NOTE

IfanyduedatefallsonSaturday,Sundayorlegalholiday,filingwillbetimelyifmade bythenextdaywhichisnotaSaturday,Sundayorholiday.

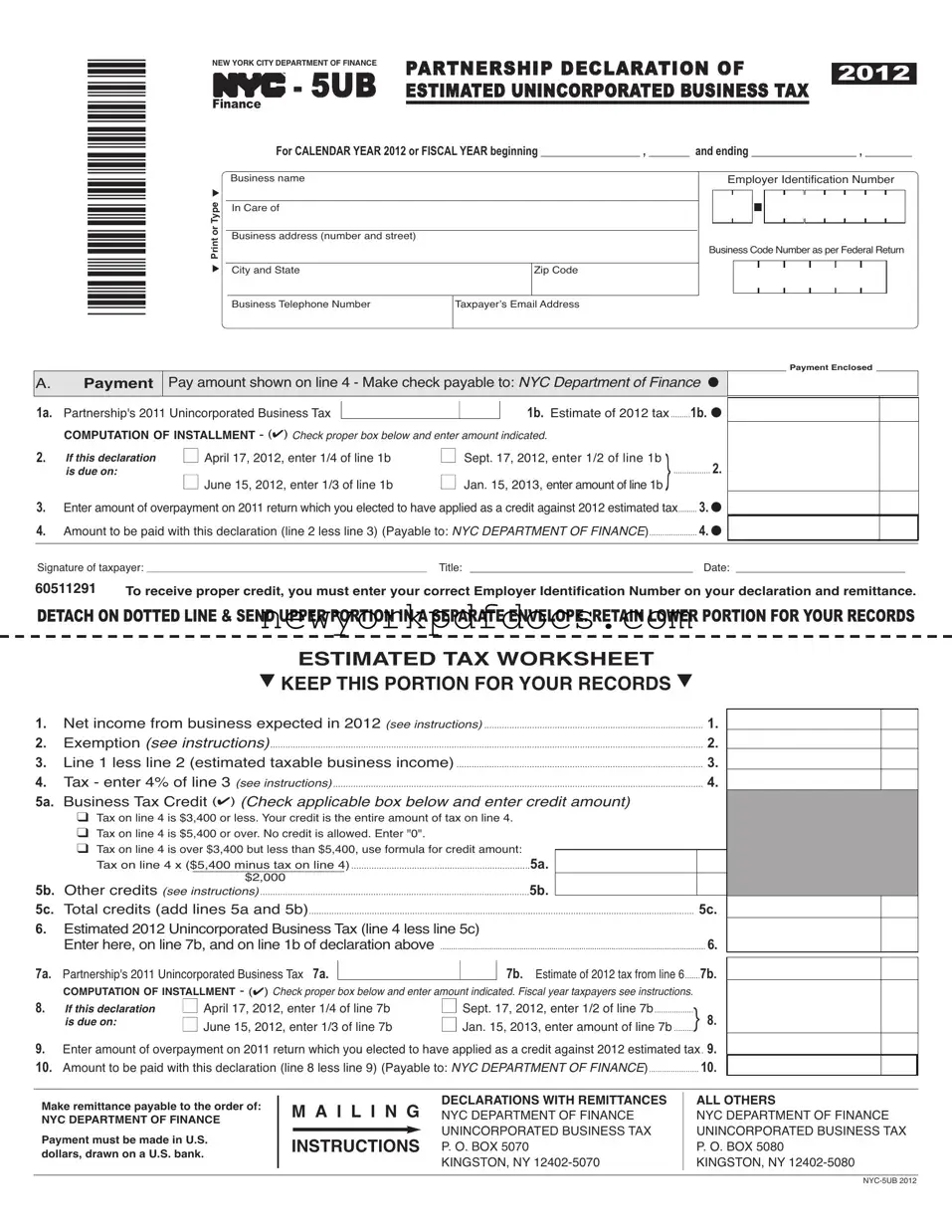

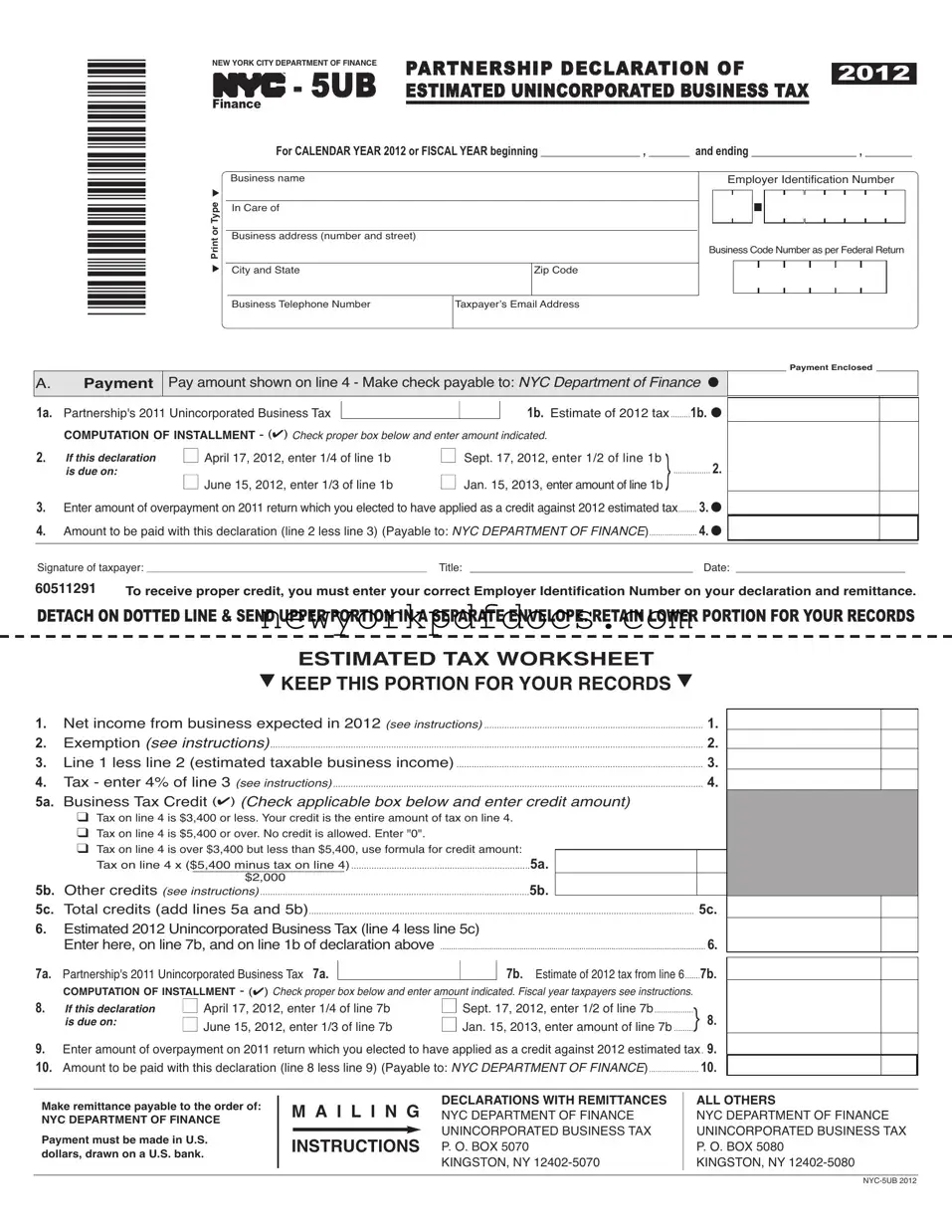

PURPOSEOFDECLARATION

ThisdeclarationformprovidesameansofpayingUnincorporatedBusinessTaxonacurrent basis for partnerships, joint ventures and similar entities (other than individuals, estates and trusts)engagedincarryingonanunincorporatedbusinessorprofession,asdefinedinSection 11-502oftheAdministrativeCode.Individuals,estatesandtrustsuseFormNYC-5UBTIfor filing their declarations.

Everyunincorporatedbusinessmustfileanincometaxreturnafterthecloseofitstaxableyear and pay any balance of tax due. If the tax has been overpaid, adjustment will be made only after the return has been filed.

WHOMUSTMAKEADECLARATION

A2012 declaration must be made by every partnership carrying on an unincorporated busi- nessorprofessioninNewYorkCityifitsestimatedtax(line6oftaxcomputationschedule) can reasonably be expected to exceed $3,400 for the calendar year 2012 (or, in the case of a fiscal year taxpayer, for the partnership fiscal year beginning in 2012).

WHENANDWHERETOFILEDECLARATION

You must file the declaration for the calendar year 2012 on or beforeApril 17, 2012, or on the applicable later dates specified in these instructions.

-Declarationswithremittances- |

- Allotherdeclarations- |

NYCDepartmentofFinance |

NYCDepartmentofFinance |

UnincorporatedBusinessTax |

UnincorporatedBusinessTax |

P.O.Box5070 |

P.O.Box5080 |

Kingston,NY12402-5070 |

Kingston,NY12402-5080 |

Fiscal year taxpayers, read instructions opposite regarding filing dates.

HOWTOESTIMATEUNINCORPORATEDBUSINESSTAX

The worksheet on the front of this form will help you in estimating the tax for 2012.

LINE1-

Theterm“netincomefrombusinessexpectedin2012”meanstheamountthepartnershipes- timatestobeitsincomefor2012computedbeforethespecificexemption.RefertoSchedule A, line 14 of the 2011 Partnership Return (Form NYC-204) and related instructions.

LINE2-EXEMPTION

The amount of the allowable exemption may be determined by referring to the instructions for the 2011 Form NYC-204, ScheduleA, line 15.

LINE4-UNINCORPORATEDBUSINESSTAX

If you expect to receive a refund or credit in 2012 of any sales or compensating use tax for which a credit was claimed in a prior year underAdministrative Code Sections 11-503 (k) (sales and use tax credit), the amount of the estimated refund or credit must be added to the tax shown on line 4 of the tax computation schedule.

LINE5b-OTHERCREDITS

Enter on line 5b the amount estimated to be the sum of any credits allowable for 2012 under AdministrativeCodeSections11-503(e)(realestatetaxescalationcredit),11-503(f)(employ- ment opportunity relocation costs credit), 11-503(i) (relocation and employment assistance program (REAP) credit, 11-503(j) (UBT paid credit), 11-503(l)(lower Manhattan REAP Credit,) 11-503(m) (NYC Film Production Credit) and 11-503(n) (Industrial Business Zone Credit,) 11-503(o) (Biotechnology Credit). (For additional details concerning these credits, refertoinstructionsforFormsNYC-114.5,NYC-114.6,NYC-114.7,NYC-114.8,NYC-114.9 andNYC-114.10.)

DECLARATION

Online1aofthedeclaration(line7aoftheEstimatedTaxWorksheet),entertheamountthe partnership reported on line 25 of its 2011 Form NYC-204. On line 1b (line 7b of the Esti- matedTaxWorksheet)entertheamountfromline6ofthetaxcomputationschedule.Thisis the amount the partnership estimates as its 2012 Unincorporated BusinessTax liability.

PAYMENTOFESTIMATEDTAX

Exceptasspecifiedelsewhereintheseinstructions,theestimatedtaxonline1bofthedeclaration ispayableinequalinstallmentsonorbeforeApril17,2012,June15,2012,September17,2012 andJanuary15,2013. Thefirstinstallmentpaymentmustaccompanythedeclaration.However, theestimatedtaxmaybepaidinfullwiththedeclaration.

Iftherewasanoverpaymentonthe2011PartnershipTaxReturnandonline32boftheNYC- 204 or line 13 of the NYC-204EZ you elected to have that overpayment applied as a credit toward your 2012 estimated tax, enter the amount from line 32b of the NYC-204 or line 13 of the NYC-204EZ on line 3 of the declaration. (Line 9 of the EstimatedTaxWorksheet).

Make remittance payable to NYC DEPARTMENT OF FINANCE. All remittances must be

payableinU.S.dollarsdrawnonaU.S.bank. Checksdrawnonforeignbankswillberejected and returned.Aseparate check for the declaration will expedite processing of the payment.

AMENDEDDECLARATION

If,afteradeclarationisfiled,theestimatedtaxincreasesordecreasesbecauseofachangein income, deductions, or allocation, you should file an amended declaration on or before the next date for payment of an installment of estimated tax. This is done by completing the amendedscheduleoftheNoticeofEstimatedTaxPaymentDue(FormNYC-B100). Thisno- tice will be automatically mailed to you.

CHARGEFORUNDERPAYMENTOFINSTALLMENTSOFESTIMATEDTAX

Acharge is imposed for underpayment of an installment of estimated tax for 2012. For in- formationregardinginterestrates,call311. IfcallingfromoutsideofthefiveNYCboroughs, please call 212-NEW-YORK (212-639-9675).TheAdministrative Code follows provisions similartotheInternalRevenueCodewithrespecttounderpaymentsofestimatedtax. Form NYC-221 may be used to determine if any charge for underpayment is due or if any excep- tionsapply. Ifitappearsthattherewasanunderpaymentofanyinstallmentofestimatedtax, a completed copy of Form NYC-221 may be attached to the return explaining why an addi- tional charge should not be made.

PENALTIES

The law imposes penalties for failure to make a declaration or pay estimated tax due or for making a false or fraudulent declaration or certification.

FISCALYEARTAXPAYERS

InthecaseofapartnershipthatfilesitsUnincorporatedBusinessTaxReturnonafiscalyear basis,substitutethecorrespondingfiscalyearmonthsforthemonthsspecifiedintheinstruc- tions. For example, if the fiscal year begins onApril 1, 2012, the Declaration of Estimated Unincorporated Business Tax will be due on July 16, 2012, together with payment of first quarterestimatedtax.Inthiscase,equalinstallmentswillbedueonorbeforeSeptember17, 2012, December 17, 2012, andApril 16, 2013.

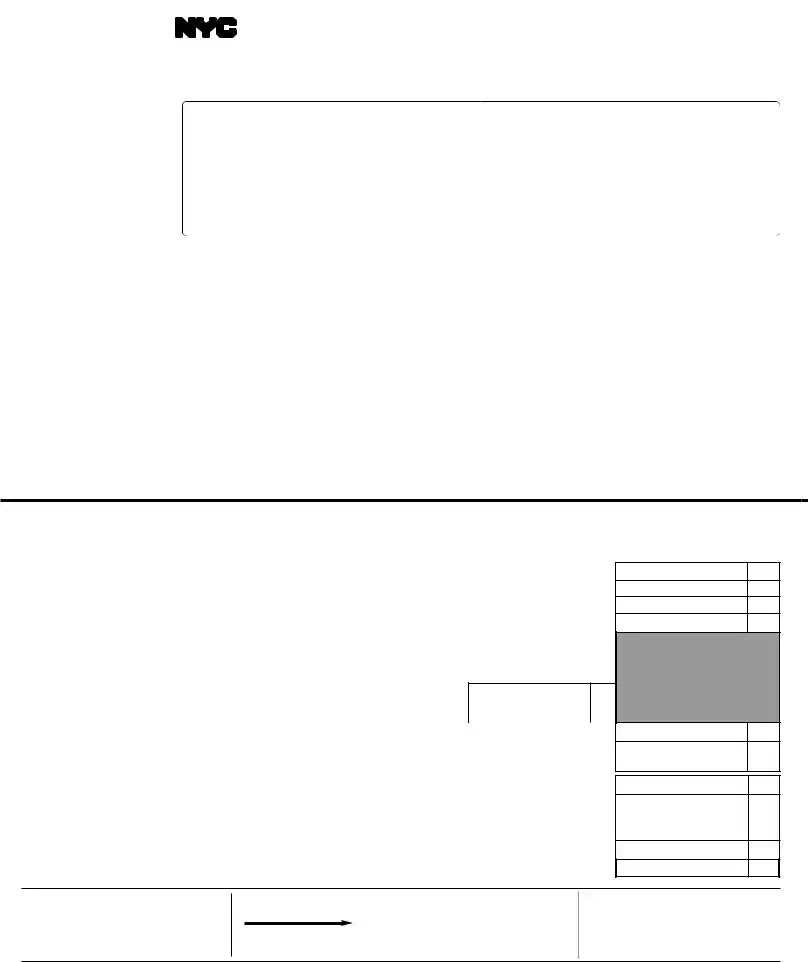

CHANGESININCOME

EventhoughonApril17,2012,apartnershipdoesnotexpectitsunincorporatedbusinesstax toexceed$3,400,achangeinincome,allocationorexemptionmayrequirethatadeclaration be filed later. In this event the requirements are as follows:

|

|

File |

Amountof |

|

Installment |

Ifrequirementforfilingoccurs: |

declaration |

estimated |

|

payment |

|

|

by: |

taxdue |

|

dates |

AFTER |

BUT BEFORE |

|

|

|

|

|

|

|

|

|

|

April 1, 2012 |

June 2, 2012 |

June 15, 2012 |

1/3 |

(1) |

June 15, 2012 |

....................................... |

|

|

|

(2) |

Sept. 17, 2012 |

....................................... |

|

|

|

(3) |

Jan. 15, 2013 |

June 1, 2012 |

Sept. 2, 2012 |

Sept. 17, 2012 |

1/2 |

(1) |

Sept. 17, 2012 |

....................................... |

|

|

|

(2) |

Jan. 15, 2013 |

|

|

|

|

|

Sept. 1, 2012 |

Jan. 1, 2013 |

Jan. 15, 2013 |

100% |

None |

If the partnership files its 2012 Unincorporated BusinessTax Return by February 15, 2013, andpaysthefullbalanceoftaxdue,itneednot:(A) fileanamendeddeclarationoranoriginal declarationotherwisedueforthefirsttimeonJanuary15,2013,or(B) paythelastinstallment of estimated tax otherwise due and payable on January 15, 2013.

CAUTION

AnextensionoftimetofileyourfederaltaxreturnorNewYorkStatepartnershipinformation return does NOTextend the filing date of your NewYork City tax return.

NOTE

Filing a declaration or an amended declaration, or payment of the last installment on January 15,2013,orfilingataxreturnbyFebruary15,2013,willnotsatisfythefilingrequirementsif thepartnershipfailedtofileorpayanestimatedtaxwhichwasdueearlierinthetaxableyear.

ELECTRONICFILING

Note:Registerforelectronicfiling. Itisaneasy,secureandconvenientwaytofileandpayan extension on-line.

For more information log on to nyc.gov/nycefile.