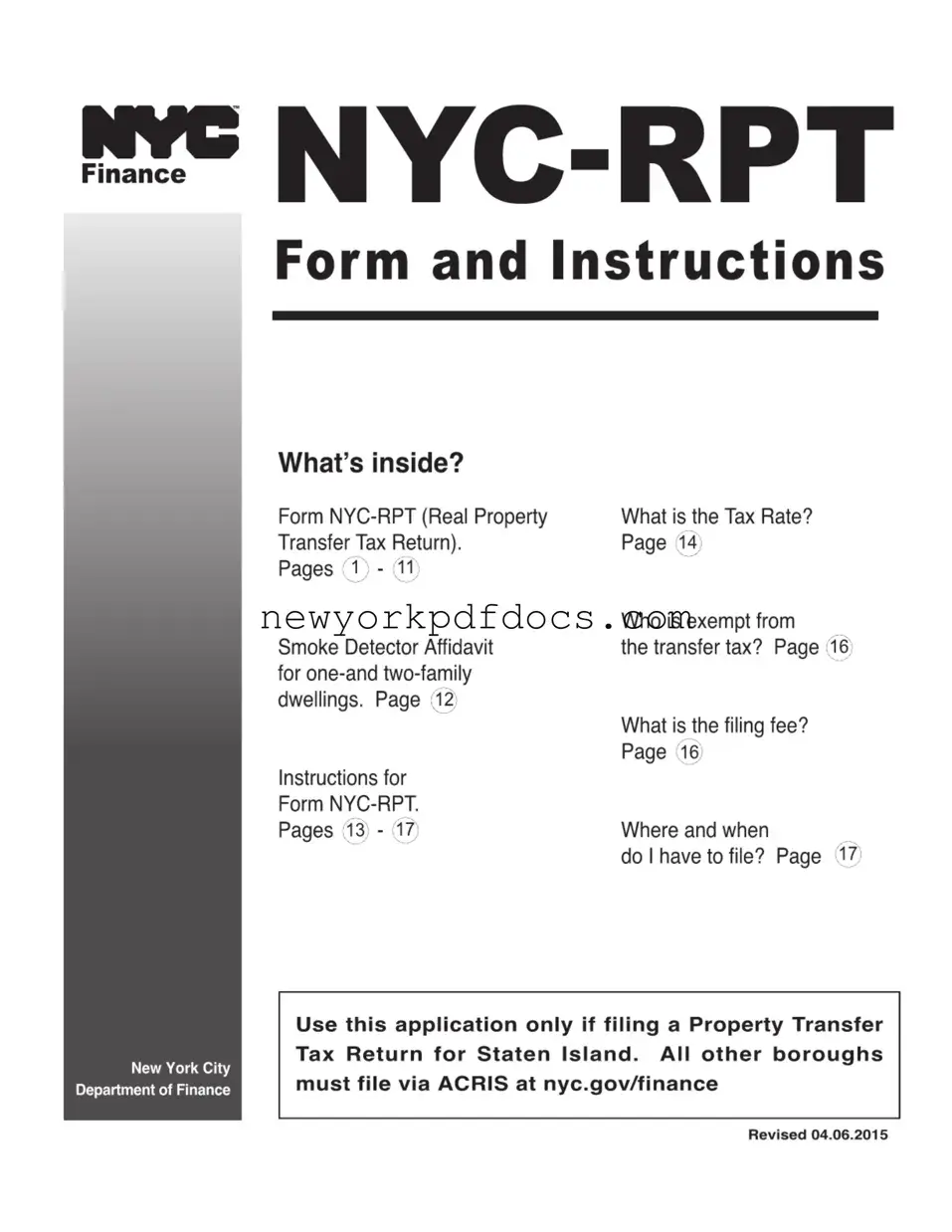

Free Nyc Rpt Form

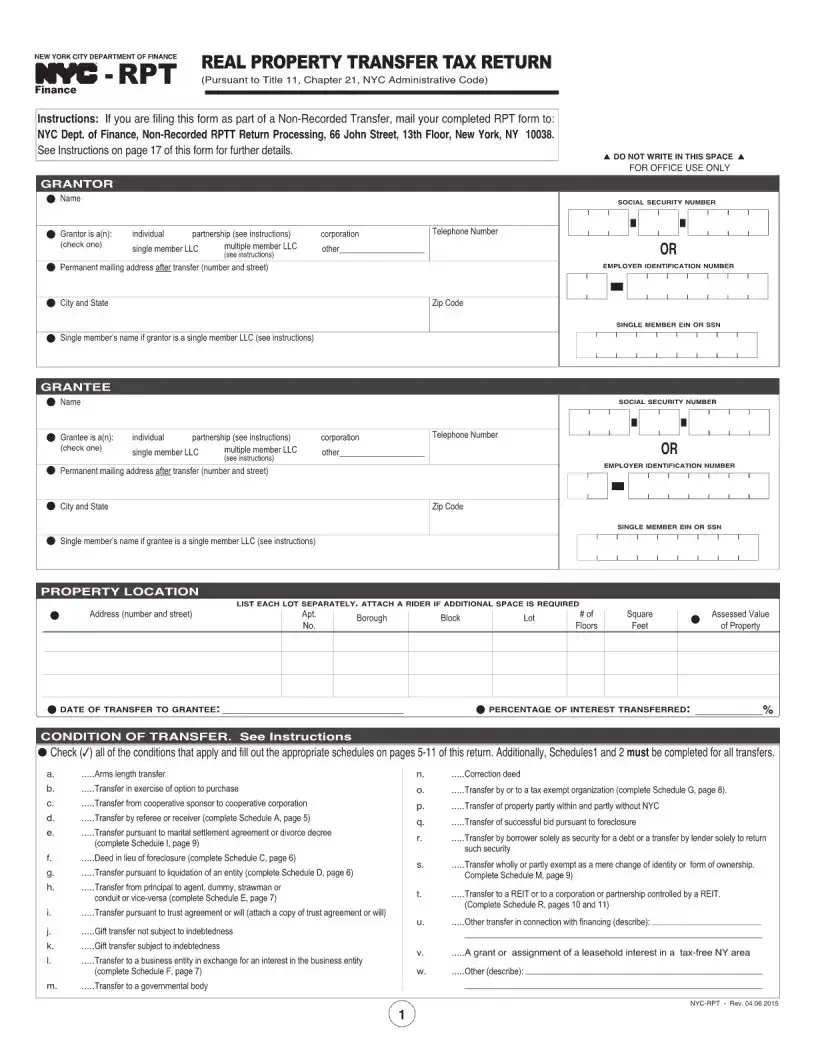

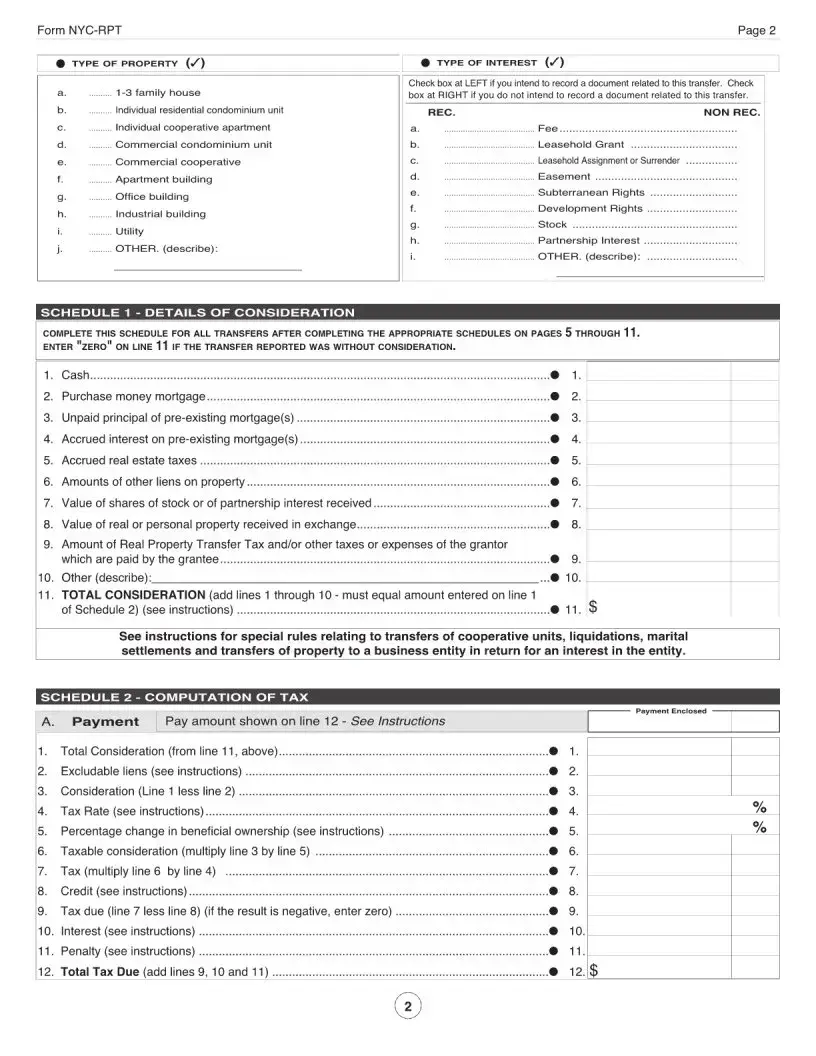

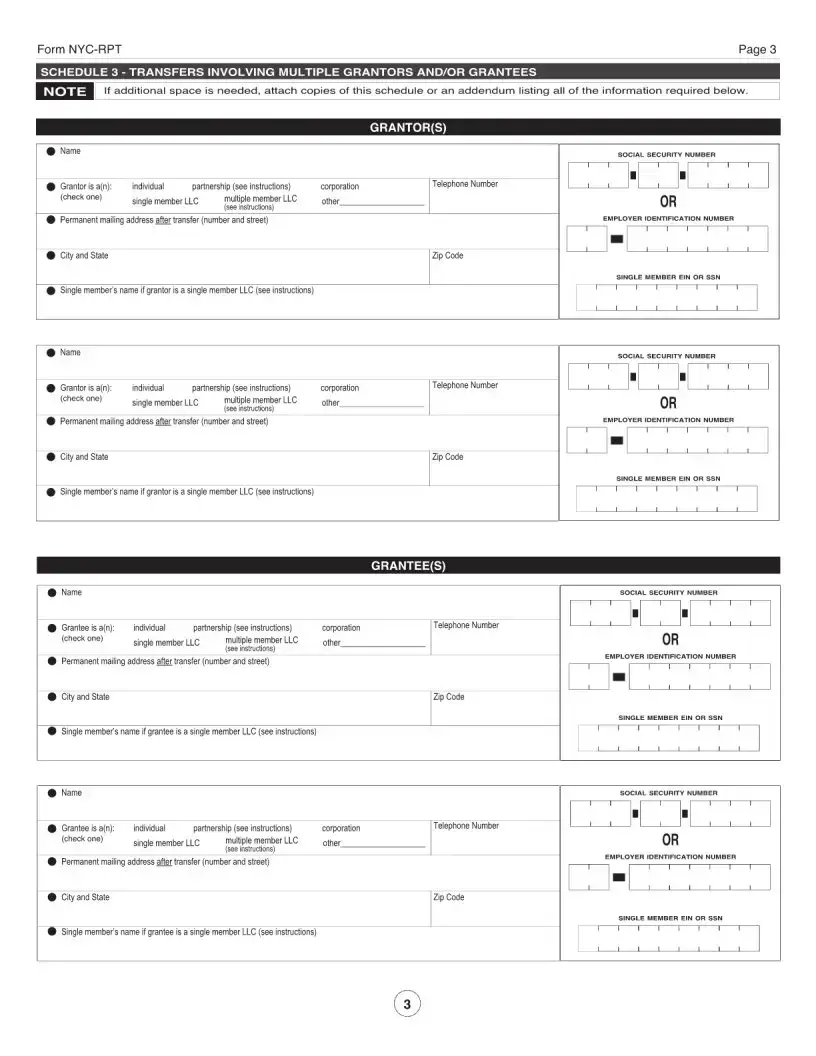

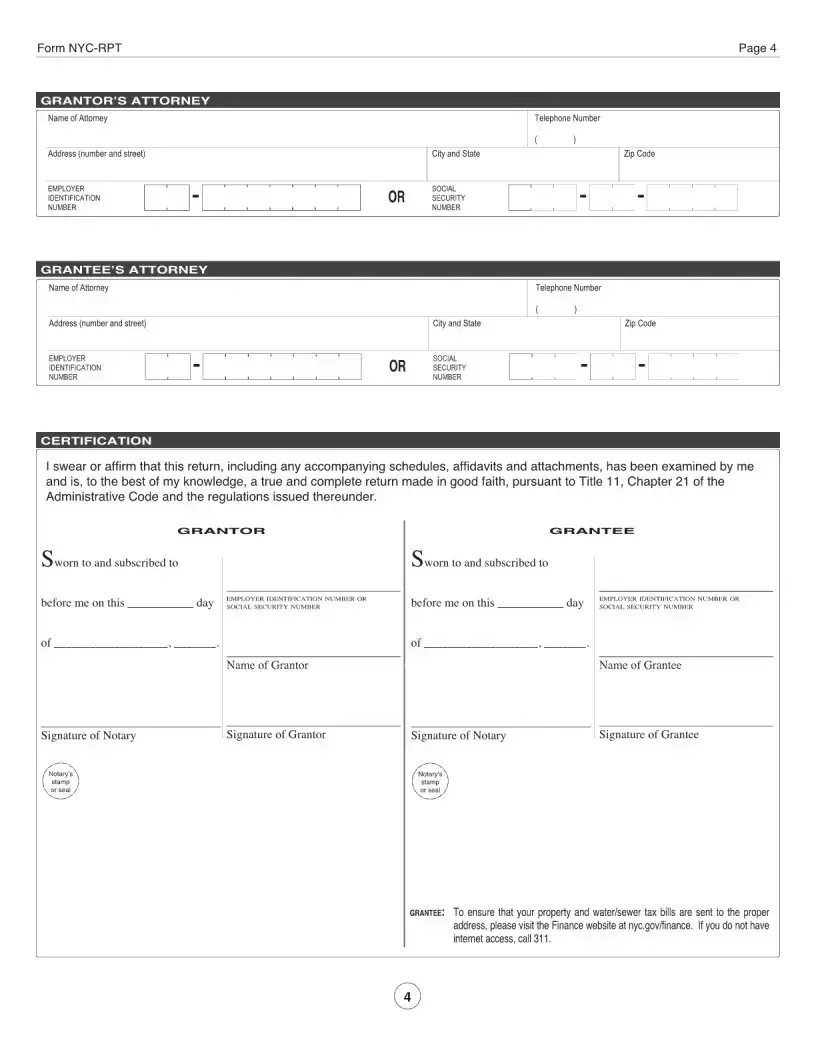

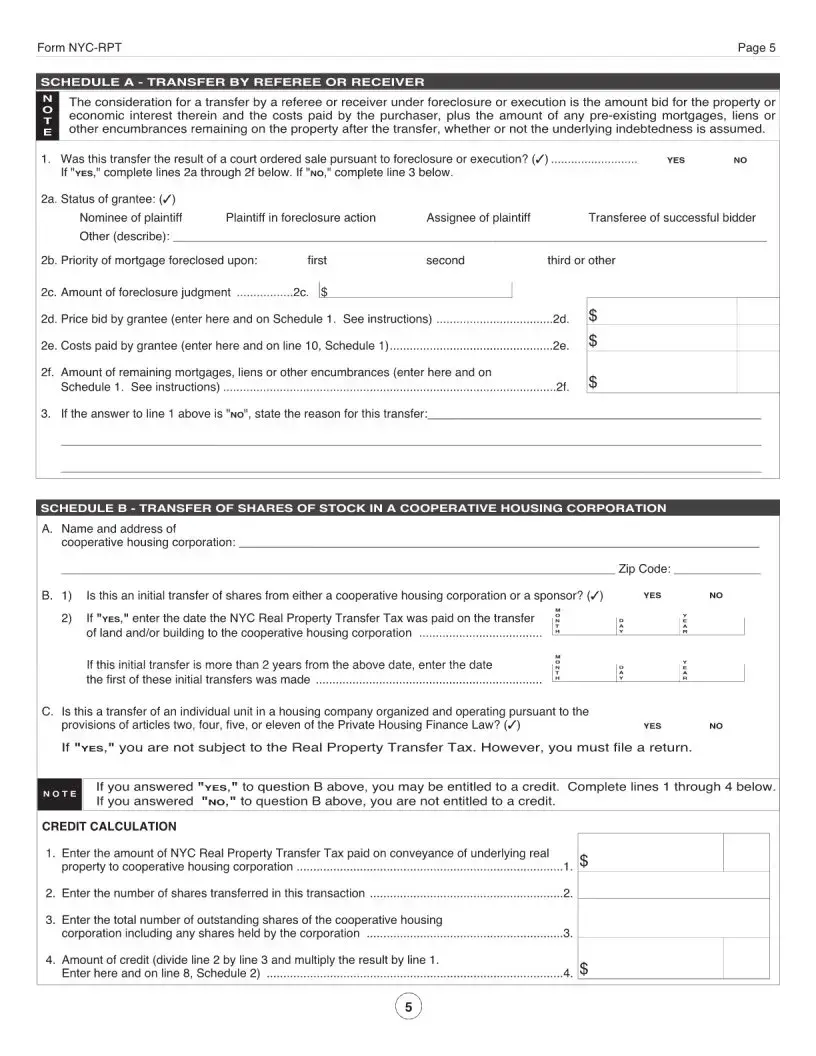

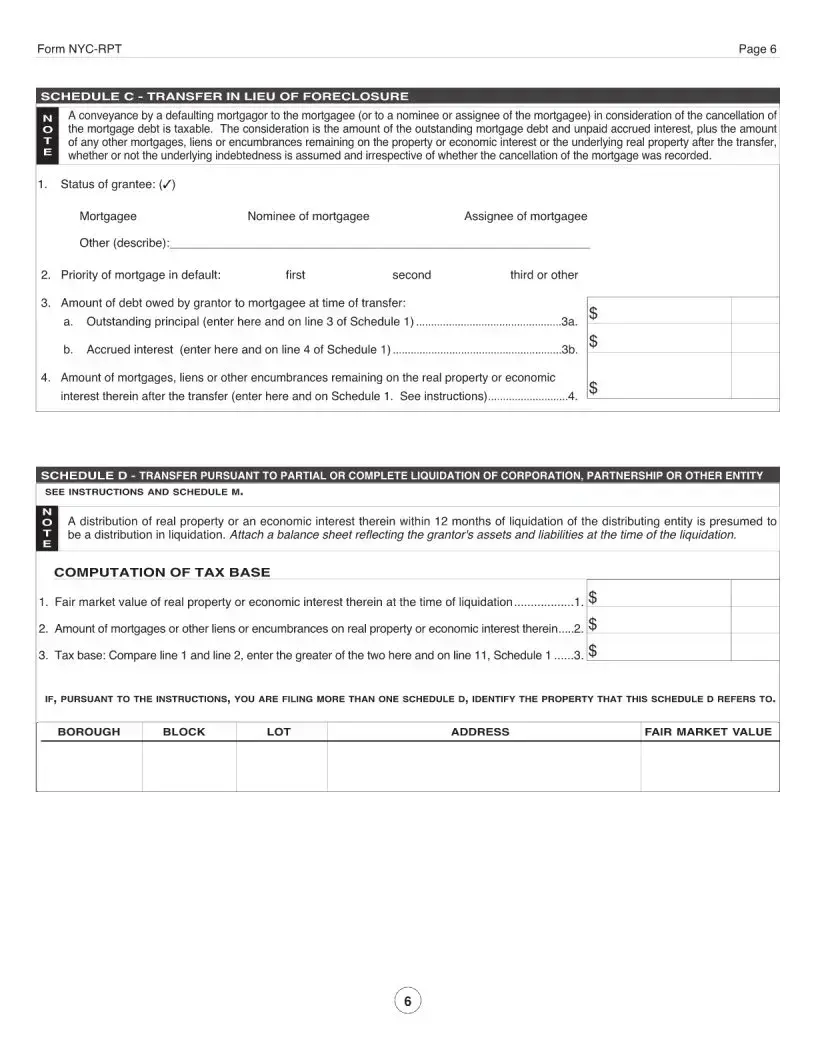

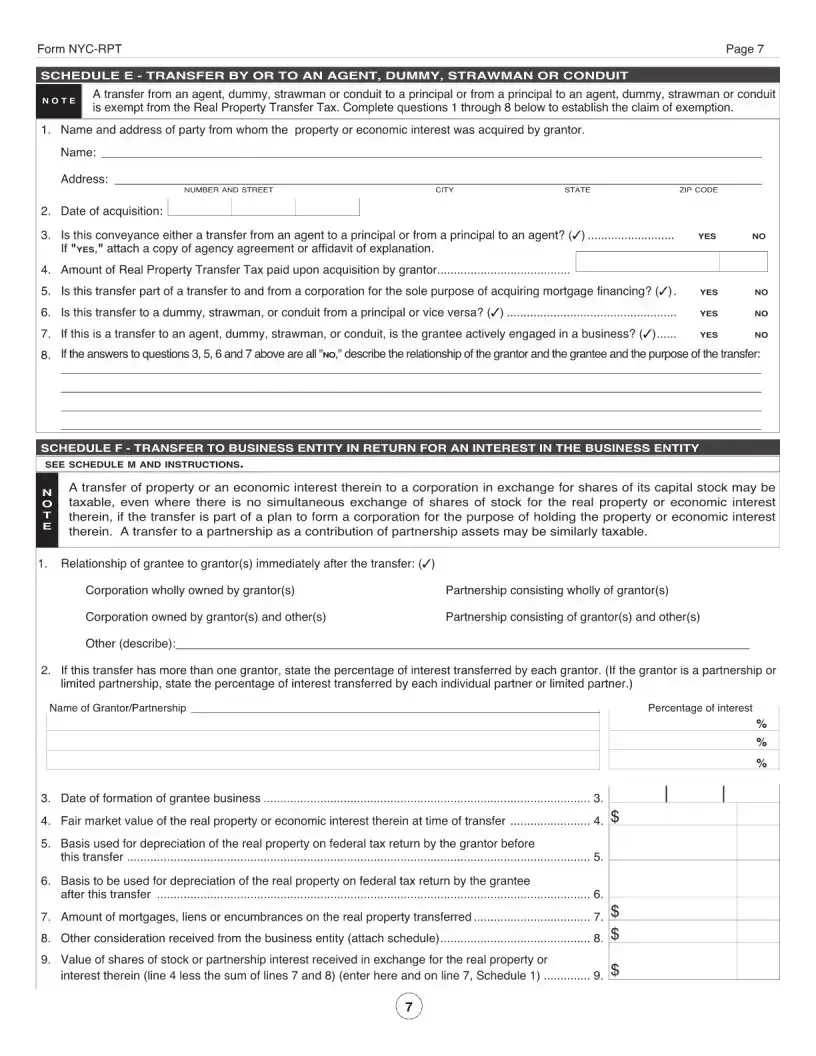

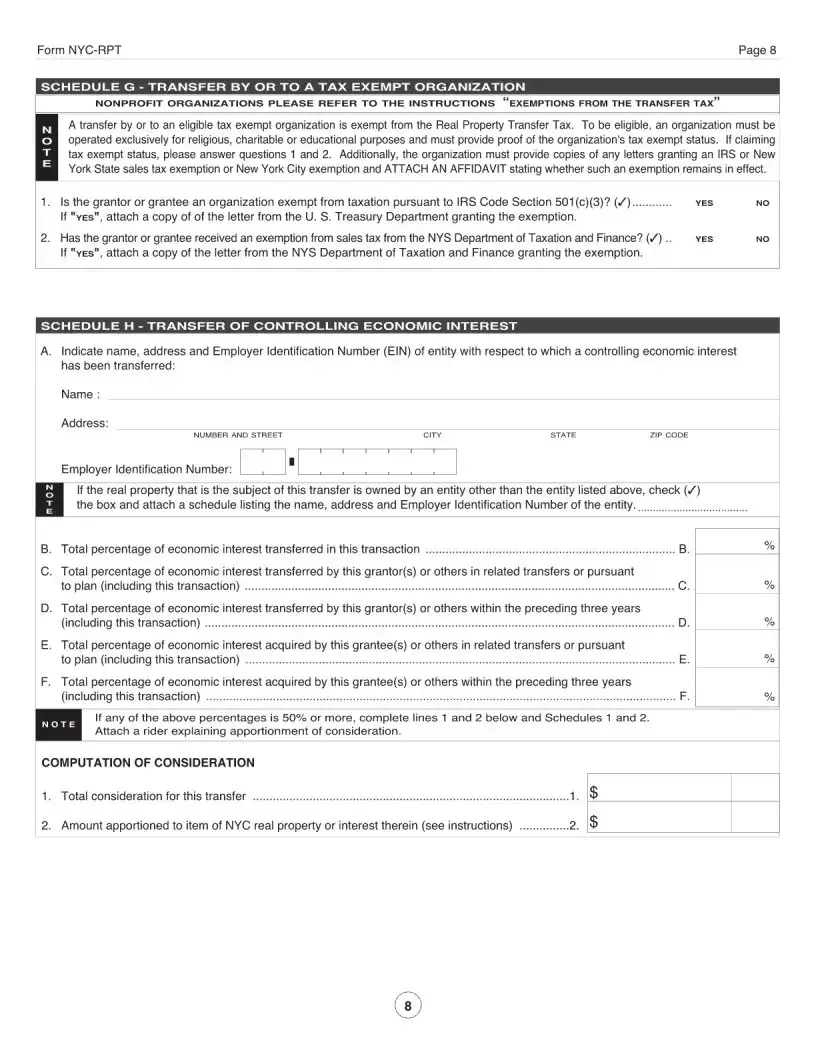

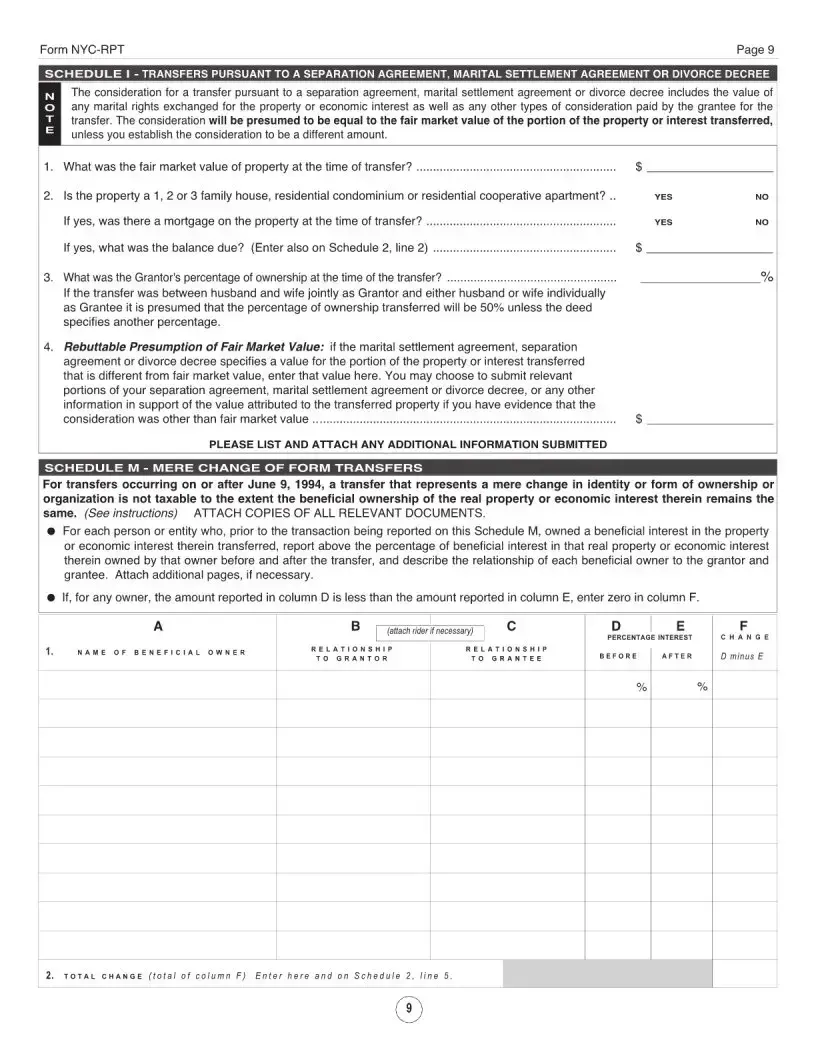

The NYC RPT form, officially known as the Real Property Transfer Tax Return, is a crucial document required for property transfers in New York City. This form ensures compliance with local tax regulations and provides necessary details about the transaction. Understanding its components is essential for both buyers and sellers to navigate the complexities of real estate transactions effectively.

Open My Document Now

Free Nyc Rpt Form

Open My Document Now

Your form isn’t finalized yet

Edit, save, and download Nyc Rpt online with ease.

Open My Document Now

or

⇓ Nyc Rpt PDF