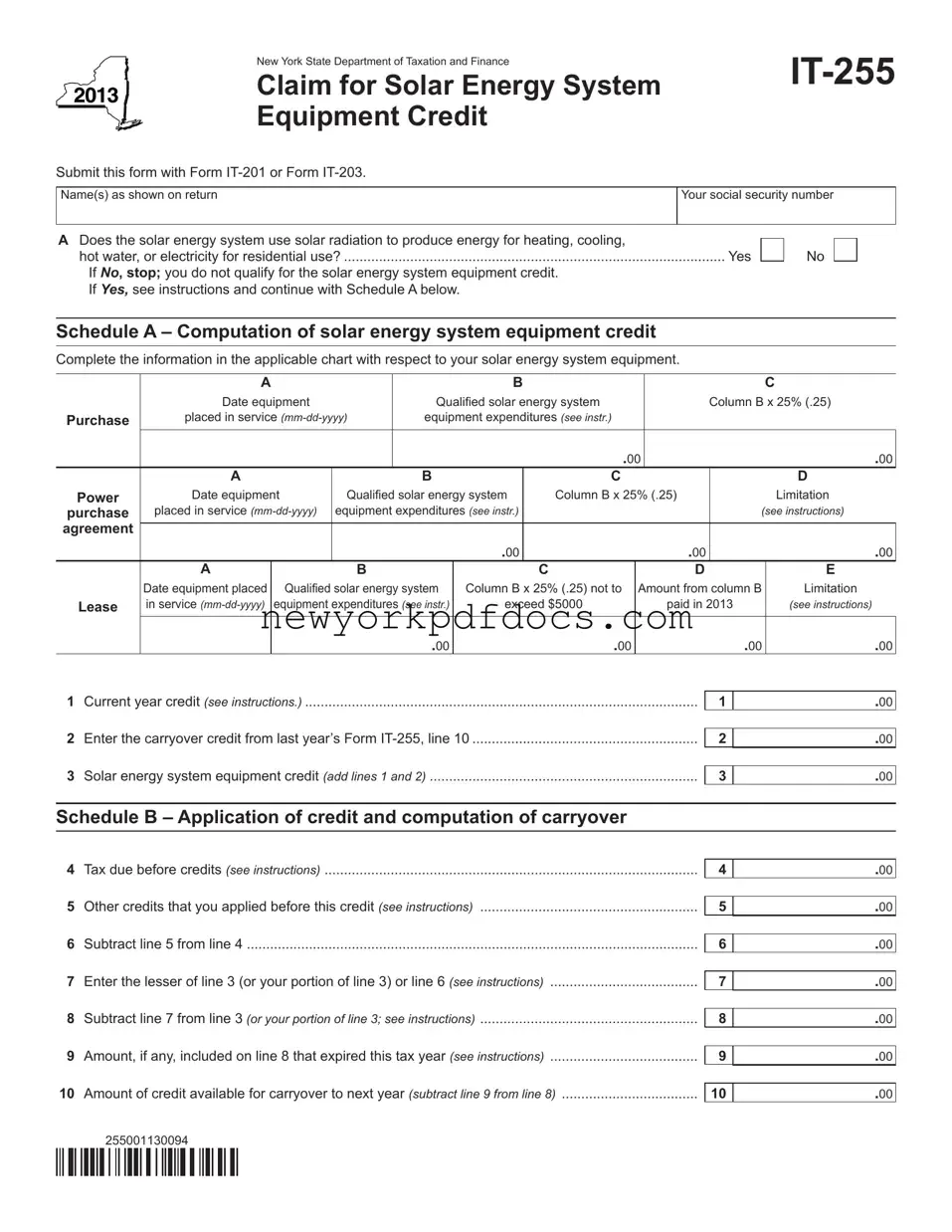

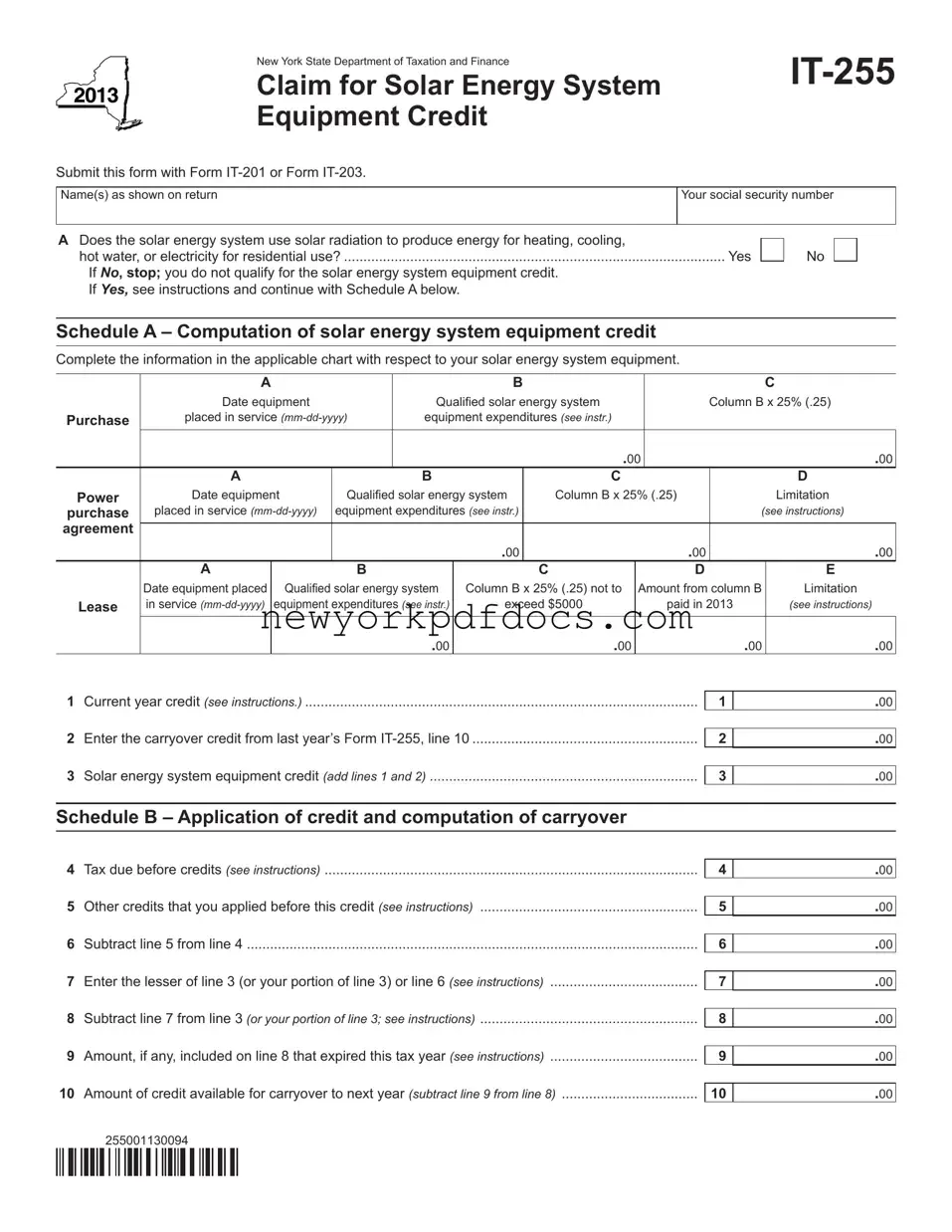

Free Nys It 255 Form

The NYS IT-255 form is a document used to claim the Solar Energy System Equipment Credit in New York State. This credit is designed to encourage the use of solar energy systems for residential purposes, helping homeowners offset the costs associated with purchasing and installing solar equipment. To qualify, applicants must meet specific criteria and provide detailed information about their solar energy systems on this form.

Open My Document Now

Free Nys It 255 Form

Open My Document Now

Your form isn’t finalized yet

Edit, save, and download Nys It 255 online with ease.

Open My Document Now

or

⇓ Nys It 255 PDF