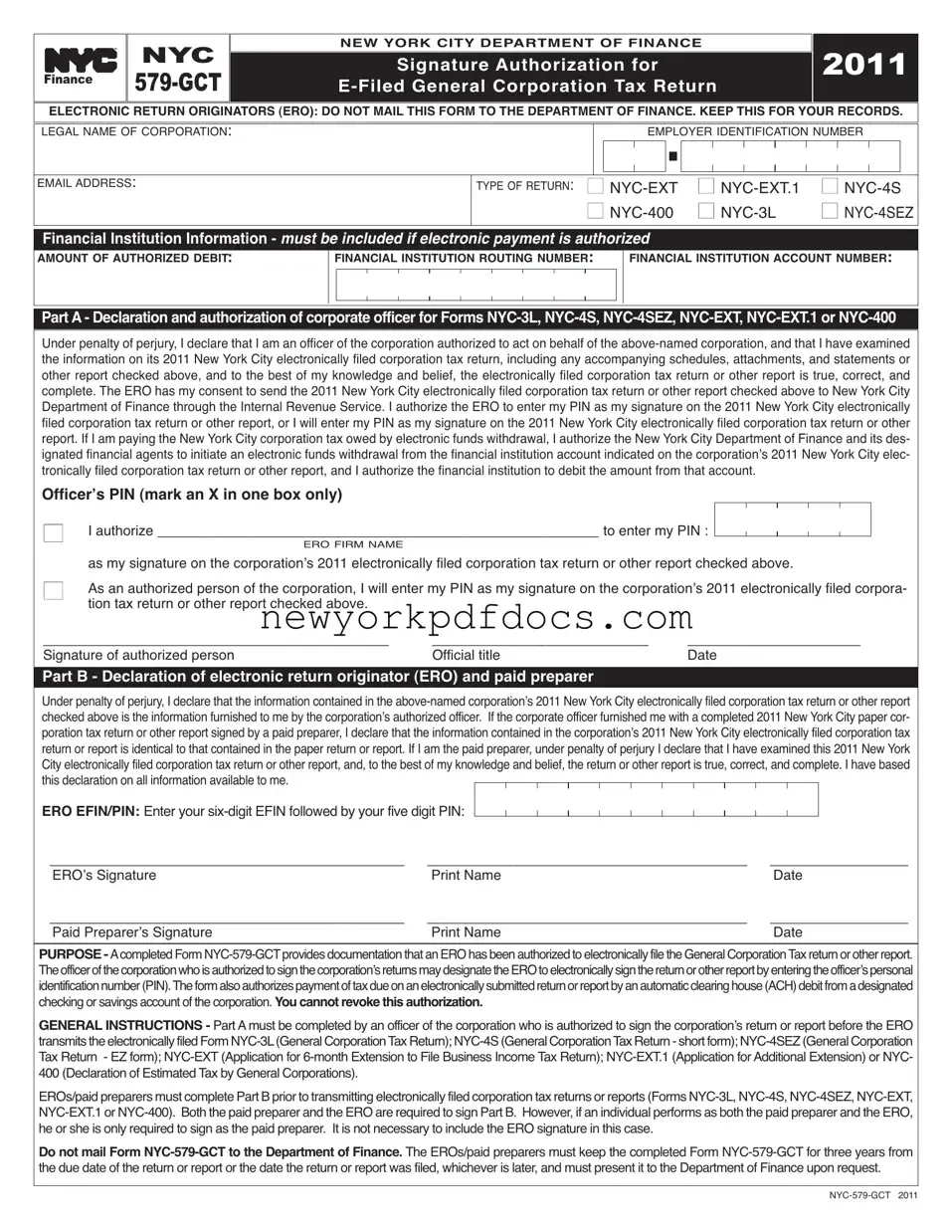

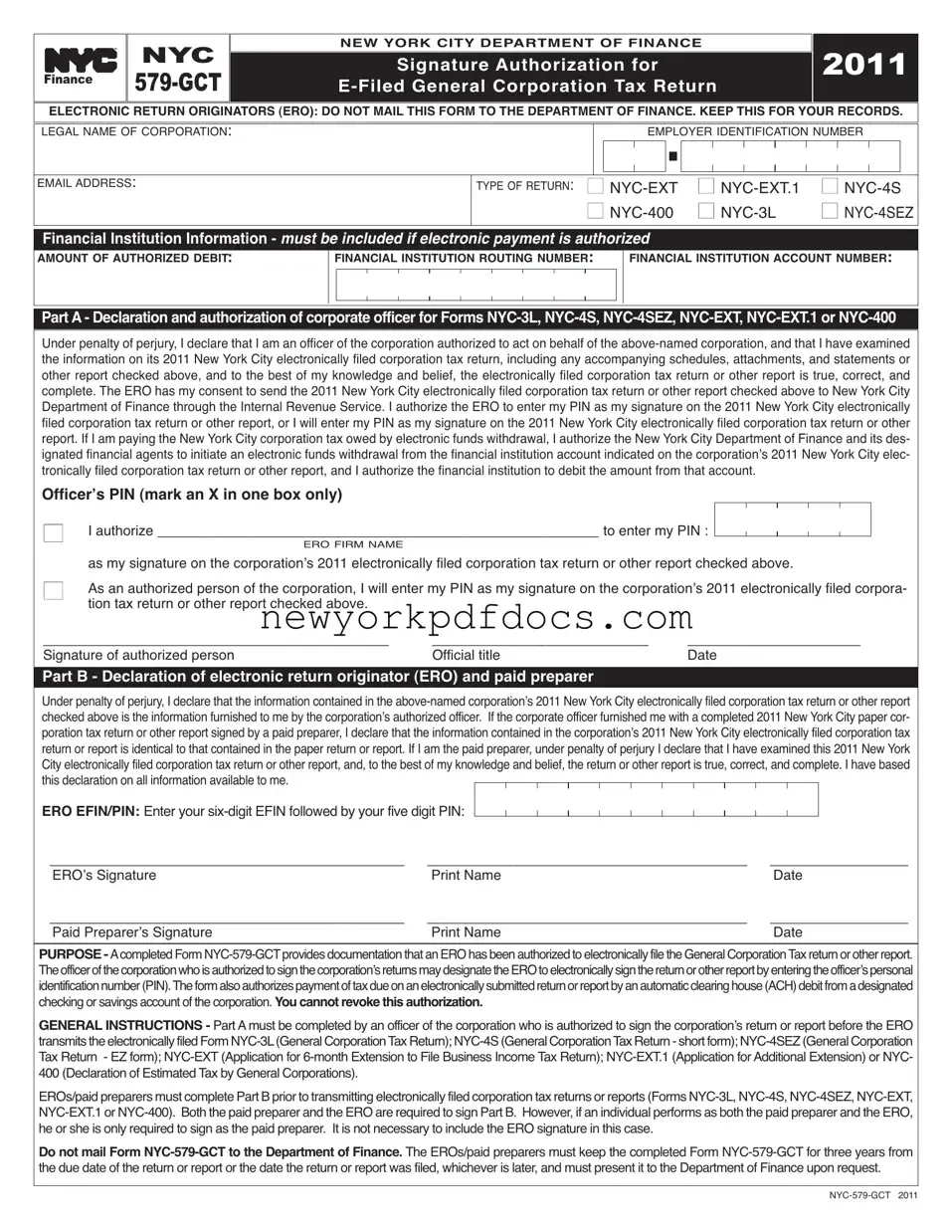

PartA-DeclarationandauthorizationofcorporateofficerforFormsNYC-3L,NYC-4S,NYC-4SEZ,NYC-EXT,NYC-EXT.1orNYC-400

Underpenaltyofperjury,IdeclarethatIamanofficerofthecorporationauthorizedtoactonbehalfoftheabove-namedcorporation,andthatIhaveexamined the information on its 2011 New York City electronically filed corporation tax return, including any accompanying schedules, attachments, and statements or other report checked above, and to the best of my knowledge and belief, the electronically filed corporation tax return or other report is true, correct, and complete.The ERO has my consent to send the 2011 NewYork City electronically filed corporation tax return or other report checked above to NewYork City Department of Finance through the Internal Revenue Service. I authorizetheEROtoentermyPINasmysignatureonthe2011NewYorkCityelectronically filedcorporationtaxreturnorotherreport,orIwillentermyPINasmysignatureonthe2011NewYorkCityelectronicallyfiledcorporationtaxreturnorother report.IfIampayingtheNewYorkCitycorporationtaxowedbyelectronicfundswithdrawal,IauthorizetheNewYorkCityDepartmentofFinanceanditsdes- ignatedfinancialagentstoinitiateanelectronicfundswithdrawalfromthefinancialinstitutionaccountindicatedonthecorporationʼs2011NewYorkCityelec- tronicallyfiledcorporationtaxreturnorotherreport,andIauthorizethefinancialinstitutiontodebittheamountfromthataccount.

Officerʼs PIN (mark an X in one box only)

■ |

I authorize ___________________________________________________ to enter my PIN : |

|

|

|

|

|

|

|

|

|

|

|

ERO FIRM NAME |

|

as my signature on the corporationʼs 2011 electronically filed corporation tax return or other report checked above. |

■As an authorized person of the corporation, I will enter my PIN as my signature on the corporationʼs 2011 electronically filed corpora- tion tax return or other report checked above.

________________________________________ |

_________________________ |

____________________ |

Signature of authorized person |

Official title |

Date |

Part B - Declaration of electronic return originator (ERO) and paid preparer

Underpenaltyofperjury,Ideclarethattheinformationcontainedintheabove-namedcorporationʼs2011NewYorkCityelectronicallyfiledcorporationtaxreturnorotherreport checkedaboveistheinformationfurnishedtomebythecorporationʼsauthorizedofficer. Ifthecorporateofficerfurnishedmewithacompleted2011NewYorkCitypapercor- porationtaxreturnorotherreportsignedbyapaidpreparer,Ideclarethattheinformationcontainedinthecorporationʼs2011NewYorkCityelectronicallyfiledcorporationtax returnorreportisidenticaltothatcontainedinthepaperreturnorreport.IfIamthepaidpreparer,underpenaltyofperjuryIdeclarethatIhaveexaminedthis2011NewYork Cityelectronicallyfiledcorporationtaxreturnorotherreport,and,tothebestofmyknowledgeandbelief,thereturnorotherreportistrue,correct,andcomplete.Ihavebased thisdeclarationonallinformationavailabletome.

ERO EFIN/PIN: Enteryoursix-digitEFINfollowedbyyourfivedigitPIN:

_________________________________________ |

_____________________________________ |

________________ |

EROʼs Signature |

Print Name |

Date |

_________________________________________ |

_____________________________________ |

________________ |

Paid Preparerʼs Signature |

Print Name |

Date |

PURPOSE-AcompletedFormNYC-579-GCTprovidesdocumentationthatanEROhasbeenauthorizedtoelectronicallyfiletheGeneralCorporationTaxreturnorotherreport. Theofficerofthecorporationwhoisauthorizedtosignthecorporation’sreturnsmaydesignatetheEROtoelectronicallysignthereturnorotherreportbyenteringtheofficer’spersonal identificationnumber(PIN).Theformalsoauthorizespaymentoftaxdueonanelectronicallysubmittedreturnorreportbyanautomaticclearinghouse(ACH)debitfromadesignated checkingorsavingsaccountofthecorporation.Youcannotrevokethisauthorization.

GENERALINSTRUCTIONS-PartAmustbecompletedbyanofficerofthecorporationwhoisauthorizedtosignthecorporationʼsreturnorreportbeforetheERO transmitstheelectronicallyfiledFormNYC-3L(GeneralCorporationTaxReturn);NYC-4S(GeneralCorporationTaxReturn-shortform);NYC-4SEZ(GeneralCorporation TaxReturn -EZform);NYC-EXT(Applicationfor6-monthExtensiontoFileBusinessIncomeTaxReturn);NYC-EXT.1(ApplicationforAdditionalExtension)orNYC- 400(DeclarationofEstimatedTaxbyGeneralCorporations).

EROs/paidpreparersmustcompletePartBpriortotransmittingelectronicallyfiledcorporationtaxreturnsorreports(FormsNYC-3L,NYC-4S,NYC-4SEZ,NYC-EXT, NYC-EXT.1orNYC-400). BoththepaidpreparerandtheEROarerequiredtosignPartB. However,ifanindividualperformsasboththepaidpreparerandtheERO, heorsheisonlyrequiredtosignasthepaidpreparer. ItisnotnecessarytoincludetheEROsignatureinthiscase.

DonotmailFormNYC-579-GCTtotheDepartmentofFinance.TheEROs/paidpreparersmustkeepthecompletedFormNYC-579-GCTforthreeyearsfrom theduedateofthereturnorreportorthedatethereturnorreportwasfiled,whicheverislater,andmustpresentittotheDepartmentofFinanceuponrequest.

2011

2011