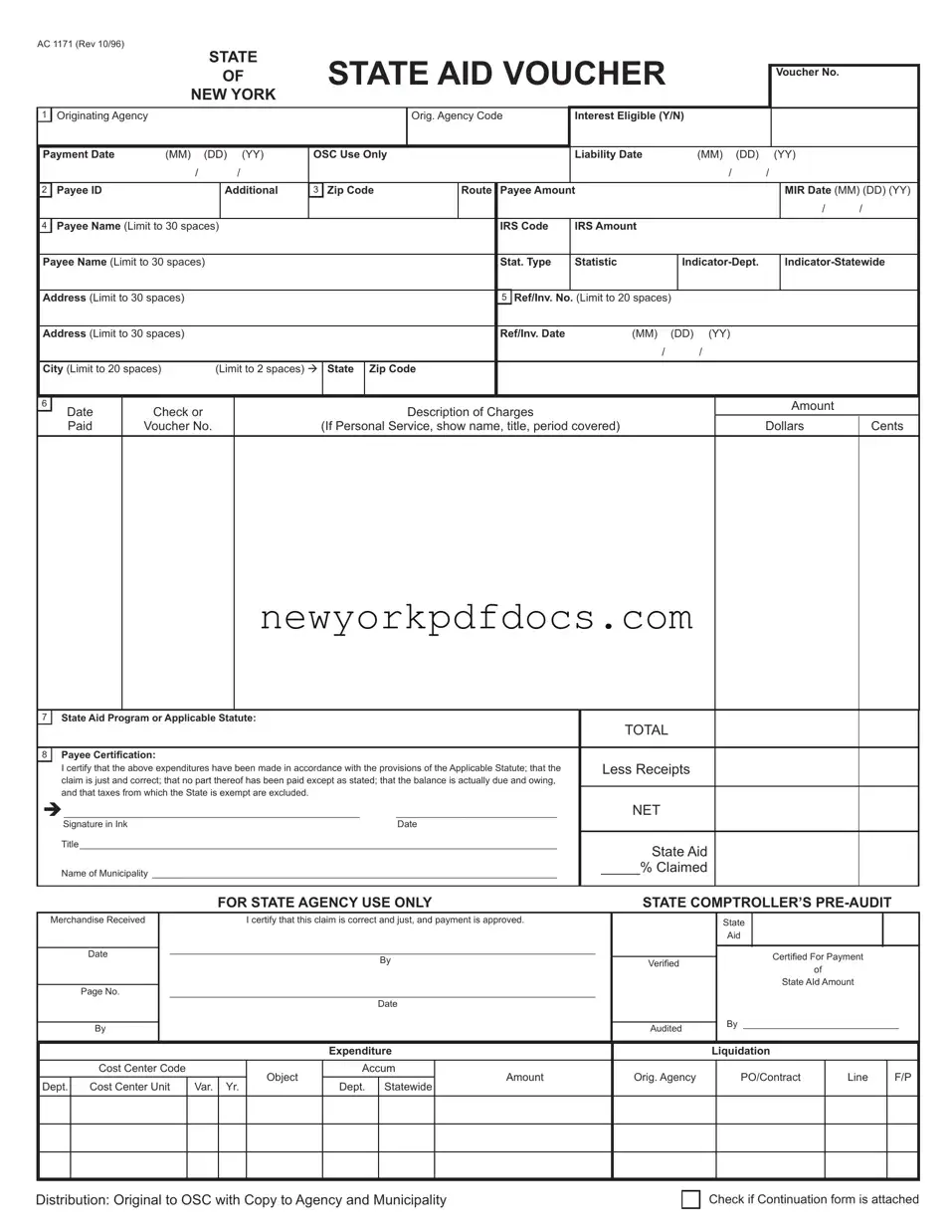

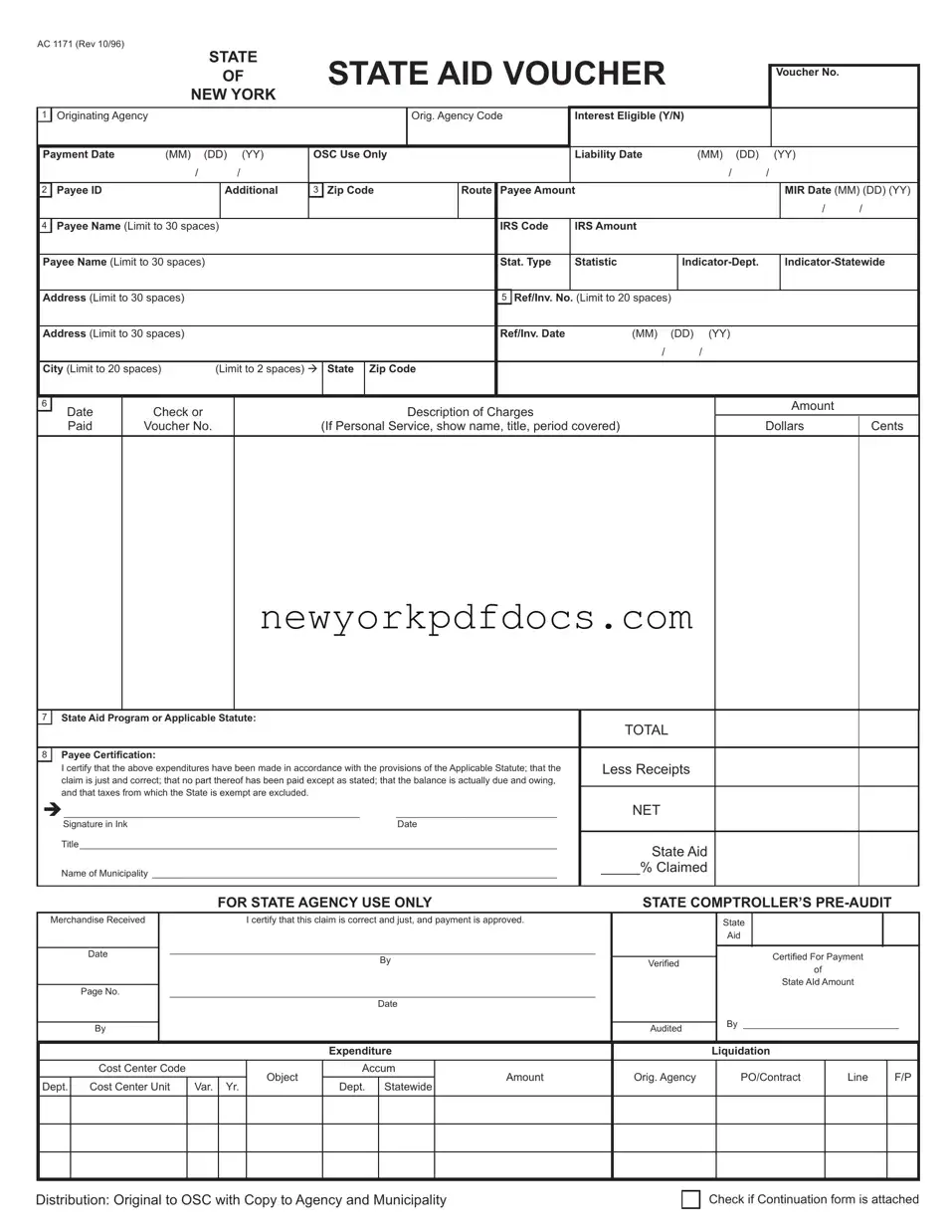

Filling out the NYS State Aid Voucher form can be straightforward, but many people stumble on some common mistakes. Understanding these pitfalls can help ensure that your submission is accurate and complete. Here are seven mistakes to watch out for when completing the form.

First, leaving fields blank is a frequent error. Each section of the form requires specific information. Omitting details such as the Payee ID or the Payment Date can delay processing. Always double-check that every required field is filled in before submitting.

Another common mistake is exceeding character limits. Each line has a specified number of characters allowed, such as the Payee Name, which is limited to 30 spaces. If you try to include more than this, your submission may be rejected. Keep your entries concise and within the limits.

Third, many people forget to sign the certification section. The certification signature is crucial as it confirms the accuracy of the information provided. Without this signature, the form cannot be processed, leading to unnecessary delays.

Additionally, failing to double-check the dates can lead to complications. Ensure that all dates, such as the Payment Date and Ref/Inv Date, are accurate and formatted correctly. Incorrect dates can create confusion and may require you to resubmit the form.

Another issue arises from using incorrect codes. Whether it’s the IRS Code or the Statute Type, using the wrong code can lead to processing errors. Always verify that you are using the correct codes that correspond to your specific situation.

Moreover, many people overlook the importance of the total amount. Ensure that the total amount claimed is accurately calculated and matches the detailed breakdown provided on the form. Inconsistencies in the amount can raise red flags and delay approval.

Finally, not keeping a copy of the submitted form is a mistake that can come back to haunt you. Always make a copy of your completed voucher for your records. This way, if any issues arise, you will have the necessary information on hand to resolve them quickly.

By avoiding these common mistakes, you can streamline the process of submitting your NYS State Aid Voucher form. Taking the time to review your work can save you from unnecessary setbacks and ensure that your funding is processed without delay.