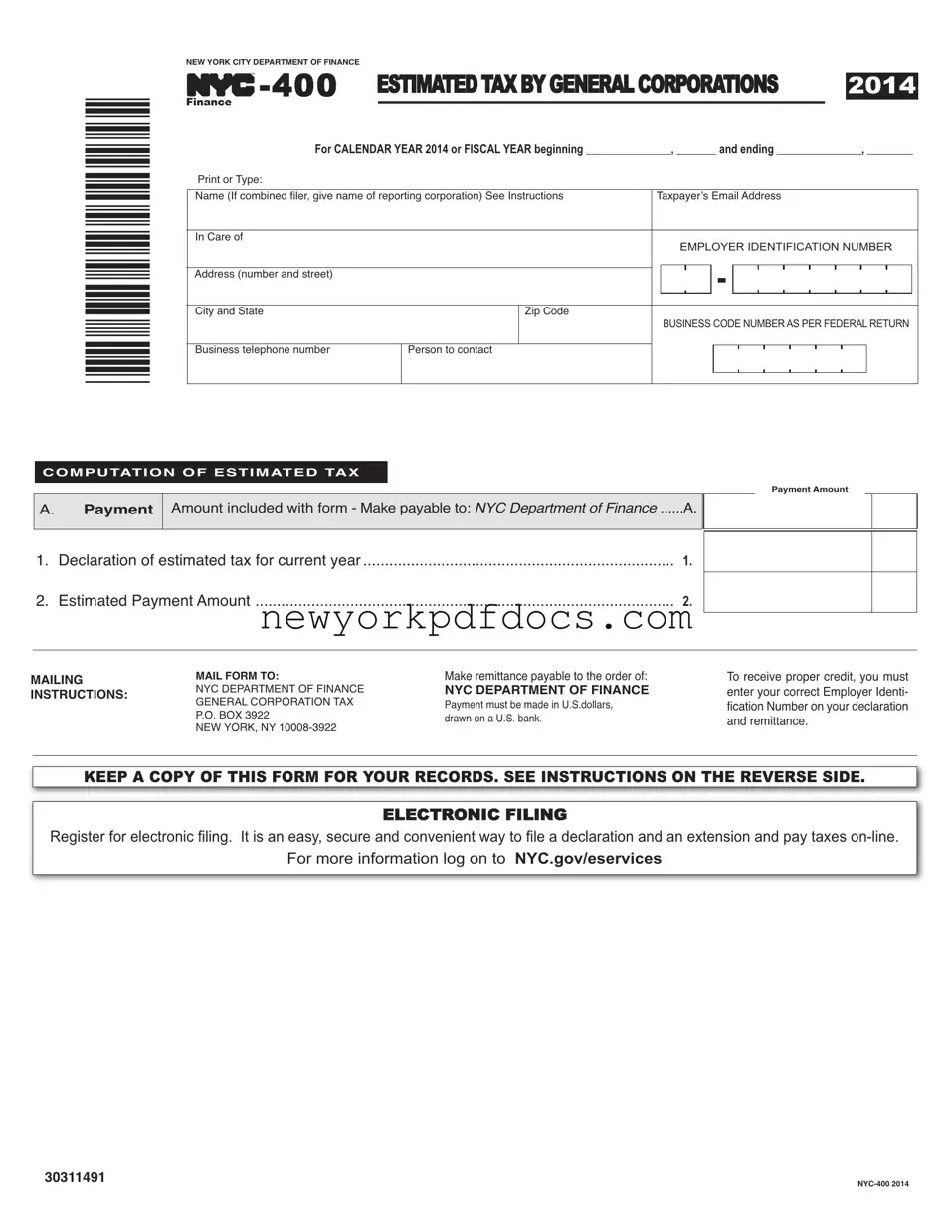

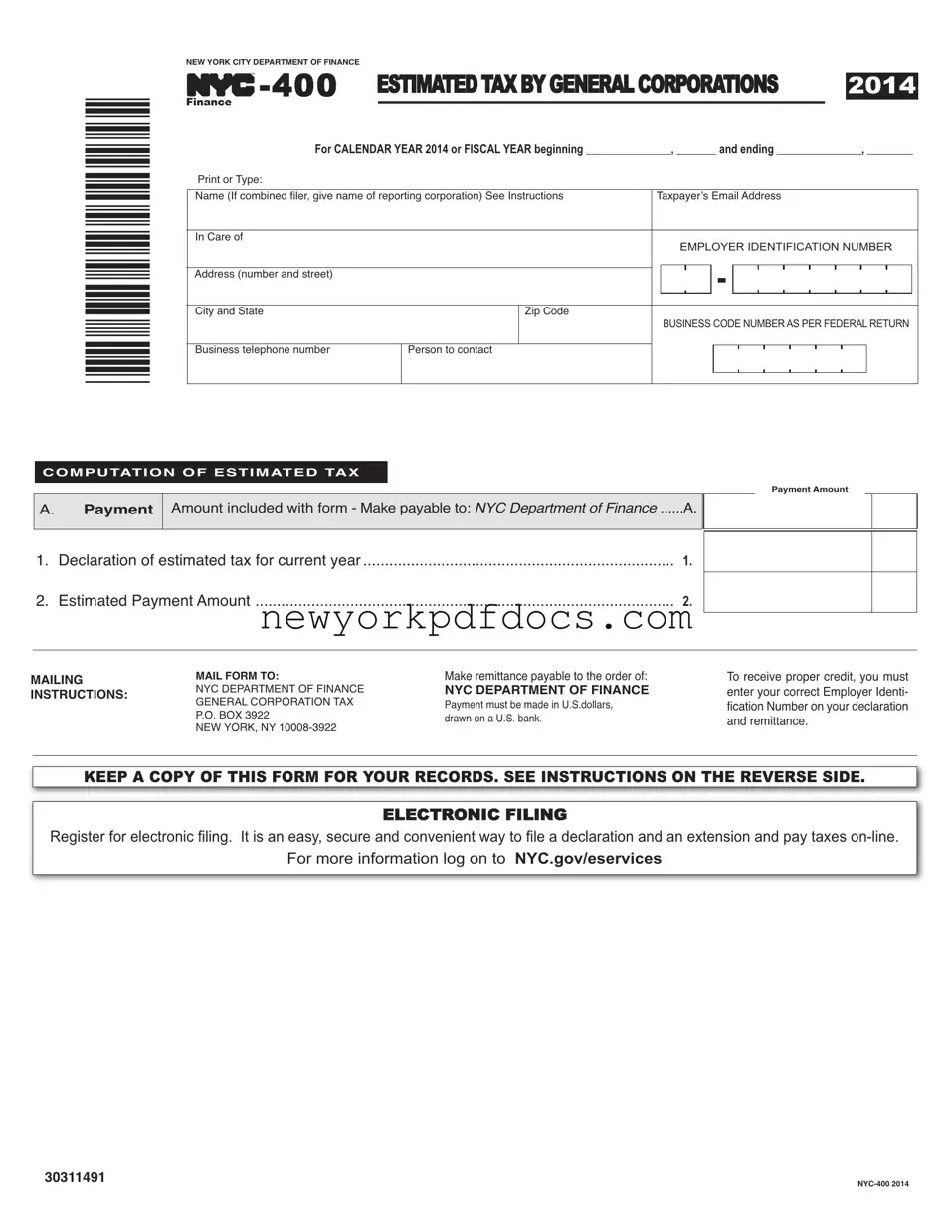

NEWYORK CITYDEPARTMENT OF FINANCE

TM -400 |

ESTIMATEDTAXBYGENERALCORPORATIONS |

2014 |

FINANCE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For CALENDAR YEAR 2014 or FISCAL YEAR beginning _______________, _______ and ending _______________, ________ |

Print or Type: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name(If combined filer, give name of reporting corporation) See Instructions |

Taxpayer’s EmailAddress |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In Care of |

|

|

|

|

EMPLOYER IDENTIFICATION NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (number and street) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City and State |

|

|

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BUSINESS CODE NUMBER AS PER FEDERAL RETURN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business telephone number |

|

Person to contact |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPUTATION OF ESTIMATED TAX

Payment Amount

Amount included with form - Make payable to: NYC Department of Finance |

......A. |

|

|

|

|

|

|

|

|

|

|

1. |

Declaration of estimated tax for current year |

1. |

2. |

Estimated PaymentAmount |

2. |

MAILFORM TO:

NYC DEPARTMENT OF FINANCE GENERAL CORPORATION TAX P.O. BOX 3922

NEW YORK, NY 10008-3922

Make remittance payable to the order of:

NYC DEPARTMENT OF FINANCE

Payment must be made in U.S.dollars, drawn on a U.S. bank.

To receive proper credit, you must enter your correct Employer Identi- ficationNumberonyourdeclaration and remittance.

KEEP A COPY OF THIS FORM FOR YOUR RECORDS. SEE INSTRUCTIONS ON THE REVERSE SIDE.

ELECTRONIC FILING

Registerforelectronicfiling. Itisaneasy,secureandconvenientwaytofileadeclarationandanextensionandpaytaxeson-line.

For more information log on to NYC.GOV/ESERVICES

Form NYC-400 - 2014 - Instructions |

Page 2 |

|

|

WHOMUSTFILE

Every corporation subject to the NewYork City General CorporationTax (Title 11, Chapter 6, Subchapter 2 of theAdministrative Code) must file a declaration (NYC-400) if its estimated tax for the current year can reasonably be expected to exceed $1,000. The term “esti- matedtax”meanstheamountoftaxthetaxpayerestimatestobeimposedbysection11-603oftheAdministrativeCodelessthesumofthe creditsestimatedtobeallowableagainstthetax. Foragroupfilingacombinedreturn, thisformshouldbefiledbythegroupmemberfil- ing the return and paying the tax.

NOTE:Ifthecurrentyear’staxisreasonablyestimatedtoexceed$1,000,anestimatedpaymentisrequiredevenifthisisthefirstyearofbusi- nessinNewYorkCityforthetaxpayerorthetaxpayerpaidonlytheminimumtaxfortheprecedingyear.Failuretopayorunderpayment ofestimatedtaxinthesecircumstanceswillresultinpenalties.

LINE1 - DECLARATIONOFESTIMATEDTAXFORCURRENTYEAR

Corporationswhosetaxliabilityfortheprecedingyearexceeds$1,000arerequiredtopay,withthetaxreportfortheprecedingyearorwith theapplicationforextensionoftimeforthefilingofsuchreport,25%ofthetaxliabilityfortheprecedingyearasafirstinstallmentofes- timatedtaxforthecurrentyear. Aftertakingcreditforthat25%paymentandfortheamountofanyoverpaymentshownonlastyear’sre- turnwhichthetaxpayerelectedtohaveappliedasacreditagainstthecurrentyear’stax,taxpayersfilingestimatedtaxarerequiredtopay the balance of estimated tax in fractional installments.

ESTIMATEDTAXDUEDATES

Iftherequirementsforfilingestimatedpayments |

Filetheformonorbeforethe: |

Thebalanceofestimatedtaxisdueasfollows: |

arefirstmetduringthetaxableyear: |

|

|

|

|

|

Before the first day of the 6th month |

15th day of the 6th month |

l 1/3 by the 15th day of the 6th month |

|

|

l 1/3 by the 15th day of the 9th month |

|

|

l 1/3 by the 15th day of the 12th month |

|

|

|

On or after the first day of the 6th month and before the |

15th day of the 9th month |

l 1/2 by the 15th day of the 9th month |

first day of the 9th month |

|

l 1/2 by the 15th day of the 12th month |

|

|

|

On or after the first day of the 9th month and before the |

15th day of the 12th month. In lieu of this form, |

Pay in full |

first day of the 12th month |

a completed tax report, with payment of any unpaid |

|

|

balance of tax, may be filed on or before the 15th day |

|

|

of the 2nd month of the following year. |

|

|

|

|

If any of the above dates fall on a Saturday, Sunday or legal holiday, the due date is the next business day.

AMENDMENTS

Anamendedformshouldbefiled,ifnecessary,tocorrectthetaxestimateandrelatedpayments.UsetheNYC-400orNoticeofEstimated TaxPaymentDueformakingamendment. Iftheamendmentismadeafterthe15thdayofthe9thmonthofthetaxableyear,anyincrease in tax must be paid with the amendment.

LATEFILING

IftheNYC-400isfiledafterthetimeprescribedinthechartabove,allinstallmentsofestimatedtaxdueonorbeforesuchtimearepayable at once and the remaining installments are due as if the form were timely filed.

PENALTY

The law imposes penalties for failure to pay or underpayment of estimated tax. (Refer to Section 11-676, Subdivisions 3 and 4 of the Admin-

istrative Code.)

ELECTRONICFILING

Note: Register for electronic filing. It is an easy, secure and convenient way to file and pay an extension on-line.

For more information log on to NYC.gov/eservices