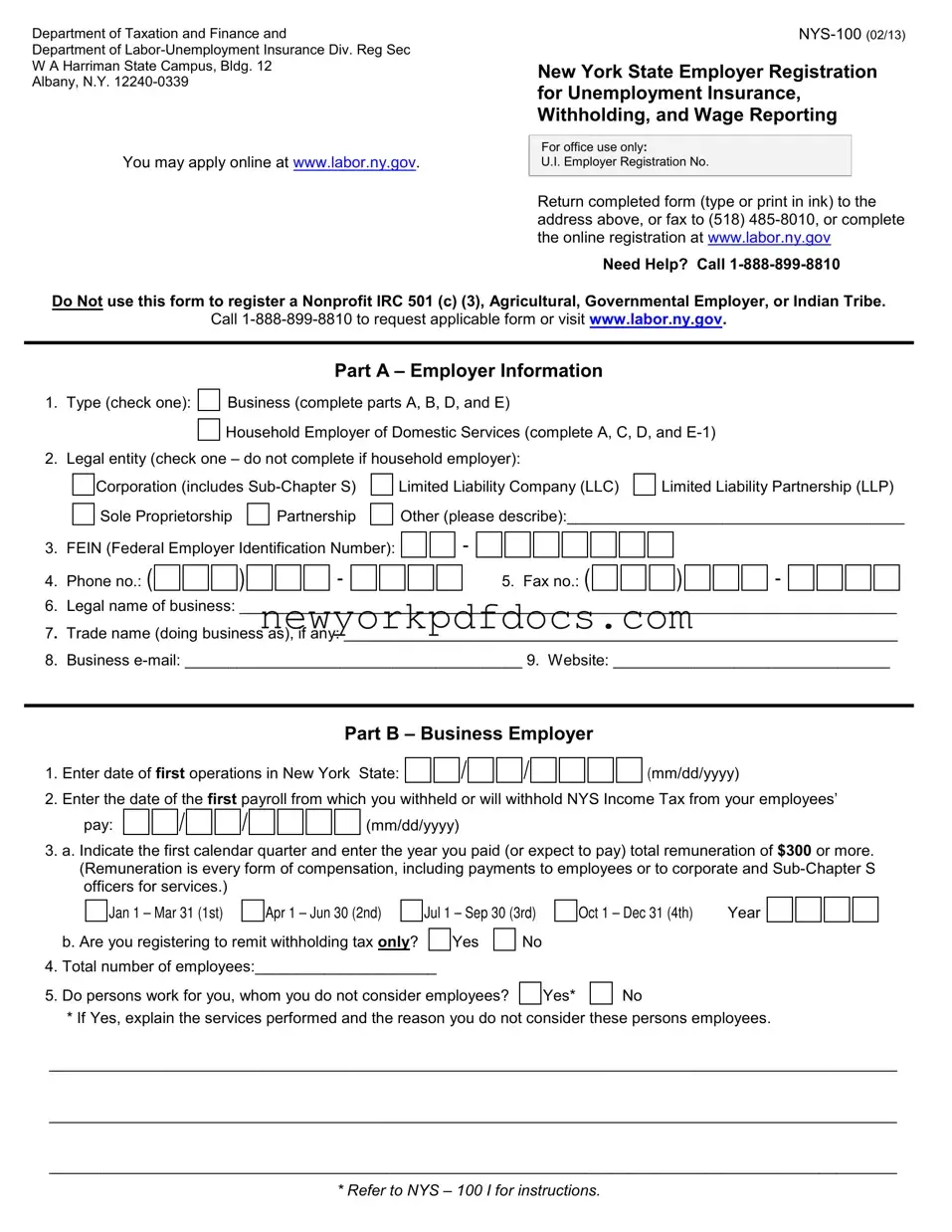

Department of Taxation and Finance and

Department of Labor-Unemployment Insurance Div. Reg Sec W A Harriman State Campus, Bldg. 12

Albany, N.Y. 12240-0339

NYS-100 (02/13)

New York State Employer Registration for Unemployment Insurance, Withholding, and Wage Reporting

You may apply online at www.labor.ny.gov.

For office use only:

U.I. Employer Registration No.

Return completed form (type or print in ink) to the address above, or fax to (518) 485-8010, or complete the online registration at www.labor.ny.gov

Need Help? Call 1-888-899-8810

Do Not use this form to register a Nonprofit IRC 501 (c) (3), Agricultural, Governmental Employer, or Indian Tribe.

Call 1-888-899-8810 to request applicable form or visit www.labor.ny.gov.

Part A – Employer Information

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Type (check one): |

|

Business (complete parts A, B, D, and E) |

|

|

|

|

|

|

|

Household Employer of Domestic Services (complete A, C, D, and E-1) |

|

|

|

|

|

2. |

Legal entity (check one – do not complete if household employer): |

|

|

|

|

|

Corporation (includes Sub-Chapter S) |

|

Limited Liability Company (LLC) |

|

Limited Liability Partnership (LLP) |

|

|

|

|

|

|

|

|

Sole Proprietorship |

|

Partnership |

|

|

Other (please describe):_______________________________________ |

|

|

|

|

|

|

3. FEIN (Federal Employer Identification Number):

4. Phone no.: ( |

|

|

|

|

|

) |

|

|

|

|

|

- |

|

|

|

|

|

|

|

5. Fax no.: ( |

|

|

|

|

|

) |

|

|

|

|

|

- |

6.Legal name of business: ____________________________________________________________________________

7.Trade name (doing business as), if any: ________________________________________________________________

8.Business e-mail: _______________________________________ 9. Website: ________________________________

Part B – Business Employer

1. |

Enter date of first operations in New York |

State: |

|

|

|

/ |

|

|

|

/ |

|

|

|

|

|

|

|

(mm/dd/yyyy) |

2. |

Enter the date of the first payroll from which you withheld or will withhold NYS Income Tax from your employees’ |

|

pay: |

|

|

|

/ |

|

|

|

/ |

|

|

|

|

|

|

|

(mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

3.a. Indicate the first calendar quarter and enter the year you paid (or expect to pay) total remuneration of $300 or more. (Remuneration is every form of compensation, including payments to employees or to corporate and Sub-Chapter S officers for services.)

|

|

|

Jan 1 – Mar 31 (1st) |

|

Apr 1 – Jun 30 (2nd) |

|

Jul 1 – Sep 30 (3rd) |

|

Oct 1 – Dec 31 (4th) |

Year |

|

b. Are you registering to remit withholding tax only? |

|

|

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Total number of employees:_____________________ |

|

|

|

|

|

|

|

|

5. |

Do persons work for you, whom you do not consider employees? |

|

|

Yes* |

|

|

No |

|

|

|

|

|

|

*If Yes, explain the services performed and the reason you do not consider these persons employees.

__________________________________________________________________________________________________

__________________________________________________________________________________________________

__________________________________________________________________________________________________

* REFER TO NYS – 100 I FOR INSTRUCTIONS.

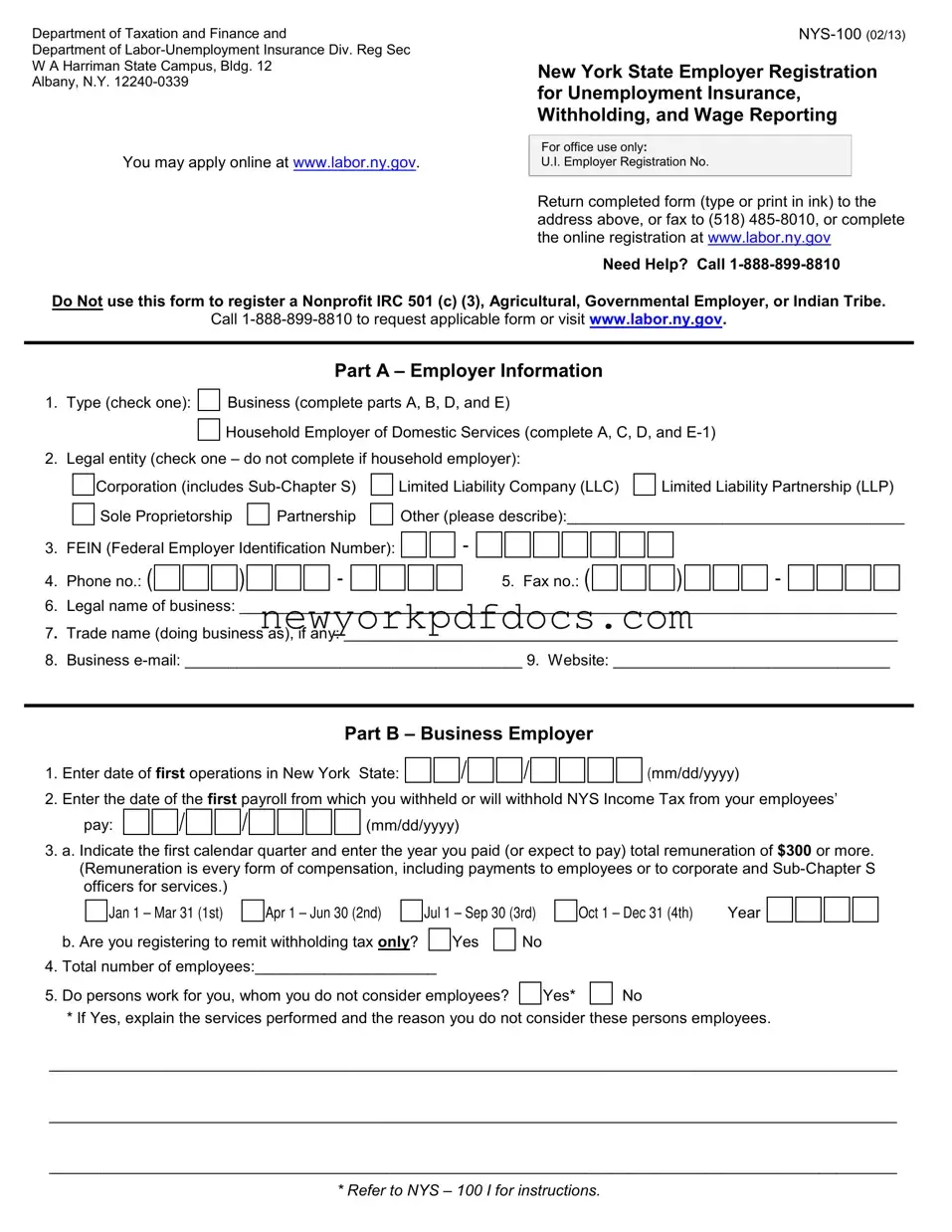

NYS 100 page 2 |

|

|

|

|

|

Legal Name: __________________________________ER Number: _________________________ |

6. |

Have you acquired the business of another employer liable for NYS Unemployment Insurance? |

|

|

|

|

|

Yes* |

|

No |

|

|

|

|

|

|

|

* If Yes, did you acquire |

|

All or |

|

|

Part? |

Date of acquisition: |

|

|

|

|

|

/ |

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prior Owner’s: Registration number: |

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

FEIN: |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal name of business: ______________________________________________________________ |

|

Address:___________________________________________________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Have you changed legal entity? |

|

|

Yes* |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part C – Household Employer of Domestic Services

1. Indicate the first calendar quarter and enter the year you paid (or expect to pay) total cash wages of $500 or more:

|

|

|

Jan 1 – Mar 31 (1st) |

|

Apr 1 – Jun 30 (2nd) |

|

Jul 1 – Sep 30 (3rd) |

|

|

Oct 1 – Dec 31 (4th) |

Year |

2. |

Enter the total number of persons employed in your home: ________________________ |

|

|

|

|

|

|

|

|

|

3. |

Will you withhold New York State income tax from these employees? |

|

|

Yes |

|

No |

|

Part D – Required Addresses

1.Mailing Address: This is your business mailing address where your Withholding Tax (WT) and Unemployment Insurance (UI) mail will be delivered. However, if you elect to have your UI mail directed to an address other than your place of business, complete number 4 below.

Street or PO Box: _______________________________________________________________________________

City:_______________________________________________________ State: _________ZIP Code:____________

2.Physical Address: This is the physical location of your business, if different from the Mailing Address in number 1.

Street: ________________________________________________________________________________________

City:_______________________________________________________ State: _________ZIP Code:____________

3.Location of Books/Records: This is the physical location where your Books and Records are maintained.

Street: ________________________________________________________________________________________

City:_______________________________________________________ State: _________ZIP Code:____________

Optional Addresses

4.Agent Address (C/O): Complete this if your UI mail should be sent to an address other than your business address.

C/O: __________________________________________________________________________________________

Street or PO Box: _______________________________________________________________________________

City:_______________________________________________________ State: _________ZIP Code:____________

5.LO 400 Form - Notice of Entitlement and Potential Charges Address: If completed, this is where the LO 400 will be directed. (It is mailed each time a former employee files a claim for Unemployment Insurance benefits.)

C/O: __________________________________________________________________________________________

Street or PO Box: _______________________________________________________________________________

City:_______________________________________________________ State: _________ZIP Code:____________

* REFER TO NYS – 100 I FOR INSTRUCTIONS.

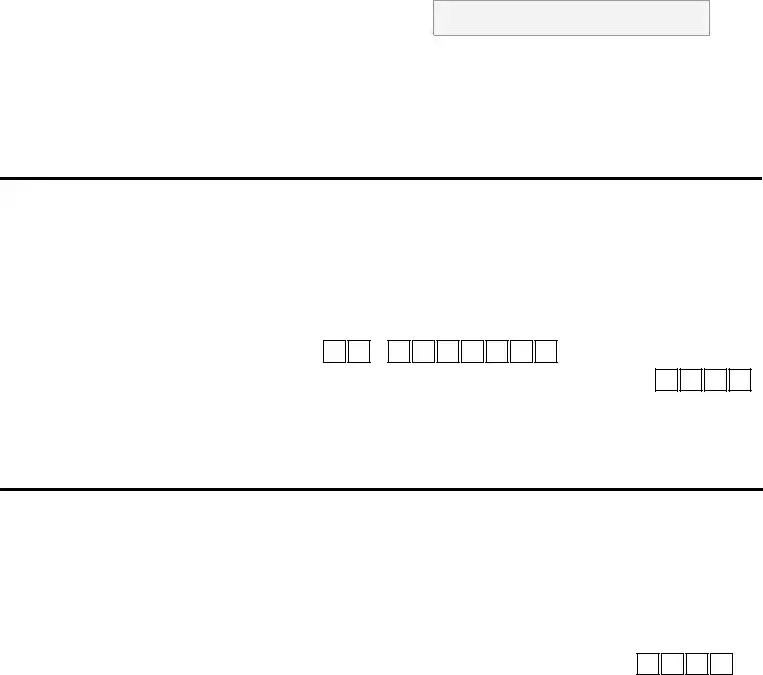

NYS 100 page 3 |

Legal Name: __________________________________ER Number: _________________________ |

Part E – Business Information

1.Complete the following for sole proprietor (owner), household employer of domestic services, all partners, including partners of LP, LLP or RLLP, all members of LLC or PLLC, and corporate officers (President, Vice President, etc.), whether or not remuneration is received or services are performed in New York State.

Name |

|

Social Security |

|

Title |

|

Residence Address |

|

|

Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.Please enter the number of physical locations at which your company operates: _____. You MUST list the physical address and answer questions A through E below, for each location. Use a separate sheet of paper for each.

a. Location: _______________________ |

____________________ |

_____________________ |

___________ |

Number and Street |

City or Town |

County |

Zip Code |

b. Approximately how many persons do you employ there? _______________

c. Check the principal activity at the above location:

Manufacturing

Wholesale trade

Retail trade

Construction

Warehousing

Transportation

Computer services

Educational services

Health & social assistance

Real estate

Scientific/professional & technical services

Finance & insurance

Arts, entertainment & recreation

Food service, drinking & accommodations

Corporate, subsidiary managing office

Other (Please specify):_____________________________________________________________________

d. If you are primarily engaged in manufacturing, complete the following:

Principal Products Produced |

Percent of Total Sales Value |

Principal Raw Materials Used |

____________________________ |

__________________________ |

_________________________ |

e. If your principal activity is not manufacturing, indicate products sold or services rendered:

Type of Establishment |

Principal Product Sold or |

Percent of Total Revenue |

|

Service Rendered |

|

_____________________________ |

__________________________ |

________________________ |

I affirm that I have read the above questions and that the answers provided are true to the best of

my knowledge and belief.

X________________________________________________________________

Signature of Officer, Partner, Proprietor, Member or Individual

_______________________________________________ Phone no.: (

Official Position

* REFER TO NYS – 100 I FOR INSTRUCTIONS.

Previous employer’s: Registration number:

Previous employer’s: Registration number: