Free Nyc Ext 1 Form

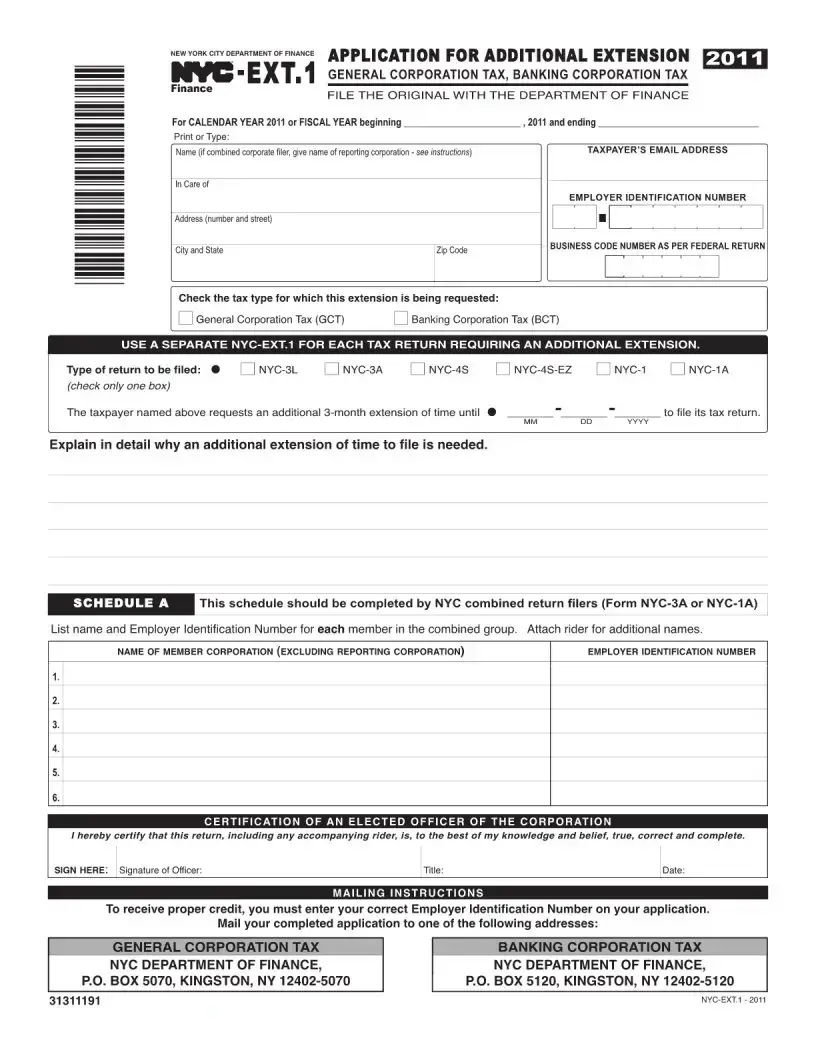

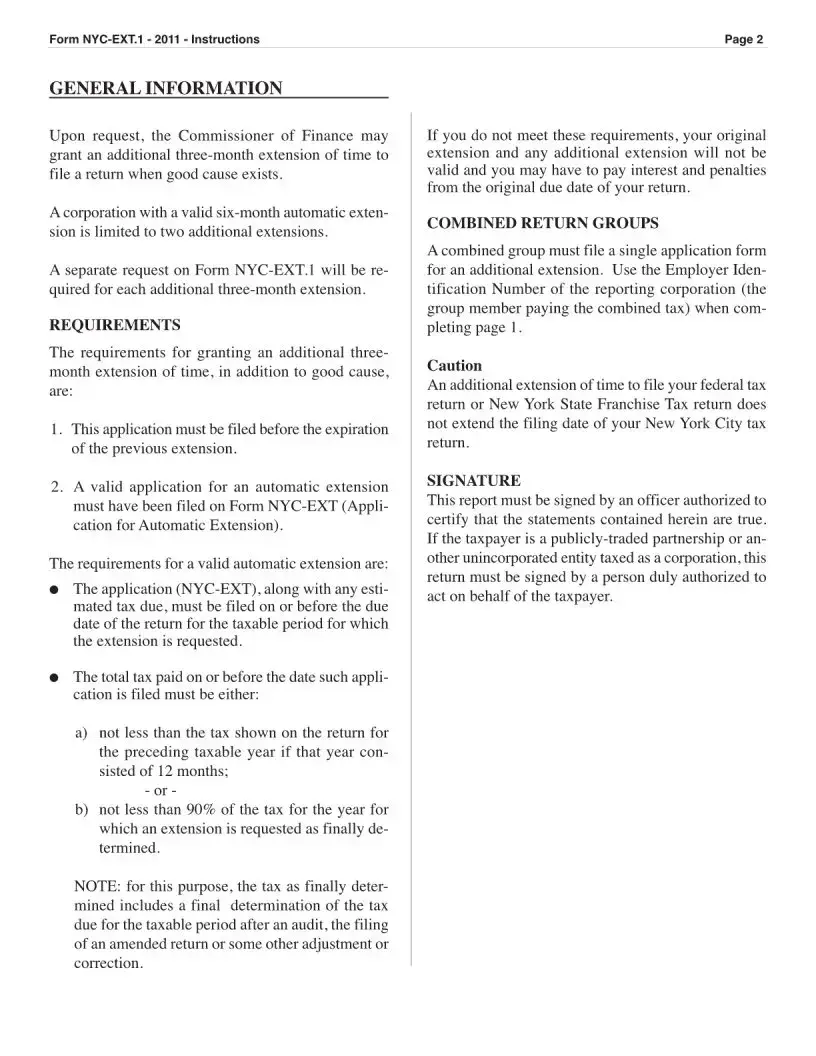

The NYC Ext 1 form is an application used by corporations to request an additional three-month extension for filing their General Corporation Tax or Banking Corporation Tax returns. This form is necessary when a corporation needs more time beyond the initial automatic six-month extension. Proper completion and submission of the NYC Ext 1 form ensure compliance with New York City tax regulations.

Open My Document Now

Free Nyc Ext 1 Form

Open My Document Now

Your form isn’t finalized yet

Edit, save, and download Nyc Ext 1 online with ease.

Open My Document Now

or

⇓ Nyc Ext 1 PDF