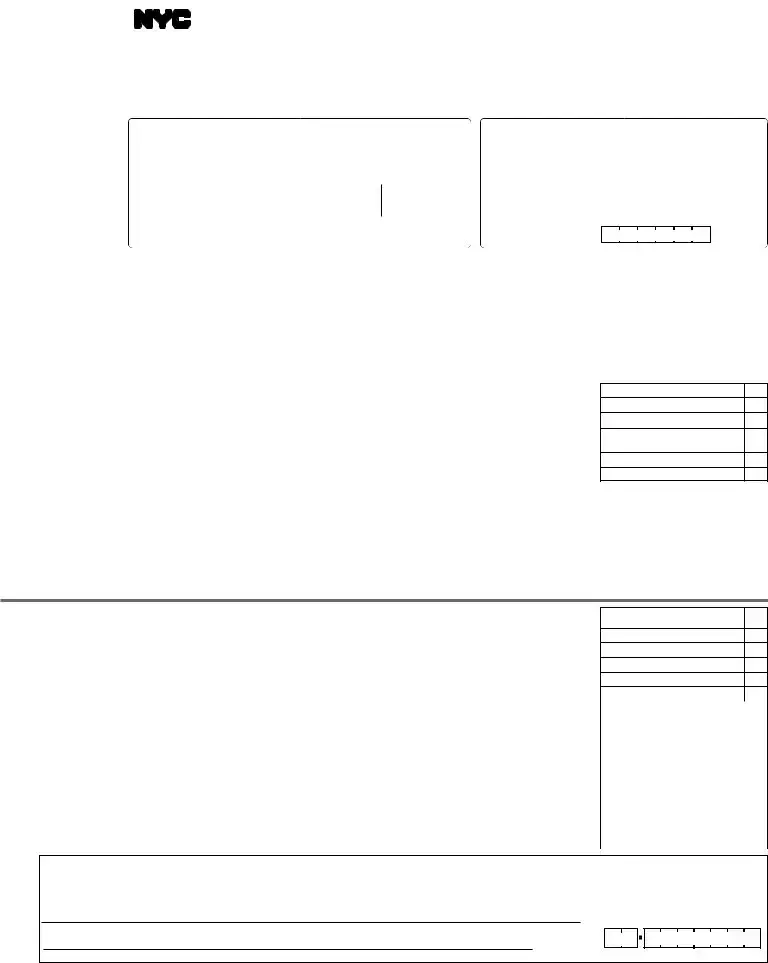

Line25a–CreditsfromformNYC-9.5UTX

EnteronthislinethecreditagainsttheUtilityTaxfortherelocationandem- ployment assistance program. (Attach Form NYC-9.5UTX.)

Line25b–CreditsfromformNYC-9.8UTX

Enter on this line the credit against the Utility Tax for the new Lower Man- hattanrelocationandemploymentassistanceprogram. (AttachFormNYC- 9.8.UTX)

INTEREST

If the tax is not paid on or before the due date, interest must be paid on the amount of the underpayment from the due date to the date paid. For infor- mation as to the applicable rate of interest, visit the Finance website at nyc.gov/financeor call 311. Interest amounting to less than $1 need not be paid.

PENALTIES

a)If you fail to file a return when due, add to the tax (less any payments made on or before the due date or any credits claimed on the return) 5% for each month or partial month the form is late, up to 25%, unless the failure is due to reasonable cause.

b)Ifthisformisfiledmorethan60dayslate,theabovelatefilingpenaltycan- notbelessthanthelesserof(1)$100or(2)100%oftheamountrequiredto be shown on the form (less any payments made by the due date or credits claimed on the return).

c)If you fail to pay the tax shown on the return by the prescribed filing date, add to the tax (less any payments made) 1/2% for each month or partial month the payment is late up to 25%, unless the failure is due to reasonable cause.

d)Thetotaloftheadditionalchargesina)andc)maynotexceed5%forany one month except as provided for in b).

e)Additional penalties may be imposed on any underpayment of the tax.

If you claim not to be liable for these additional charges, a statement in sup- port of your claim should be attached to the return.

SIGNATURE

This report must be signed by an officer authorized to certify that the state- mentscontainedhereinaretrue. Ifthetaxpayerisapartnershiporanotherun- incorporatedentity,thisreturnmustbesignedbyapersondulyauthorizedto act on behalf of the taxpayer.

FILINGARETURNAND PAYMENTOFTAX

Returns are due on or before the 25th day of each month, if filing on a monthly basis, covering gross income for the preceding calendar month. However, if the tax liability is less than $100,000 for the preceding calendar year, determined on an annual or annualized basis, returns are due for the current tax year on a semi-annual basis on or before July 25th and January 25thcoveringasix-monthtaxperiodofJanuary-JuneandJuly-December,re- spectively.

PaymentmustbemadeinU.S.dollars,drawnonaU.S.bank. Checksdrawn on foreign banks will be rejected and returned. Make remittance payable to the order of NYC DEPARTMENT OF FINANCE.

For further information, call 311. If calling from outside the five NYC bor- oughs, call 212-NEW-YORK (212-639-9675).

PreparerAuthorization: If you want to allow the Department of Finance to discuss your return with the paid preparer who signed it, you must check the "yes" box in the signature area of the return. This authorization applies only to the individual whose signature appears in the "Preparer's Use Only" sectionofyourreturn. Itdoesnotapplytothefirm,ifany,showninthatsec- tion. By checking the "Yes" box, you are authorizing the Department of Fi- nance to call the preparer to answer any questions that may arise during the

processing of your return. You are also authorizing the preparer to:

●Give the Department any information missing from your return,

●Call the Department for information about the processing of your re- turn or the status of your refund or payment(s), and

●Respond to certain notices that you have shared with the preparer aboutmatherrors,offsets,andreturnpreparation. Thenoticeswillnot be sent to the preparer.

Youarenotauthorizingthepreparertoreceiveanyrefundcheck,bindyou to anything (including any additional tax liability), or otherwise represent you before the Department. The authorization cannot be revoked; however, the authorization will automatically expire twelve (12) months after the due date (without regard to any extensions) for filing this return. Failure to

checktheboxwillbedeemedadenialofauthority.

MAILREMITTANCEAND RETURNTO:

NYC DEPARTMENT OF FINANCE

P. O. BOX 5110

KINGSTON, NY 12402-5110

TOAVOIDTHE IMPOSITION OFPENALTIES,thisreturnmustbefiledwithyourre- mittanceinfullfortheamountofthetaxpostmarkedwithin25daysafterthe endoftheperiodcoveredbythereturn.