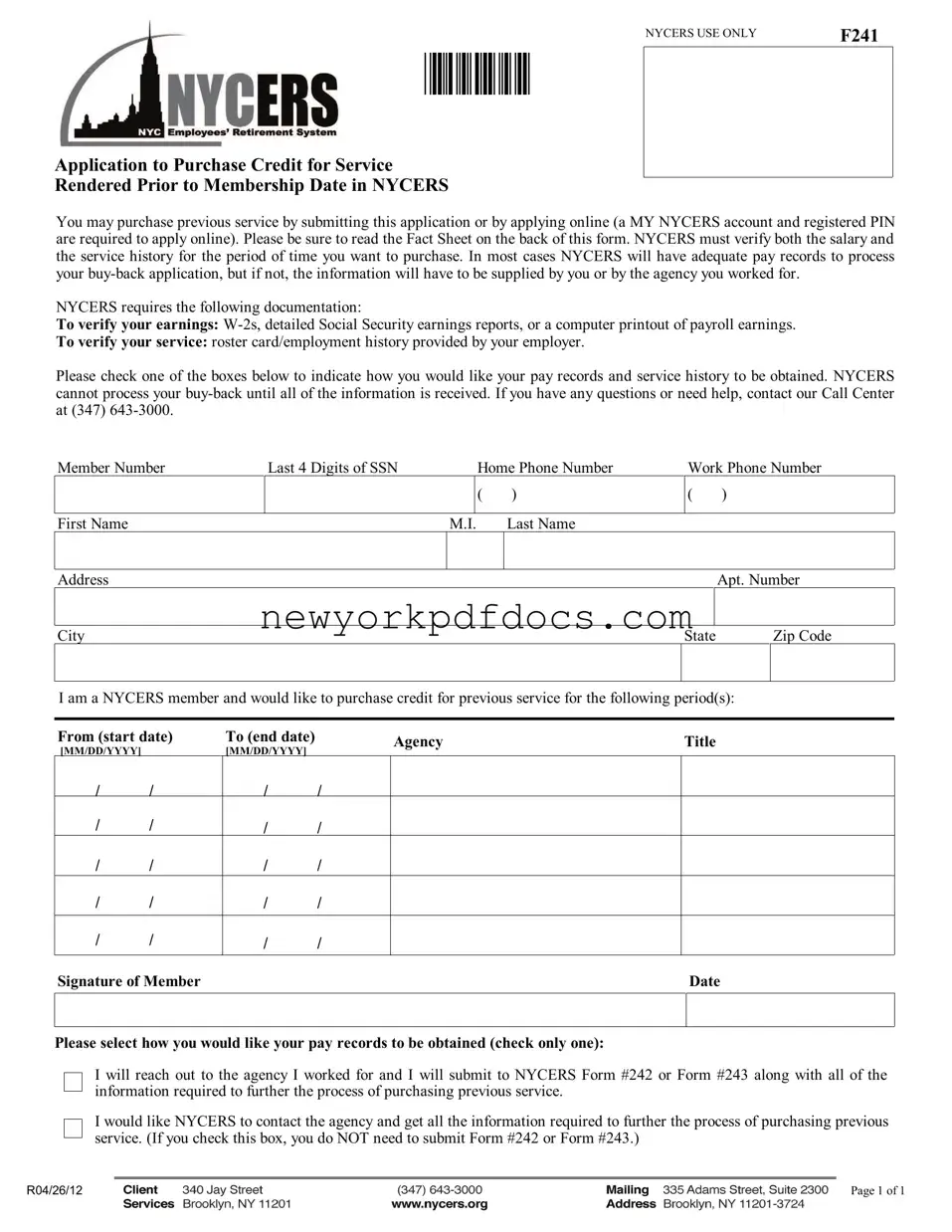

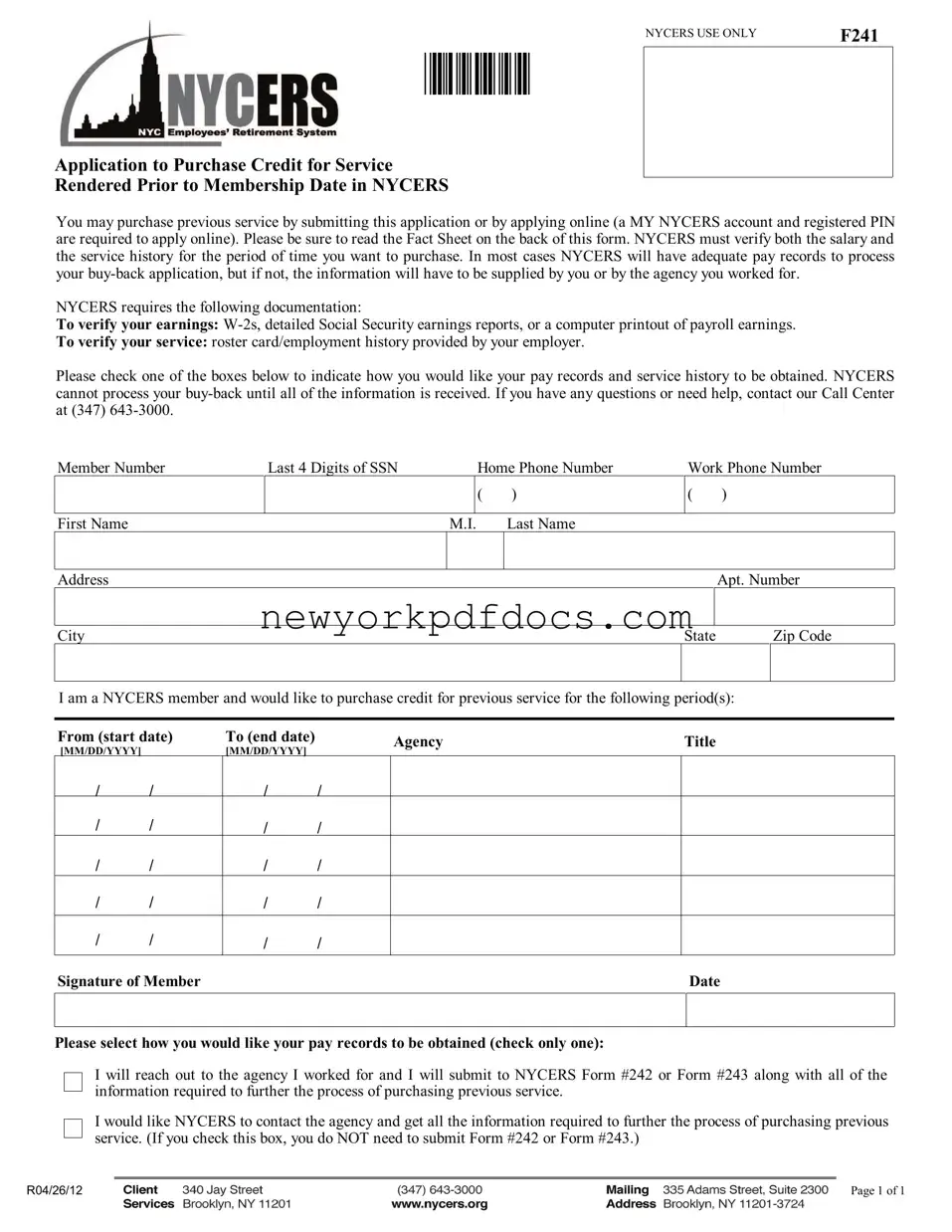

F241

FACT SHEET

What previous service can I purchase?

Tier 1 members: You are eligible to buy back full or part-time New York City service rendered previous to your NYCERS membership.

All other Tiers: You can buy back full or part-time public service rendered within New York State prior to your NYCERS membership. For the service you want to buy back, you must have been in a position that would have allowed you to join a public employee retirement system in New York State (regardless of whether you actually joined or not).

All Tiers: You are not eligible to buy back time you worked for a private company, for the federal government, or for any government office outside of New York State.

Will the previous service I buy back make me eligible to retire sooner?

Generally, yes. In most plans, you are able to retire sooner when you buy back previous service. There are a couple of exceptions, however. Some plans don't allow all the types of previous service to count as qualifying time - such as in the Tier 1 and 2 Career Pension Plan (Plans A and C). In some Special Programs, such as the Transit 55/25 Program, the service cannot be used at all. If you are unsure of the rules under your plan, contact NYCERS before you apply to purchase any previous service.

Does it pay for me to buy back previous service?

Generally, yes. Since most of NYCERS' retirement benefits are calculated based on your years of service, the additional years - under most plans - will increase your benefit. There are a couple of exceptions:

•Some plans have a cap on the maximum number of years that can be included in your benefit calculation.

•Some plans have stricter requirements for the types of service that can be used in your benefit calculation.

If you are unsure of the rules under your plan, contact NYCERS before you apply to purchase any previous service.

How much does it cost to buy back previous service?

The easiest way to estimate the cost of your buy back is by using our online interactive calculator. All you have to do is activate your MY NYCERS account on our website (www.nycers.org). The Buy Back Calculator enables you to obtain an estimated cost to purchase previous service based on information taken from your account, as well as information you wish to include. You can try various dates, salary amounts, and other situations, to see how these amounts affect your estimate. Or you can get an estimate through the NYCERS' Call Center. Remember these are only estimates. The true cost of purchasing previous service can only be received after you actually fill out an application.

Tier 1 and 2: The cost is based on your current earnings. You will pay double your full normal deduction for the same period being claimed. For example, if you are buying back six months of service, you will have double deductions taken from your current salary for a six-month period.

Tier 3 and 4: The cost is based on the wages you earned during the period claimed, multiplied by your contribution rate(s), plus interest from the date of such service to the date full payment is made at the rate of 5% compounded annually. So, the sooner you apply and pay for your previous service, the less interest you will have to pay.

Tier 6 22-Year Plan Members: The cost is 3% of the wages earned during the period you are buying back, plus 5% interest compounded annually from the date of such service to the date full payment is made.

Tier 6 Basic and Special Plan Members: The cost is 6% of the wages earned during the period you are buying back, plus 5% interest compounded annually from the date of such service to the date full payment is made.