Employee Self-Service Overview

•Instant access to your HR, payroll, tax, and benefits data.

•Reduced paper waste with electronic pay stubs – in line with PlaNYC “green” initiative.

|

Frequently Asked Questions |

|

|

Employee Self-Service |

|

|

|

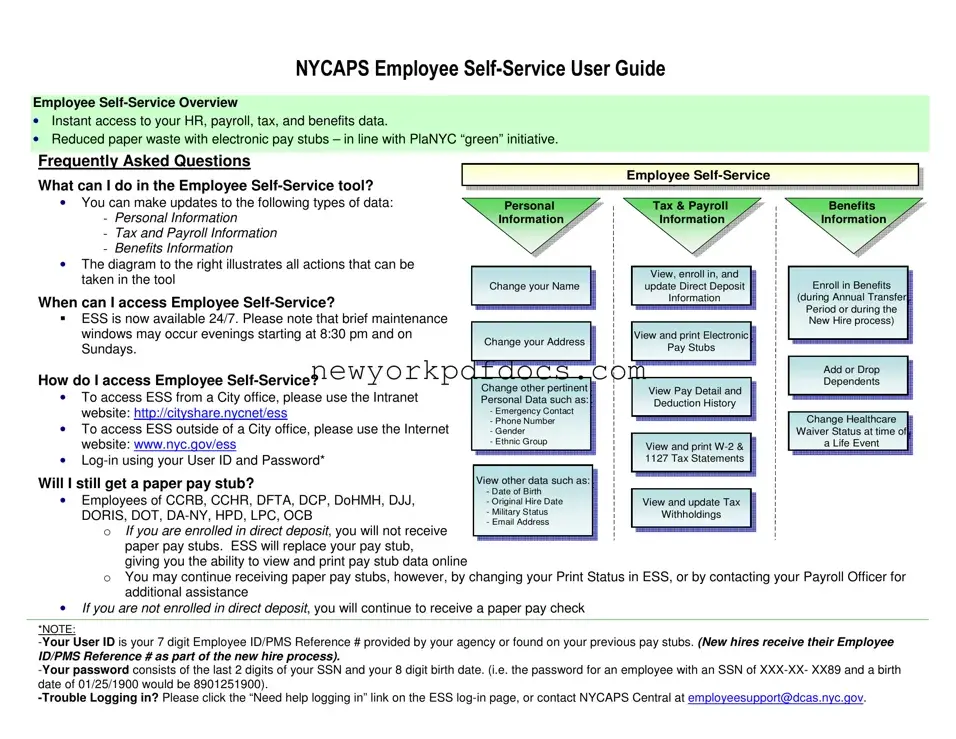

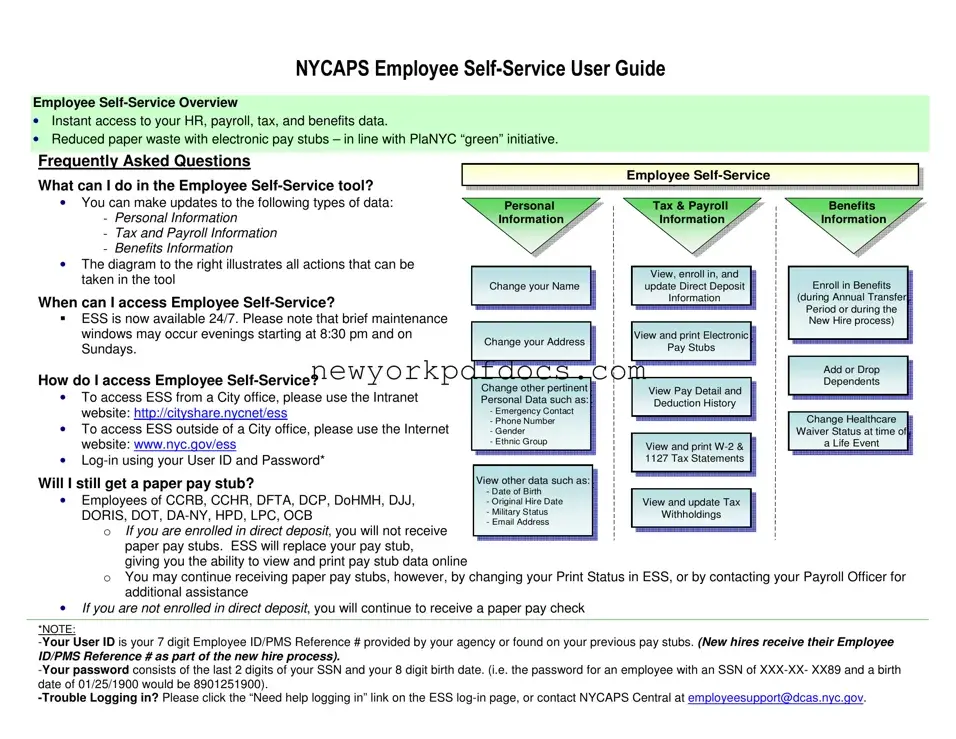

What can I do in the Employee Self-Service tool? |

Employee Self-Service |

|

|

• You can make updates to the following types of data: |

Personal |

Tax & Payroll |

Benefits |

- Personal Information |

Personal |

Tax & Payroll |

Benefits |

Information |

Information |

Information |

|

Information |

Information |

Information |

-Tax and Payroll Information

-Benefits Information

•The diagram to the right illustrates all actions that can be

taken in the tool |

|

|

|

View, enroll in, and |

|

|

Change your Name |

View, enroll in, and |

Enroll in Benefits |

update Direct Deposit |

|

Change your Name |

update Direct Deposit |

Enroll in Benefits |

When can I access Employee Self-Service? |

|

|

|

Information |

(during Annual Transfer |

|

|

|

Information |

|

(during Annual Transfer |

|

|

|

|

|

Period or during the |

ESS is now available 24/7. Please note that brief maintenance |

|

|

|

|

|

Period or during the |

|

|

|

|

|

New Hire process) |

windows may occur evenings starting at 8:30 pm and on |

|

|

|

|

|

New Hire process) |

|

|

|

View and print Electronic |

|

|

|

|

Change your Address |

|

View and print Electronic |

|

|

|

Sundays. |

Change your Address |

|

Pay Stubs |

|

|

|

|

|

|

Pay Stubs |

|

|

|

|

|

|

|

|

|

Add or Drop |

|

How do I access Employee Self-Service? |

|

|

|

|

|

Add or Drop |

|

Change other pertinent |

|

|

|

|

Dependents |

|

|

|

View Pay Detail and |

|

Dependents |

|

• To access ESS from a City office, please use the Intranet |

Change other pertinent |

|

|

|

|

Personal Data such as: |

|

View Pay Detail and |

|

|

|

|

Personal Data such as: |

|

Deduction History |

|

|

|

website: http://cityshare.nycnet/ess |

- Emergency Contact |

|

Deduction History |

|

|

|

- Emergency Contact |

|

|

|

|

Change Healthcare |

|

|

- Phone Number |

|

|

|

|

• To access ESS outside of a City office, please use the Internet |

- Phone Number |

|

|

|

Change Healthcare |

|

- Gender |

|

|

|

Waiver Status at time of |

|

|

- Gender |

|

|

|

Waiver Status at time of |

website: www.nyc.gov/ess |

- Ethnic Group |

|

View and print W-2 & |

|

a Life Event |

- Ethnic Group |

|

|

a Life Event |

|

|

|

|

View and print W-2 & |

|

|

|

• Log-in using your User ID and Password* |

|

|

|

1127 Tax Statements |

|

|

|

|

|

|

1127 Tax Statements |

|

|

|

|

|

|

|

|

Will I still get a paper pay stub? |

View other data such as: |

|

View other data such as: |

|

|

- Date of Birth |

|

• Employees of CCRB, CCHR, DFTA, DCP, DoHMH, DJJ, |

- Date of Birth |

View and update Tax |

- Original Hire Date |

|

- Original Hire Date |

View and update Tax |

DORIS, DOT, DA-NY, HPD, LPC, OCB |

- Military Status |

Withholdings |

- Military Status |

- Email Address |

Withholdings |

O If you are enrolled in direct deposit, you will not receive |

- Email Address |

|

|

|

|

paper pay stubs. ESS will replace your pay stub, |

|

|

|

giving you the ability to view and print pay stub data online |

|

|

|

OYou may continue receiving paper pay stubs, however, by changing your Print Status in ESS, or by contacting your Payroll Officer for additional assistance

•If you are not enrolled in direct deposit, you will continue to receive a paper pay check

*NOTE:

-Your User ID is your 7 digit Employee ID/PMS Reference # provided by your agency or found on your previous pay stubs. (New hires receive their Employee

ID/PMS Reference # as part of the new hire process).

-Your password consists of the last 2 digits of your SSN and your 8 digit birth date. (i.e. the password for an employee with an SSN of XXX-XX- XX89 and a birth date of 01/25/1900 would be 8901251900).

-Trouble Logging in? Please click the “Need help logging in” link on the ESS log-in page, or contact NYCAPS Central at employeesupport@dcas.nyc.gov.