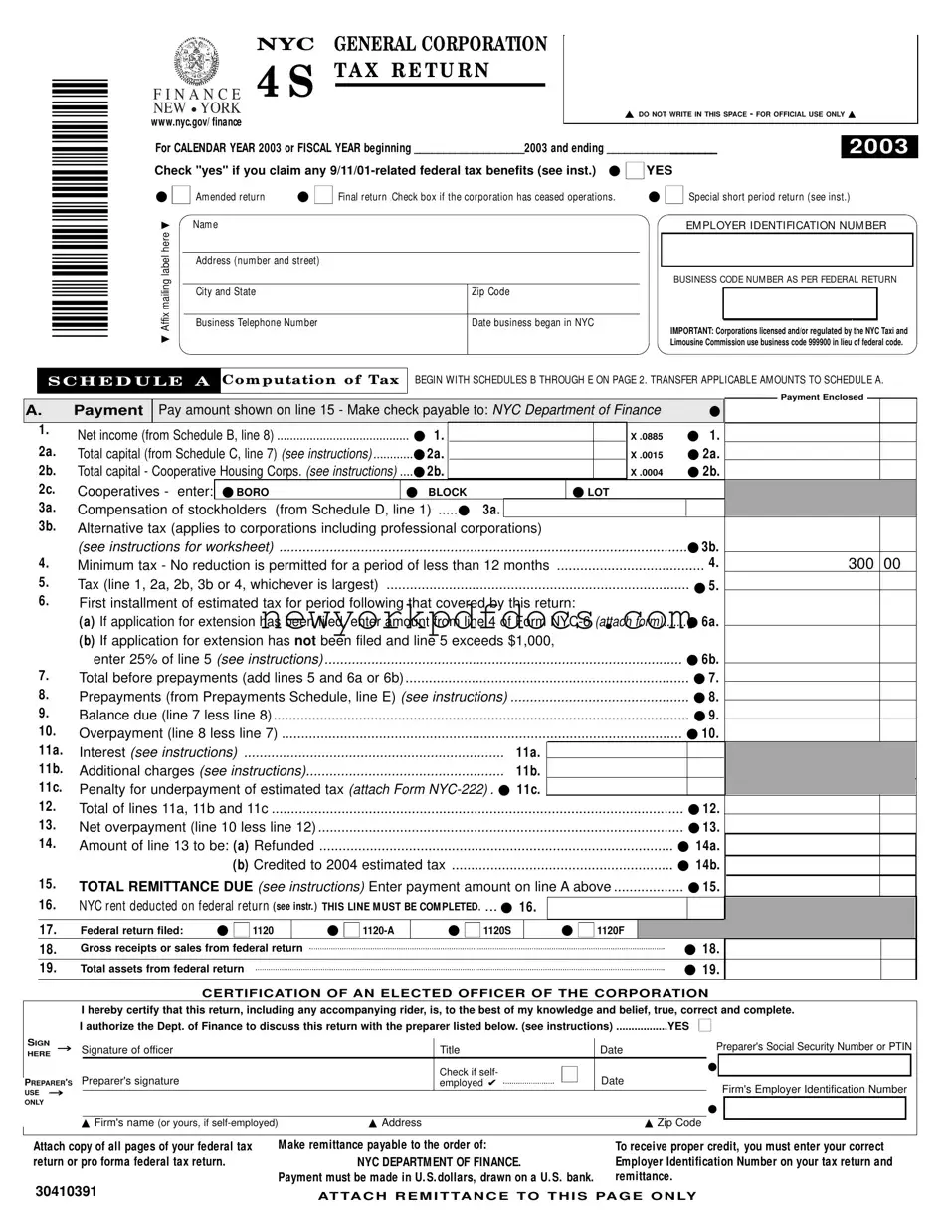

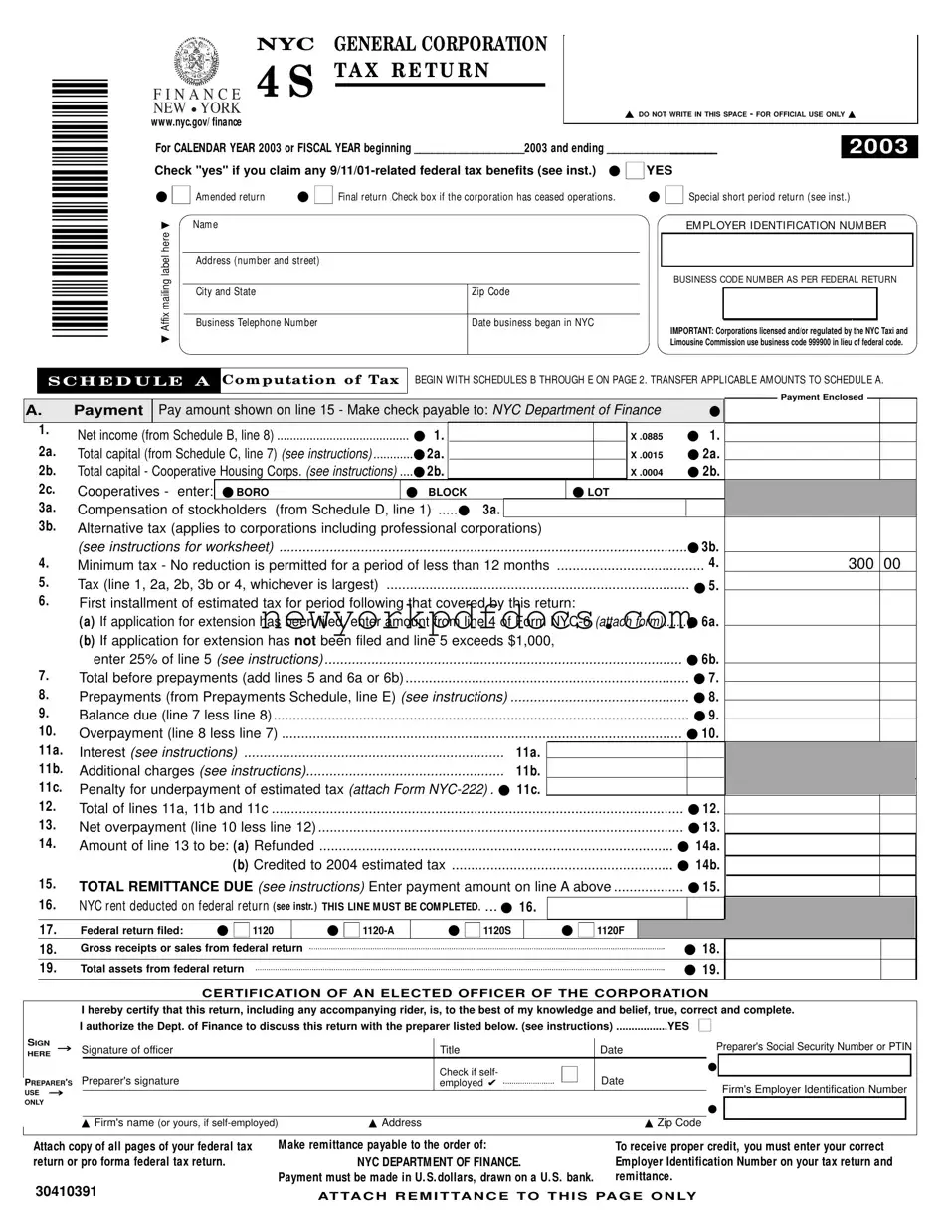

Filling out the NYC 4S form can be a straightforward process, but many people stumble due to common mistakes. One frequent error is neglecting to check the correct boxes. For instance, if a corporation has ceased operations, it’s essential to mark the appropriate box indicating a final return. Failing to do so can lead to confusion and potential delays in processing.

Another mistake involves the Employer Identification Number (EIN). It’s crucial to enter the correct EIN on the form. An incorrect number can result in the return being misfiled or rejected. Always double-check this information before submitting the form.

Many individuals also overlook the importance of including all required schedules. The NYC 4S form references several schedules that must be completed and attached. If these are missing, the form may be deemed incomplete, leading to further complications down the line.

Additionally, some people forget to sign the form. The certification by an elected officer of the corporation is mandatory. Without this signature, the return may not be considered valid, which could result in penalties or other issues.

Another common error is miscalculating the tax amounts. Whether it’s the net income, capital, or any other figures, double-checking calculations can save time and prevent errors. Simple arithmetic mistakes can lead to significant discrepancies in tax owed.

People often fail to provide adequate information about stockholders. The form requires details about stockholders owning more than 5% of the issued capital stock. Omitting this information can lead to incomplete filings and possible audits.

Many also neglect to attach the necessary federal tax return copies. The instructions specify that all pages of the federal return or pro forma return must be attached. Failing to include these documents can result in delays in processing.

Another mistake is not reviewing the mailing instructions. Each type of return has a specific mailing address. Sending the return to the wrong address can cause significant delays in processing and could even result in penalties.

Finally, many people miss the deadline for filing. The due date for the 2003 return is March 15, 2004. Failing to file on time can lead to penalties and interest charges, so it’s important to mark your calendar and plan ahead.