Valid Promissory Note Document for New York

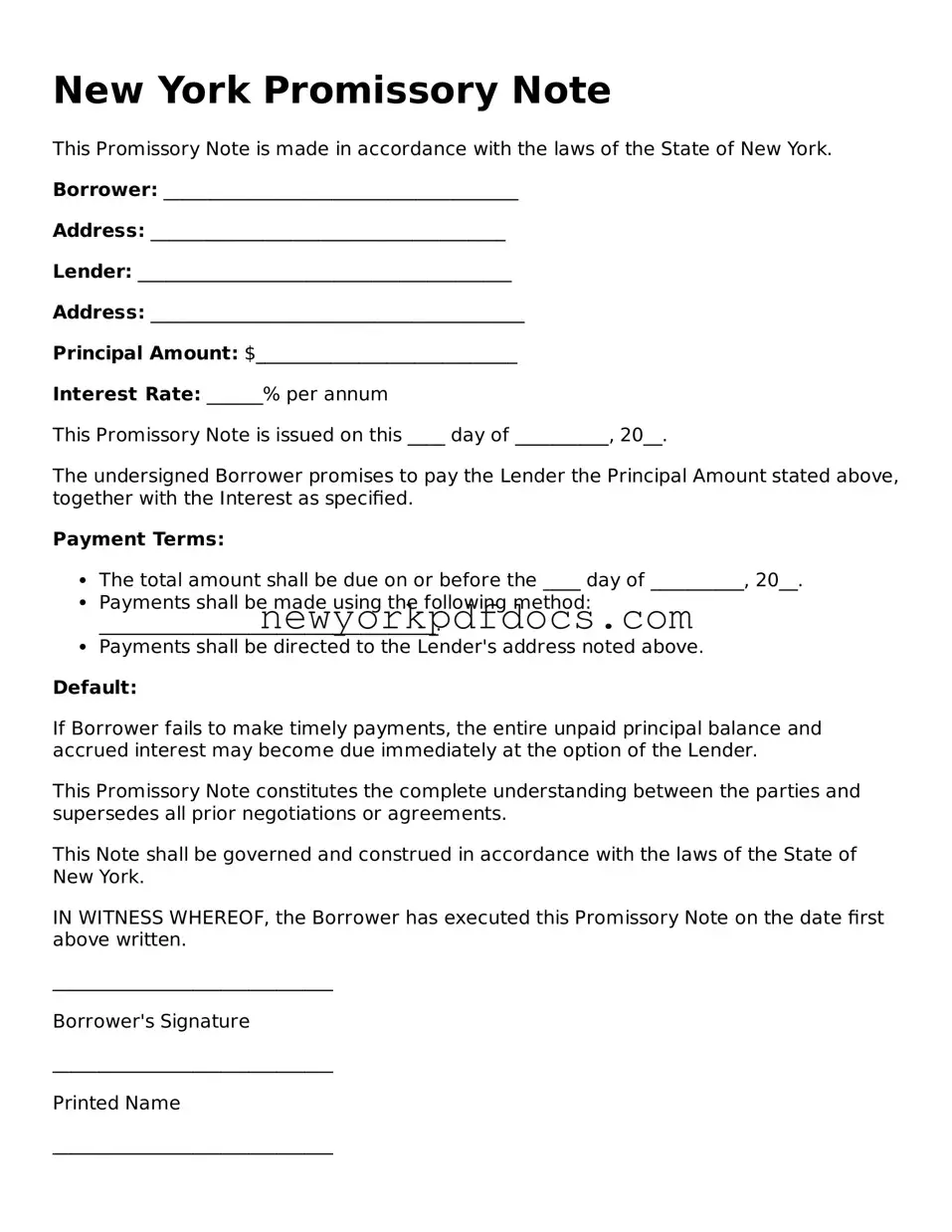

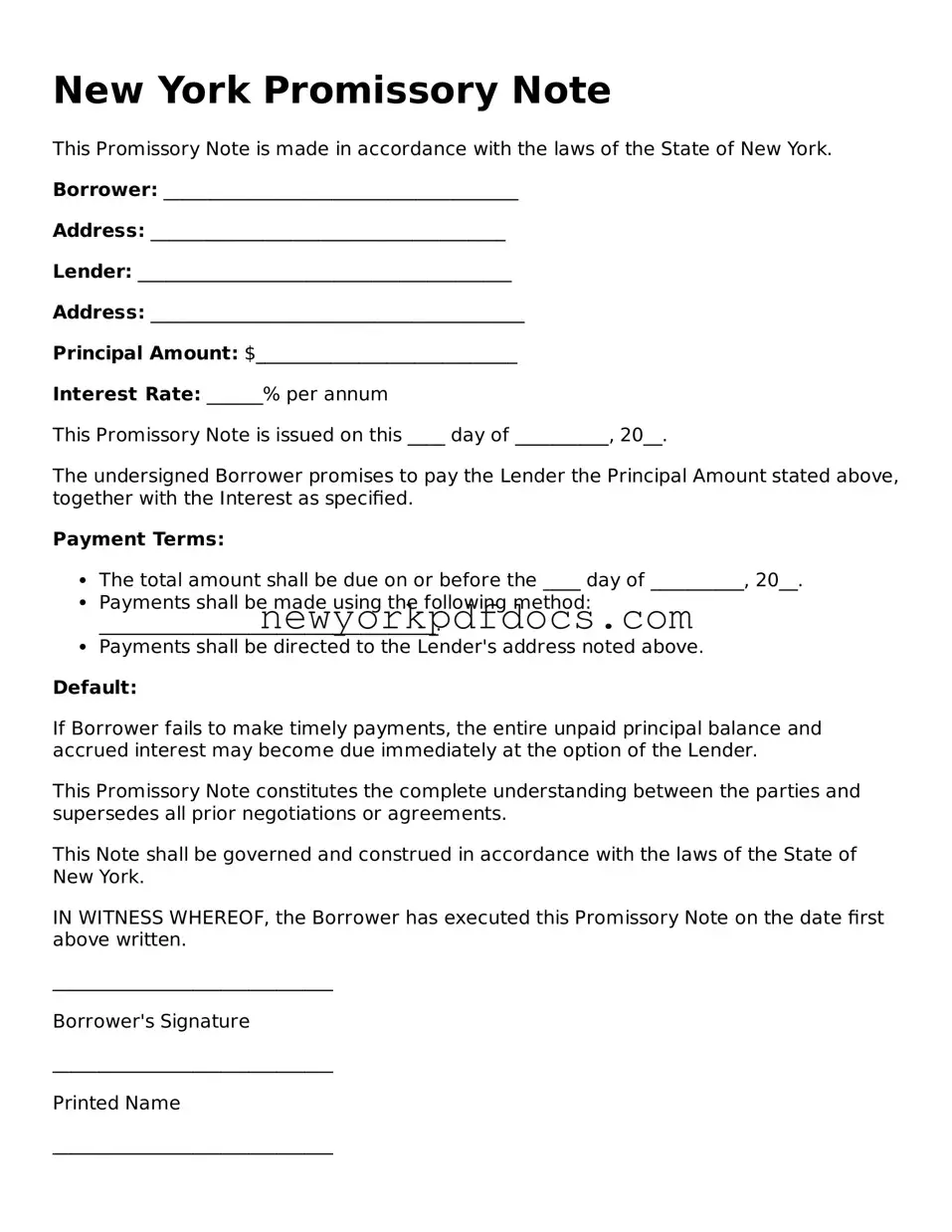

A New York Promissory Note is a written promise to pay a specified amount of money to a designated party at a predetermined time. This financial document serves as a crucial tool for both lenders and borrowers, outlining the terms of repayment and ensuring clarity in the transaction. Understanding the nuances of this form can empower individuals to navigate their financial commitments with confidence.

Open My Document Now

Valid Promissory Note Document for New York

Open My Document Now

Your form isn’t finalized yet

Edit, save, and download Promissory Note online with ease.

Open My Document Now

or

⇓ Promissory Note PDF