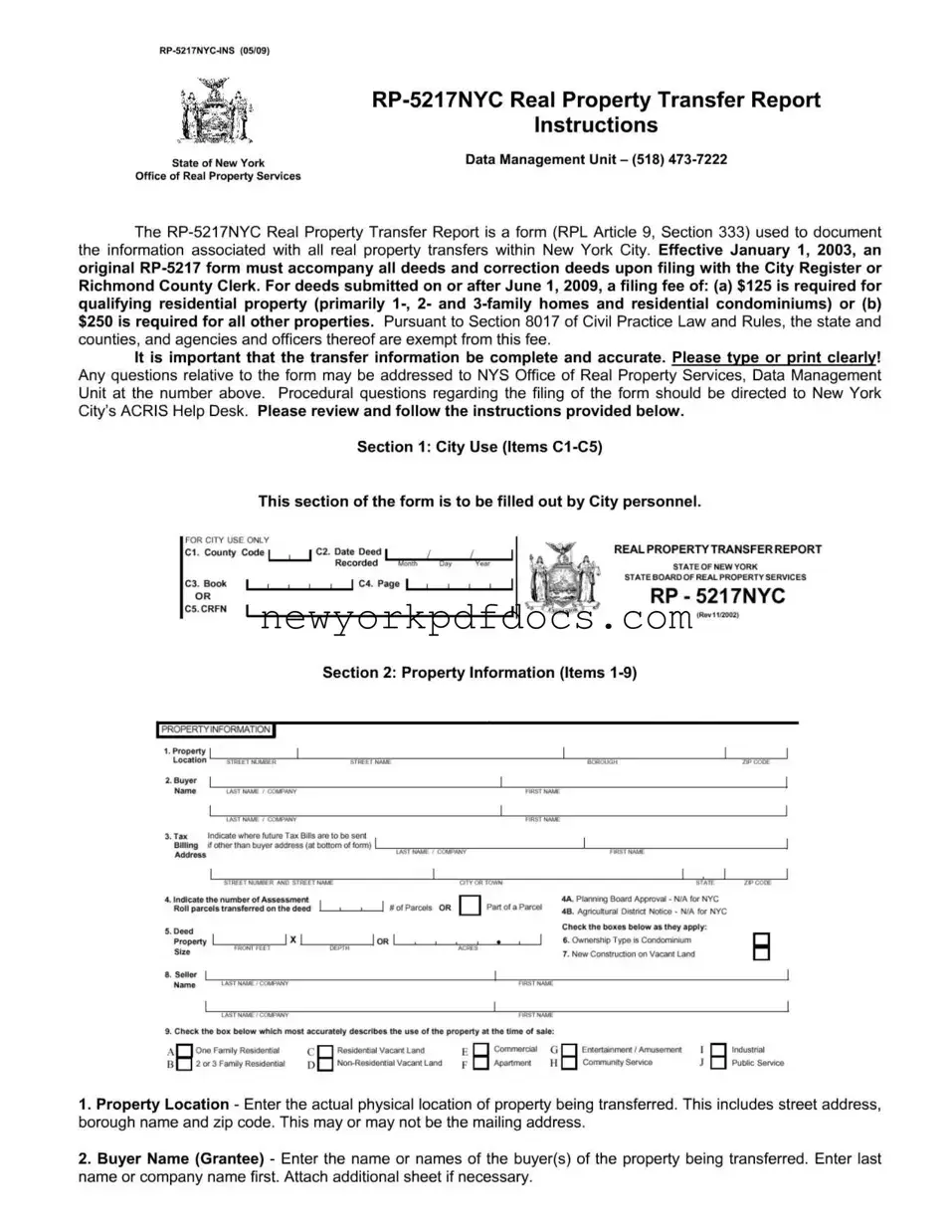

Filling out the RP-5217NYC form can be a straightforward process, but many people make common mistakes that can lead to delays or complications. One frequent error is failing to provide complete property information. It’s essential to include the full physical address, including the street name, borough, and zip code. Omitting any part of this information can create confusion and may result in the form being rejected.

Another mistake often made involves the buyer and seller names. It’s important to list the last name or company name first, followed by the first name. If there are multiple buyers or sellers, attaching an additional sheet with their names is necessary. Forgetting to do this can lead to incomplete documentation and potential issues down the line.

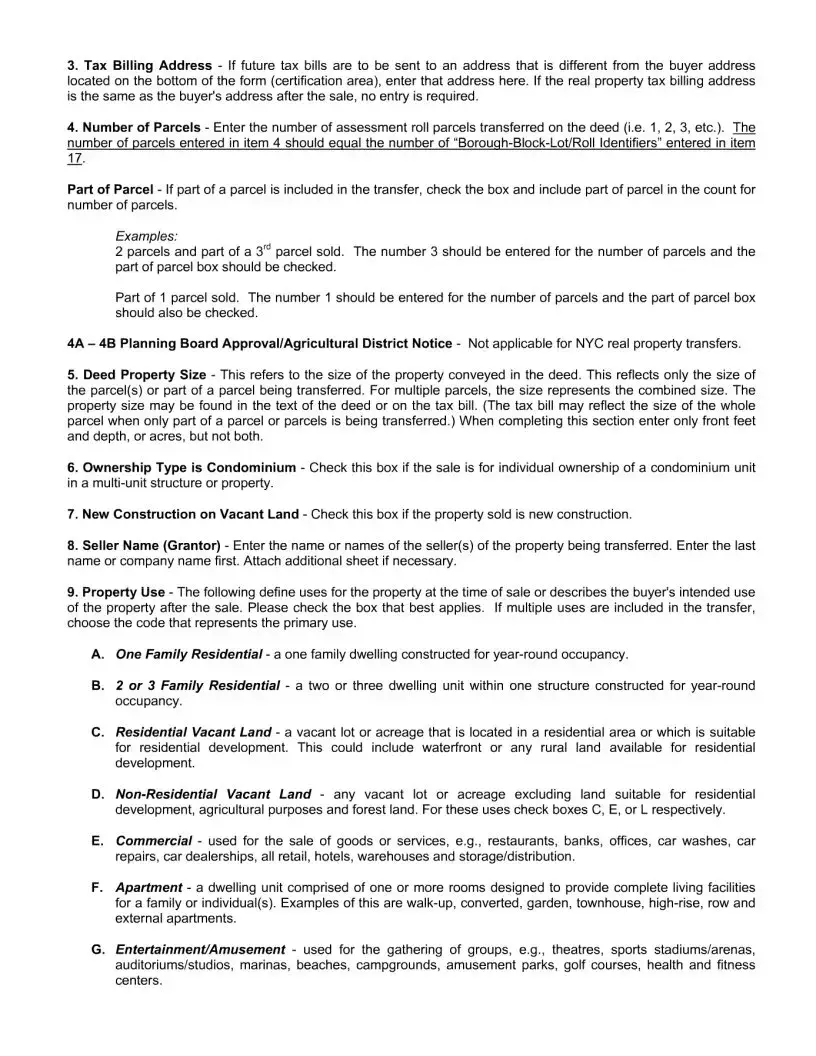

People sometimes overlook the tax billing address as well. If future tax bills are to be sent to a different address than the buyer’s, it must be clearly indicated on the form. Neglecting to specify this can result in tax bills being sent to the wrong location, which can create headaches for all parties involved.

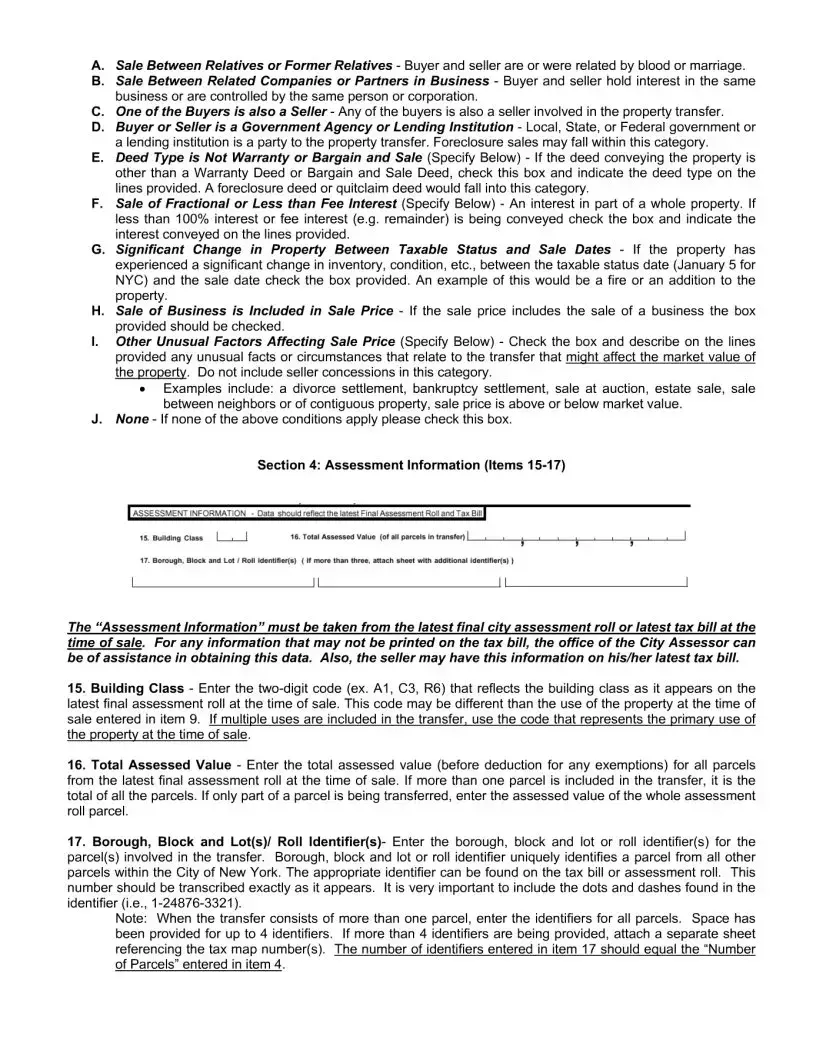

Additionally, many individuals fail to accurately count the number of parcels being transferred. The number entered in the form should match the “Borough-Block-Lot/Roll Identifiers” provided later in the document. If the number of parcels does not align, it could raise questions during processing.

Another common error is related to the property size. When completing this section, it’s crucial to enter only front feet and depth, or acres, but not both. This can lead to confusion regarding the size of the property being transferred, which may cause issues with the transaction.

Furthermore, individuals often forget to check the appropriate boxes for ownership type and property use. If the property is a condominium or new construction, these boxes must be checked. Failing to do so may lead to misunderstandings about the nature of the property being transferred.

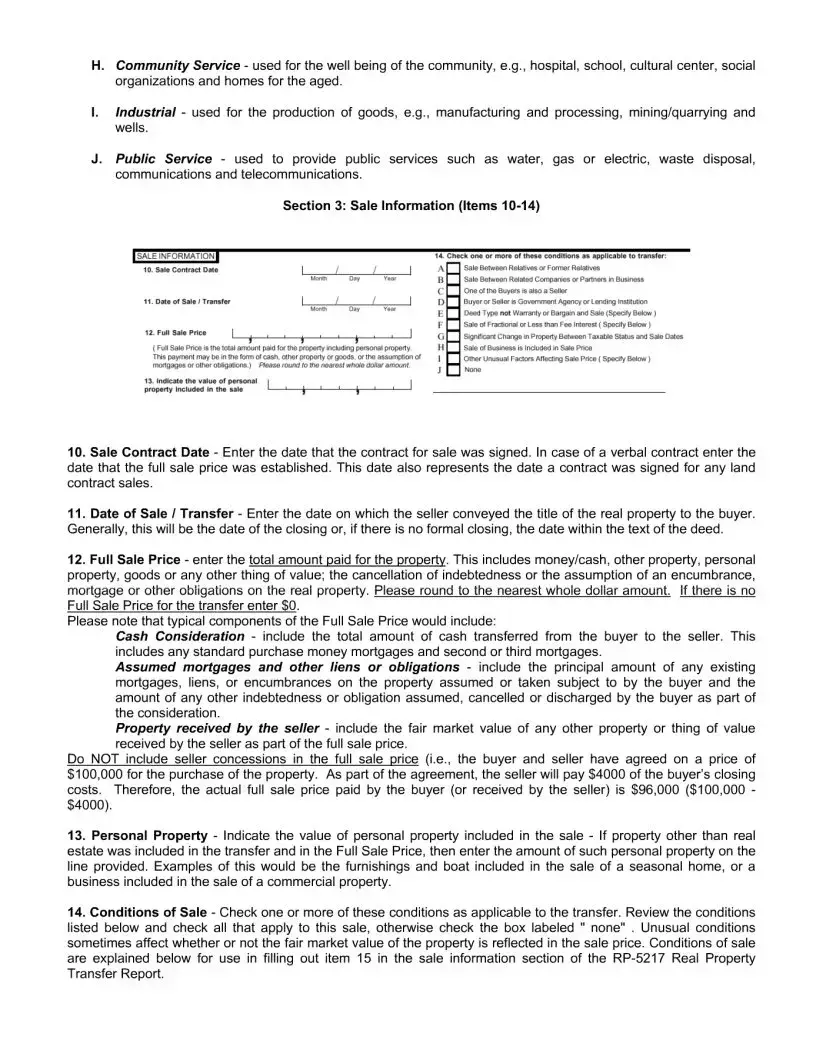

People also tend to skip over the sale information section. It’s vital to provide the sale contract date and check any applicable conditions regarding the transfer. This information helps clarify the nature of the transaction and can prevent complications during the filing process.

Lastly, not reviewing the entire form before submission can lead to minor errors that could have been easily corrected. Taking a moment to double-check all entries ensures that the form is complete and accurate, which can save time and effort in the long run.