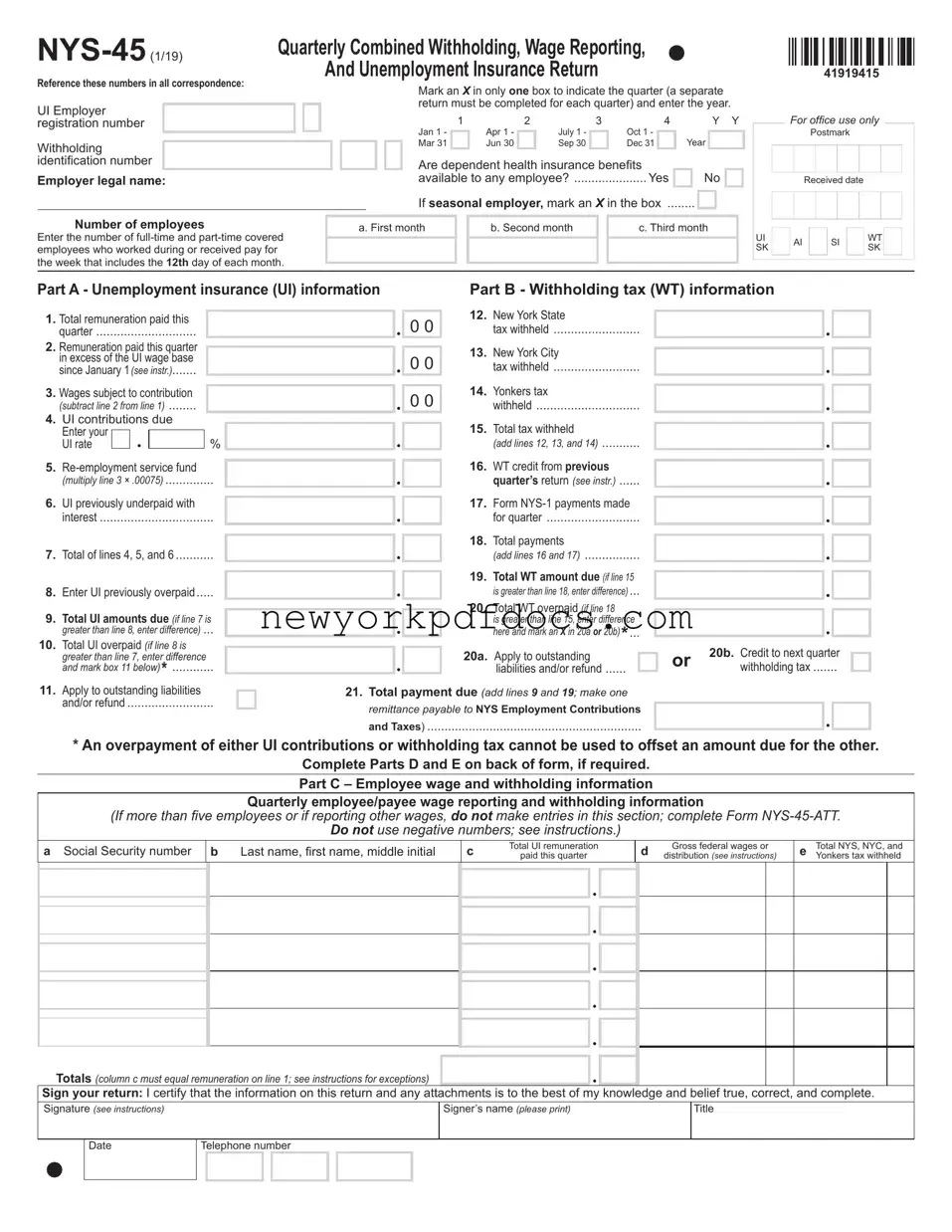

Filling out the NYS-45 form can be a straightforward process, but many people make common mistakes that can lead to delays or issues with their filings. One frequent error is failing to mark the correct quarter. It’s essential to only mark an "X" in one box to indicate the quarter you are reporting. Marking more than one box can cause confusion and may result in processing delays.

Another mistake is not entering the correct year. Make sure that the year you enter matches the quarter you are reporting. This simple oversight can lead to significant complications down the line, especially if the form is reviewed by tax authorities.

Many individuals also overlook the requirement to provide their Withholding Identification Number. This number is crucial for identifying your account and ensuring your payments are correctly applied. Without it, your submission may be considered incomplete.

Additionally, some people forget to include the total number of employees who worked during the quarter. Entering the number of full-time and part-time employees accurately is necessary for both unemployment insurance and tax calculations. Missing this information can lead to incorrect assessments of your liabilities.

Incorrectly calculating the total remuneration paid this quarter is another common error. Ensure that the figures you report are accurate and reflect what was actually paid. This will help avoid discrepancies that could trigger audits or additional inquiries.

Failing to sign the return is a mistake that can easily be overlooked. Remember, your signature certifies that the information provided is accurate to the best of your knowledge. Without your signature, the form may be deemed invalid.

Another frequent issue arises from not including the correct payment amount. If you owe taxes, ensure that the total payment due is calculated correctly. Double-check your math to avoid overpaying or underpaying.

Some filers neglect to review the instructions for any specific requirements related to their business type, such as seasonal employers. If you fall into this category, make sure to mark the appropriate box. This will help clarify your status and ensure proper processing.

Using negative numbers is another mistake that can complicate your filing. The form clearly states that negative numbers are not allowed. Ensure that all entries reflect positive amounts to avoid confusion.

Lastly, failing to keep a copy of the completed form for your records can be detrimental. Always retain a copy of your submission for future reference. This will help if any questions arise or if you need to verify your filings later.