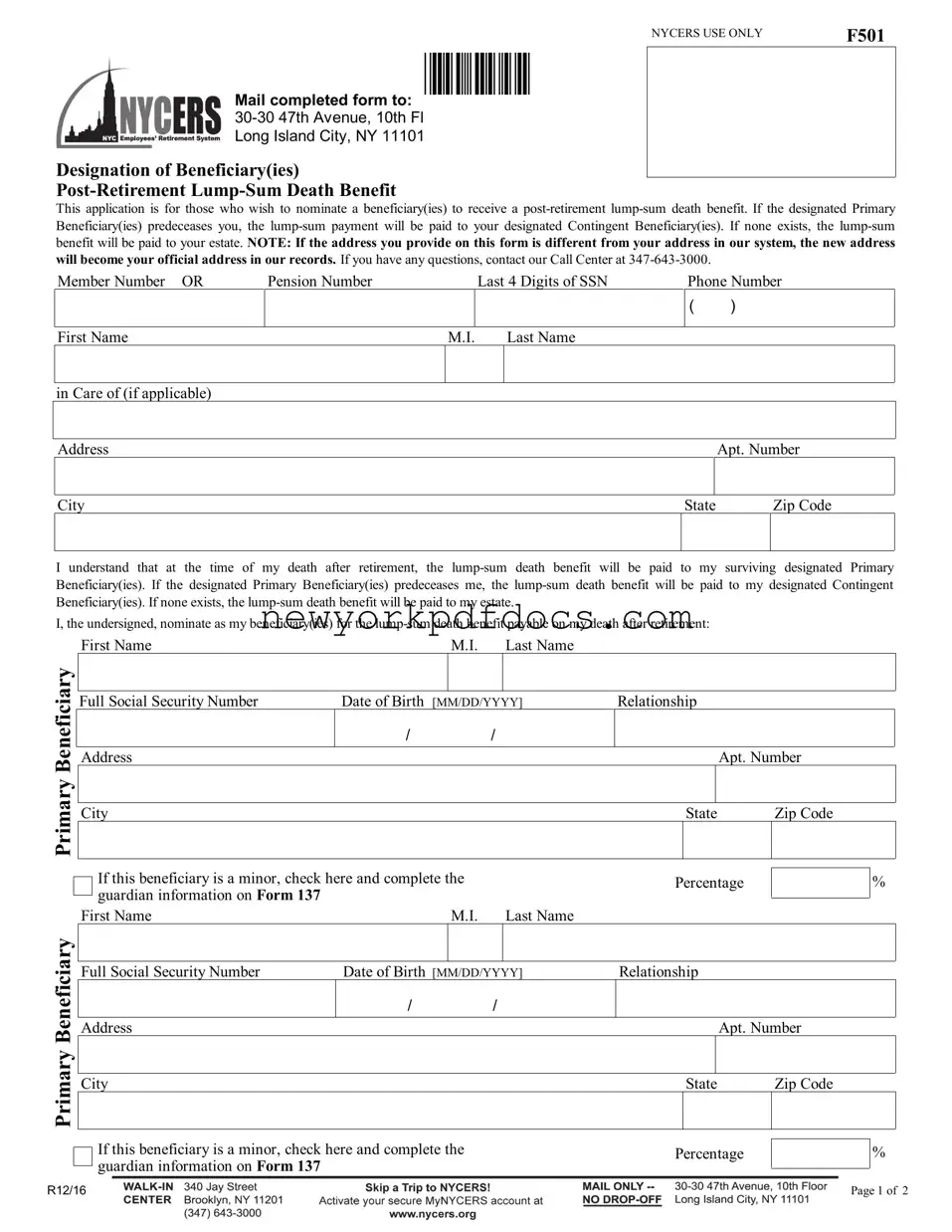

Filling out the NYCERS F501 form can be straightforward, but there are common mistakes that individuals make. One frequent error is failing to provide complete and accurate personal information. This includes not only the member's name and contact details but also the Social Security number and pension number. Incomplete information can lead to delays or rejections of the application.

Another common mistake is neglecting to designate both primary and contingent beneficiaries. If a primary beneficiary predeceases the member, the benefit will go to the contingent beneficiary. If neither is designated, the benefit will default to the member's estate, which may not align with their wishes.

People often forget to check the box for minor beneficiaries. If a designated beneficiary is underage, it is crucial to indicate this and complete the guardian information on Form 137. Omitting this step can complicate the distribution of benefits after the member's passing.

Many individuals also overlook the requirement to notarize the form. The signatures must be acknowledged by a Notary Public or Commissioner of Deeds. Failing to have the form notarized can render it invalid, delaying the process of benefit distribution.

Additionally, some applicants mistakenly think they can write in additional beneficiaries after nominating their estate. This is incorrect; if the estate is chosen as a beneficiary, all other sections must be left blank. This misunderstanding can lead to confusion and potential issues in the future.

Another error involves not providing the correct percentage allocations for multiple beneficiaries. Each beneficiary must have a designated percentage of the benefit. If the percentages do not total 100%, the application may be rejected or lead to disputes among beneficiaries.

Individuals sometimes forget to sign and date the form. This step is essential, as an unsigned form is not valid. It is important to double-check that the signature is present before submitting the application.

Lastly, applicants may not review the entire form for clarity and accuracy before submission. A thorough review can catch any mistakes or omissions that could lead to complications later on. Taking the time to ensure that everything is correct can save time and effort in the long run.