FACT SHEET

Can you explain the two benefits?

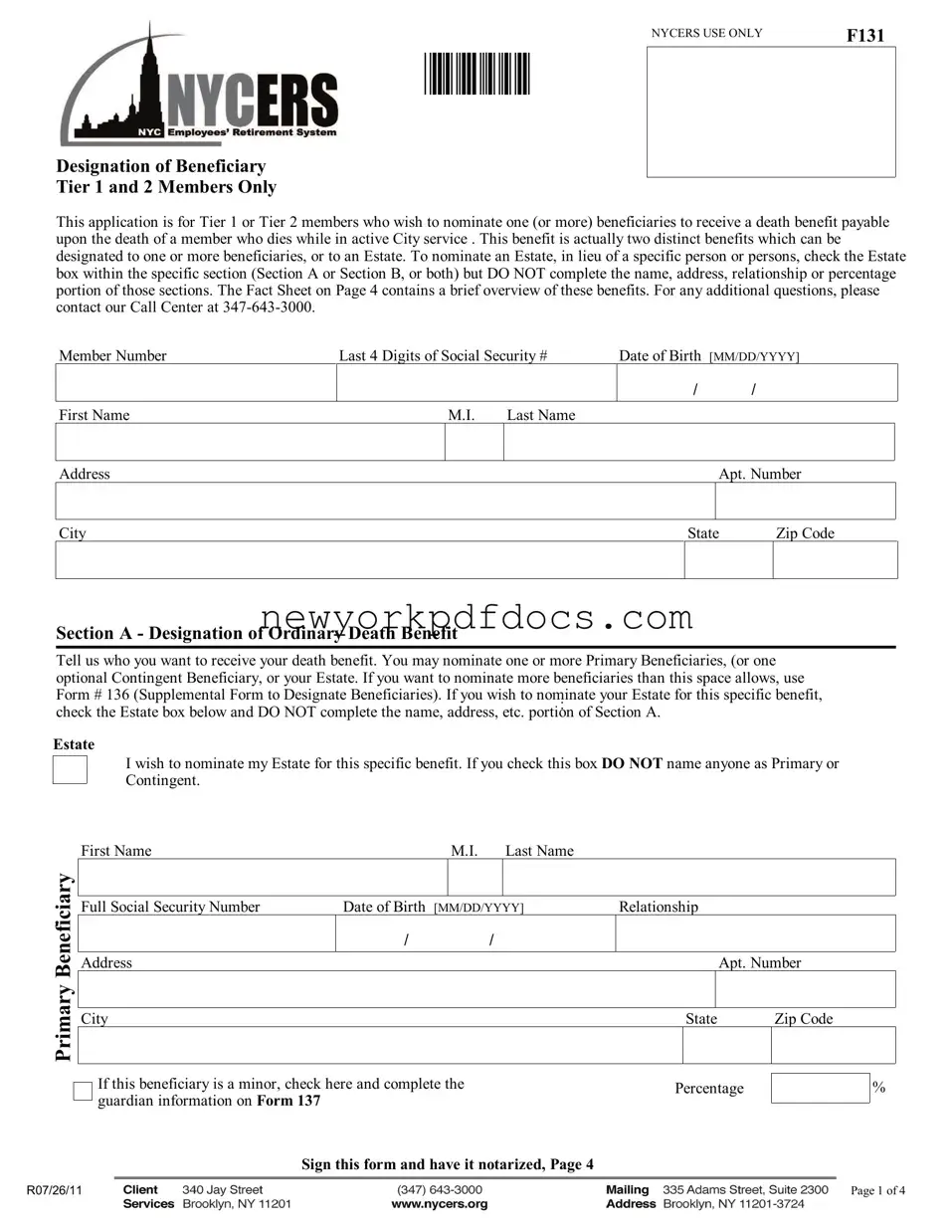

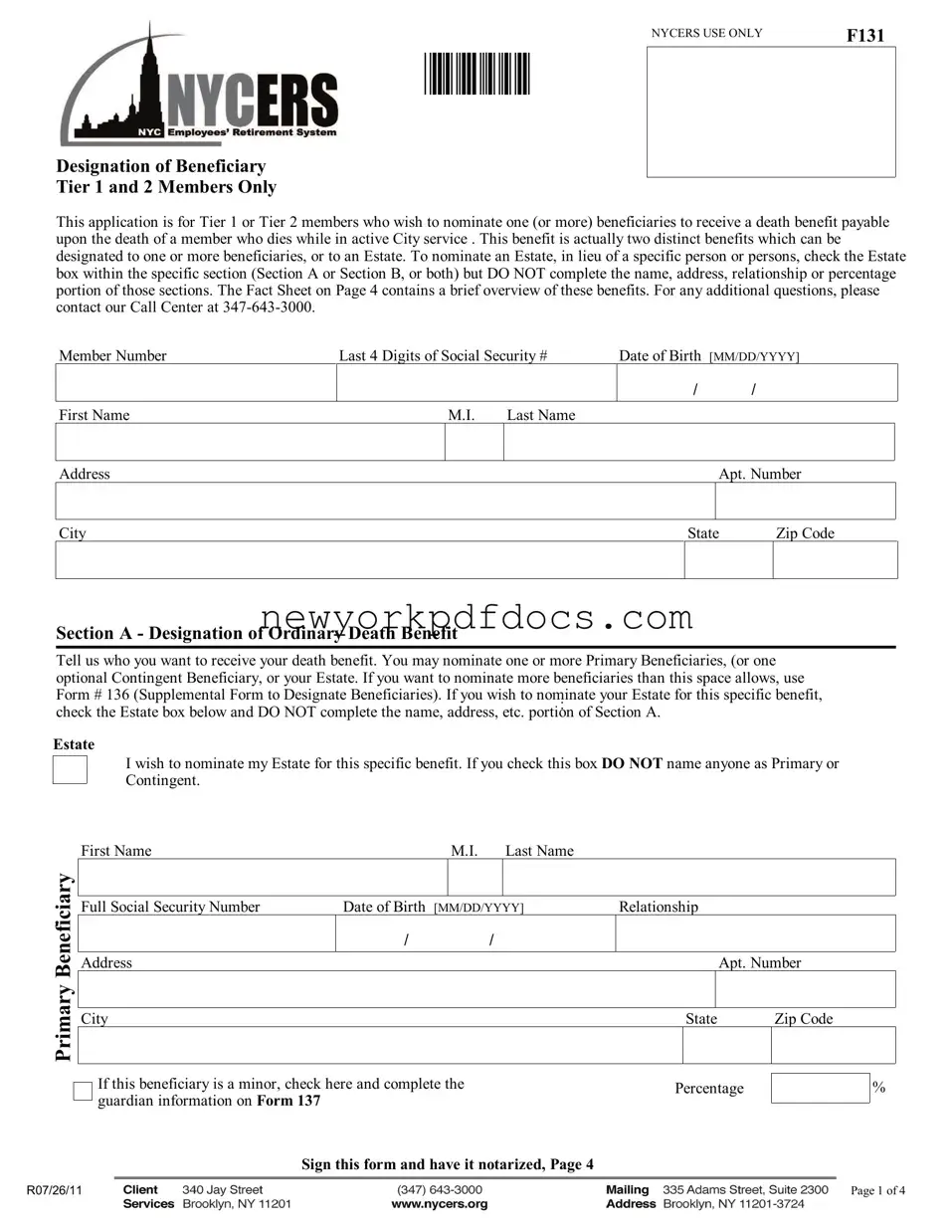

If you should die while in active City service, the person you nominate as your beneficiary is eligible to collect a death benefit (typically some multiple of your annual salary) and the refund of your accumulated deductions (contributions) plus

the interest they have accrued.

Can the same person receive both benefits?

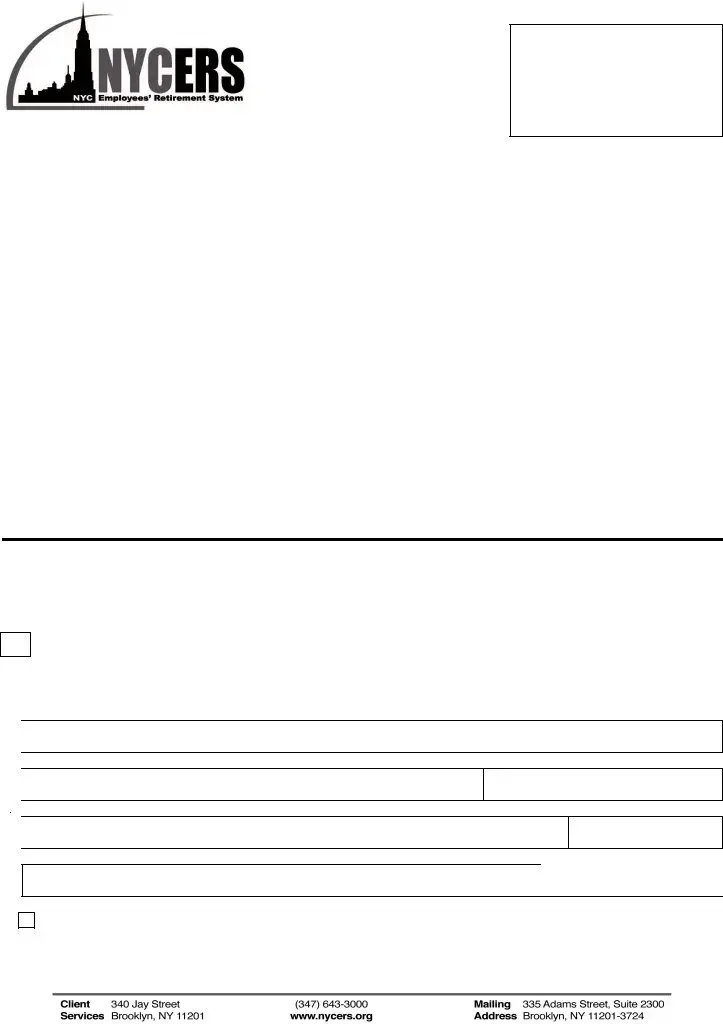

You do not have to name the same person, but you can - the choice is yours. You can nominate one or more people (or your Estate) to receive the death benefit and the refund of the accumulated deductions. If you nominate more than one person each will be paid according to the percentages you indicate on this form (combined percentages must total 100%). If no percentages are indicated, the benefits will be shared equally.

What happens if I want to nominate more beneficiaries than this form has allotted me?

This forms allows for only two Primary and one Contingent beneficiaries for each benefit. If you want to nominate more than that you can file Form # 136 which is the Supplemental Form to Designate Beneficiaries.

What happens if I want to nominate my estate rather than a person?

All you have to do is check off the Estate box in the appropriate Section (A or B or both). For example, you could nominate your Estate for the death benefit (Section A) and a specific person for the refund of your accumulated deductions (Section B). However, if you select Estate for either or both benefits you must leave the name, address and relationship information blank in each section.

Do the people I have listed here act as my nomination for all benefits?

No. You are nominating people (or your Estate) only for this specific benefit. Should your death be the result of an on-the-job accident, an accidental death benefit is payable upon application in this priority*: spouse (who has not remarried), child under the age of 18, or a dependent parent. If no such beneficiary exists, the benefit is payable to the beneficiaries on this form. *One important distinction exists for members of the Uniformed Sanitation Force. Their accidental death benefit is payable to their spouse (for their entire lifetime) even if they have remarried.

How do I change my beneficiary on file?

To change an existing beneficiary nomination you must file another Designation of Beneficiary form. It is important that you always have a current beneficiary on file. You can check the status of your beneficiary on file when you receive your Annual Disclosure Statement. All active members receive this statement in February/March every year.

What happens if my beneficiary information is out of date?

You must change it right away. NYCERS is required to make payments to the person we have listed on file as your designated beneficiary.

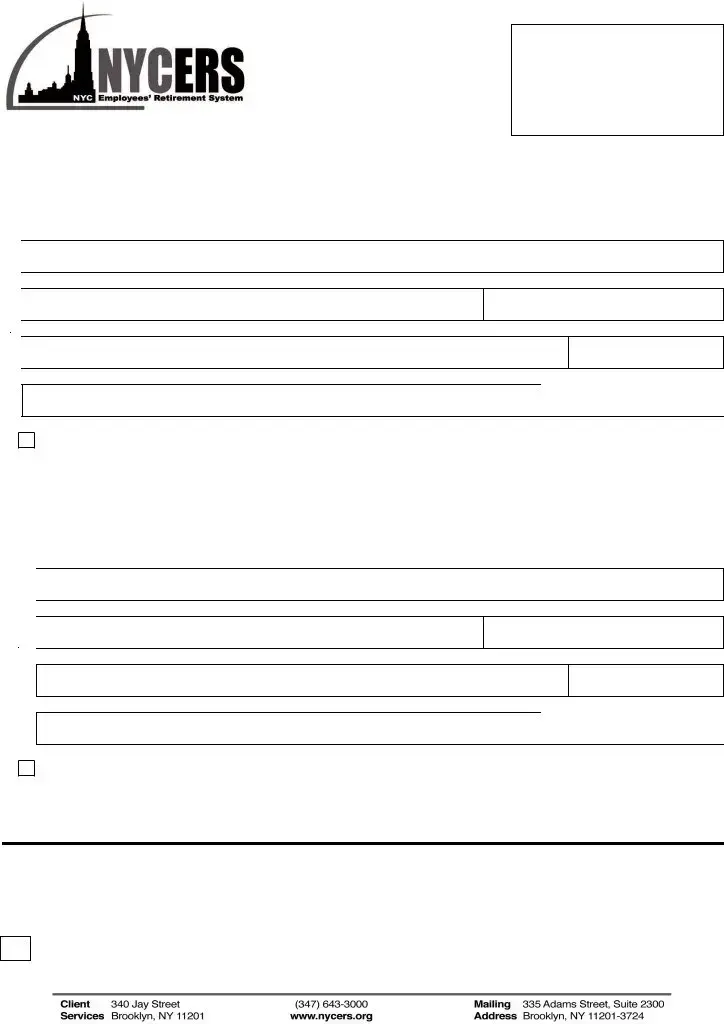

This form must be acknowledged before a Notary Public or Commissioner of Deeds

State of |

|

County of |

|

|

On this |

|

day of |

|

|

2 0 |

|

, personally appeared |

before me the above named, |

|

|

|

|

|

|

, to me known, and known to |

me to be the individual described in and who executed the foregoing instrument, and he or she acknowledged to me that he or she executed the same, and that the statements contained therein are true.

Signature of Notary Public or Commissioner of Deeds

Official Title

Expiration Date of Commission

Sign this form and have it notarized, THIS PAGE