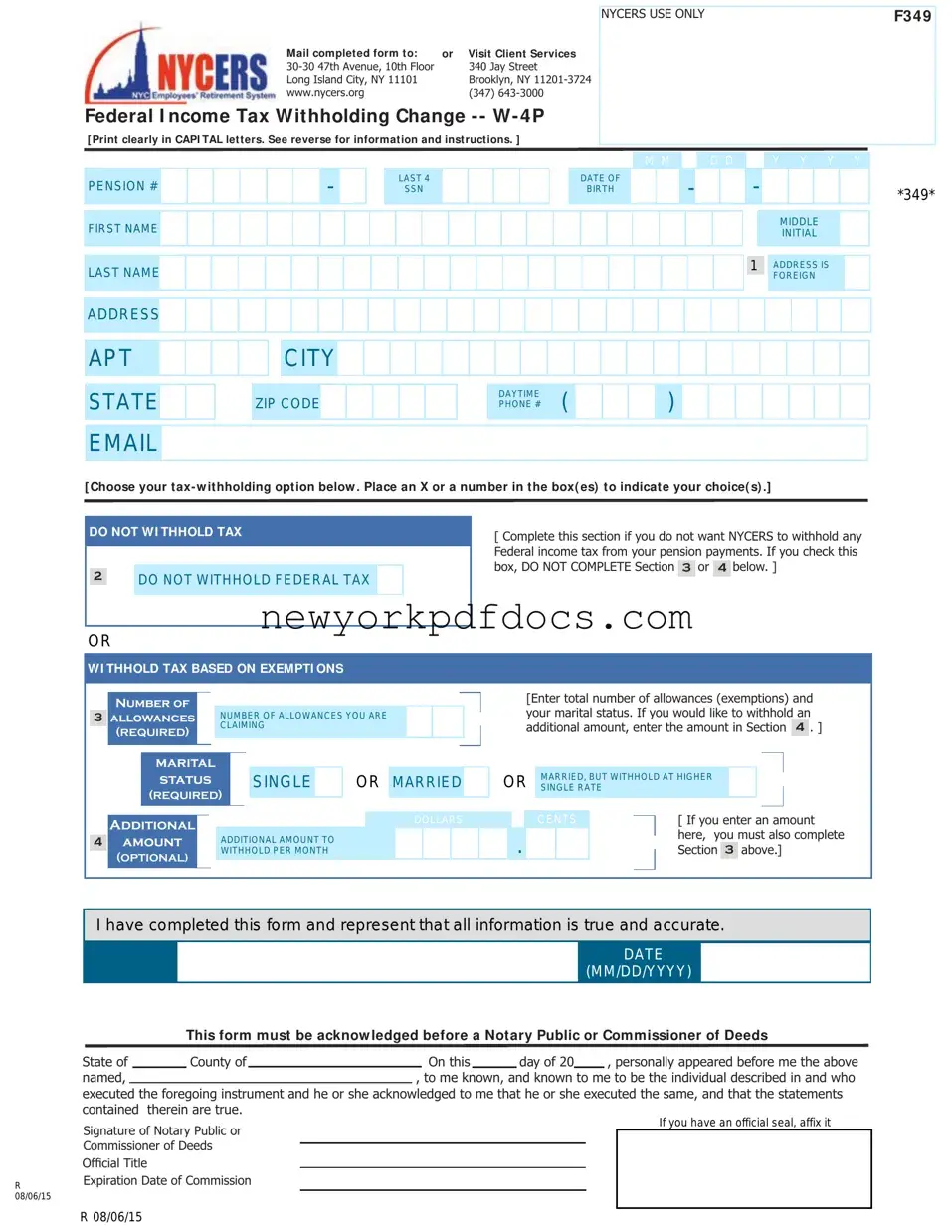

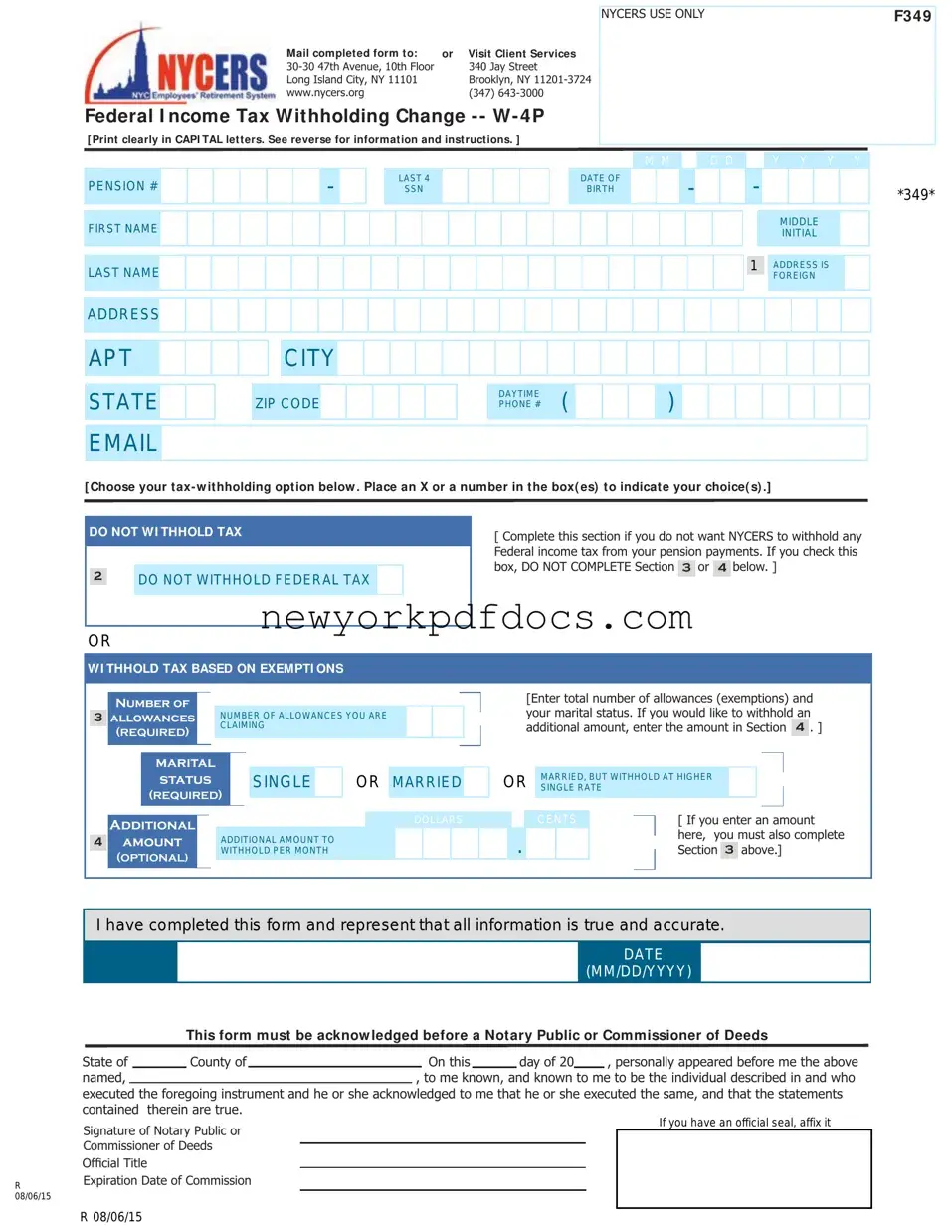

Filling out the NYCERS F349 form can seem straightforward, but many individuals make common mistakes that can delay processing or lead to incorrect tax withholding. One frequent error is not printing clearly in capital letters. When forms are not legible, it can create confusion and result in processing delays. Always take the time to write clearly, ensuring that every letter is easily identifiable.

Another mistake involves not selecting a tax withholding option. The form provides specific choices, and failing to mark an option can lead to NYCERS withholding no taxes by default. This oversight can have financial implications, especially if individuals expect to have taxes deducted from their pension payments. Always double-check that you have made your selection.

Many people also forget to complete the required sections fully. For instance, if you choose to withhold tax based on exemptions, you must provide the number of allowances and your marital status. Omitting this information can result in a processing hold. Ensure that every required field is filled out completely before submitting the form.

In addition, individuals often overlook the additional amount section. If you wish to withhold more than the standard amount, you need to specify this in Section 4. Leaving this section blank when you intended to withhold an extra amount can lead to unexpected tax liabilities later on.

Another common mistake is neglecting to have the form notarized. The NYCERS F349 form requires acknowledgment by a Notary Public or Commissioner of Deeds. Failing to complete this step can invalidate the form, causing further delays in processing your request. Always ensure that this important step is not overlooked.

Moreover, individuals sometimes forget to check the expiration date of the Notary's commission. If the notary's commission has expired, the acknowledgment may be deemed invalid. Before submitting, verify that the notary's credentials are current.

People also frequently submit the form without reviewing it for errors. Simple mistakes, such as typos or incorrect information, can lead to complications. Taking a moment to review the completed form can save time and prevent unnecessary issues.

Lastly, some individuals fail to keep a copy of the submitted form for their records. This can be problematic if there are questions or issues later on. Always make a copy of your completed form before mailing it or submitting it in person. This practice ensures you have a reference point for any future inquiries.

2

2  3

3 4

4

5

5 6

6 7

7 8

8 9

9

0

0

A

A  B

B C

C D

D E

E F

F G

G

H

H I

I  J

J  K

K L

L  M

M N

N O

O  P

P Q

Q

R

R  S

S T

T  U

U

V

V  W

W X

X  Y

Y  Z

Z