*266*

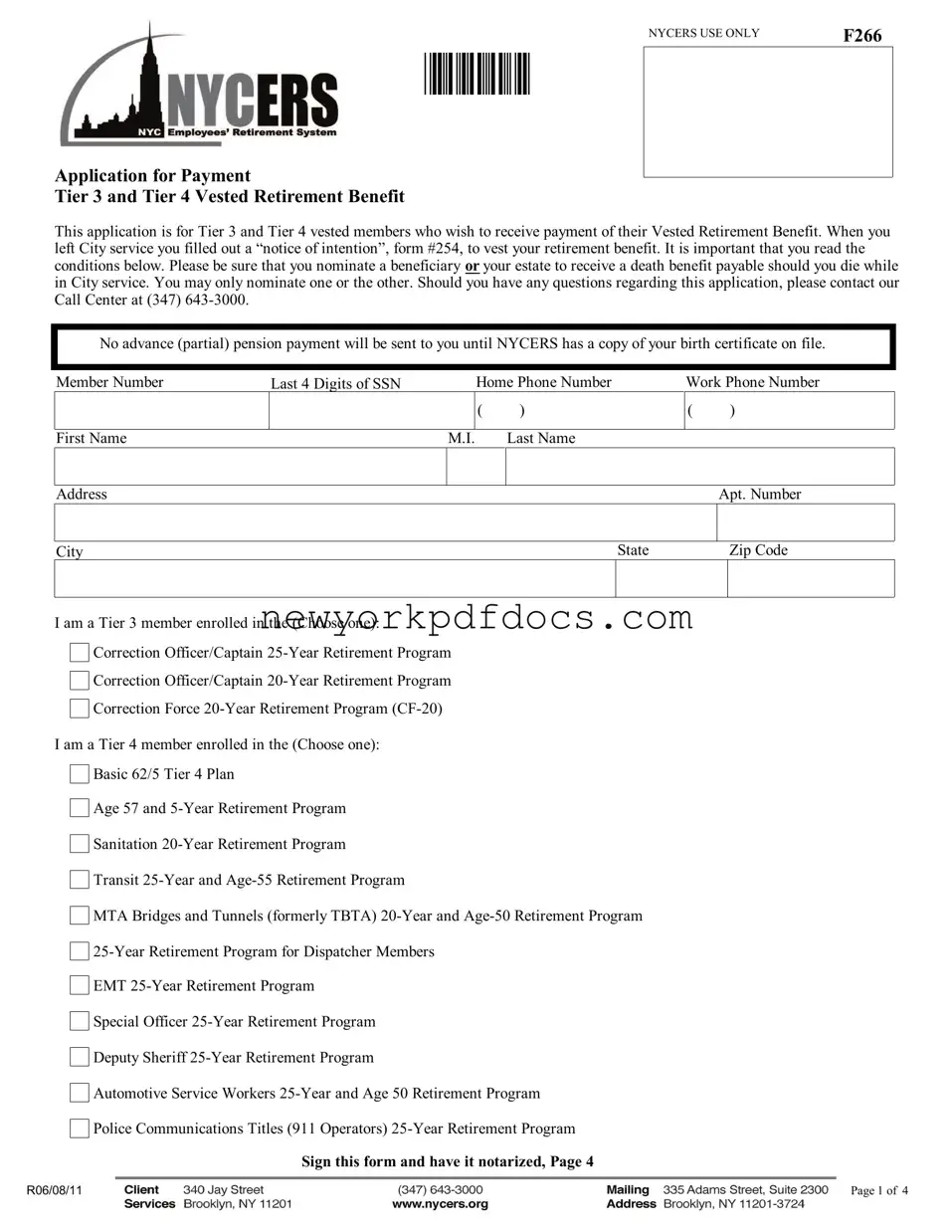

Application for Payment

Tier 3 and Tier 4 Vested Retirement Benefit

This application is for Tier 3 and Tier 4 vested members who wish to receive payment of their Vested Retirement Benefit. When you left City service you filled out a “notice of intention”, form #254, to vest your retirement benefit. It is important that you read the conditions below. Please be sure that you nominate a beneficiary or your estate to receive a death benefit payable should you die while in City service. You may only nominate one or the other. Should you have any questions regarding this application, please contact our Call Center at (347) 643-3000.

No advance (partial) pension payment will be sent to you until NYCERS has a copy of your birth certificate on file.

Member Number |

Last 4 Digits of SSN |

Home Phone Number |

( )

First Name |

M.I. |

Last Name |

|

|

|

|

|

|

|

|

Address |

|

|

|

Apt. Number |

|

|

|

|

|

|

City |

|

|

State |

|

Zip Code |

|

|

|

|

|

|

I am a Tier 3 member enrolled in the (Choose one):

Correction Officer/Captain 25-Year Retirement Program

Correction Officer/Captain 20-Year Retirement Program

Correction Force 20-Year Retirement Program (CF-20)

I am a Tier 4 member enrolled in the (Choose one):

Basic 62/5 Tier 4 Plan

Age 57 and 5-Year Retirement Program

Sanitation 20-Year Retirement Program

Transit 25-Year and Age-55 Retirement Program

MTA Bridges and Tunnels (formerly TBTA) 20-Year and Age-50 Retirement Program

25-Year Retirement Program for Dispatcher Members

EMT 25-Year Retirement Program

Special Officer 25-Year Retirement Program

Deputy Sheriff 25-Year Retirement Program

Automotive Service Workers 25-Year and Age 50 Retirement Program

Police Communications Titles (911 Operators) 25-Year Retirement Program

Sign this form and have it notarized, Page 4

Member Number |

Last 4 Digits of SSN |

|

|

Option Selection:

Once your eligibility is verified and this form is processed, you will receive a letter from NYCERS providing the full complement of retirement options available. In the interim, to afford you maximum protection from the date of your vested retirement until the date of your first full payment, you must select a temporary retirement option, as well as a beneficiary. Once vested, if you should die before selecting either of the options, or if you fail to name a beneficiary, NO DEATH BENEFIT WILL BE PAYABLE FROM

NYCERS.

The two temporary options are: The Ten Year Certain Option and the 100% Joint-and-Survivor Option. Please read the descriptions of both before choosing your retirement option. Please choose only one of the following.

Ten-Year Certain

If you die within ten years from the date of your retirement, the reduced monthly retirement benefit will continue to be paid to your surviving primary beneficiary for the unexpired balance of the ten-year period. If the designated primary beneficiary predeceases you, the balance of the payment continues to your contingent beneficiary. If none exists, it is paid in a lump-sum to your estate. Should a primary beneficiary die after receiving payments, the balance will be paid in a lump-sum to your contingent beneficiary. If none exists, the lump-sum balance is paid to the estate of the primary beneficiary. You may nominate both a primary and a contingent beneficiary under this option.

100% Joint-and-Survivor

This option assures you and your designated beneficiary a reduced benefit for lifetime. Should you die, your designated beneficiary will receive the same lifetime benefit. Because this option guarantees two specific people an income for life, the life expectancies of the retiree as well as the beneficiary are taken into consideration. Therefore, once you designate a beneficiary and the option is in force, you cannot change your beneficiary designation, even if he/she precedes you in death. You may only nominate a primary beneficiary under this option.

Beneficiary Selection

This is split into two sections: Section A - Designation of Beneficiary and Section B - Nomination of Your Estate. It is important that you only fill out one section, for if you fill out both, your selection will be voided.

Section A - Designation of Beneficiary

A designated beneficiary is the person who is on file at NYCERS to receive a survivor benefit payable upon the death of a member. If you decide to nominate your estate rather than a person DO NOT FILL OUT THIS SECTION, see Section B.

The beneficiary whom I wish to nominate to receive my death benefit is:

Primary Beneficiary

First Name

Full Social Security Number

Address

City

M.I. Last Name

Date of Birth [MM/DD/YYYY] |

Relationship |

/ /

Apt. Number

If this beneficiary is a minor, check here and complete the guardian information on Form 137

Sign this form and have it notarized, Page 4

Member Number |

Last 4 Digits of SSN |

|

|

If I have chosen the Ten Year Certain and my designated primary beneficiary dies before the ten-year period expires, the contingent beneficiary whom I nominate to receive benefits is:

Contingent Beneficiary

First Name

Full Social Security Number

Address

City

M.I. Last Name

Date of Birth [MM/DD/YYYY] |

Relationship |

/ /

Apt. Number

If this beneficiary is a minor, check here and complete the guardian information on Form 137

Section B - Designation of Estate: Please initial the box below if you wish to nominate your estate. You may not fill in the above section if you fill out part B.

I am nominating my Estate as my beneficiary for my regular death benefit. I understand that in order for this selection to be valid I may not write in any other beneficiary’s name on this form, and I have, in fact, left all other designation of beneficiary sections on this form blank.

Should your death be the result of an on-the-job accident, an accidental death benefit is payable upon application in this priority: spouse (who has not remarried), child under the age 25, dependent parent, or any other qualified dependent under the age of 21. If no such beneficiary exists, then your benefit is payable to the names you list on this form.

Federal Tax Withholding

Federal tax law provides that all payers are required to withhold Federal income tax on periodic payments (similar to wages), unless you elect to be excluded from such withholding. This election will remain in effect until revoked by you. If you do not complete this election, Federal income tax will be withheld at the rate of a married individual claiming three exemptions.

Please indicate your withholding selection by marking the appropriate choice below:

Do not withhold Federal income tax from my pension. (Do not complete 2 or 3 if you select this option)

2. |

Withhold based on |

|

|

|

|

|

(Check one only) |

Single |

number of exemptions using the following status (You may also enter a dollar amount in choice 3):

Married |

|

Married, but withhold at higher "Single" rate |

In addition to the amount withheld based on my exemptions and filing status in choice 2,

I would like to withhold $ |

|

Per Month (Must specify dollar amount only) |

|

|

|

Note: You cannot enter an amount here without entering a number of exemptions in choice 2 (even if that number is zero).

Sign this form and have it notarized, Page 4

Member Number |

Last 4 Digits of SSN |

|

|

I, the undersigned, hereby make application for payment of a Vested Retirement Benefit under the provisions of my retirement plan.

Signature of Member |

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This form must be acknowledged before a Notary Public or Commissioner of Deeds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State of |

|

County of |

|

|

On this |

|

day of |

|

|

2 0 |

|

, personally appeared |

before me the above named, |

|

|

|

|

|

|

, to me known, and known to |

me to be the individual described in and who executed the foregoing instrument, and he or she acknowledged to me that he or she

executed the same, and that the statements contained therein are true. |

If you have an official seal, affix it |

Signature of Notary Public or |

|

|

Commissioner of Deeds |

|

|

|

|

|

|

|

|

Official Title |

|

|

|

|

|

|

Expiration Date of Commission |

|

|

|

|

|

|

|

|

Sign this form and have it notarized, THIS PAGE