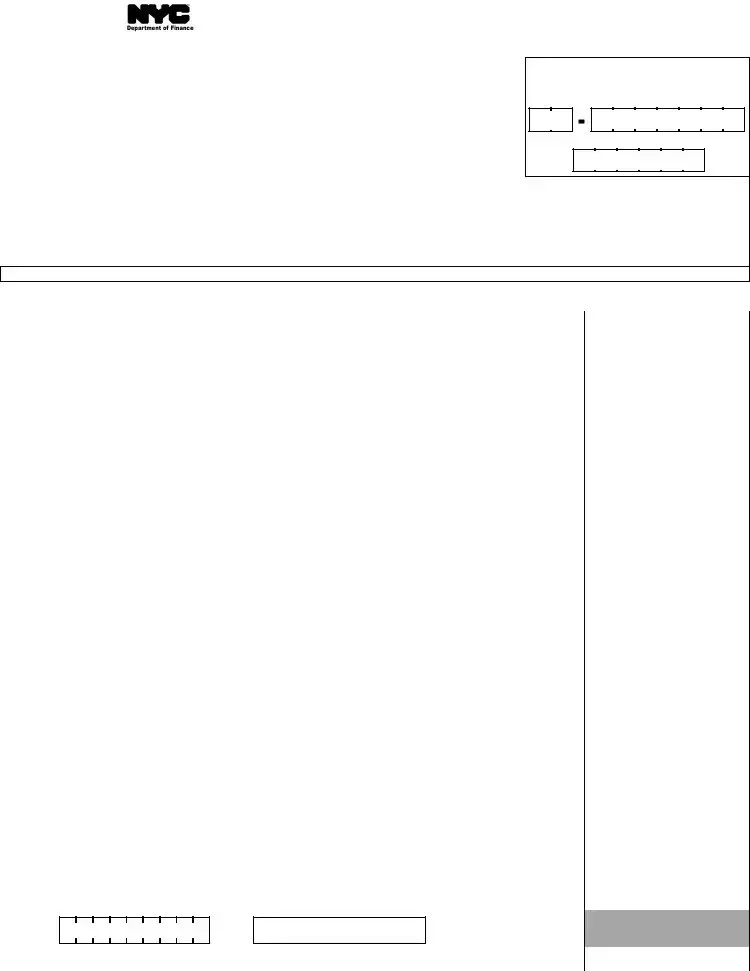

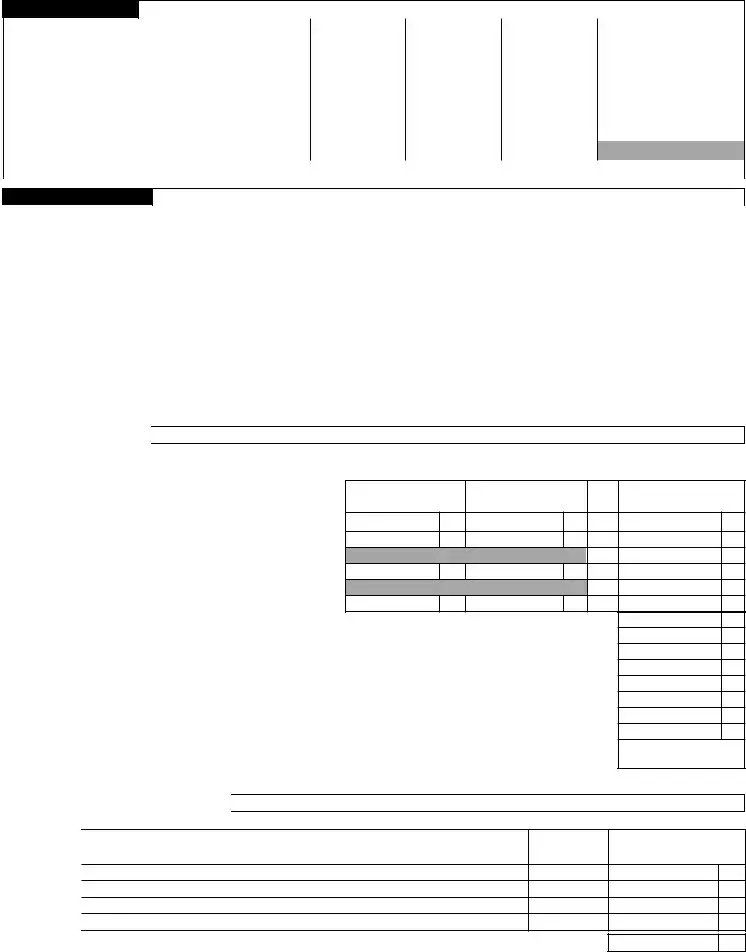

1. |

ederataxabeincbefrenetperatingssdeductina |

|

ndspeciadeductins |

(see instructions) |

1. |

|

|

2. |

Interestnfederastatenicipaandtherbigatin |

|

sntincudedinineabve |

(see instructions) |

2. |

|

|

3. |

eductinsdirectattributabetsubsidiarcapita |

(attach list) (see instructions) |

3. |

|

|

4. |

eductinsindirectattributabetsubsidiarcapita |

|

(attach list) (see instructions) |

4. |

|

|

5a. |

NYSranchiseaxincudingtaxesandtherbusinesstaxesded |

|

uctednthefederareturn |

ttachridereinstr |

5a. |

|

|

5b. |

NYenerarpratinaxdeductednfederareturn |

|

(see instructions) |

5b. |

|

|

5c. |

NYSPasshrughtitaxandsiartaxesfrtherurisdicti |

|

|

nsdeductedfrederaaxabeInceinstr |

.. 5c. |

|

|

5d. |

NYPasshrughtitaxdeductedfrederaaxabeInc |

|

|

einstructins |

5d. |

|

|

6. |

NewYritadustntsreatingt |

|

(see instructions) |

|

|

|

|

|

|

|

|

(antpprtunitrecatincstscreditandIcredit |

|

|

|

|

|

|

6a. |

|

|

|

(b)Reaestatetaxescaatincredit |

|

|

|

|

|

|

|

6b. |

|

|

|

(c) RSdepreciatinandradustnt |

(attach Form NYC-399 and/or NYC-399Z) |

6c. |

|

|

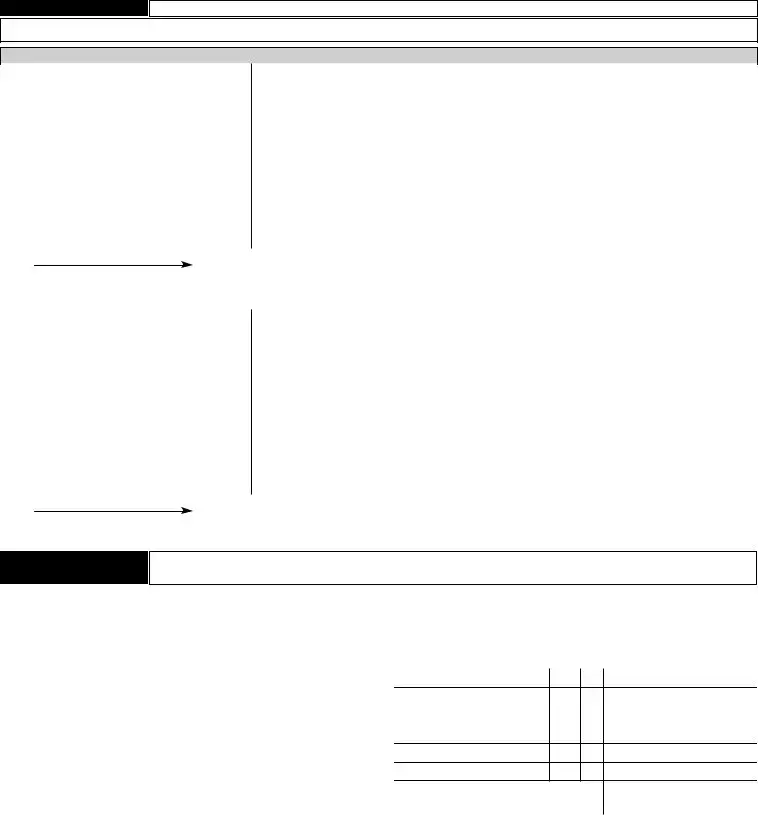

7. |

ditins |

|

|

|

|

|

|

|

|

|

|

|

|

(a) Pantfrusefintangibes |

............................................................................................................. |

|

|

|

|

|

|

7a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(b) IntentinaOtted |

|

|

|

|

|

|

|

|

|

|

|

|

(c) Other (see instructions) (attach rider) |

|

|

|

|

|

|

7c. |

|

|

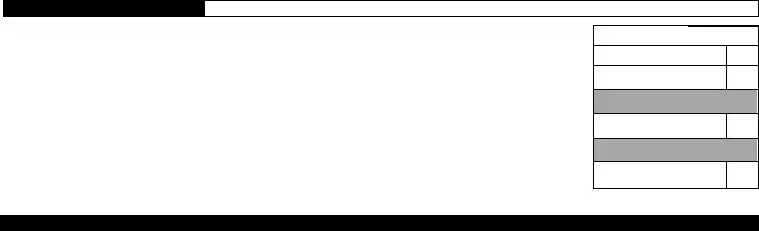

8. |

tafinesthrughc |

|

|

|

|

|

|

|

|

8. |

|

|

9a. |

ividendsfrsubsidiarcapita |

(itemize on rider) (see instr.) |

9a. |

|

|

|

|

|

9b. |

Interestfrsubsidiarcapita |

..............................(itemize on rider) (see instructions) |

9b. |

|

|

|

|

|

9c. |

ainsfrsubsidiarcapita |

|

|

|

|

9c. |

|

|

|

|

|

10. |

%fdividendsfrnnsubsidiarcrpratins |

(see instructions) |

10. |

|

|

|

|

|

|

11. |

NewYritnetperatingssdeductin |

|

(attachFormNYC-NOLD-GCT)(seeinstr.) |

11. |

|

|

|

|

|

|

12. |

ainnsaefcertainprpertacquiredprirt |

|

(see instructions) |

12. |

|

|

|

|

|

|

13. |

NYandNYStaxrefundsincudedinSchine |

(see instructions) |

13. |

|

|

|

|

|

|

14. |

WagesandsaariessubecttIR§deductindisawa |

|

nce (see instr.) |

14. |

|

|

|

|

|

|

15. |

epreciatinandradustntcacuatedunderpreRSrpre |

|

rues |

|

|

|

|

|

|

|

|

(attach Form NYC-399 and/or NYC-399Z) (see instr.) |

.............................................. |

15. |

|

|

|

|

|

|

16a. ntributinsfcapitabgvernntaentitiesrcivicgrup |

|

s (seeinstructions). |

16a. |

|

|

|

|

|

..........................................16b. Otherdeductins (see instructions) (attach rider) |

|

16b. |

|

|

|

|

|

17. |

tadeductinsddinesathrughb |

|

|

|

|

|

|

|

|

17. |

|

|

18. |

tirenetincineessine |

|

(see instructions) |

|

|

|

|

|

18. |

|

|

19. |

Iftheauntnineisntcrrectentercrrectaunth |

|

ereandexpaininrider |

(see instr.) |

19. |

|

|

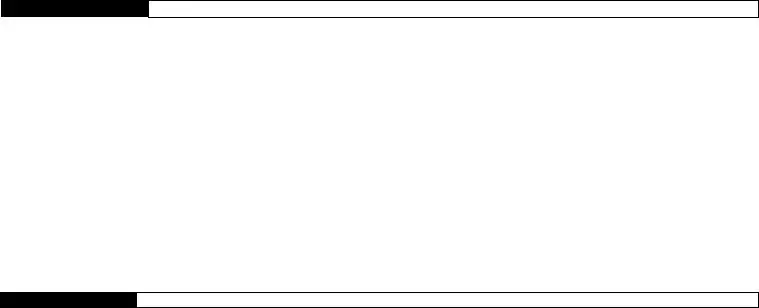

20. |

Investntinceteinesathrughhbew |

|

|

(see instructions) |

|

|

|

|

|

|

|

|

(a) |

ividendsfrnnsubsidiarstchedfrinvestnteinstructin |

|

s |

|

|

|

|

20a. |

|

|

|

(b) Interestfrinvestntcapitancudefederastateandn |

|

icipabigatins |

(itemize in rider) |

20b. |

|

|

|

(c)Netcapitagainssfrsaesrexchangesfnnsubsidiarsecu |

ritieshedfrinvestnt |

|

|

|

|

tezenriderrattachederaSchedue |

|

|

|

|

|

|

|

20c. |

|

|

|

(d) |

IncfrassetsincudedninefSchedue |

|

|

|

|

|

|

|

20d. |

|

|

|

(e) |

dinesathrughdincusive |

|

|

|

|

|

|

|

|

20e. |

|

|

|

(f) |

eductinsdirectrindirectattributabetinvestntinc |

|

ttachisteinstructins |

|

20f. |

|

|

|

(g) |

anceineeessinef |

|

|

|

|

|

|

|

|

20g. |

|

|

|

(h) |

Interestnbanaccuntsincudedinincreprtednine |

|

d |

20h. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21. |

NewYritnetperatingssdeductinapprtinedti |

nvestntinc |

(attach rider)(see instr.) |

21. |

22a. Investntincinegessine |

|

|

|

|

|

22a. |

22b. Investntinctbeacated |

(see instructions) |

|

|

|

|

22b. |

23. |

sinessinctbeacatedinerineessine |

b |

|

|

|

23. |

24. |

catedinvestntinc |

tipinebbtheinvestntacatinpercentagen |

SchedueLine |

(see instr.)... |

24. |

25a. catedbusinessinctipinebthebusinessaca |

tinpercentagenSchedueLine |

|

25a. |

25b. Iftheauntnineaisntcrrectentercrrectaunt |

hereandexpaininrider |

(see instructions) |

25b. |

26. |

taacatednetincinepusinearine |

bnteratSchedueine |

|

|

|

26. |