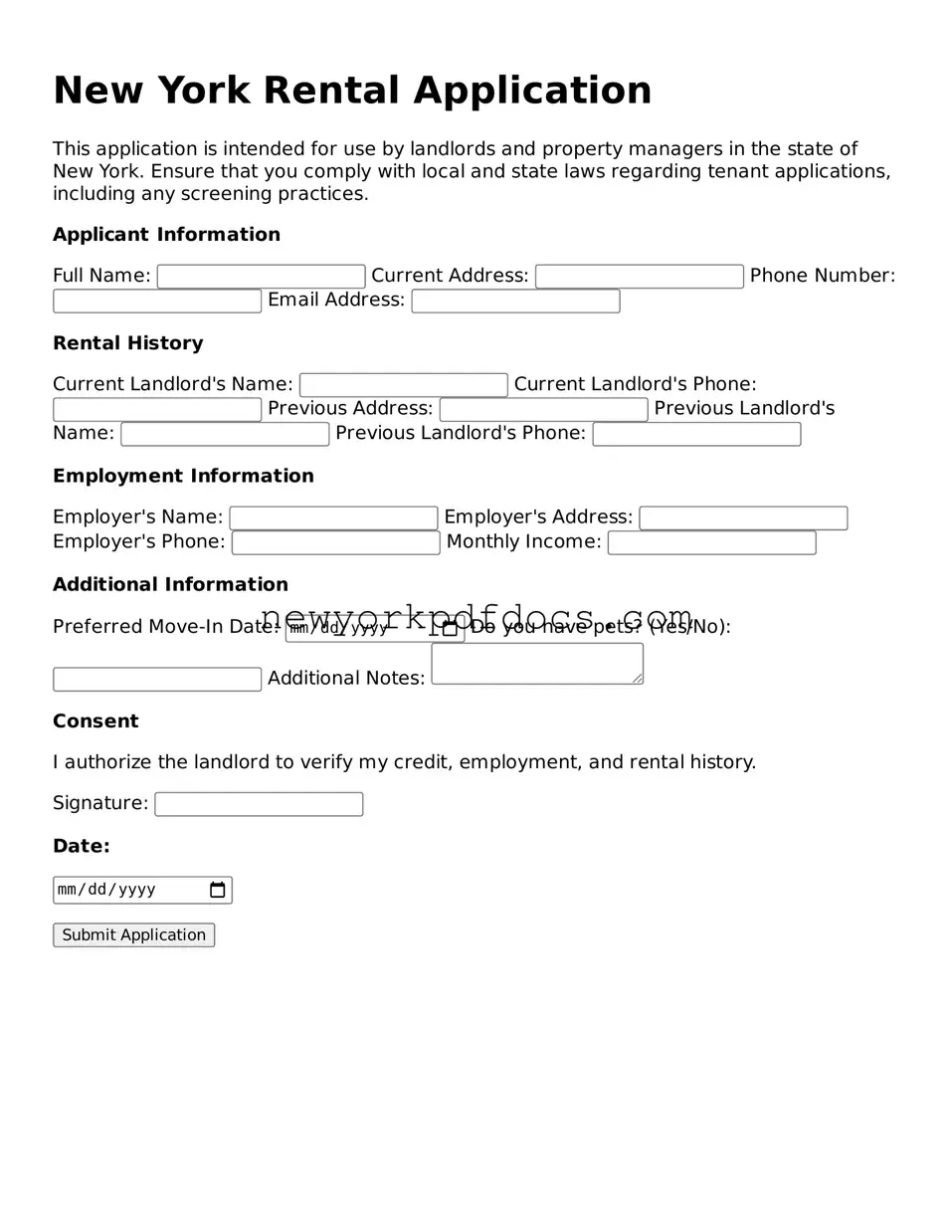

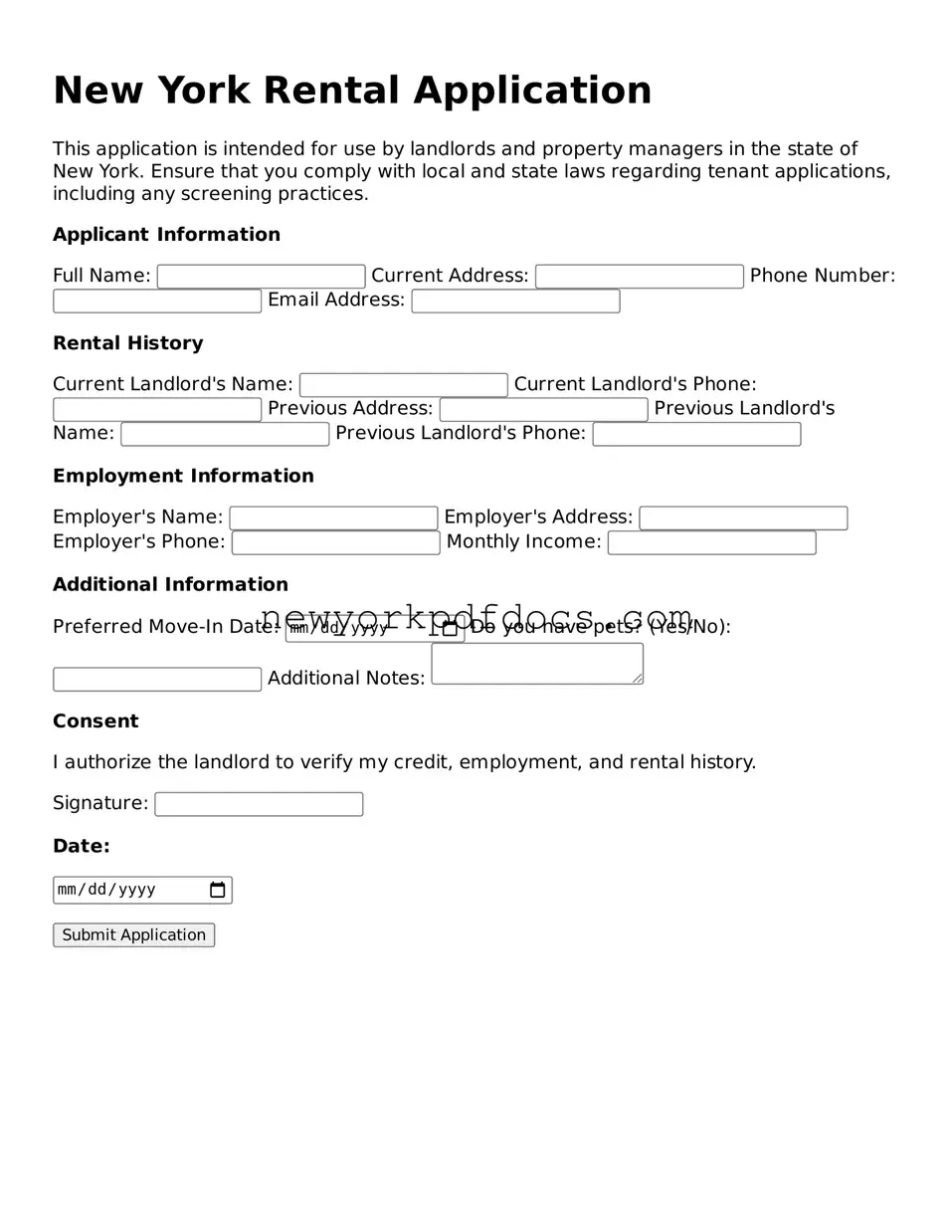

Filling out a New York Rental Application can be a straightforward process, but many applicants make common mistakes that can hinder their chances of securing a rental. One frequent error is providing incomplete information. Landlords often look for detailed information about your employment history, rental history, and personal references. Omitting any of these details can raise red flags for landlords, making them hesitant to move forward with your application.

Another mistake involves inaccuracies in the provided information. Applicants sometimes misstate their income or employment status. It’s crucial to ensure that all figures are accurate and reflect your current situation. Misrepresentation, even if unintentional, can lead to immediate disqualification from consideration.

Additionally, failing to disclose previous rental issues can be detrimental. If you have a history of eviction or late payments, it’s better to be upfront about it. Landlords appreciate honesty and may be willing to discuss your past circumstances rather than discovering them later through a background check.

Many applicants also neglect to check their credit reports before applying. A poor credit score can significantly impact your application. By reviewing your credit report in advance, you can address any discrepancies and be prepared to explain any negative marks to potential landlords.

Providing insufficient references is another common pitfall. Landlords typically want to hear from previous landlords or employers. Failing to include reliable references or providing outdated contact information can slow down the application process and create doubt about your reliability as a tenant.

Some applicants overlook the importance of a well-crafted cover letter. While not always required, a personal touch can set you apart from other applicants. A brief introduction explaining why you would be a great tenant can make a positive impression.

Another mistake is not following the application instructions carefully. Each rental application may have specific requirements, such as submitting documents or providing additional information. Ignoring these instructions can lead to delays or rejection of your application.

In addition, many applicants forget to proofread their application. Simple typos or grammatical errors can create an impression of carelessness. Taking a moment to review your application can help ensure that it is polished and professional.

Finally, applicants often fail to submit the application in a timely manner. The rental market can be competitive, and delays can mean losing out on a desired property. Submitting your application promptly can demonstrate your eagerness and commitment to securing the rental.