exercising a franchise or franchises, holding property or doing business in NewYork City.

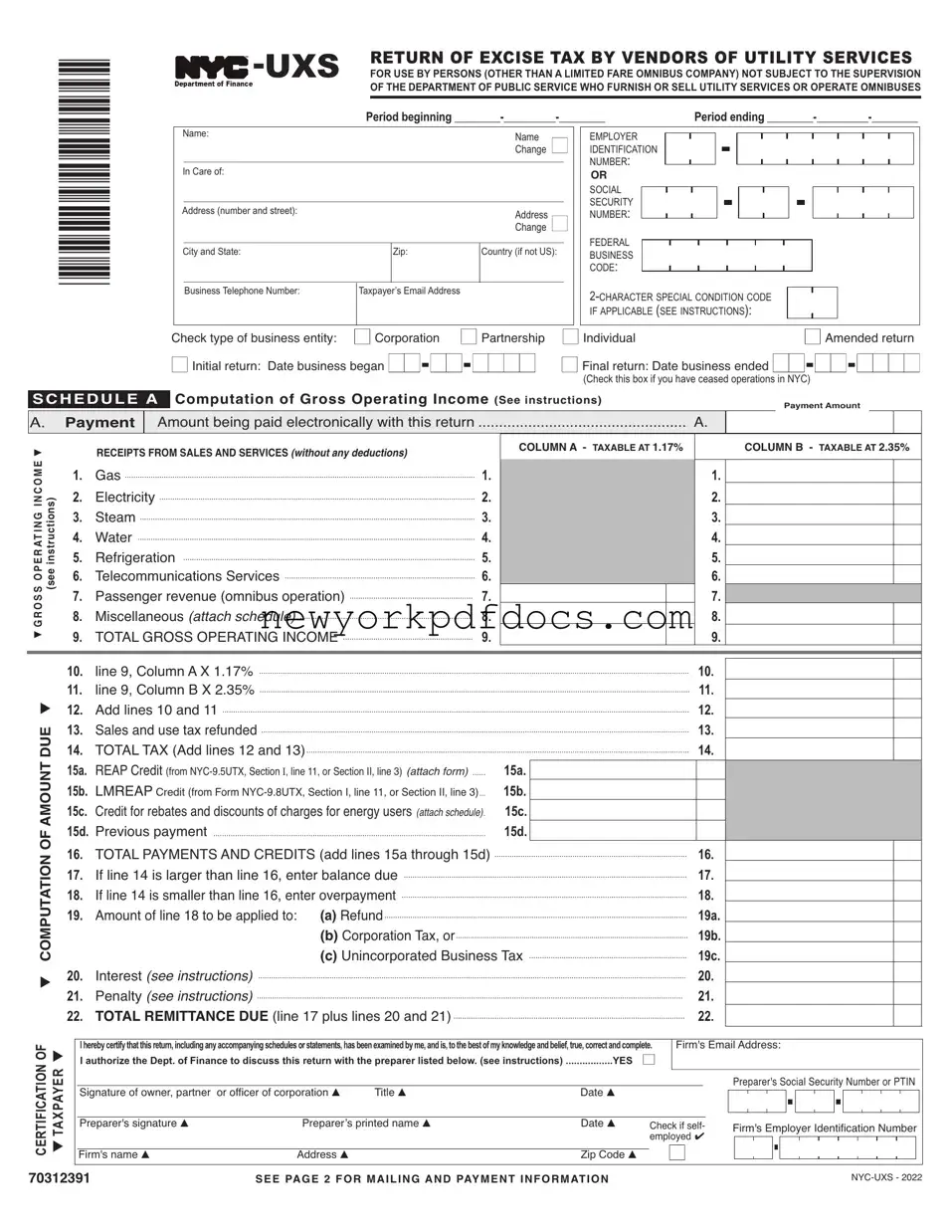

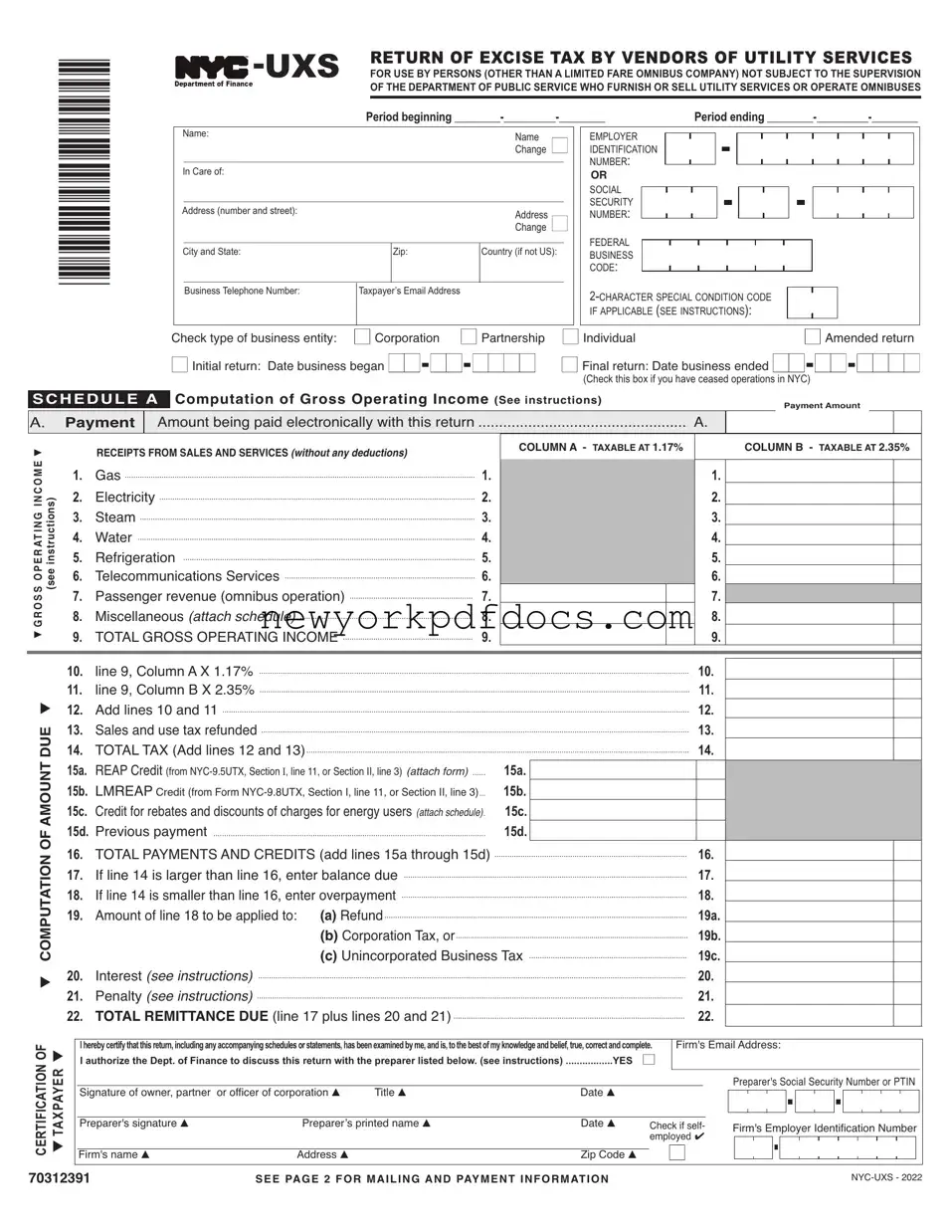

A vendor of utility services is taxable on gross operating income as de- fined above. The following chart provides the rates.

lVendors of utility services other than

omnibus operators...................................................................2.35% of gross operating income

lOmnibus operators not subject to

Department of Public Service supervision ...............1.17% of gross operating income

INTEREST

If the tax is not paid on or before the due date, interest must be paid on the amount of the underpayment from the due date to the date paid. For information as to the applicable rate of interest visit the Finance website at nyc.gov/finance or call 311. Interest amounting to less than $1 need not be paid.

PENALTIES

a)A late filing penalty is assessed if you fail to file this form when due, unless the failure is due to reasonable cause. For every month or partial month that this form is late, add to the tax (less any pay- ments made on or before the due date) 5%, up to a total of 25%.

b)If this form is filed more than 60 days late, the above late filing penalty cannot be less than the lesser of (1) $100 or (2) 100% of the amount required to be shown on the form (less any payments made by the due date or credits claimed on the return).

c)Alatepaymentpenaltyisassessedifyoufailtopaythetaxshownon this form by the prescribed filing date, unless the failure is due to rea- sonable cause. For every month or partial month that your payment is late,addtothetax(lessanypaymentsmade)1/2%,uptoatotalof25%.

d)The total of the additional charges in a and c may not exceed 5% for any one month except as provided for in b.

e)Additionalpenaltiesmaybeimposedonanyunderpaymentofthetax.

If you claim not to be liable for these additional charges, attach a state- ment to your return explaining the delay in filing, payment or both.

FILINGARETURNAND PAYMENTOFTAX

Returns are due on or before the 25th day of each month, if filing on a monthly basis, covering gross operating income for the preceding calen- dar month. However, if the tax liability is less than $100,000 for the pre- cedingcalendaryear,determinedonanannualorannualizedbasis,returns are due for the current tax year on a semi-annual basis on or before July 25th and January 25th covering a six-month tax period of January-June and July-December, respectively.

Payment must be made in U.S. dollars, drawn on a U.S. bank. Checks drawn on foreign banks will be rejected and returned. Make remittance payable to the order of: NYC DEPARTMENT OF FINANCE.

SIGNATURE

This report must be signed by an officer authorized to certify that the statements contained herein are true. If the taxpayer is a partnership or anotherunincorporatedentity,thisreturnmustbesignedbyapersonduly authorized to act on behalf of the taxpayer.

For further information, call 311. If calling from outside the five bor- oughs, call 212-NEW-YORK (212-639-9675).

PreparerAuthorization: If you want to allow the Department of Fi- nance to discuss your return with the paid preparer who signed it, you must check the "yes" box in the signature area of the return.This author- izationappliesonlytotheindividualwhosesignatureappearsinthe"Pre- parer's Use Only" section of your return. It does not apply to the firm, if any, shown in that section. By checking the "Yes" box, you are author- izing the Department of Finance to call the preparer to answer any ques- tions that may arise during the processing of your return. Also, you are authorizing the preparer to:

lGive the Department any information missing from your return,

lCall the Department for information about the processing of your return or the status of your refund or payment(s), and

lRespondtocertainnoticesthatyouhavesharedwiththepreparer about math errors, offsets, and return preparation. The notices will notbe sent to the preparer.

Youarenotauthorizingthe preparer to receive any refund check, bind you to anything (including any additional tax liability), or otherwise rep- resent you before the Department. The authorization cannot be revoked, however, the authorization will automatically expire twelve (12) months aftertheduedate(withoutregardtoanyextensions)forfilingthisreturn.

Failuretochecktheboxwillbedeemedadenialofauthority.

MAILING INSTRUCTIONS

All returns, except refund returns:

NYC Department of Finance

UtilityTax

P.O. Box 5564

Binghamton, NY13902-5564

Remittances - Pay online with Form NYC-200V at nyc.gov/eser- vices, or Mail payment and Form NYC-200V only to:

NYC Department of Finance

P.O. Box 3933

NewYork, NY 10008-3933

Returns claiming refunds:

NYC Department of Finance

UtilityTax

P.O. Box 5563

Binghamton, NY13902-5563

TOAVOID THE IMPOSITION OFPENALTIES,youramountofthetaxduemustbe

paid in full and this return must be filed and postmarked within 25 days aftertheendoftheperiodcoveredbythereturn.