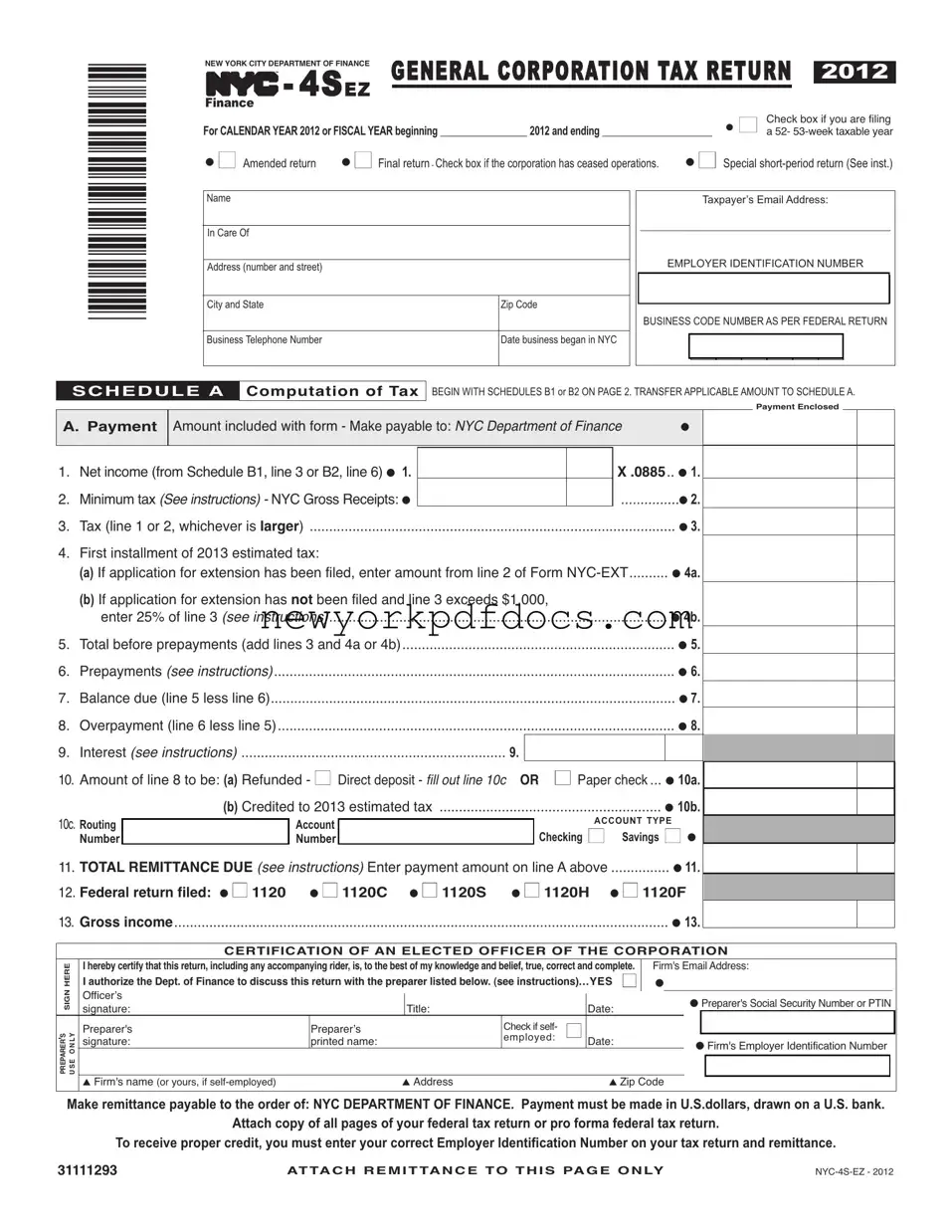

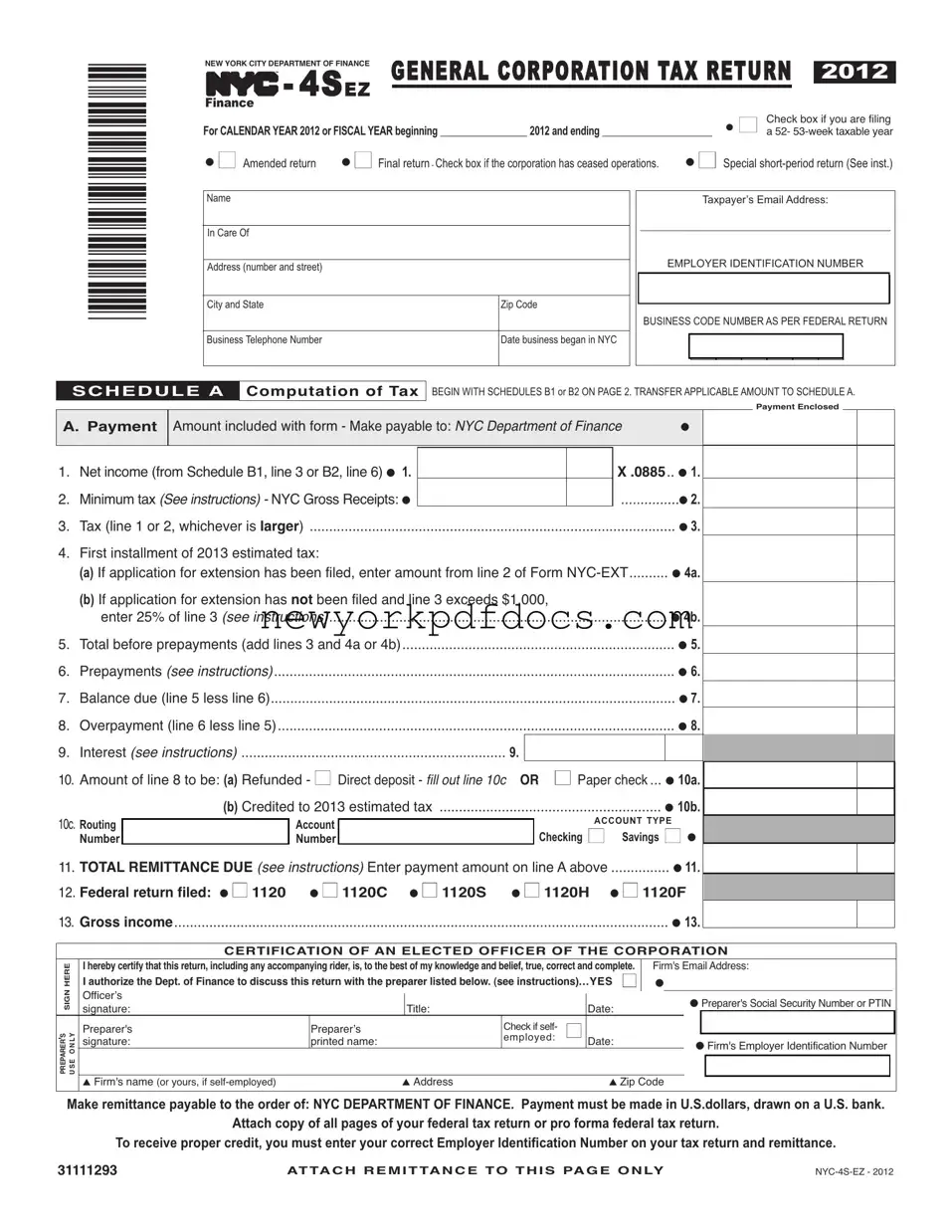

Free Nyc 4S Ez Form

The NYC 4S EZ form is a simplified tax return designed for corporations operating within New York City. This form allows eligible businesses to report their general corporation tax with ease, ensuring compliance with local tax regulations. By utilizing this streamlined process, corporations can efficiently manage their tax obligations while minimizing the burden of paperwork.

Open My Document Now

Free Nyc 4S Ez Form

Open My Document Now

Your form isn’t finalized yet

Edit, save, and download Nyc 4S Ez online with ease.

Open My Document Now

or

⇓ Nyc 4S Ez PDF