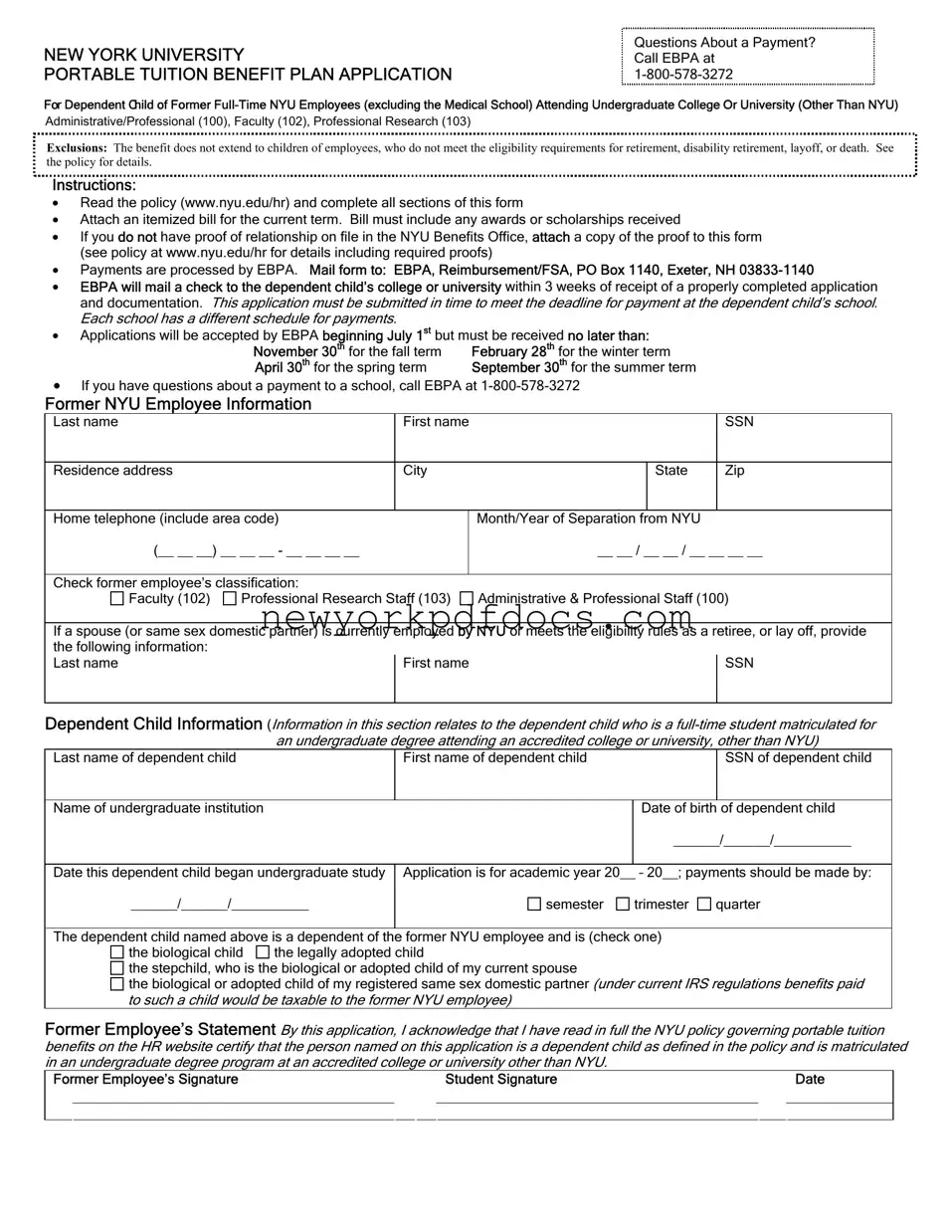

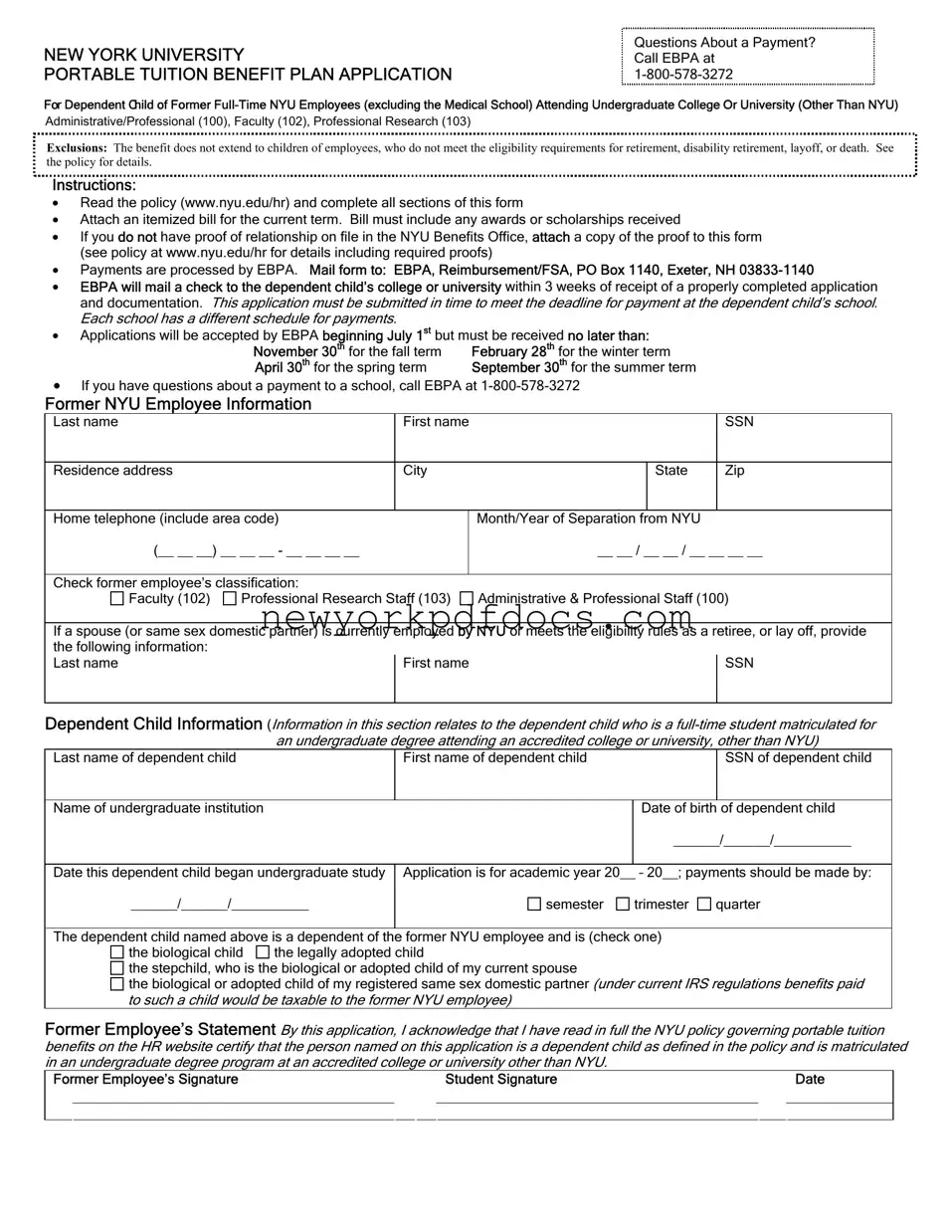

For Dependent Child of Former Full-Time NYU Employees (excluding the Medical School) Attending Undergraduate College Or University (Other Than NYU)

Administrative/Professional (100), Faculty (102), Professional Research (103)

EXCLUSIONS: The benefit does not extend to children of employees, who do not meet the eligibility requirements for retirement, disability retirement, layoff, or death. See the policy for details.

Instructions:

•Read the policy (www.nyu.edu/hr) and complete all sections of this form

•Attach an itemized bill for the current term. Bill must include any awards or scholarships received

•If you do not have proof of relationship on file in the NYU Benefits Office, attach a copy of the proof to this form (see policy at www.nyu.edu/hr for details including required proofs)

•Payments are processed by EBPA. Mail form to: EBPA, Reimbursement/FSA, PO Box 1140, ExEter, NH 03833-1140

•EBPA will mail a check to the dependent child’s college or university within 3 weeks of receipt of a properly completed application and documentation. This application must be submitted in time to meet the deadline for payment at the dependent child’s school. Each school has a different schedule for payments.

•Applications will be accepted by EBPA beginning July 1st but must be received no later than:

November 30th for the fall term |

February 28th for the winter term |

April 30th for the spring term |

September 30th for the summer term |

•If you have questions about a payment to a school, call EBPA at 1-800-578-3272

Former NYU Employee Information

Last name |

|

First name |

|

|

SSN |

|

|

|

|

|

|

|

Residence address |

|

City |

|

State |

Zip |

|

|

|

|

|

|

Home telephone (include area code) |

|

Month/Year of Separation from NYU |

|

(__ __ __) __ __ __ - __ __ __ __ |

|

|

__ __ / __ __ / __ __ __ __ |

|

|

|

|

|

Check former employee’s classification: |

|

|

|

Faculty (102) |

Professional Research Staff (103) |

Administrative & Professional Staff (100) |

If a spouse (or same sex domestic partner) is currently employed by NYU or meets the eligibility rules as a retiree, or lay off, provide the following information:

Dependent Child Information (Information in this section relates to the dependent child who is a full-time student matriculated for an undergraduate degree attending an accredited college or university, other than NYU)

Last name of dependent child |

|

First name of dependent child |

|

SSN of dependent child |

|

|

|

|

|

Name of undergraduate institution |

|

|

Date of birth of dependent child |

|

|

|

______/______/__________ |

|

|

|

Date this dependent child began undergraduate study |

Application is for academic year 20__ – 20__; payments should be made by: |

______/______/__________ |

semester |

trimester |

quarter |

|

|

|

The dependent child named above is a dependent of the former NYU employee and is (check one) |

|

the biological child |

the legally adopted child |

|

|

the stepchild, who is the biological or adopted child of my current spouse |

|

|

the biological or adopted child of my registered same sex domestic partner (under current IRS regulations benefits paid to such a child would be taxable to the former NYU employee)

Former Employee’s Statement By this application, I acknowledge that I have read in full the NYU policy governing portable tuition benefits on the HR website certify that the person named on this application is a dependent child as defined in the policy and is matriculated in an undergraduate degree program at an accredited college or university other than NYU.

Former Employee’s Signature |

|

Student Signature |

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|