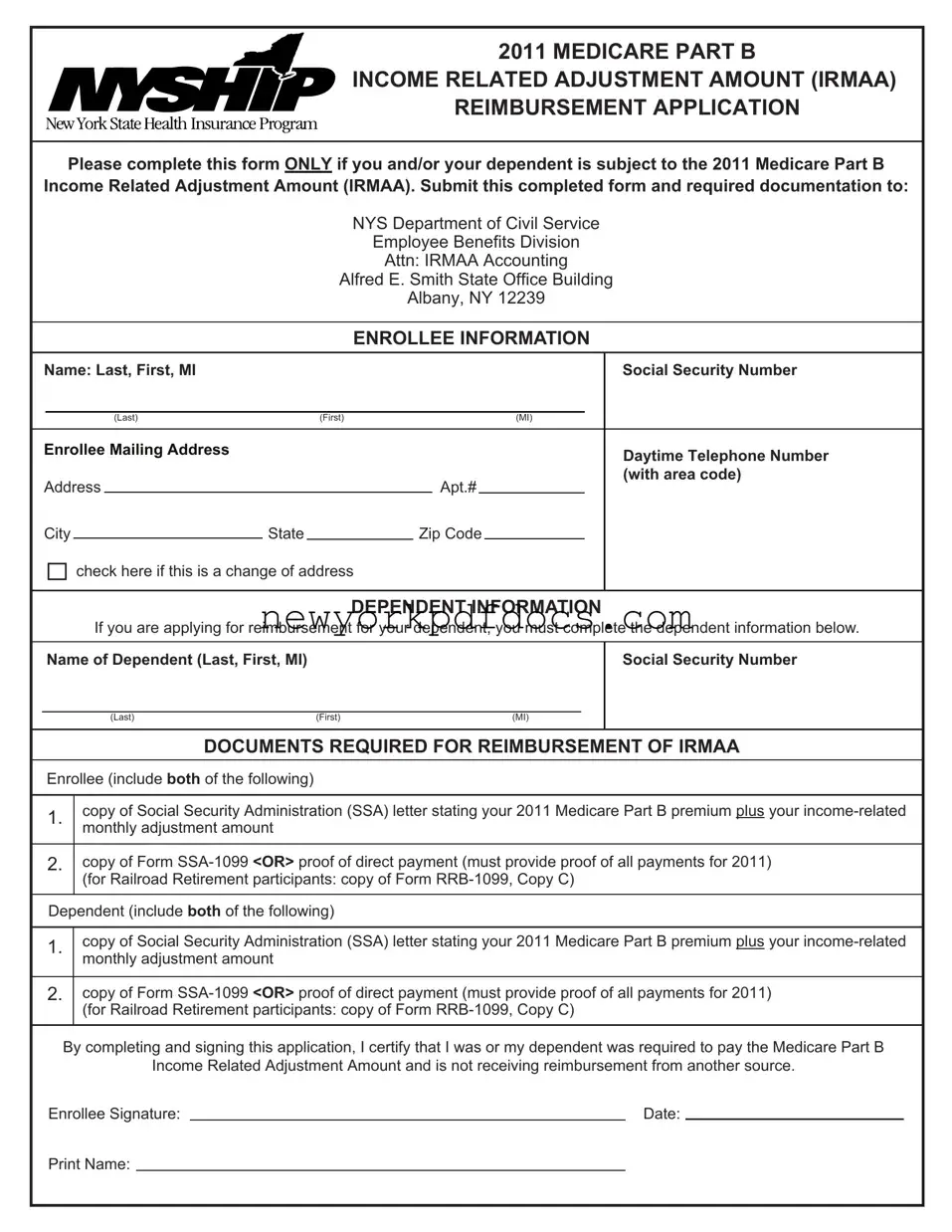

Filling out the NYSHIP form can be straightforward, but many people make common mistakes that can delay their reimbursement. One frequent error is not providing complete personal information. Make sure to fill in all required fields, including your full name, Social Security number, and mailing address. Missing even a small detail can cause issues.

Another mistake is failing to check if the address has changed. If you’ve moved recently, it’s essential to indicate that on the form. Not doing so can lead to delays in receiving important documents or reimbursements.

Many applicants forget to include all necessary documentation. For reimbursement, both the enrollee and dependent must provide specific documents. This includes the Social Security letter and Form SSA-1099. Double-check that you have included everything required.

Some people also overlook the importance of signing the application. Without a signature, the form cannot be processed. Make sure to sign and date the application before submitting it.

Another common mistake is misreading the instructions regarding reimbursement from another source. If you receive reimbursement from another source, you must fill out that section correctly. Failing to do so can complicate your application.

Additionally, many applicants do not keep copies of their submitted forms and documents. It’s wise to make a copy of everything you send. This can be helpful if there are any questions or issues later on.

Some people submit their application close to the deadline without allowing enough time for processing. Remember that refunds can take 90-120 days. Submit your application as early as possible to avoid any last-minute stress.

Another mistake is not providing accurate contact information. Make sure your daytime telephone number is correct. If the Employee Benefits Division needs to reach you, they will want to contact you without any hassle.

Lastly, failing to understand the HIPAA Release Form can lead to complications if you want the Employee Benefits Division to discuss your application with your dependent. If you need assistance, ensure that you complete this form correctly.

By avoiding these common mistakes, you can help ensure a smoother process for your NYSHIP reimbursement application.