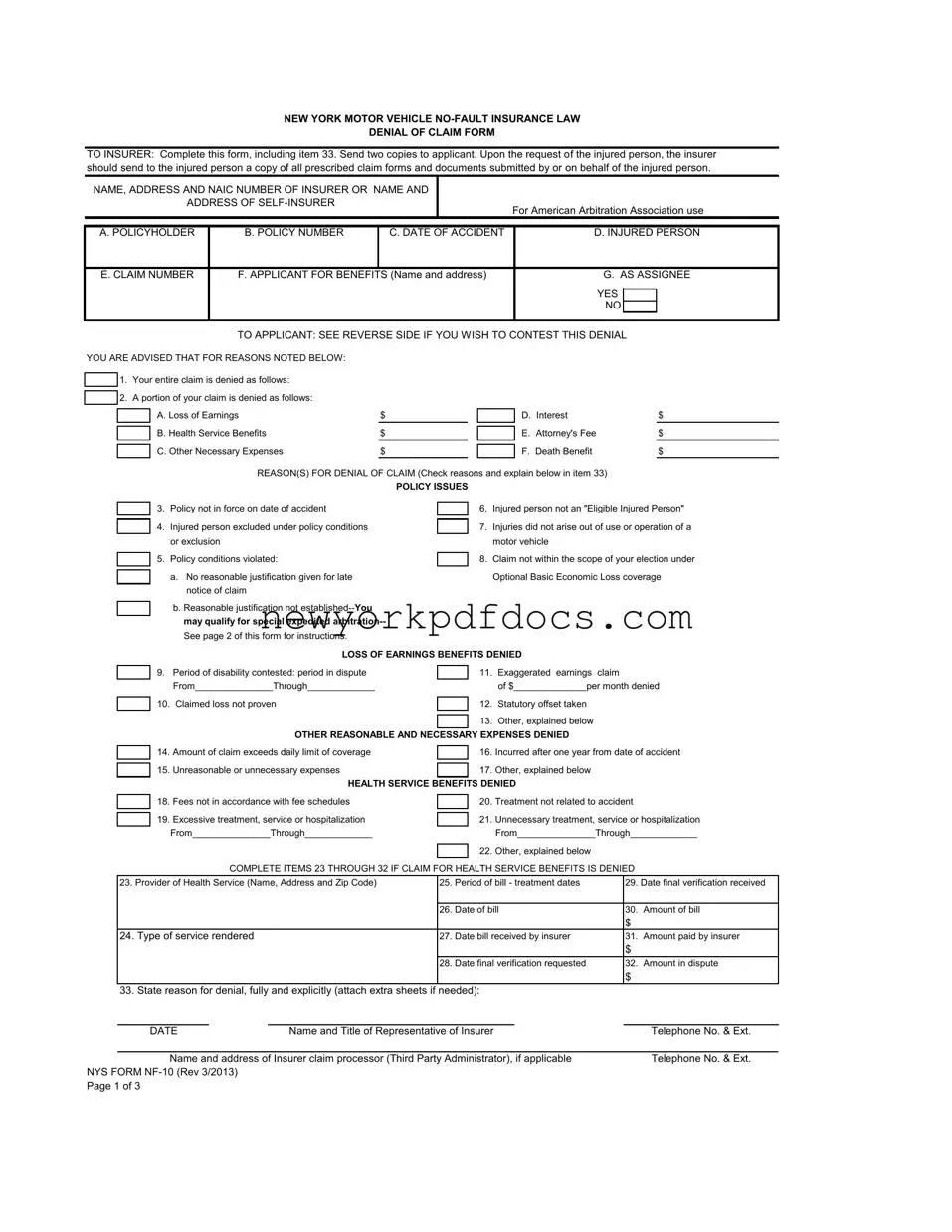

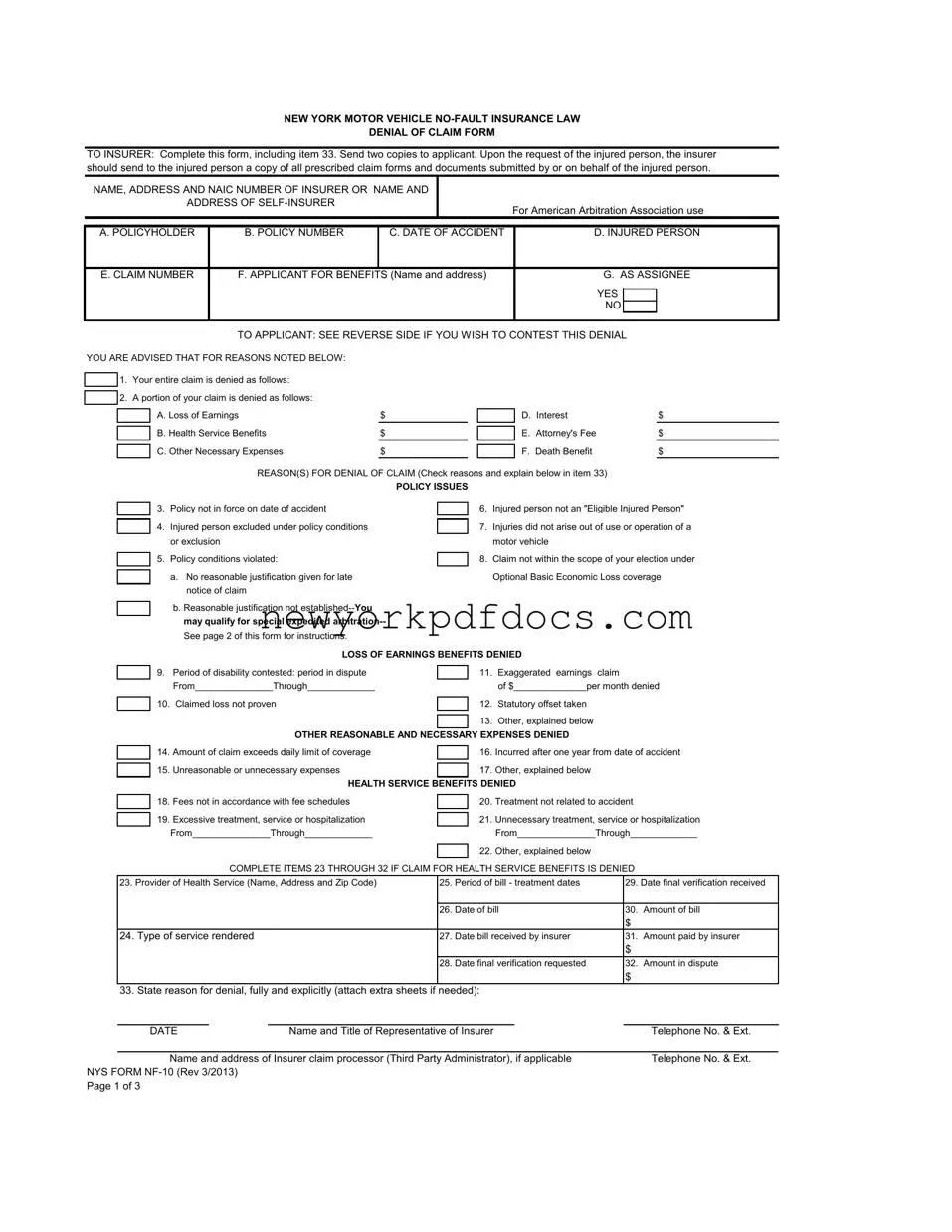

DENIAL OF CLAIM FORM -- PAGE TWO

IF YOU WISH TO CONTEST THIS DENIAL, YOU HAVE THE FOLLOWING OPTIONS:

1.Should you wish to take this matter up with the New York State Department of Financial Services, you may file with the Department either on its website at http://www.dfs.ny.gov/consumer/fileacomplaint.htm or you may write to or visit the Consumer Assistance Unit, Financial Frauds and Consumer Protection Division, New York State Department of Financial Services, at: One State Street, New York, NY 10004; One Commerce Plaza, Albany, NY 12257; 163B Mineola Boulevard, Mineola, NY 11501, or Walter J. Mahoney Office Building, 65 Court Street, Buffalo, NY 14202.

Although the Department of Financial Services will attempt to resolve disputed claims, it cannot order or require an insurer to pay a disputed claim. If you wish to file a written complaint, send one copy of this Denial of Claim Form with copies of other pertinent documents with a letter fully explaining your complaint to the Department of Financial Services at one of the above addresses.

If you choose this option, you may at a later date still submit this dispute to arbitration or bring a lawsuit; or

2.You may submit this dispute to arbitration. If you wish to submit this claim to arbitration, then mail or e-mail a copy of this Denial of Claim Form along with a complete submission of all other pertinent documents and a table of contents listing your submissions, in duplicate

together with a $40 filing fee, payable by check, money order, or credit card to the American Arbitration Association (AAA) to:

AMERICAN ARBITRATION ASSOCIATION (AAA)

NEW YORK INSURANCE CASE MANAGEMENT CENTER 120 BROADWAY

NEW YORK, NEW YORK 10271

nyicmc.filingsubmissions@adr.org

Please contact the American Arbitration Association's customer service department at (917) 438-1660 with any questions about case filing.

A complete copy of this filing, listing all bills and proofs as well as a table of contents listing your submissions must be provided to the AAA and the insurer at the time of filing for arbitration. The filing must be complete with all necessary documentation, as any late submission may not be admissible at arbitration. The filing fee will be returned to you if the arbitrator awards you any portion of your claim. However, you may be assessed the costs of the arbitration proceeding if the arbitrator finds your claim to be frivolous, without factual or legal merit or was filed for the purpose of harassing the respondent. The decision of an arbitrator is binding, except for limited grounds for review set forth in the Law and regulations promulgated thereunder.

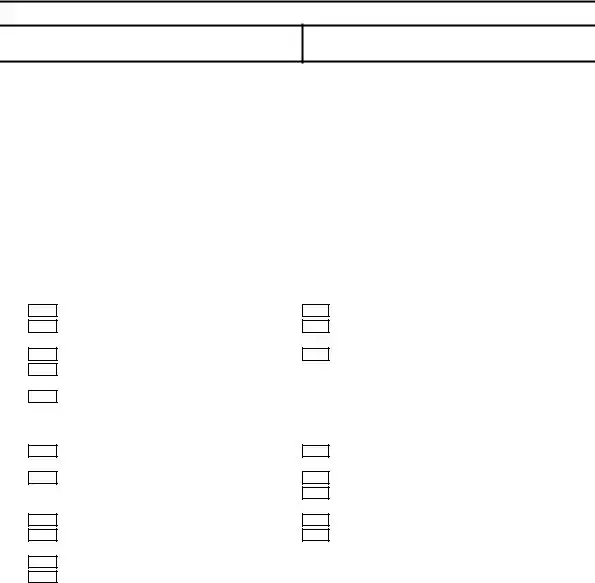

If you are contesting the denial of claim and wish to submit the dispute to arbitration, state on accompanying sheets the reason(s) you believe the denied or overdue benefits should be paid. Attach proof of disability and verification of loss of earnings in dispute, sign below, and send the completed form to the American Arbitration Association at the address given in item 2 above.

Loss of earnings: |

Date claim made:_____________________ |

Gross earnings per month $______________________ |

Period of dispute: |

From ___________ Through _____________ |

Amount claimed: $_____________________________ |

Other: (attach additional sheet if necessary)

·Upon your request, if you file for arbitration within 90 days of the date of this denial or the claim becoming overdue, your case will be scheduled for arbitration on a priority basis.

·You qualify for special expedited arbitration if the insurer has determined that your written justification for submitting late notice of claim failed to meet a “reasonableness standard”. Your specific request for special expedited arbitration must be filed within 30 days of the date of denial. Your filing must be complete and contain all information that you are submitting at the time of filing.

NYS FORM NF-10 (Rev 3/2013)

Page 2 of 3