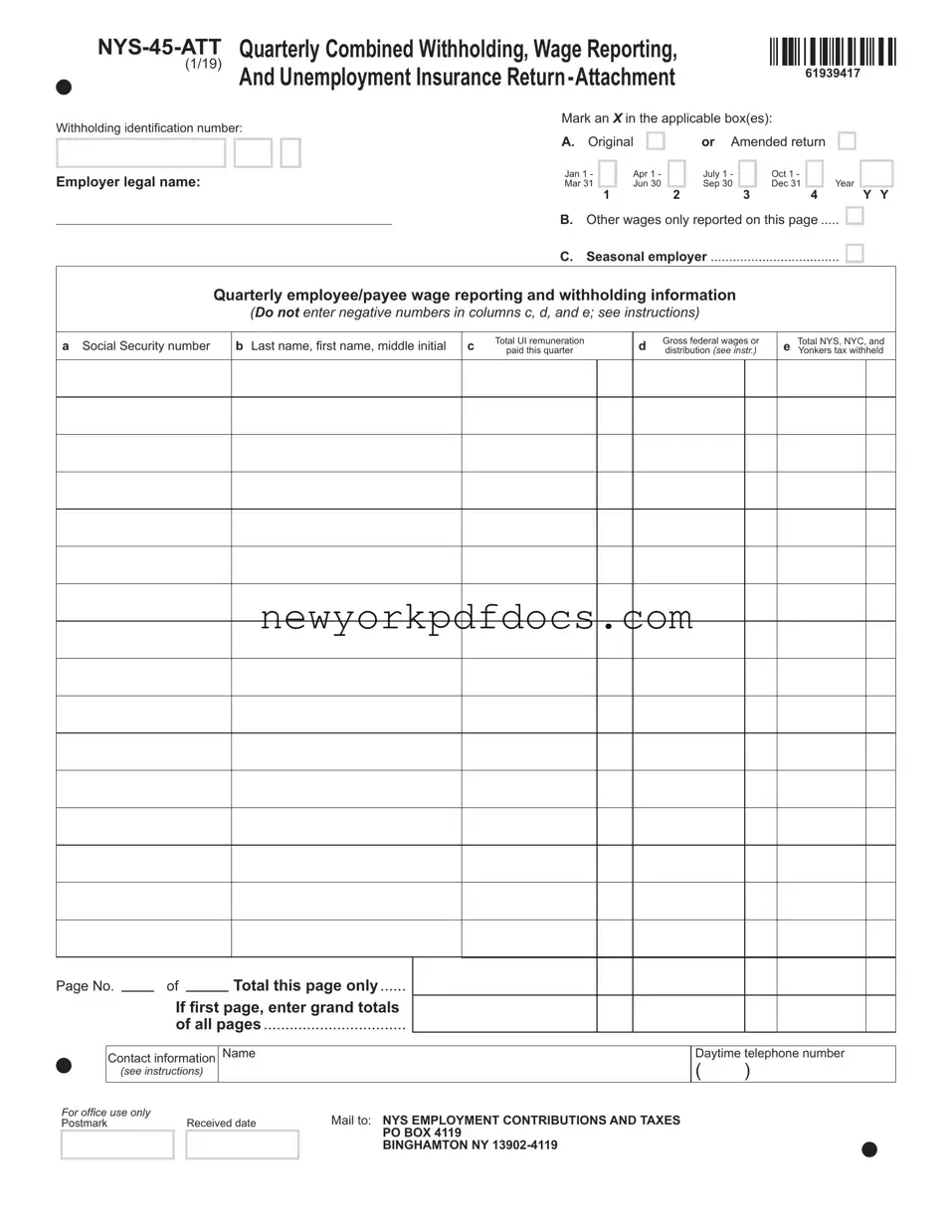

Completing the NYS-45-ATT form accurately is crucial for compliance with state regulations. One common mistake is failing to mark the correct box for the type of return. Individuals often overlook the importance of indicating whether the return is original or amended. This oversight can lead to processing delays and potential penalties.

Another frequent error is providing incorrect or incomplete employer information. The employer's legal name must match the name registered with the state. Any discrepancies can result in complications during the review process. Ensure that all details are accurate and up to date.

Many filers neglect to include the correct withholding identification number. This number is essential for proper identification of the employer and their tax obligations. Without it, the form may be rejected, causing unnecessary delays in processing.

When reporting wages, some individuals mistakenly enter negative numbers in the wage columns. This is explicitly prohibited on the form and can lead to confusion. Always ensure that only positive figures are reported in the total UI remuneration, gross federal wages, and tax withheld columns.

Inaccurate social security numbers are another common mistake. Each employee's social security number must be entered correctly to avoid issues with wage reporting and tax withholding. Double-check this information to ensure accuracy.

Another area of concern is the failure to provide grand totals on the first page. If this is the first page submitted, it is essential to summarize the totals of all pages. Omitting this information can lead to processing errors and delays.

Some filers forget to include their contact information, particularly the daytime telephone number. This information is vital for the tax authorities to reach out if there are questions or issues with the submission. Providing accurate contact details can expedite the resolution of any potential problems.

Another mistake is not adhering to the submission deadlines. The form must be submitted quarterly, and missing a deadline can result in fines. It is crucial to mark the due dates on your calendar and submit the form on time.

Lastly, many people fail to review the instructions provided with the form. These instructions offer valuable guidance on how to complete each section accurately. Ignoring these can lead to mistakes that could have been easily avoided.

By being aware of these common mistakes and taking the necessary steps to avoid them, individuals can ensure a smoother filing process and maintain compliance with state regulations.