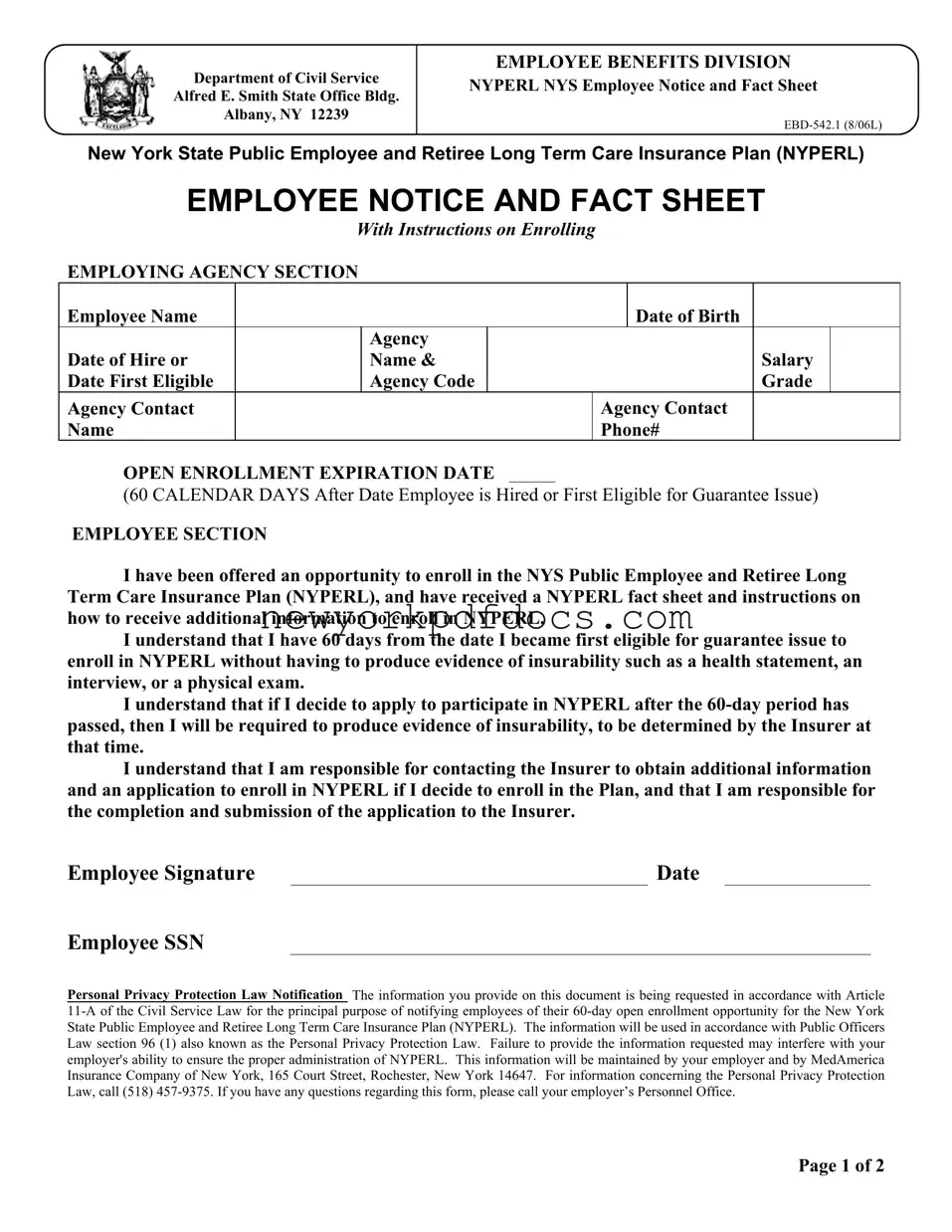

New York State Public Employee Long Term Care Insurance Plan (NYPERL)

EMPLOYEE NOTICE AND FACT SHEET

With Instructions on Enrolling

NYPERL is your employer's voluntary, employee-pay-all group long-term care insurance plan.

Long-term care is assistance you need if you are unable to carry out the basic activities of everyday living—bathing, continence, dressing, toileting, eating, or transferring, such as from a chair or bed. The need could arise from an accident or a debilitating illness. Or it could simply be the natural result of aging.

Only a small portion of the long-term care services you are likely to need are covered by health insurance or Medicare and long term care is expensive. According to a NYS Partnership study conducted in 2004, the average nursing facility cost in New York State is $95,937 per year.

NYPERL is designed to provide financial protection against the costs associated with long-term care covered services provided by a(n): nursing facility; home health care agency; adult day care center; or assisted living facility.

Premiums are based upon your age when you apply and the benefits you select. The younger you are when you apply, the lower the premium. As in any long term care insurance product, premiums may change, but only if the insurer changes the premium rates for all persons in the same premium payment class, regardless of where you reside at the time of the premium change.

NYPERL is administered and insured by MedAmerica Insurance Company of New York (Home Office: Rochester,

NY) and MedAmerica Insurance Company (Home Office: Pittsburgh, PA) headquartered in Rochester.

You should not buy long term care insurance if the only way you can afford to pay for it is by not paying other important bills. Look closely at your needs and resources, and discuss it with a family member to decide if long-term care insurance is right for you.

INSTRUCTIONS ON ENROLLING

An enrollment kit and more NYPERL information may be obtained by calling MedAmerica’s NYPERL Customer Service toll free number, 1-866-474-LTCI (5824), or by visiting the NYPERL website at www.NYPERL.net. Once you have reviewed the materials in the enrollment kit or the information on the website, Customer Service staff can walk you through the enrollment form and answer any questions you might have.

NYPERL applications are found in the Enrollment Booklet in the enrollment kit or are available on the NYPERL website. Submit your completed application to MedAmerica, not to your employer.

If an eligible employee is actively at work and applies for NYPERL during the 60 day open enrollment period, a health statement, health interview, physical exam or other evidence of insurability is not required. If you are an eligible employee applying under open enrollment, use Enrollment Form 1 found in the Enrollment Booklet of the enrollment kit.

If you are applying after the expiration of open enrollment or if an eligible family member is applying, use Enrollment Form 2 found in the Enrollment Booklet of the enrollment kit. This enrollment form contains a health statement that you must complete with the application.

Page 2 of 2