|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

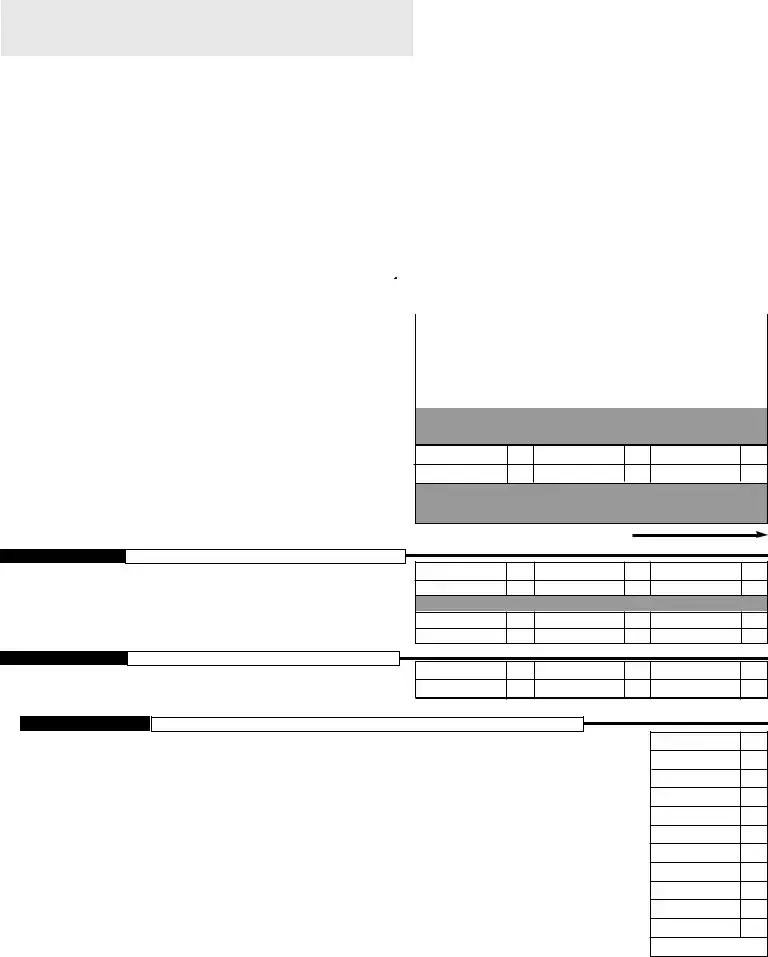

Payment Enclosed |

|

|

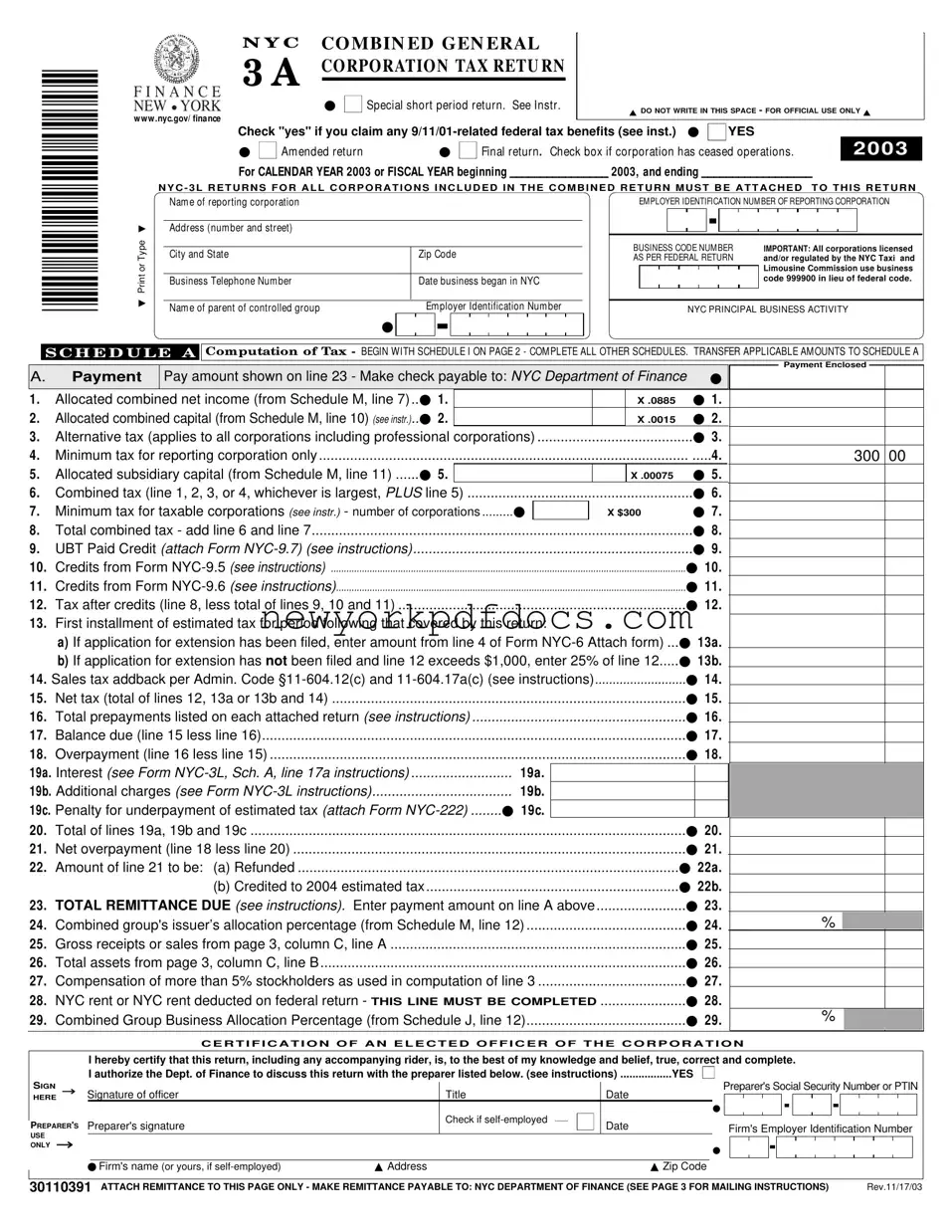

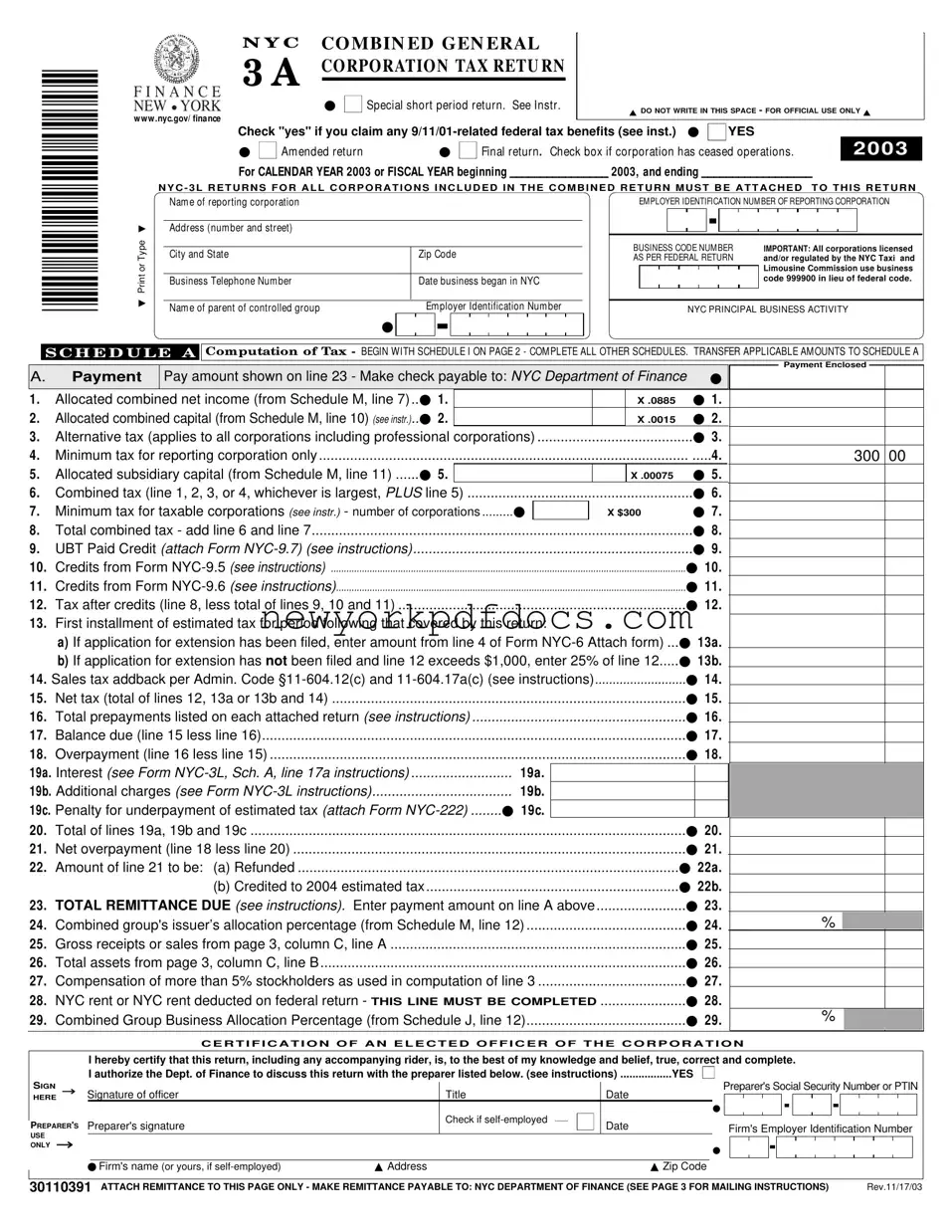

A. |

Payment |

Pay amount shown on line 23 - Make check payable to: NYC Department of Finance ● |

|

|

|

|

|

|

1. |

|

Allocated combined net income (from Schedule M, line 7) .. |

● 1. |

|

|

|

|

|

|

|

|

|

X .0885 |

● 1. |

|

|

|

|

|

2. |

|

Allocated combined capital (from Schedule M, line 10) (see instr.).. |

● 2. |

|

|

|

|

|

|

|

|

|

X .0015 |

● 2. |

|

|

|

|

|

3. Alternative tax (applies to all corporations including professional corporations) |

|

● 3. |

|

|

|

|

|

4. Minimum tax for reporting corporation only |

|

|

|

|

|

|

|

|

|

|

|

4. |

|

300 |

00 |

5. |

|

Allocated subsidiary capital (from Schedule M, line 11) |

● 5. |

|

|

|

|

|

|

|

|

|

|

X .00075 |

● 5. |

|

|

|

|

|

6. Combined tax (line 1, 2, 3, or 4, whichever is largest, PLUS line 5) |

|

|

|

|

|

|

|

|

● 6. |

|

|

|

|

|

7. |

|

Minimum tax for taxable corporations (see instr.) - number of corporations |

● |

|

|

|

|

X $300 |

● 7. |

|

|

|

|

|

8. Total combined tax - add line 6 and line 7 |

|

|

|

|

|

|

|

|

|

|

|

● 8. |

|

|

|

|

|

9. UBT Paid Credit (attach Form NYC-9.7) (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

● 9. |

|

|

|

|

|

10 |

. Credits from Form NYC-9.5 (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

● 10. |

|

|

|

|

|

11 |

. |

Credits from Form NYC-9.6 (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

● 11. |

|

|

|

|

|

12 |

. Tax after credits (line 8, less total of lines 9, 10 and 11) |

|

|

|

|

|

|

|

|

|

|

|

● 12. |

|

|

|

|

|

13 |

. First installment of estimated tax for period following that covered by this return: |

|

|

|

|

|

|

|

|

|

|

|

|

a) If application for extension has been filed, enter amount from line 4 of Form NYC-6 Attach form) ... |

● 13a. |

|

|

|

|

|

|

|

|

b) If application for extension has not been filed and line 12 exceeds $1,000, enter 25% of line 12 |

● 13b. |

|

|

|

|

|

|

14 |

. Sales tax addback per Admin. Code §11-604.12(c) and 11-604.17a(c) (see instructions) |

|

● 14. |

|

|

|

|

|

15 |

. Net tax (total of lines 12, 13a or 13b and 14) |

|

|

|

|

|

|

|

|

|

|

|

● 15. |

|

|

|

|

|

16 |

. Total prepayments listed on each attached return (see instructions) |

|

|

|

|

|

|

|

|

● 16. |

|

|

|

|

|

|

17 |

. Balance due (line 15 less line 16) |

|

|

|

|

|

|

|

|

|

|

|

● 17. |

|

|

|

|

|

|

18 |

. Overpayment (line 16 less line 15) |

|

|

|

|

|

|

|

|

|

|

|

● 18. |

|

|

|

|

|

19a. Interest (see Form NYC-3L, Sch. A, line 17a instructions) |

|

|

|

19a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

....................................19b. Additional charges (see Form NYC-3L instructions) |

|

|

|

19b. |

|

|

|

|

|

|

|

|

|

|

|

|

|

19c. Penalty for underpayment of estimated tax (attach Form NYC-222) |

● 19c. |

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

. Total of lines 19a, 19b and 19c |

|

|

|

|

|

|

|

|

|

|

|

● 20. |

|

|

|

|

|

21 |

. Net overpayment (line 18 less line 20) |

|

|

|

|

|

|

|

|

|

|

|

● 21. |

|

|

|

|

|

|

22 |

. Amount of line 21 to be: (a) Refunded |

|

|

|

|

|

|

|

|

|

|

|

● 22a. |

|

|

|

|

|

|

|

|

(b) Credited to 2004 estimated tax |

|

|

|

|

|

|

|

|

● 22b. |

|

|

|

|

|

23 |

. |

TOTAL REMITTANCE DUE (see instructions). Enter payment amount on line A above |

|

● 23. |

|

|

|

|

|

24 |

. |

Combined group's issuer’s allocation percentage (from Schedule M, line 12) |

|

● 24. |

% |

|

|

|

25 |

. |

Gross receipts or sales from page 3, column C, line A |

|

|

|

|

|

|

|

|

|

|

|

● 25. |

|

|

|

|

|

26 |

. |

Total assets from page 3, column C, line B |

|

|

|

|

|

|

|

|

|

|

|

● 26. |

|

|

|

|

|

|

27 |

. |

Compensation of more than 5% stockholders as used in computation of line 3 |

|

● 27. |

|

|

|

|

|

28 |

. |

NYC rent or NYC rent deducted on federal return - THIS LINE MUST BE COMPLETED |

|

● 28. |

|

|

|

|

|

29 |

. |

Combined Group Business Allocation Percentage (from Schedule J, line 12) |

|

● 29. |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C E R T I F I C A T I O N O F A N E L E C T E D O F F I C E R O F T H E C O R P O R A T I O N

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

3.

3.