NOTE

If any due date falls on Saturday, Sunday or legal holiday, filing will be timely if made by the next day which is not a Saturday, Sunday or holiday.

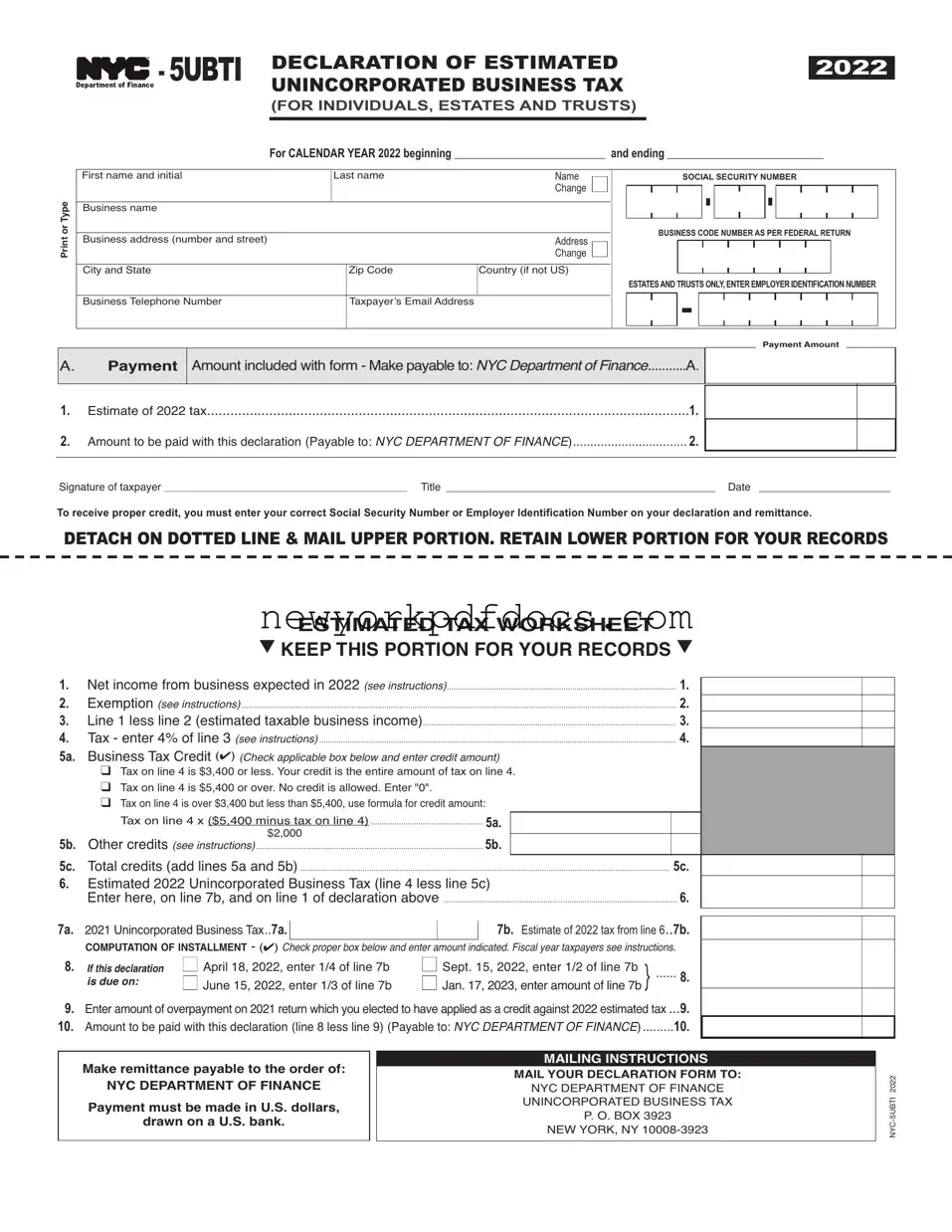

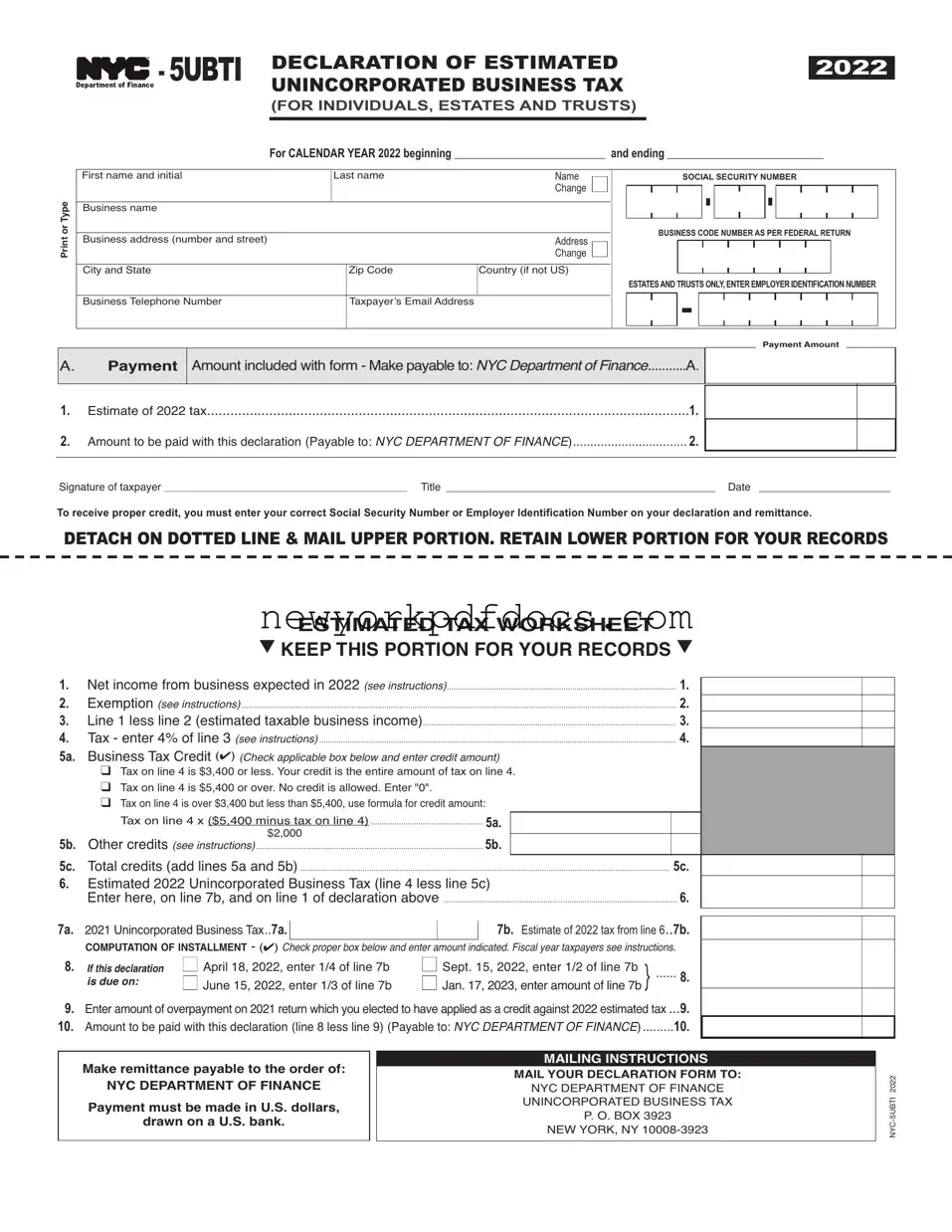

PURPOSE OF DECLARATION

This declaration form provides a means of paying Unincorporated Business Tax on a current basis for individuals, estates and trusts engaged in carrying on an unincorporated business or profession, as defined in Section 11-502 of the Administrative Code. Partnerships use Form NYC-5UB for filing their declarations.

Every unincorporated business must file an income tax return after the close of its taxable year and pay any balance of tax due. If the tax has been overpaid, adjustment will be made only after the return has been filed.

WHO MUST MAKE A DECLARATION

A 2022 declaration must be made by every individual, estate and trust carrying on an unincor- porated business or profession in New York City if its estimated tax (line 6 of tax computation schedule) can reasonably be expected to exceed $3,400 for the calendar year 2022 (or, in the case of a fiscal year taxpayer, for the fiscal year beginning in 2022).

WHEN AND WHERE TO FILE DECLARATION

You must file the declaration for the calendar year 2022 on or before April 18, 2022, or on the applicable later dates specified in these instructions.

Mail your declaration form with or without remittance to:

NYC Department of Finance

Unincorporated Business Tax

P. O. Box 3923

New York, NY 10008-3923

Fiscal year taxpayers, read instructions opposite regarding filing dates.

HOW TO ESTIMATE UNINCORPORATED BUSINESS TAX The worksheet on the front of this form will help you in estimating the tax for 2022.

LINE 1 -

The term “net income from business expected in 2022” means the amount estimated to be the 2022 net income from business, including professions, before the unincorporated business ex- emption. See Schedule A, line 14 of the 2021 Unincorporated Business Tax Return and related instructions (Form NYC-202 or NYC-202EIN).

LINE 2 - EXEMPTION

For the amount of the allowable exemption, see the instructions for the 2021 Form NYC-202 or NYC-202EIN, Schedule A, line 15.

LINE 4 - UNINCORPORATED BUSINESS TAX

If you expect to receive a refund or credit in 2022 of any sales or compensating use tax for which a credit was claimed in a prior year under Administrative Code Section 11-503(k) (sales and use tax credit), the amount of the estimated refund or credit must be added to the tax shown on line 4 of the tax computation schedule.

LINE 5b - OTHER CREDITS

Enter on line 5b the amount estimated to be the sum of any credits allowable for 2022 under Ad- ministrative Code Sections 11-503(e) (real estate tax escalation credit), 11-503(f) (employment opportunity relocation costs credit) 11-503(i) (relocation and employment assistance program (REAP) credit, 11-503(l) (lower Manhattan REAP Credit) 11-503(n) (Industrial Business Zone Credit) and 11-503(p) (Beer Production Credit). (For additional details concerning these cred- its, refer to instructions for Forms NYC-114.5, NYC-114.6, NYC-114.8 and NYC-114.12.)

Make remittance payable to NYC DEPARTMENT OF FINANCE. All remittances must be payable in U. S. dollars drawn on a U. S. bank. Checks drawn on foreign banks will be rejected and returned. A separate check for the declaration will expedite processing of the payment.

AMENDED DECLARATION

If, after a declaration is filed, the estimated tax increases or decreases because of a change in income, deductions, or allocation, you should file an amended declaration on or before the next date for payment of an installment of estimated tax.

CHARGE FOR UNDERPAYMENT OF INSTALLMENTS OF ESTIMATED TAX

A charge is imposed for underpayment of an installment of estimated tax for 2022. For infor- mation regarding interest rates, call 311. If calling from outside of the five NYC boroughs, please call 212-NEW-YORK (212-639-9675). The Administrative Code follows provisions similar to the Internal Revenue Code with respect to underpayments of estimated tax. Form NYC-221 may be used to determine if any charge for underpayment is due or if any exceptions apply. If it appears that there was an underpayment of any installment of estimated tax, a com- pleted copy of Form NYC-221 may be attached to the return explaining why an additional charge should not be made.

PENALTIES

The law imposes penalties for failure to make a declaration or pay estimated tax due or for making a false or fraudulent declaration or certification.

FISCAL YEAR TAXPAYERS

A taxpayer filing its Unincorporated Business Tax Return on a fiscal year basis should substi- tute the corresponding fiscal year months for the months specified in the instructions. For ex- ample, if the fiscal year begins on April 1, 2022, the Declaration of Estimated Unincorporated Business Tax will be due on July 15, 2022, together with payment of first quarter estimated tax. In this case, equal installments will be due on or before September 15, 2022, December 15, 2022, and April 18, 2023.

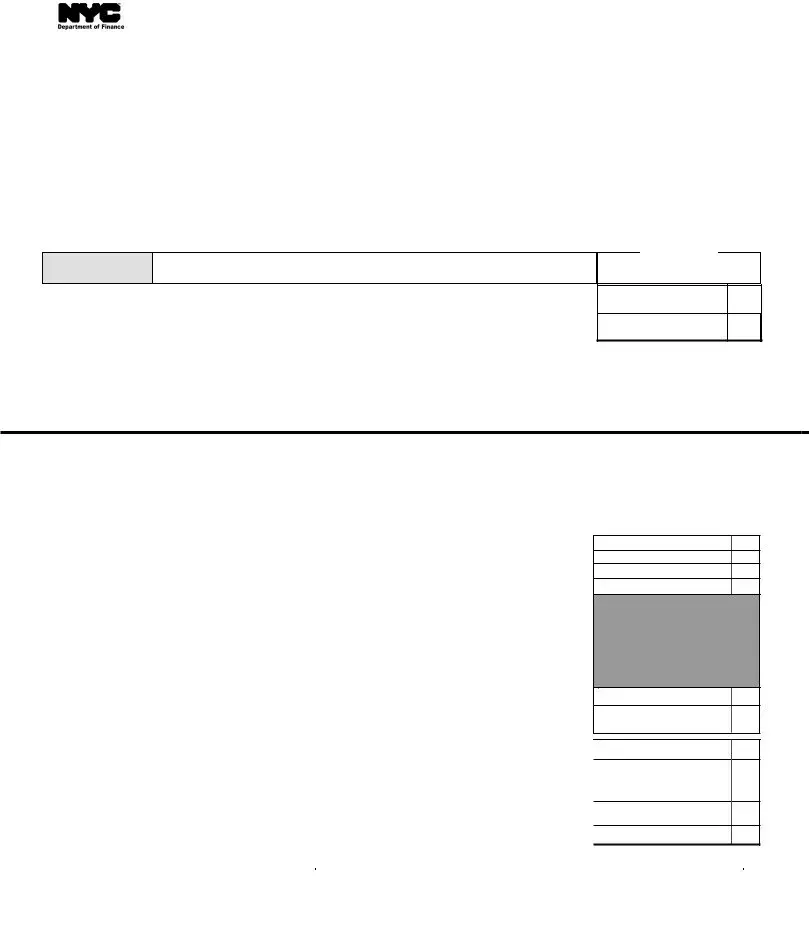

CHANGES IN INCOME

Even though on April 18, 2022, you do not expect your unincorporated business tax to exceed $3,400, a change in income, allocation or exemption may require that a declaration be filed later. In this event the requirements are as follows:

If requirement for filing occurs: |

File |

Amount of |

|

Installment |

declaration by: |

estimated |

|

payment |

|

|

|

tax due |

|

dates |

after |

but before |

|

|

|

|

|

|

|

|

|

|

April 1, 2022 |

June 1, 2022 |

June 15, 2022 |

1/3 |

(1) |

June 15, 2022 |

|

|

|

|

(2) |

Sept. 15, 2022 |

|

|

|

|

(3) |

Jan. 17, 2023 |

June 1, 2022 |

Sept. 1, 2022 |

Sept. 15, 2022 |

1/2 |

(1) |

Sept. 15, 2022 |

|

|

|

|

(2) |

Jan. 17, 2023 |

|

|

|

|

|

|

Sept. 1, 2022 |

Jan. 1, 2023 |

Jan. 17, 2023 |

100% |

|

None |

|

|

|

|

|

|

If you file your 2022 Unincorporated Business Tax Return by February 15, 2023, and pay the full balance of tax due, you need not: (a) file an amended declaration or an original declaration otherwise due for the first time on January 17, 2023, or (b) pay the last installment of estimated tax otherwise due and payable on January 17, 2023.

CAUTION

An extension of time to file your federal tax return or New York State personal income tax re- turn does NOT extend the filing date of your New York City tax return.

ELECTRONIC FILING

Note: Register for electronic filing. It is an easy, secure and convenient was to file a declara- tion and an extension and pay taxes on-line.

For more information log on to NYC.gov/eservices

NOTE

Filing a declaration or an amended declaration, or payment of the last installment on January 17, 2023, or filing a tax return by February 15, 2023, will not satisfy the filing requirements if you failed to file or pay an estimated tax which was due earlier in the taxable year.

PRIVACY ACT NOTIFICATION

The Federal Privacy Act of 1974, as amended, requires agencies requesting Social Security Numbers to in- form individuals from whom they seek this information as to whether compliance with the request is vol- untary or mandatory, why the request is being made and how the information will be used. The disclosure of Social Security Numbers for taxpayers is mandatory and is required by section 11-102.1 of the Admin- istrative Code of the City of New York. Such numbers disclosed on any report or return are requested for tax administration purposes and will be used to facilitate the processing of tax returns and to establish and maintain a uniform system for identifying taxpayers who are or may be subject to taxes administered and collected by the Department of Finance, and, as may be required by law, or when the taxpayer gives writ- ten authorization to the Department of Finance for another department, person, agency or entity to have ac- cess (limited or otherwise) to the information contained in his or her return.