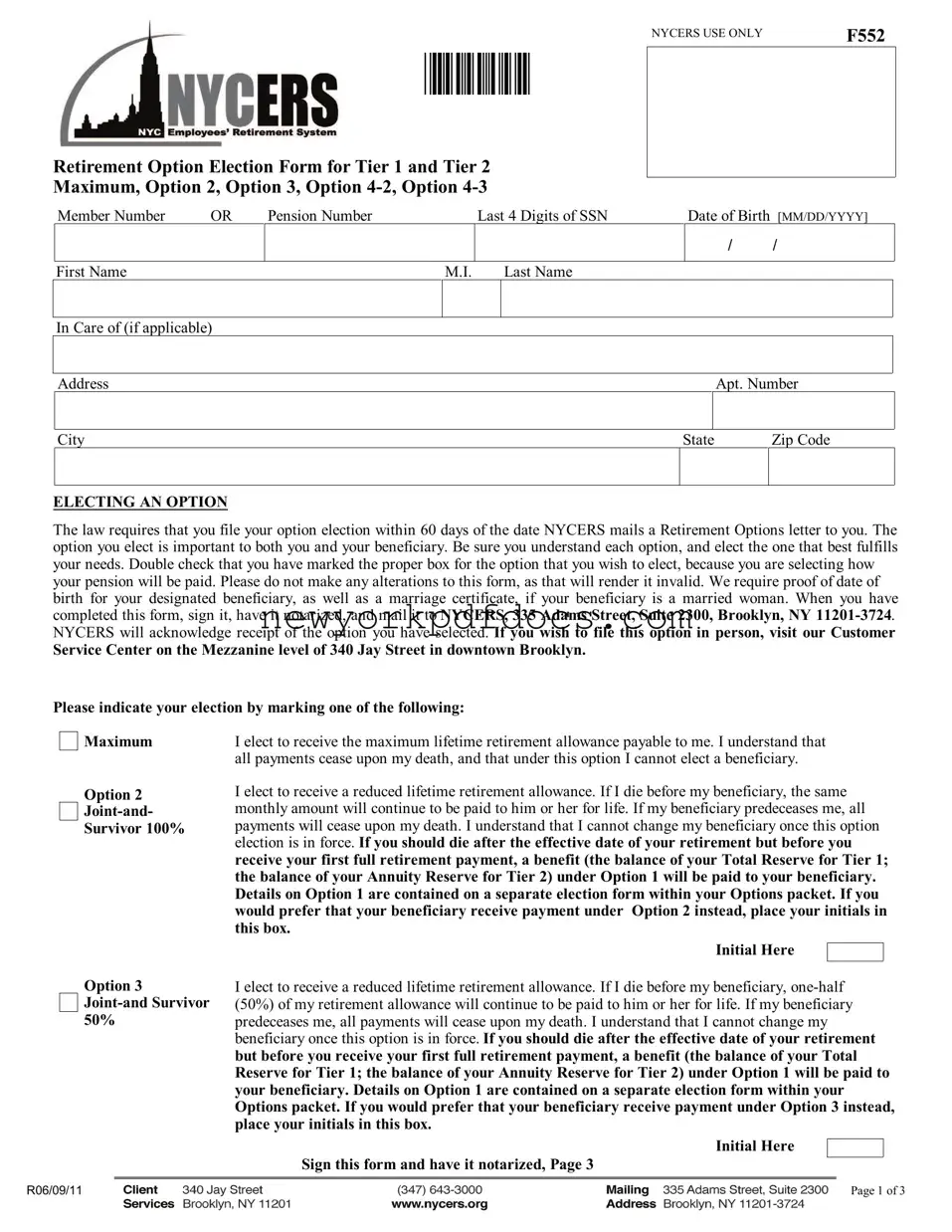

Filling out the NYCERS F552 form can be a straightforward process, but mistakes can lead to delays or complications. One common error is failing to submit the form within the required 60-day timeframe. The law mandates that the option election must be filed within this period after receiving the Retirement Options letter. Missing this deadline can result in the loss of the desired retirement option.

Another frequent mistake is neglecting to mark the correct box for the chosen retirement option. Each option has specific implications for both the retiree and their beneficiary. A simple oversight in marking the box can lead to selecting an option that does not align with one’s financial goals or family needs.

Inaccurate personal information is also a significant issue. Providing incorrect details, such as the member number, Social Security number, or date of birth, can result in processing delays. It is crucial to double-check all entries for accuracy before submission.

Additionally, some individuals fail to include required documentation, such as proof of date of birth for the designated beneficiary or a marriage certificate if the beneficiary is a married woman. Omitting these documents can lead to the form being considered incomplete.

Many people overlook the necessity of notarization. The form must be signed in the presence of a Notary Public or Commissioner of Deeds. Without this step, the form is invalid, and the election cannot be processed.

Another mistake involves not understanding the implications of the chosen option. Each option has distinct benefits and drawbacks, and failing to comprehend these can lead to future financial strain. It is essential to review and understand each option thoroughly before making a decision.

Some individuals mistakenly provide information about a beneficiary when electing the Maximum Allowance option. This option does not allow for any beneficiary designation, and including this information can cause confusion and delays in processing the application.

Another common error is not initialing the box if one prefers their beneficiary to receive payment under Options 2, 3, 4-2, or 4-3. This initialing is a critical step that indicates the member's choice, and failing to do so can lead to the default option being applied.

Lastly, people often forget to keep a copy of the completed form for their records. Retaining a copy is important for future reference and to ensure that any discrepancies can be addressed promptly.