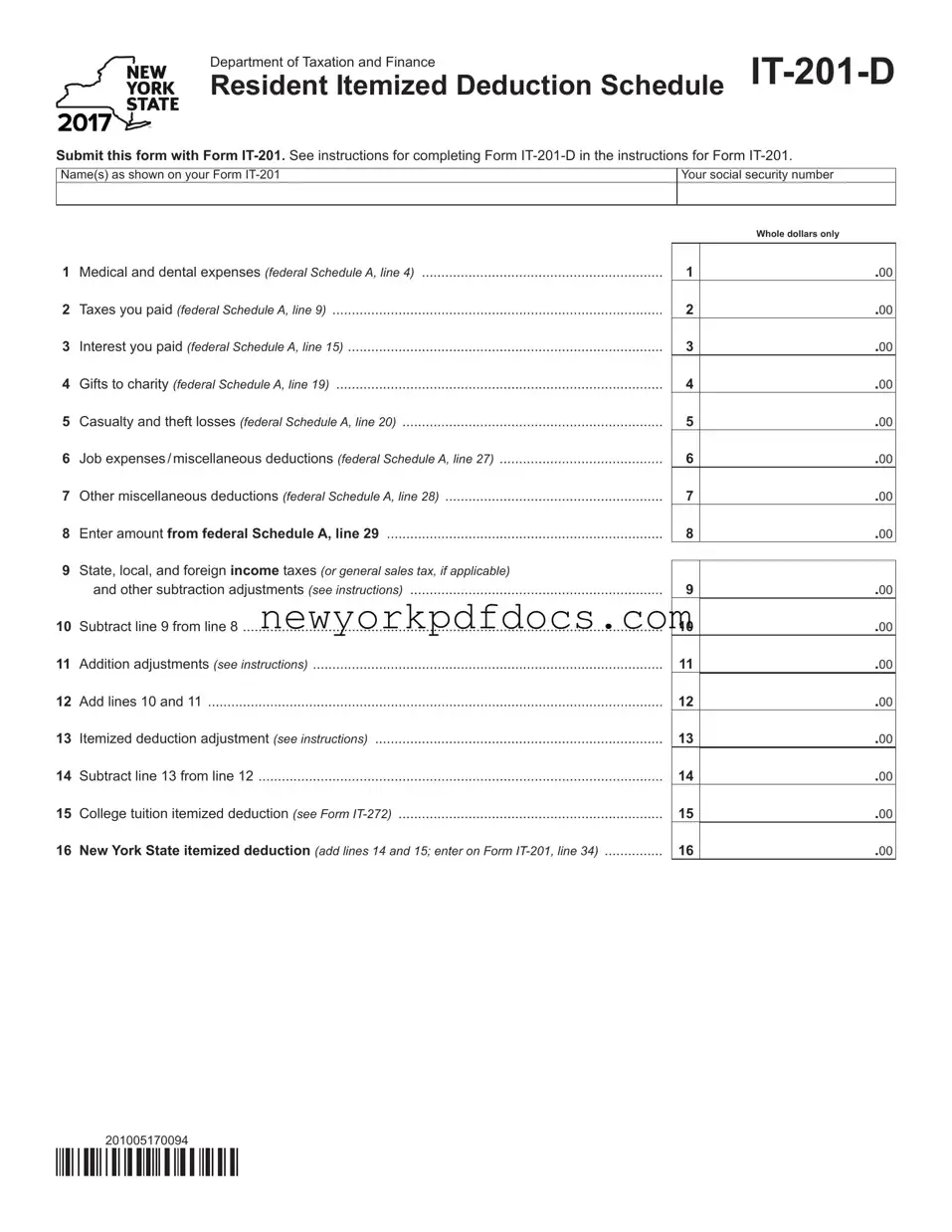

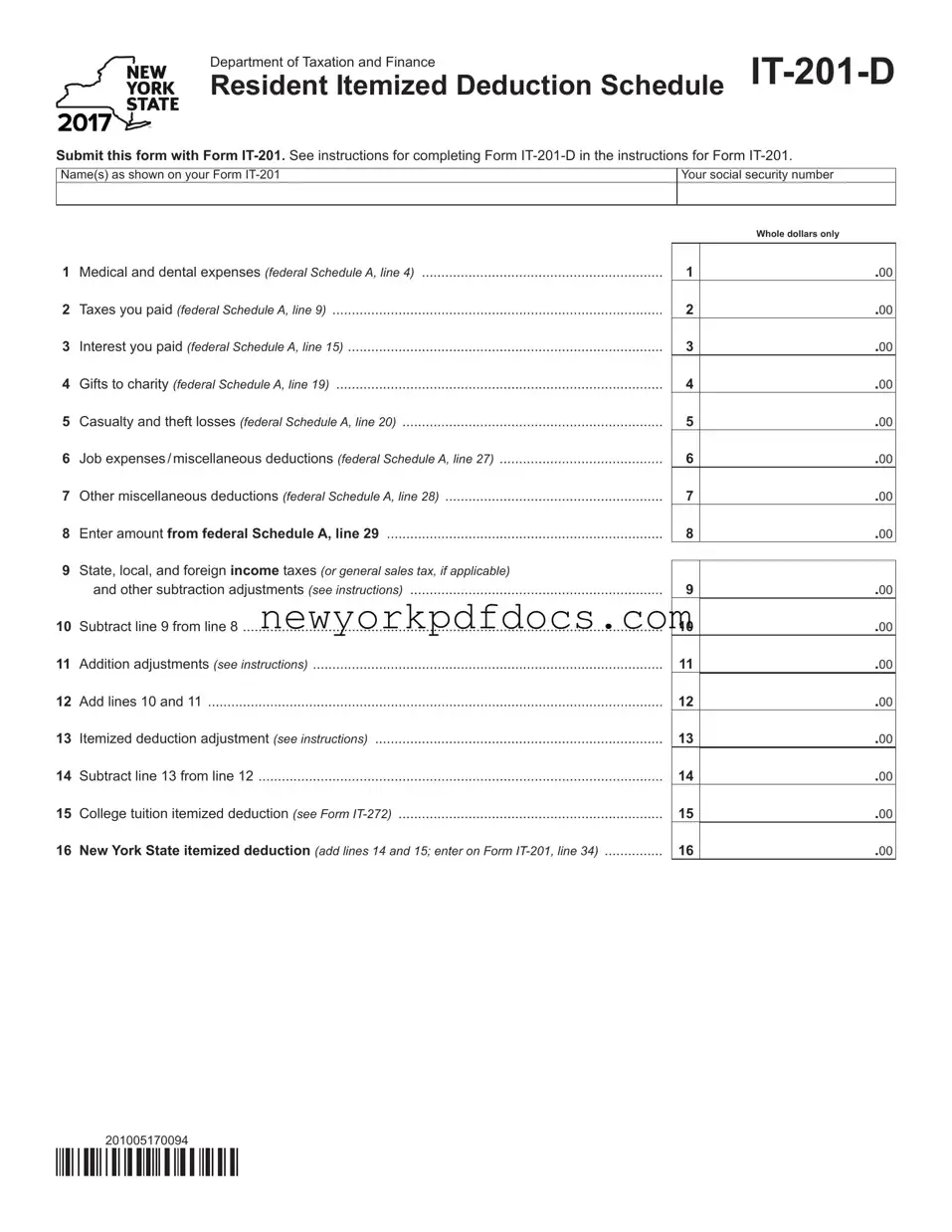

Filling out the NYS IT-201-D form can be a straightforward process, but there are common mistakes that individuals often make. Awareness of these pitfalls can help ensure that the form is completed accurately and efficiently.

One common mistake is failing to include the name(s) as shown on Form IT-201. It is essential to match the names exactly to avoid any discrepancies that could delay processing. Additionally, neglecting to provide the correct social security number can lead to complications. This number must be accurate to ensure that the tax return is properly linked to the taxpayer's identity.

Another frequent error involves entering amounts in the wrong sections of the form. For instance, some individuals mistakenly input medical and dental expenses in the wrong line. It is crucial to refer back to the federal Schedule A to confirm that the amounts correspond to the appropriate lines. Similarly, confusion often arises with the taxes paid section, where taxpayers might mix up local and state taxes, resulting in inaccuracies.

Many people also overlook the requirement to report amounts in whole dollars only. This means that cents should not be included, which can lead to rounding errors if not adhered to. Furthermore, failing to subtract line 9 from line 8 correctly can result in incorrect totals. This calculation is vital for determining the final itemized deduction amount.

Some taxpayers forget to include any addition adjustments that may apply to their situation. These adjustments can significantly impact the final calculations. It is important to review the instructions carefully to ensure that all relevant adjustments are accounted for. Additionally, many individuals may miscalculate the final itemized deduction adjustment, which can lead to further errors down the line.

Another mistake is not entering the college tuition itemized deduction, if applicable. This deduction can provide additional tax benefits, but it must be reported correctly on line 15. Lastly, individuals sometimes fail to add lines 14 and 15 accurately before transferring the total to Form IT-201. This final step is crucial for ensuring that the correct amount is reflected on the primary tax form.

By being aware of these common mistakes, taxpayers can improve their accuracy when completing the NYS IT-201-D form. Taking the time to double-check each section and following the instructions carefully can lead to a smoother filing experience.