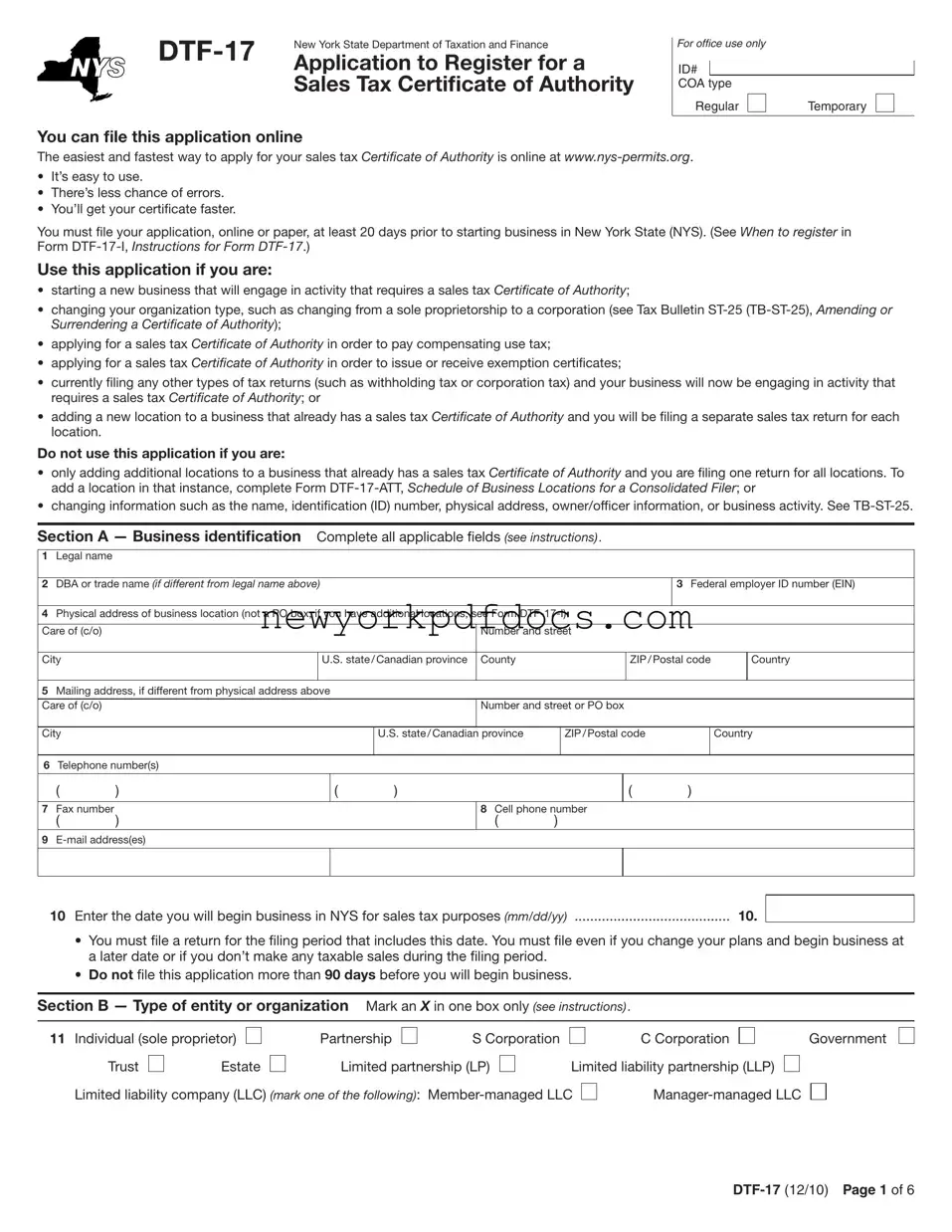

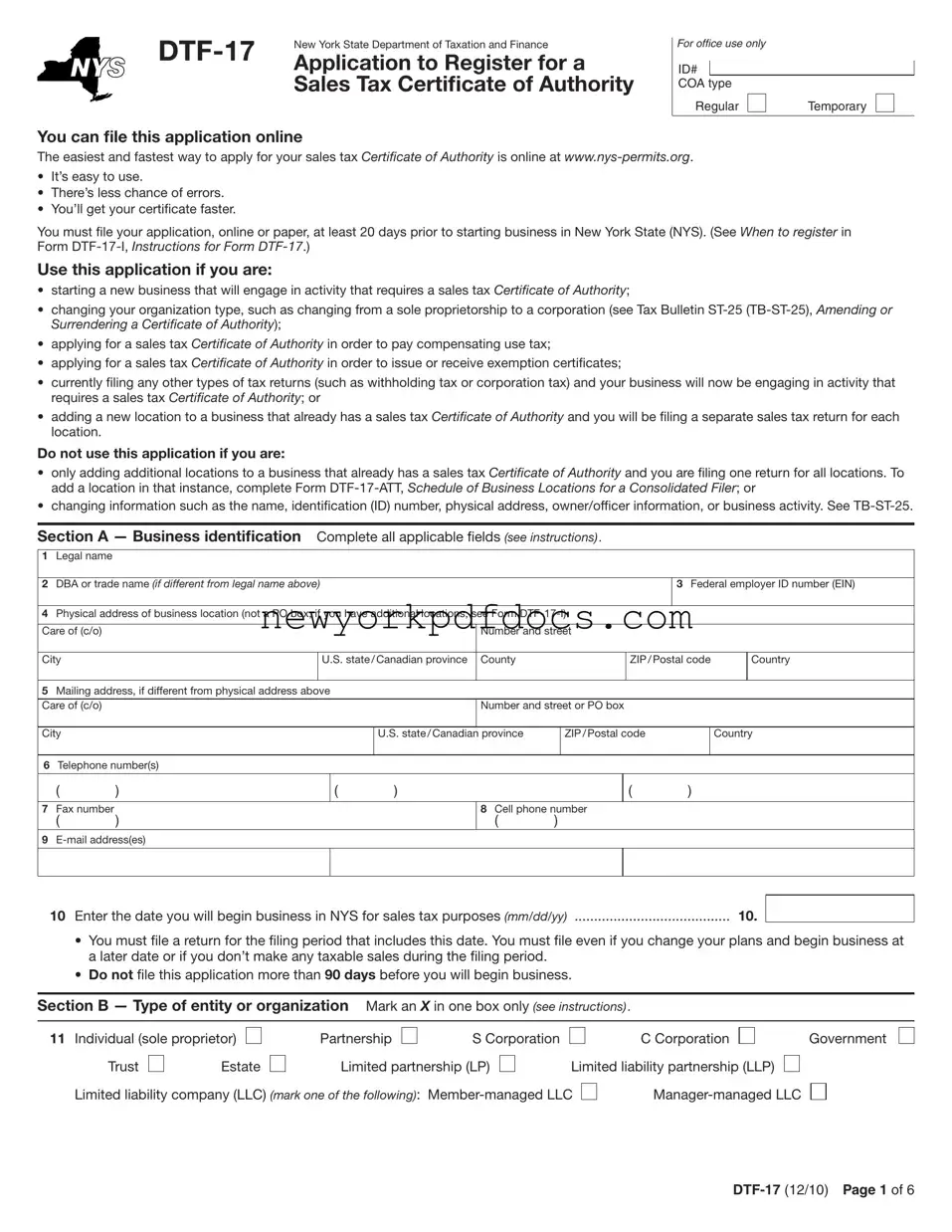

DTF-17 |

New York State Department of Taxation and Finance |

|

|

Application to Register for a |

|

Sales Tax Certificate of Authority |

For office use only

ID#

COA type

You can file this application online

The easiest and fastest way to apply for your sales tax Certificate of Authority is online at www.nys-permits.org.

•It’s easy to use.

•There’s less chance of errors.

•You’ll get your certiicate faster.

You must ile your application, online or paper, at least 20 days prior to starting business in New York State (NYS). (See When to register in Form DTF-17-I, Instructions for Form DTF-17.)

Use this application if you are:

•starting a new business that will engage in activity that requires a sales tax Certificate of Authority;

•changing your organization type, such as changing from a sole proprietorship to a corporation (see Tax Bulletin ST-25 (TB-ST-25), Amending or Surrendering a Certificate of Authority);

•applying for a sales tax Certificate of Authority in order to pay compensating use tax;

•applying for a sales tax Certificate of Authority in order to issue or receive exemption certiicates;

•currently iling any other types of tax returns (such as withholding tax or corporation tax) and your business will now be engaging in activity that requires a sales tax Certificate of Authority; or

•adding a new location to a business that already has a sales tax Certificate of Authority and you will be iling a separate sales tax return for each location.

Do not use this application if you are:

•only adding additional locations to a business that already has a sales tax Certificate of Authority and you are iling one return for all locations. To add a location in that instance, complete Form DTF-17-ATT, Schedule of Business Locations for a Consolidated Filer; or

•changing information such as the name, identiication (ID) number, physical address, owner/oficer information, or business activity. See TB-ST-25.

Section A — Business identification Complete all applicable ields (see instructions) .

1Legal name

2DBA or trade name (if different from legal name above)

3Federal employer ID number (EIN)

4Physical address of business location (not a PO box; if you have additional locations, see Form DTF-17-I)

Care of (c/o) |

|

Number and street |

|

|

|

|

|

|

|

City |

U.S. state / Canadian province |

County |

ZIP / Postal code |

Country |

|

|

|

|

|

5Mailing address, if different from physical address above

Care of (c/o) |

|

Number and street or PO box |

|

|

|

|

|

|

City |

U.S. state / Canadian province |

ZIP / Postal code |

Country |

|

|

|

|

|

6Telephone number(s)

7 Fax number

( )

9E-mail address(es)

10 Enter the date you will begin business in NYS for sales tax purposes (mm/dd/yy) |

10. |

•You must ile a return for the iling period that includes this date. You must ile even if you change your plans and begin business at a later date or if you don’t make any taxable sales during the iling period.

•Do not ile this application more than 90 days before you will begin business.

Section B — Type of entity or organization Mark an X in one box only (see instructions) .

11Individual (sole proprietor)

Partnership |

S Corporation |

Limited partnership (LP)

Limited liability partnership (LLP)

Limited liability company (LLC) (mark one of the following): Member-managed LLC

DTF-17 (12/10) PAGE 1 of 6

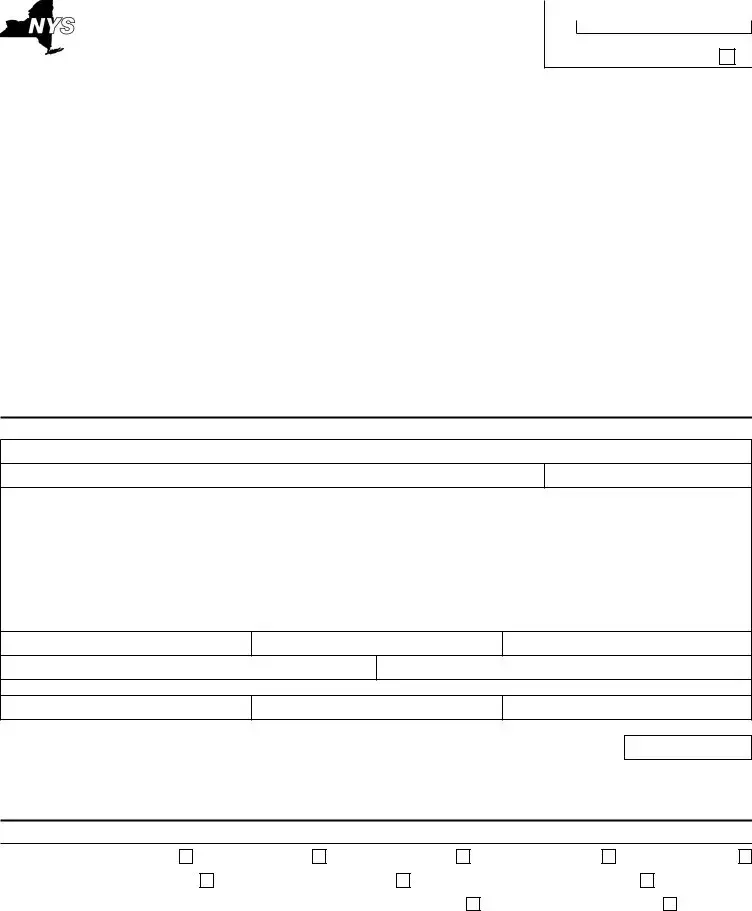

PAGE 2 of 6 DTF-17 (12/10)

Section B — Type of entity or organization (continued)

12a |

Are you a franchisee? |

12a. Yes |

12b |

If Yes, provide franchisor’s name and address: |

|

No

Franchisor’s name

Franchisor’s address (number and street)

U.S. state/Canadian province

Section C — Business information (see instructions)

If you have more than one permanent place of business, mark an X in the appropriate box to indicate how you will ile.

13a Separate sales tax returns for each location (you must complete a separate Form DTF-17 for each location) |

13a. |

13b One sales tax return for all locations (you must also complete Form DTF-17-ATT) |

13b. |

14a If you or your business currently ile, have iled in the past, or were required to ile sales tax returns or returns for other NYS business taxes, such as corporation tax or withholding tax, enter the ID number(s) below.

ID number

ID number

ID number

Tax type

Tax type

Tax type

14b Were you previously registered to collect sales tax, but your Certificate of Authority expired or was |

|

|

|

|

surrendered, revoked, or suspended? |

14b. Yes |

No |

|

If Yes, provide the ID number from your previous business (if available) |

|

|

|

14c |

14c. |

|

|

15You can choose to register as a temporary vendor if your business does not expect to make taxable sales for more than two consecutive sales tax quarters (see instructions). Provide the date that your business

activity will end (mm/dd/yy) |

|

|

|

|

15. |

|

|

|

16 If you acquired all or part of the assets of a business that was registered (or required to be registered) for sales tax, |

|

did you ile Form AU-196.10, Notification of Sale, Transfer, or Assignment in Bulk, with the Tax Department? |

... 16. Yes |

No |

|

Information about former business owner: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

Sales tax ID number |

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (number and street) |

|

City |

U.S. state / Canadian province |

ZIP / Postal code |

|

|

Country |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section D — Business activity |

Mark an X in the applicable box for each item (see instructions). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Licenses

17a Are you or do you intend to be licensed by the NYS Liquor Authority (SLA)? |

17a. |

Yes |

17b If Yes, enter your SLA license number (if available) |

17b. |

|

|

18a |

Are you or do you intend to be licensed by the NYS Lottery? |

18a. |

Yes |

18b |

If Yes, enter your Lottery retailer number (if available) |

18b. |

|

|

|

|

19a |

.............Do you or will you operate a facility registered with the NYS Department of Motor Vehicles (DMV)? |

19a. |

Yes |

19b |

If Yes, enter your DMV facility number (if available) |

19b. |

|

|

|

|

DTF-17 (12/10) PAGE 3 of 6

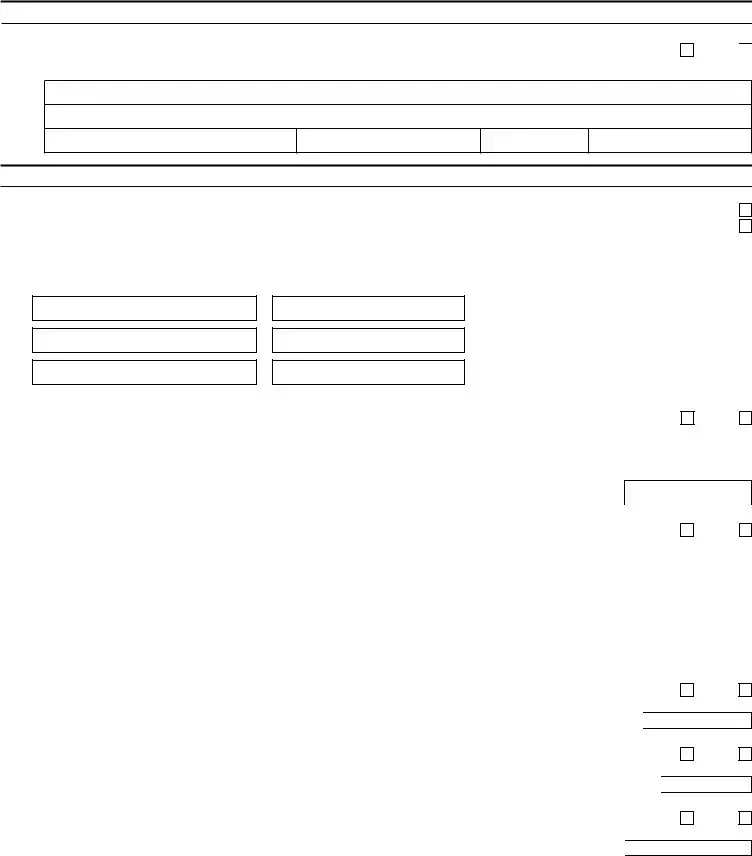

Section D — Business activity (continued)

Sales of goods and services

Do you intend to sell or provide any of the following goods and services? |

|

|

20a Cigarettes or other tobacco products sold at retail |

20a. |

Yes |

|

If Yes, complete and attach Form DTF-716, Application for Registration of Retail Dealers |

|

|

|

and Vending Machines for Sales of Cigarettes and Tobacco Products. |

|

|

20b |

New tires (automotive, motorcycle, trailer, etc.) |

20b. |

Yes |

20c |

Passenger car rentals |

20c. |

Yes |

20d |

Motor fuel sold at a illing station |

20d. |

Yes |

20e |

Diesel motor fuel sold at a illing station |

20e. |

Yes |

20f |

Heating fuels, including diesel, irewood, pellets, or coal |

20f. |

Yes |

20g |

Electricity or gas (including propane in containers of 100 pounds or more), steam, or refrigeration |

20g. |

Yes |

20h |

Mobile telecommunications service |

20h. |

Yes |

20i |

Other telecommunications service, including telephone answering service |

20i. |

Yes |

20j |

Clothing or footwear |

20j. |

Yes |

20k |

Hotel, motel, or other accommodations located in Nassau County or Niagara County |

20k. |

Yes |

20l |

Restaurant or tavern food or drink, or other food service (including catering, take-out, cafeterias, etc.) |

|

|

|

located in Nassau County or Niagara County |

20l. |

Yes |

20m |

Admissions to places of amusement, club dues, and/or cabaret charges located in Niagara County |

20m. |

Yes |

No

No

No

No

No

No

No

No

No

No

No

No

No

20n |

Parking or garaging services |

20n. |

Yes |

20o |

Interior decorating or design services |

20o. |

Yes |

20p |

Beauty, barbering, or miscellaneous personal services |

20p. |

Yes |

20q |

Interior cleaning or maintenance services |

20q. |

Yes |

20r |

Protective or detective services |

20r. |

Yes |

20s |

Credit rating or reporting services |

20s. |

Yes |

20t |

Hotel, motel, or other accommodations |

20t. |

Yes |

|

Other: |

|

|

20u |

Are you a manufacturer or a wholesaler that does not make retail sales? |

20u. |

Yes |

20v |

Will you participate solely in lea markets, antique shows, or other shows? |

20v. |

Yes |

20w |

Will you conduct business solely as a sidewalk vendor? |

20w. |

Yes |

No

No

No

No

No

No

No

No

No

No

Section E — Account and reporting information

21Enter the information for the bank account where sales tax money will be deposited. You must provide this information even if the account you list will not be used exclusively for sales tax purposes.

Manufacturers and wholesalers: enter the primary bank account information for your business.

Bank name

22 Do you intend to accept credit cards? |

22. Yes |

No

23If this is not the entity that will be reporting the income from the operations of this business on an income tax return or corporation tax return, enter the name and EIN of the legal entity or social security number (SSN) for the individual that will be reporting the income from the operations of the business iling sales and use tax returns.

Name of legal entity or individual

PAGE 4 of 6 DTF-17 (12/10)

Section F — Business description (see instructions)

24a In the space below, briely describe your business activities. Describe the products or services that you will sell in NYS from the business location(s) that you are registering. Please be speciic. See the instructions for examples.

Enter the NAICS code that best describes the principal (and secondary, if appropriate) activity of the business location(s) that you are registering. You can ind a list of NAICS codes in Publication 910, Principal Business Activity for New York State Purposes, or by using the online NAICS Code Lookup on our Web site (see Need help? in Form DTF-17-I).

24b Principal NAICS code (required)

Section G — Responsible person(s) (see instructions)

Enter the applicable information for all responsible persons (see instructions). This includes, but is not limited to, owners, partners, members, oficers, and any other person responsible for the business’s day-to-day operations. You must provide all the information that we ask for, including SSN. Attach a separate sheet if necessary.

25 |

Name (first, middle initial, last, suffix) |

|

|

|

|

Business title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address (number and street; not a PO Box) |

|

City |

|

|

U.S. state /Canadian province |

ZIP/ Postal code |

Country |

|

|

|

|

|

|

|

|

|

|

|

SSN |

Home phone number |

|

Effective date of assuming responsibility |

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Primary duties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E-mail address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All responsible persons must complete the following — except those in |

Ownership |

Proit distribution percentage, if different than |

|

C corporations, government entities, trusts, and estates |

percentage if over 5%: |

ownership percentage and if over 5%: |

|

|

|

|

|

|

|

|

|

|

|

|

Name (first, middle initial, last, suffix) |

|

|

|

|

Business title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address (number and street; not a PO Box) |

|

City |

|

|

U.S. state /Canadian province |

ZIP/ Postal code |

Country |

|

|

|

|

|

|

|

|

|

|

|

SSN |

Home phone number |

|

Effective date of assuming responsibility |

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Primary duties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E-mail address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All responsible persons must complete the following — except those in |

Ownership |

Proit distribution percentage, if different than |

|

C corporations, government entities, trusts, and estates |

percentage if over 5%: |

ownership percentage and if over 5%: |

|

|

|

|

|

|

|

|

|

|

|

|

Name (first, middle initial, last, suffix) |

|

|

|

|

Business title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address (number and street; not a PO Box) |

|

City |

|

|

U.S. state /Canadian province |

ZIP/ Postal code |

Country |

|

|

|

|

|

|

|

|

|

|

|

SSN |

Home phone number |

|

Effective date of assuming responsibility |

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Primary duties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E-mail address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All responsible persons must complete the following — except those in |

Ownership |

Proit distribution percentage, if different than |

|

C corporations, government entities, trusts, and estates |

percentage if over 5%: |

ownership percentage and if over 5%: |

|

|

|

|

|

|

|

|

|

|

|

|

Name (first, middle initial, last, suffix) |

|

|

|

|

Business title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address (number and street; not a PO Box) |

|

City |

|

|

U.S. state /Canadian province |

ZIP/ Postal code |

Country |

|

|

|

|

|

|

|

|

|

|

|

SSN |

Home phone number |

|

Effective date of assuming responsibility |

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Primary duties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E-mail address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All responsible persons must complete the following — except those in |

Ownership |

Proit distribution percentage, if different than |

|

C corporations, government entities, trusts, and estates |

percentage if over 5%: |

ownership percentage and if over 5%: |

|

|

|

|

|

|

|

|

|

|

|

DTF-17 (12/10) PAGE 5 of 6

Section G — Responsible person(s) (continued)

|

Name (first, middle initial, last, suffix) |

|

|

|

|

Business title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address (number and street; not a PO Box) |

|

City |

|

|

U.S. state /Canadian province |

ZIP/ Postal code |

Country |

|

|

|

|

|

|

|

|

|

|

|

SSN |

Home phone number |

|

Effective date of assuming responsibility |

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Primary duties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E-mail address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All responsible persons must complete the following — except those in |

Ownership |

Proit distribution percentage, if different than |

|

C corporations, government entities, trusts, and estates |

percentage if over 5%: |

ownership percentage and if over 5%: |

|

|

|

|

|

|

|

|

|

|

|

|

Name (first, middle initial, last, suffix) |

|

|

|

|

Business title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address (number and street; not a PO Box) |

|

City |

|

|

U.S. state /Canadian province |

ZIP/ Postal code |

Country |

|

|

|

|

|

|

|

|

|

|

|

SSN |

Home phone number |

|

Effective date of assuming responsibility |

|

|

|

( |

) |

|

|

|

|

|

|

|

|

Primary duties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E-mail address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All responsible persons must complete the following — except those in |

Ownership |

Proit distribution percentage, if different than |

|

C corporations, government entities, trusts, and estates |

percentage if over 5%: |

ownership percentage and if over 5%: |

|

|

|

|

|

|

|

|

|

|

|

Section H — Tax preparer information —If you have no preparer leave this section blank and continue with section I.

Tax preparer’s or irm’s name |

|

|

Preparer’s or irm’s EIN (if known) |

Preparer’s NYTPRIN (if known) |

|

|

|

|

|

|

|

|

|

Preparer’s or irm’s address (number and street) |

City |

U.S. state/Canadian province |

ZIP/Postal code |

|

|

Country |

|

|

|

|

|

|

|

|

|

Preparer’s E-mail address |

|

|

|

Preparer’s telephone number |

|

Preparer’s PTIN (if known) |

|

|

|

|

( |

) |

|

|

|

|

If you want sales tax information mailed to this preparer, mark an X in the box .............................................................................................

Section I — Signature of responsible person – Complete all ields (see instructions)

I certify that the above statements are true, complete, and correct, and that no material information has been omitted. I make these statements with the knowledge that willfully providing false or fraudulent information with this document may constitute a felony or other crime under New York State Law, punishable by a substantial ine and possible jail sentence. I also understand that the Tax Department is authorized to investigate the validity of any information entered on this document.

|

SSN |

|

|

Date |

|

|

|

|

Title |

Daytime telephone number |

|

|

( |

) |

|

If your application is missing information or is not signed, we will return it to you.

Mail your application to: NYS TAX DEPARTMENT

SALES TAX REGISTRATION UNIT

W A HARRIMAN CAMPUS

ALBANY NY 12227

PAGE 6 of 6 DTF-17 (12/10)

This page was intentionally left blank.