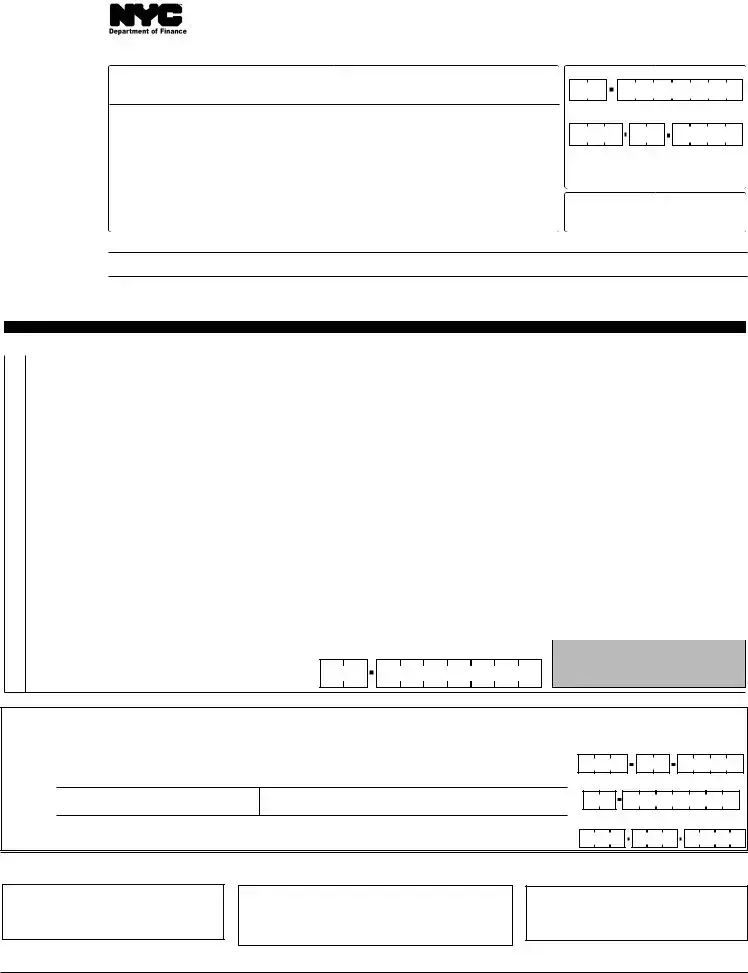

IF YOU ARE FILING ON PAPER, USE THIS PAGE IF YOU HAVE THREE OR LESS PREMISES OR MAKE COPIES IF YOU HAVE ADDITIONAL PREMISES. IF YOU CHOOSE TO USE A SPREADSHEET, YOU MUST USE THE SUPPLEMENTAL SMALL BUSI- NESS TAX CREDIT WORKSHEET WHICH YOU CAN DOWNLOAD FROM OUR WEBSITE AT WWW.NYC.GOV/CRTINFO.

If the answer to this Question is NO for any of the premises, you are not eligible for this credit for those premises whose Base Rent

BeforeReductioniseitherlessthan$250,000 orequaltoorgreaterthan$550,000 andyoushouldnotcompletethisworksheetforthosepremises.

INCOME FACTOR CALCULATIONS - Complete either lines 1a and 1b OR lines 2a and 2b |

1a. Enter amount of total income, if total income is $5,000,000 or less (see instructions) |

|

1a. |

______________________________________ |

1b. Income factor (see instructions) |

|

|

|

|

|

|

1b. |

______________________________________ |

2a. Enter amount of total income if total income is more than $5,000,000 |

|

|

|

|

|

|

|

|

|

but less than $10,000,000 (see instructions) |

|

|

|

|

|

|

2a. |

______________________________________ |

2b. If total income is more than $5,000,000 but less than $10,000,000: |

|

|

|

|

|

|

|

|

|

Income Factor is (10,000,000 - line 2a) / 5,000,000 |

|

2b. |

______________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RENT FACTOR CALCULATIONS - Complete either lines 3a and 3b OR lines 4a and 4b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3a. Enter amount of base rent, if base |

|

PREMISES |

|

|

|

|

PREMISES |

|

|

|

|

PREMISES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

rent from Page 2, line 7 is less |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

than $500,000 |

|

3a. |

_________________________________________________________________________________________ |

3b. Rent factor (see instructions) |

3b. |

_________________________________________________________________________________________ |

4a. Enter amount of base rent if base rent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

from Page 2, line 7 is at least |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$500,000 but less than $550,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(see instructions) |

4a. |

_________________________________________________________________________________________ |

4b. If base rent from Page 2, line 7 is at least |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$500,000 but less than $550,000: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rent Factor is ($550,000 - line 4a) / 50,000 |

4b. |

_________________________________________________________________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CREDIT CALCULATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5a. Page 2, line 15 (Tax at 6%) |

5a. |

_________________________________________________________________________________________ |

5b. Page 2, line 16 (Tax Credit from Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Credit Computation Worksheet on Page 2) |

5b. |

_________________________________________________________________________________________ |

5c. (line 5a - line 5b) X (line 1b or 2b) X (line 3b or 4b). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter here and on Page 2, line 17 |

5c. |

_________________________________________________________________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

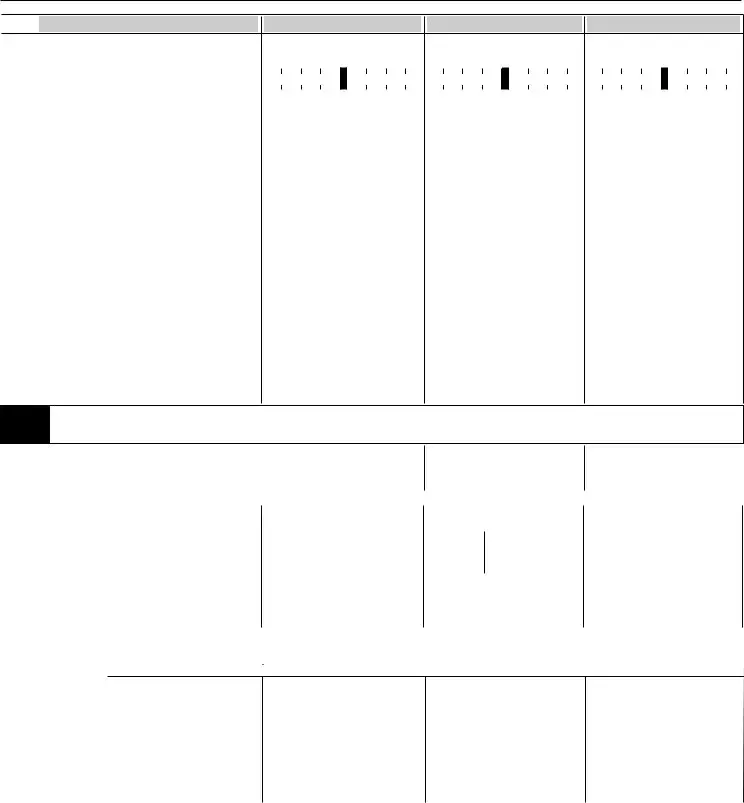

WORKSHEET FOR TENANTS WHO PAY RENT FOR A PERIOD OTHER THAN ONE MONTH |

|

To determine the annualized rent, divide the rent paid during the tax period by the number of days for which the rent was paid and multiply |

|

the result by the number of days in the tax year. Enter the result on line 4 here and on Form NYC-CRA, Page 2, line 12. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PREMISES |

|

|

PREMISES |

|

|

|

|

PREMISES |

|

*20032291* |

1. Amount of rent paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

for the period ................... 1. |

_____________________________________________________________________________________ |

|

2. Number of days in the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

rental period for which |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

rent was paid................... 2. |

_____________________________________________________________________________________ |

|

3. Rent per day (divide |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

line 1 by line 2. Round to |

|

|

|

|

|

|

|

|

|

|

|

the nearest whole dollar). 3. |

_____________________________________________________________________________________ |

|

4. Annualized rent (multiply |

|

|

|

|

|

|

|

|

|

|

|

rent per day, line 3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

by 365. In case of a leap |

|

|

|

|

|

|

|

|

|

|

|

year, multiply by 366. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Round to the nearest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

whole dollar).................... 4. |

_____________________________________________________________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20032291 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|