Free Nys Ct 245 Form

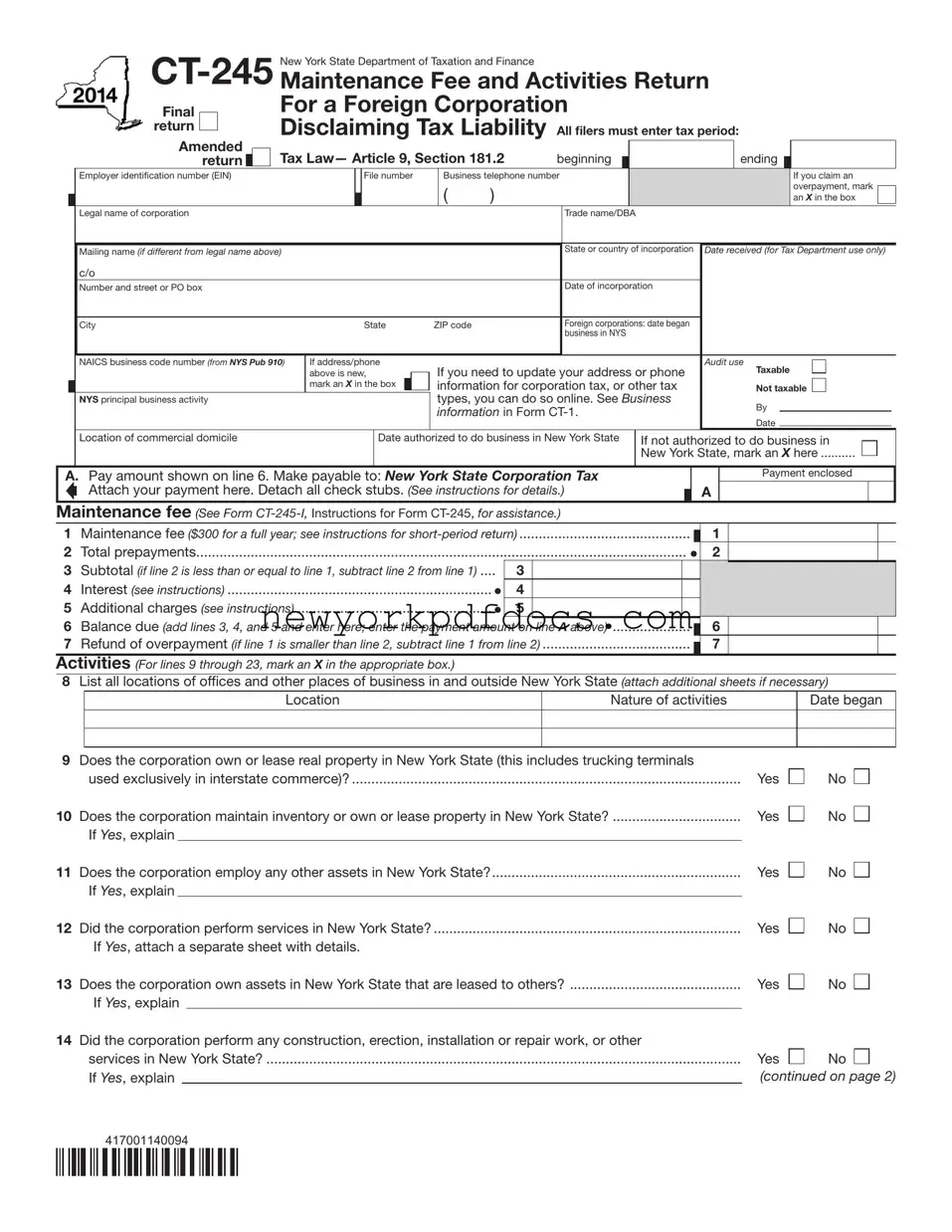

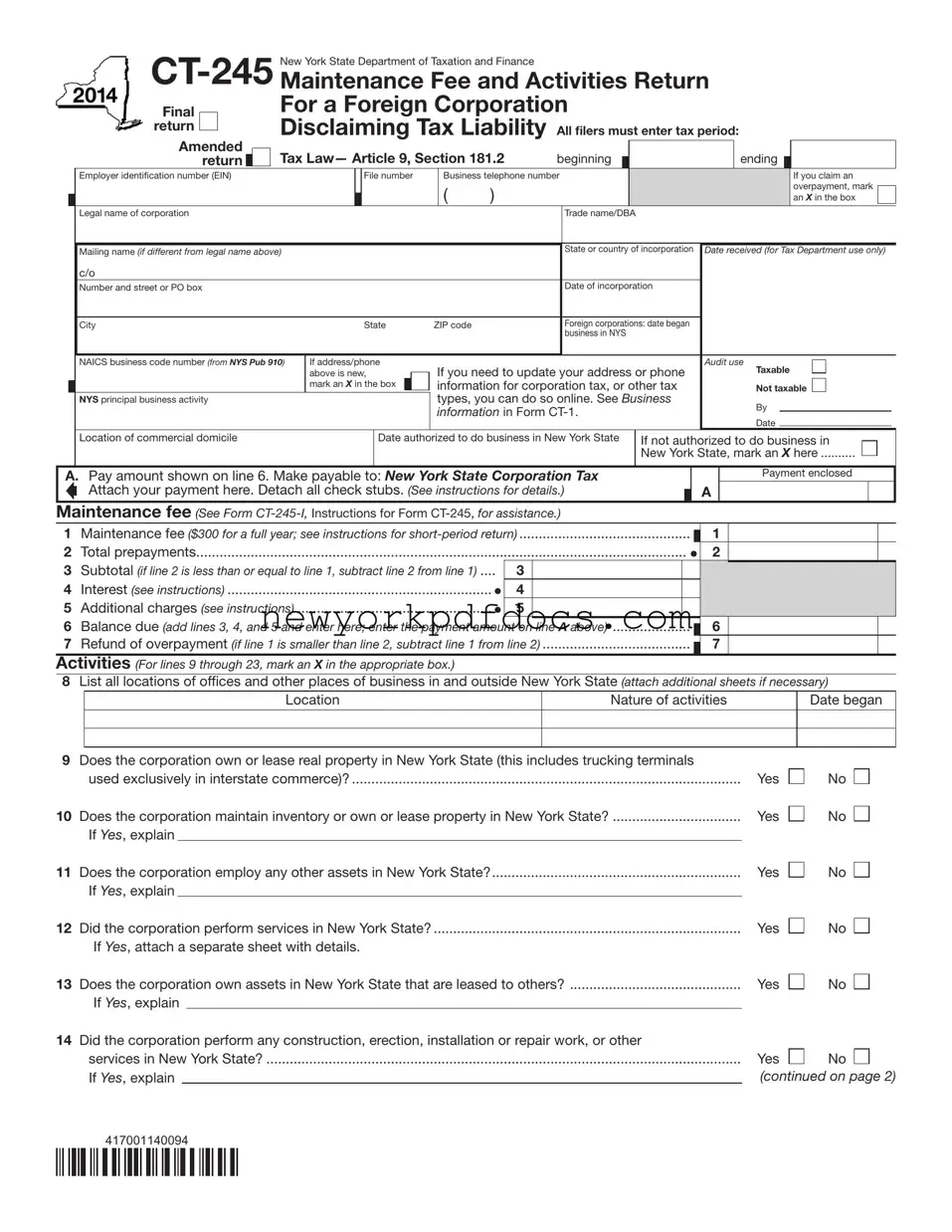

The NYS CT-245 form is a Maintenance Fee and Activities Return required for foreign corporations doing business in New York State. This form allows corporations to declare their tax liability and provide essential information about their business activities within the state. Proper completion of the CT-245 is crucial for compliance with New York tax regulations.

Open My Document Now

Free Nys Ct 245 Form

Open My Document Now

Your form isn’t finalized yet

Edit, save, and download Nys Ct 245 online with ease.

Open My Document Now

or

⇓ Nys Ct 245 PDF