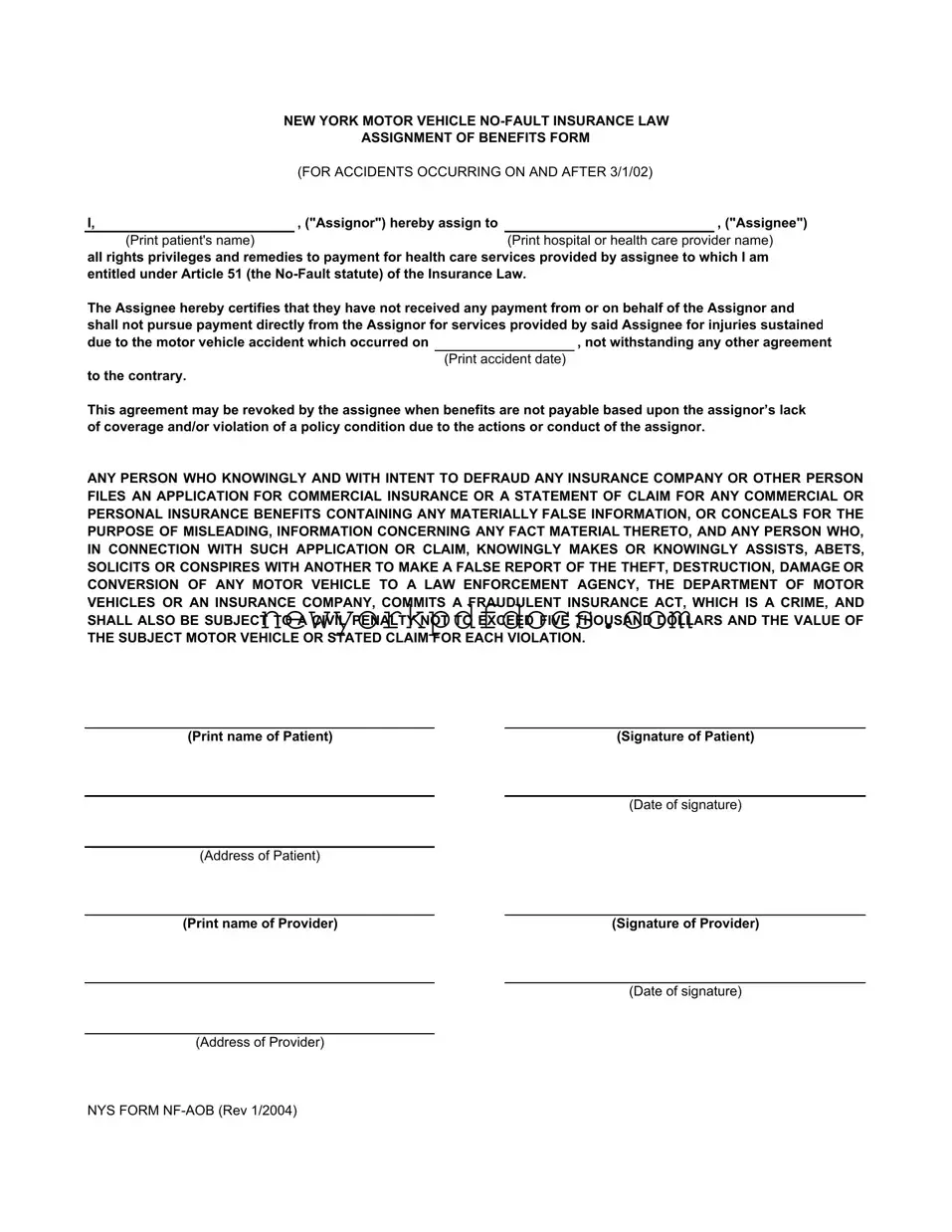

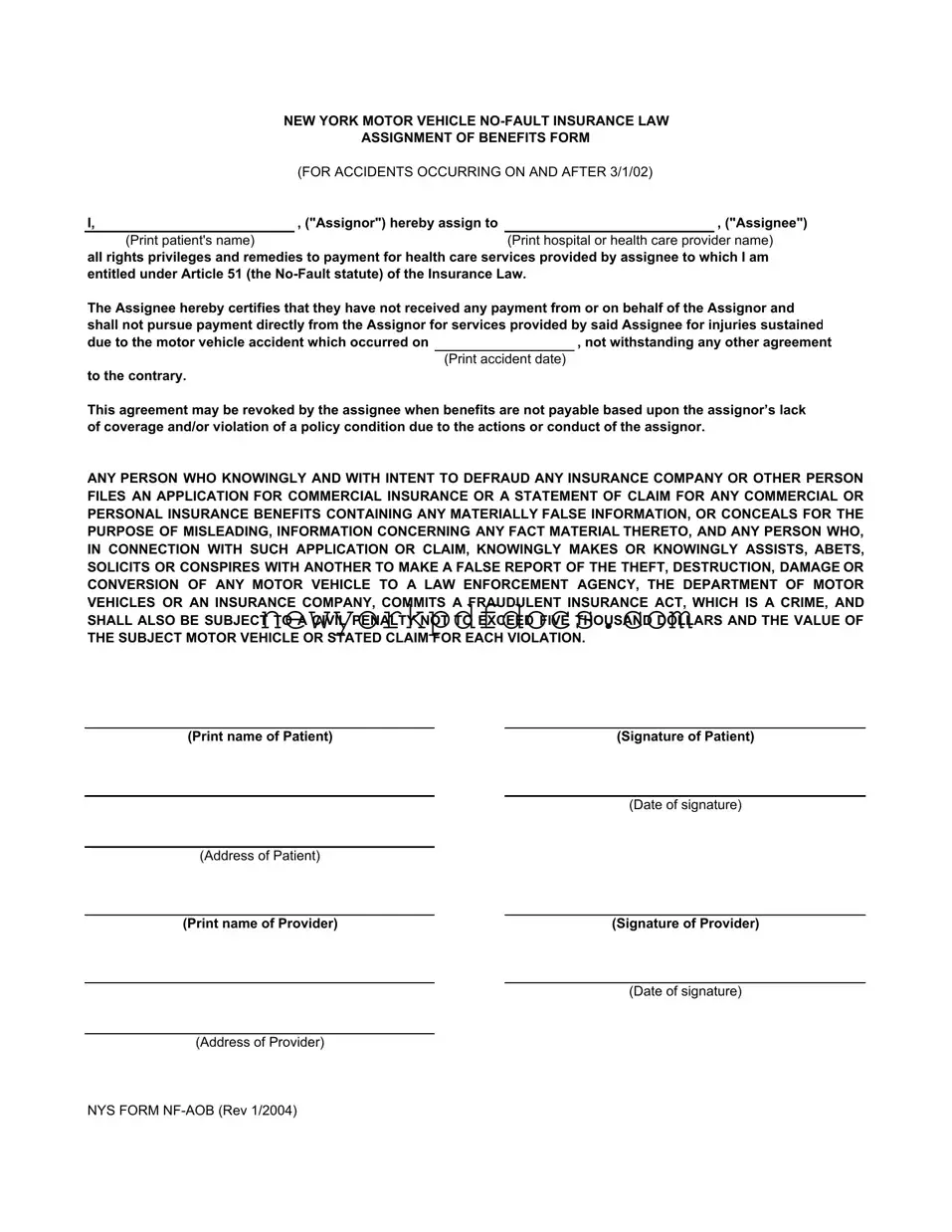

Free Nys Nf Aob Form

The NYS NF AOB form is a crucial document in New York's motor vehicle no-fault insurance system, designed to facilitate the assignment of benefits for healthcare services following an accident. This form allows individuals, referred to as "Assignors," to transfer their rights to payment for medical services to healthcare providers, known as "Assignees." Understanding its implications is essential for both patients and providers to ensure proper handling of insurance claims and to avoid potential legal issues.

Open My Document Now

Free Nys Nf Aob Form

Open My Document Now

Your form isn’t finalized yet

Edit, save, and download Nys Nf Aob online with ease.

Open My Document Now

or

⇓ Nys Nf Aob PDF