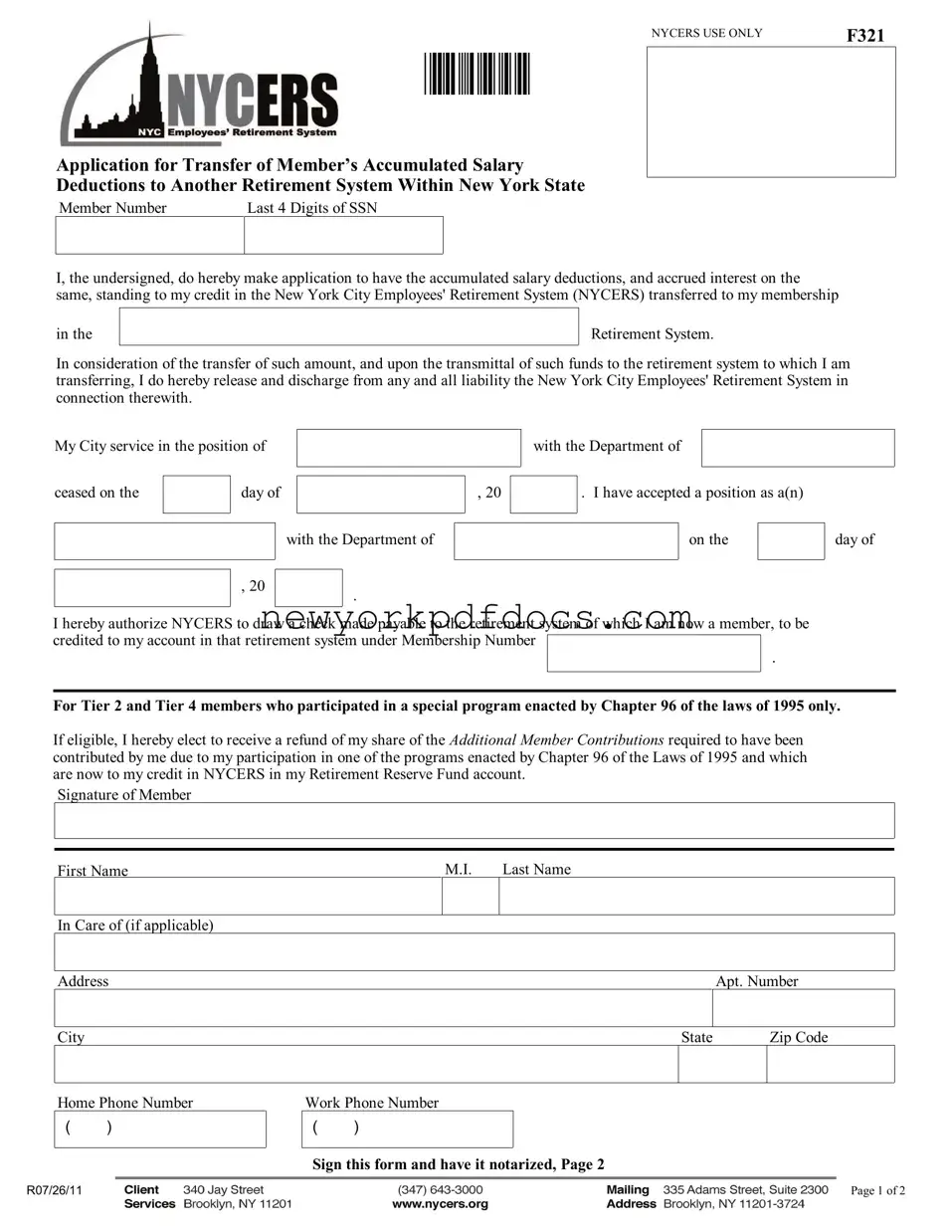

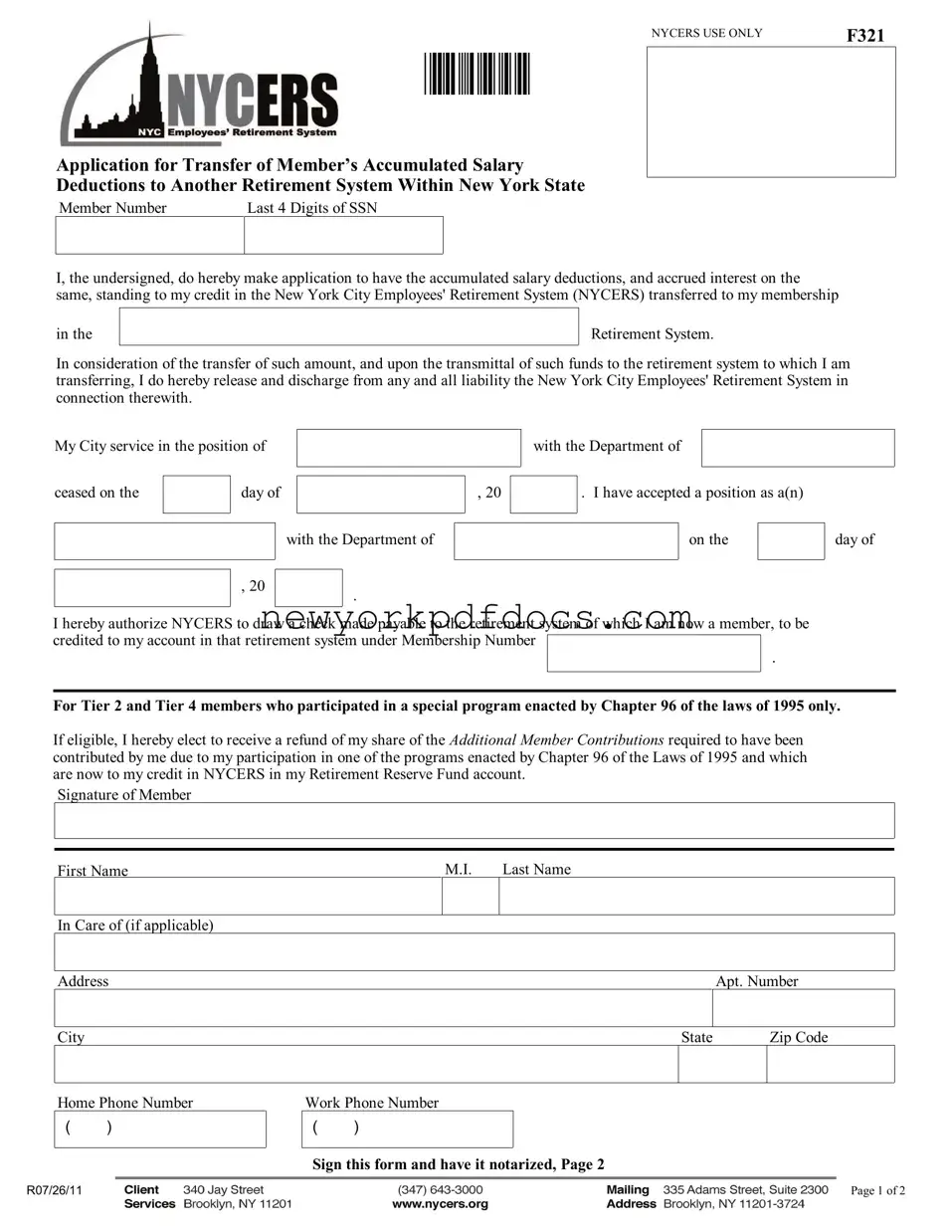

Free Nycers F321 Form

The NYCERS F321 form is an application used by members of the New York City Employees' Retirement System to transfer their accumulated salary deductions to another retirement system within New York State. This form not only facilitates the transfer of funds but also releases NYCERS from any liability related to that transfer. Understanding how to properly complete and submit the F321 form is essential for a smooth transition between retirement systems.

Open My Document Now

Free Nycers F321 Form

Open My Document Now

Your form isn’t finalized yet

Edit, save, and download Nycers F321 online with ease.

Open My Document Now

or

⇓ Nycers F321 PDF