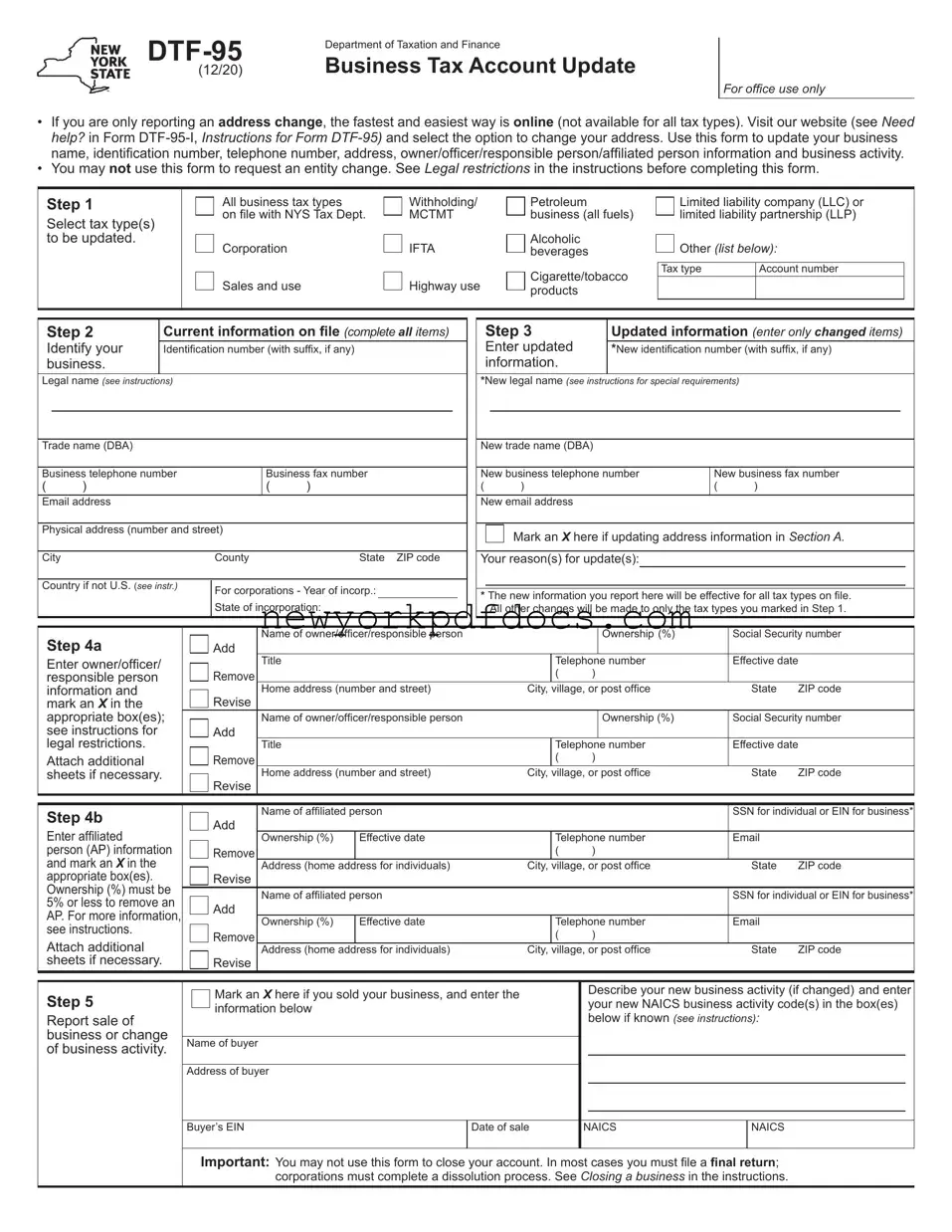

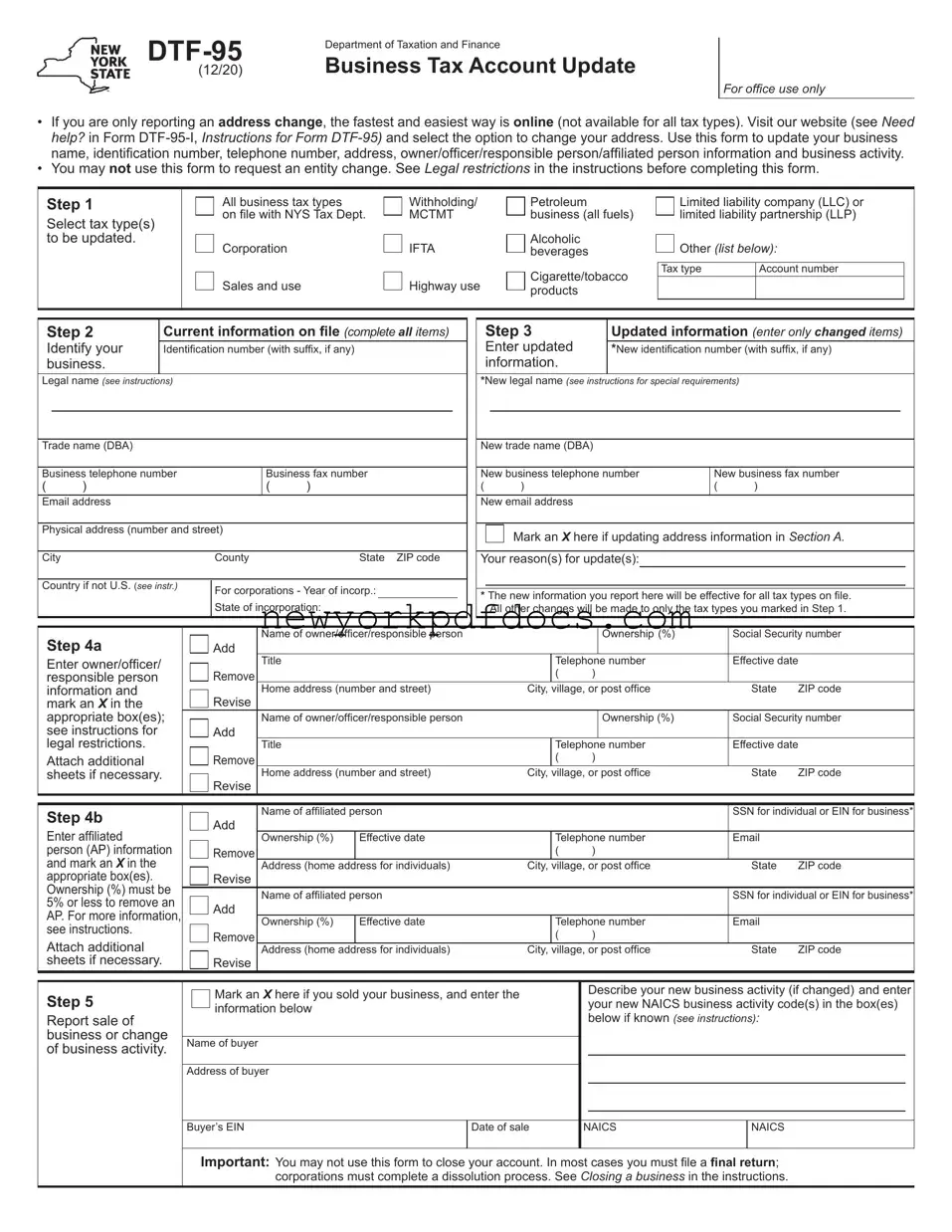

Completing the NYS DTF-95 form can be straightforward, but several common mistakes can lead to delays or complications. One frequent error is failing to provide the correct identification number. This number is crucial for the New York State Tax Department to accurately process your update. Double-check that you have included the correct identification number, including any suffixes, if applicable.

Another common mistake involves neglecting to fill out all required fields in the current information section. Omitting essential details such as your legal name, trade name, or business telephone number can result in processing delays. Ensure that every item in Step 2 is completed thoroughly to avoid unnecessary complications.

Some individuals mistakenly believe that updating their address alone can be done through this form. While the DTF-95 allows for address updates, it is important to note that if you are only changing your address, you may want to use the online option or Form DTF-96 instead. Using the wrong form can cause confusion and slow down the process.

In Step 3, only enter the items that have changed. A common error is to repeat information that has not changed, which can create inconsistencies in your records. Make sure to clearly indicate only the updated information to streamline the processing of your form.

When listing owners or responsible persons in Step 4, it is crucial to provide accurate ownership percentages. Errors in this section can lead to issues with the ownership records of your business. If you are unsure about the ownership percentage, verify it before submission to avoid complications.

Additionally, failing to sign and date the form can result in rejection. The signature certifies that the information provided is accurate and that you are authorized to submit the updates. Always ensure that you have signed the form before mailing it.

Some people may overlook the instructions regarding legal restrictions. If you plan to make significant changes, such as an entity change, this form is not appropriate. Understanding these restrictions can save you time and prevent potential issues.

Lastly, be cautious about mailing the form to the correct address. Many individuals neglect to check the instructions for the appropriate mailing address, which can lead to delays in processing. Always confirm the mailing address listed in Step 6 before sending your form.

Mark an

Mark an