Filling out the NYS-1 form can be straightforward, but many people make common mistakes that can lead to delays or issues with their tax filings. Here are seven mistakes to watch out for.

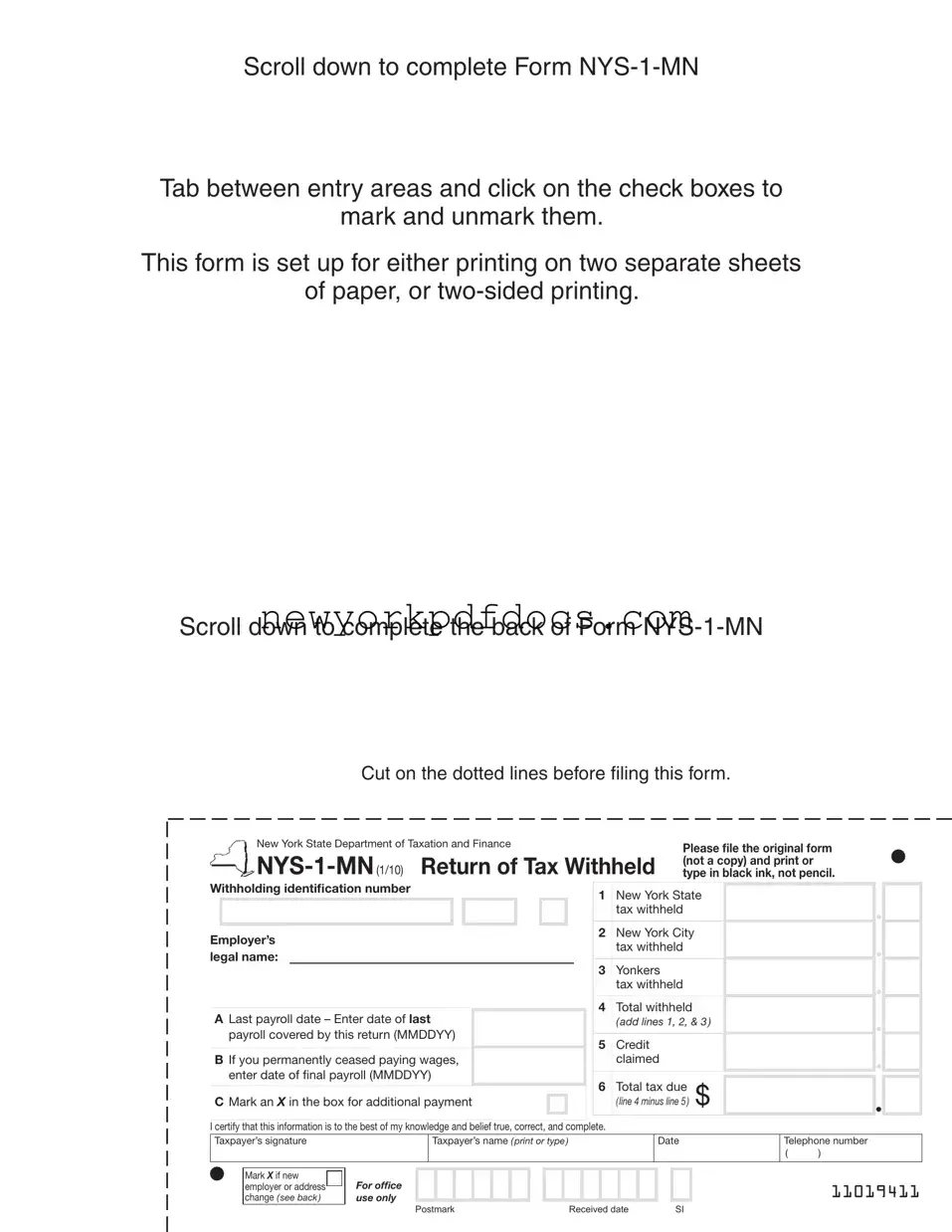

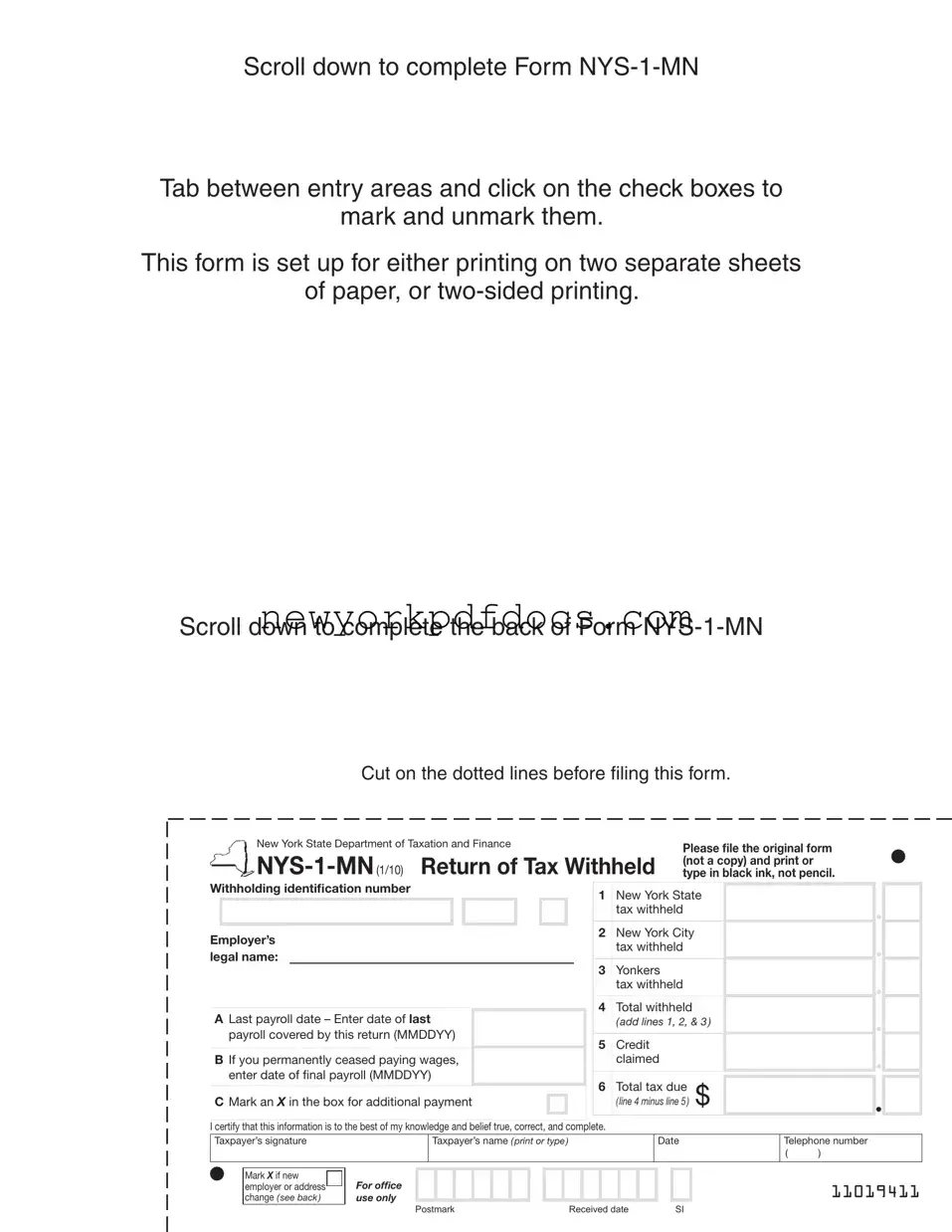

First, many individuals forget to use black ink when filling out the form. It’s essential to print or type in black ink, as using pencil or other colors can result in the form being rejected. Always double-check your ink choice before submitting.

Second, some people fail to provide their withholding identification number. This number is crucial for processing your return accurately. Without it, your submission may not be linked to your account, causing unnecessary complications.

Another common error is neglecting to mark the appropriate boxes for the taxes withheld. Ensure you mark an X in the boxes for New York State, New York City, and Yonkers taxes, as well as for total withheld. Missing these marks can lead to incorrect calculations of your total tax due.

Additionally, many filers overlook the requirement to sign and date the form. This certification confirms that the information provided is true and correct. A missing signature can delay processing, so always remember to sign before sending.

Some individuals also forget to include their contact information. Providing a telephone number is important in case the tax department needs to reach you for clarification or additional information. Make sure to fill in this section completely.

Another mistake is not cutting along the dotted lines before filing the form. This step is often overlooked, but it is necessary to ensure that the form is submitted correctly. Take the time to cut the form as instructed.

Lastly, failing to mail the form to the correct address can cause significant delays. Be sure to send your completed form to the NYS Tax Department’s processing unit, as indicated on the form, to ensure it reaches the right destination.

Avoiding these common mistakes will help ensure that your NYS-1 form is processed smoothly and efficiently. Take your time, review your entries, and follow the instructions carefully.