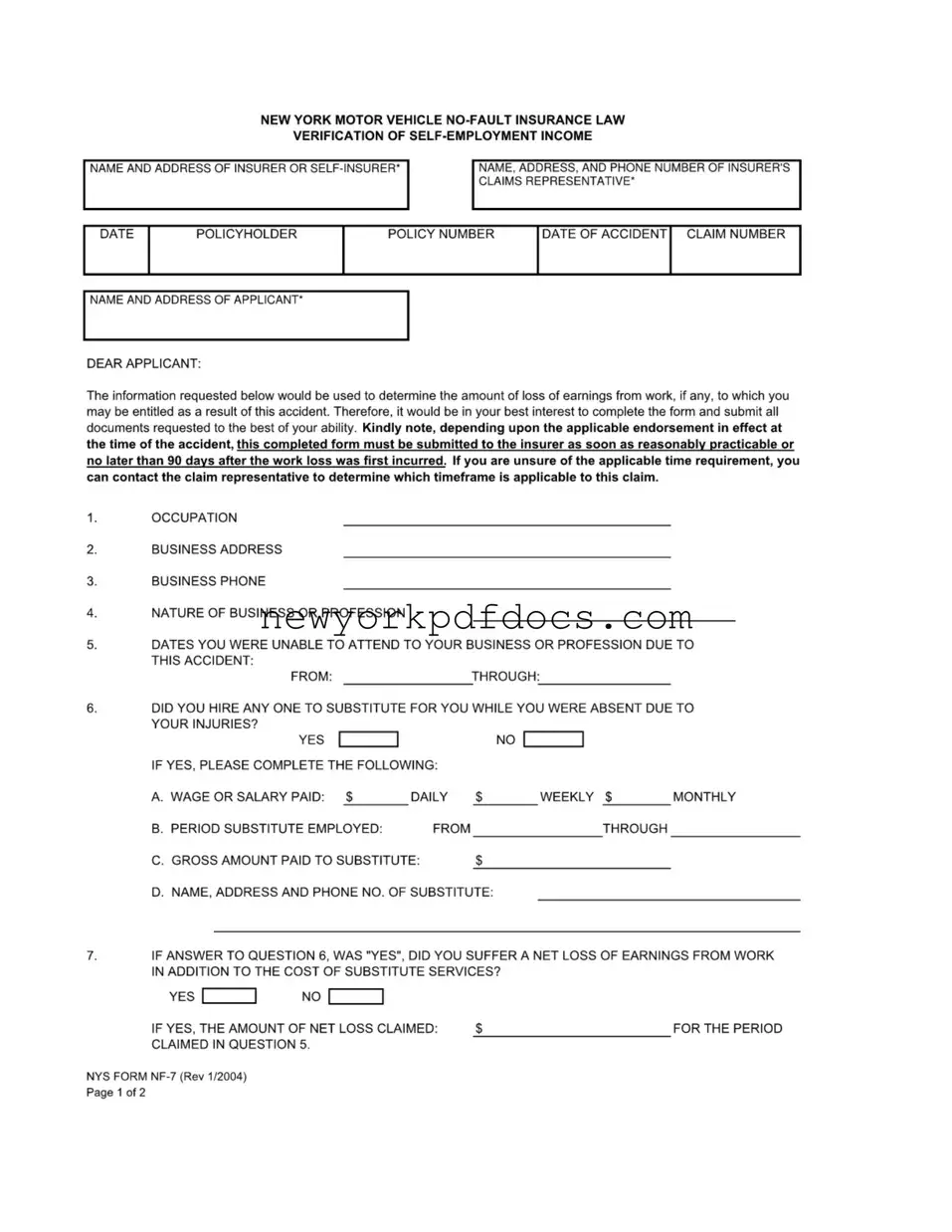

Filling out the NYS NF-7 form can be a straightforward process, but several common mistakes can lead to delays or complications in your claim. One major error is not providing complete information in the designated fields. For instance, failing to include your occupation or business address can hinder the insurer’s ability to assess your claim accurately. Each section of the form is crucial for establishing your self-employment income and loss of earnings.

Another frequent mistake involves the dates you were unable to work due to the accident. Applicants often leave these fields blank or provide vague date ranges. It is essential to be precise, as the insurer needs this information to calculate your loss accurately. The timeframe should reflect the actual period of your inability to work, from the start date through to when you resumed your business activities.

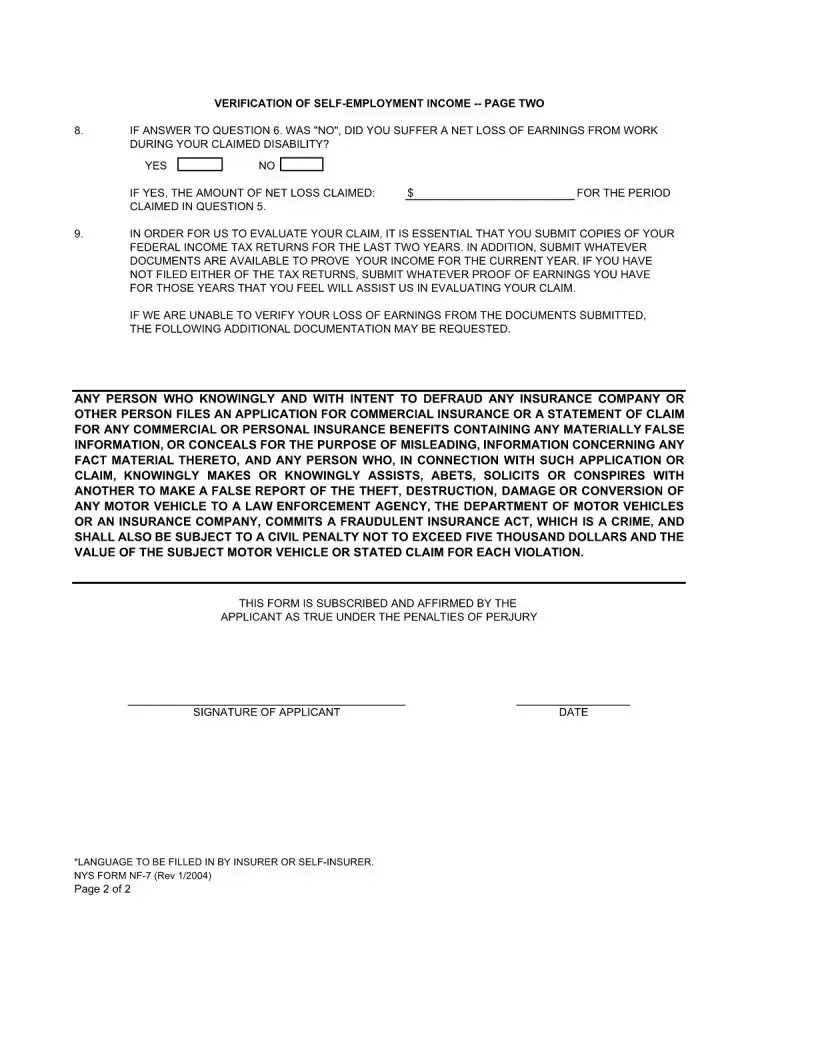

Some people overlook the importance of documenting their income. The form requires copies of your federal income tax returns for the last two years. Failing to submit these documents can result in a lack of verification for your claimed earnings. If you haven’t filed your taxes, provide any available proof of income, such as bank statements or invoices, to support your claim.

Additionally, applicants sometimes misunderstand the question regarding hiring a substitute. It’s crucial to answer this question accurately. If you did hire someone to cover your duties, you must complete the relevant sections detailing their wage or salary, the period they worked, and the total amount paid. Omitting this information can lead to confusion and may affect the outcome of your claim.

Moreover, many applicants fail to double-check their calculations. When stating the amount of net loss claimed, ensure that the figures are correct and correspond to the information provided in previous sections. Errors in arithmetic can lead to discrepancies that may delay your claim or result in a lower payout.

Lastly, some individuals neglect to sign and date the form. This step is essential, as it affirms that the information you provided is true and complete. Without your signature, the form may be considered invalid, causing unnecessary delays in processing your claim.