|

ColumnG |

total amount that may be deducted for New |

|

Indicate the depreciation method selected for |

York City purposes in the current tax year for |

|

the computation of the New York City allow- |

an SUV subject to the special provisions. See |

|

able depreciation deduction.Any method used |

Finance Memorandum 22-1, “Application of |

|

to compute depreciation that would have been |

IRC §280F Limits to Sport Utility Vehicles”. |

|

allowed under IRC §167, had the property been |

|

|

|

|

|

acquired on September 10, 2001, will be ac- |

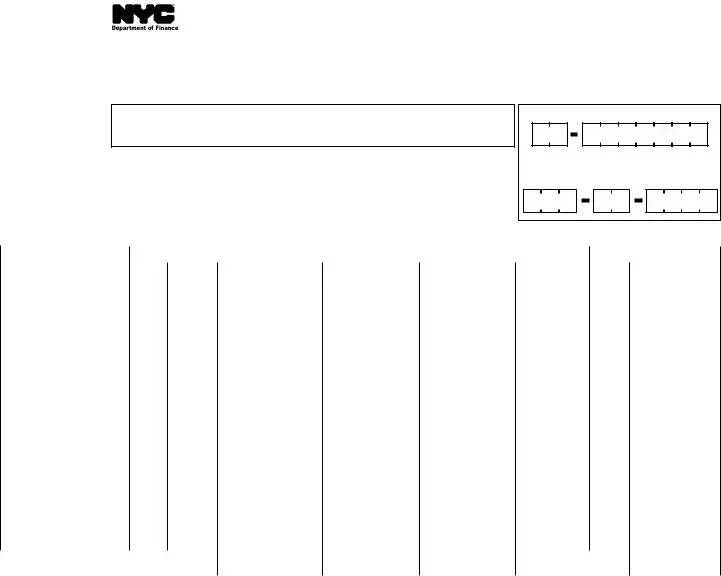

SCHEDULE B |

|

ceptable. This includes such methods as |

|

|

|

|

|

straight-line depreciation, declining balance |

Column A |

|

|

depreciation, sum-of-the-years-digits method |

Enter each item of property disposed of during |

|

or any other consistent method. |

the taxable year separately.Attach a rider if ad- |

|

|

ditional room is needed. |

|

Column I |

|

|

|

|

|

Enter depreciation computed by the method in- |

Column D |

|

|

dicated in column G computed as IRC §167 |

Enter for each item of property the total amount |

|

would have applied had the property been ac- |

of federal deductions used in the computation |

|

quired on September 10, 2001. Total of this |

of prior years’ federal taxable income. For an |

|

column will be the amount allowable as a de- |

SUV subject to the special provisions, the |

|

duction for New York City. |

amount entered in Column D should include |

|

any amount deducted under section 179 of the |

|

|

|

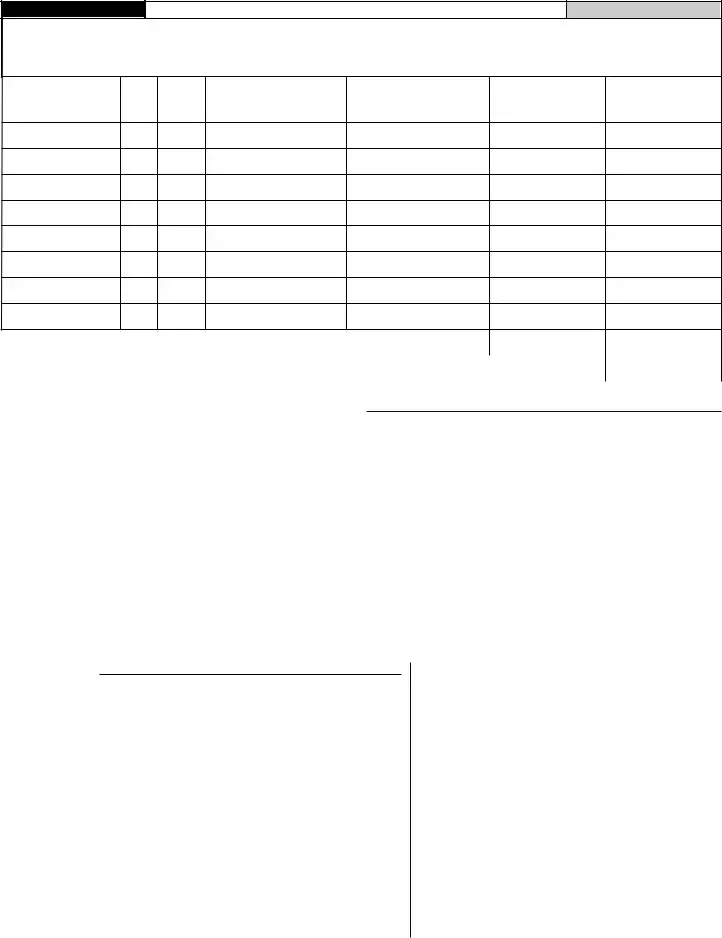

LINE 1a |

Internal Revenue Code. |

|

|

|

|

|

|

Enter total of columns F and I on lines 4 and 5 |

Column E |

|

|

of Schedule C, as indicated. |

|

|

Enter for each item of property the total amount |

|

|

|

If you have disposed of “qualified property” |

of New York City deductions used in the com- |

|

other than “qualified Resurgence Zone prop- |

putation of prior years’ New York City entire |

|

erty,” in any year after the year of acquisition, |

net income. |

|

|

you must complete Schedule B. |

Column F |

|

|

|

|

|

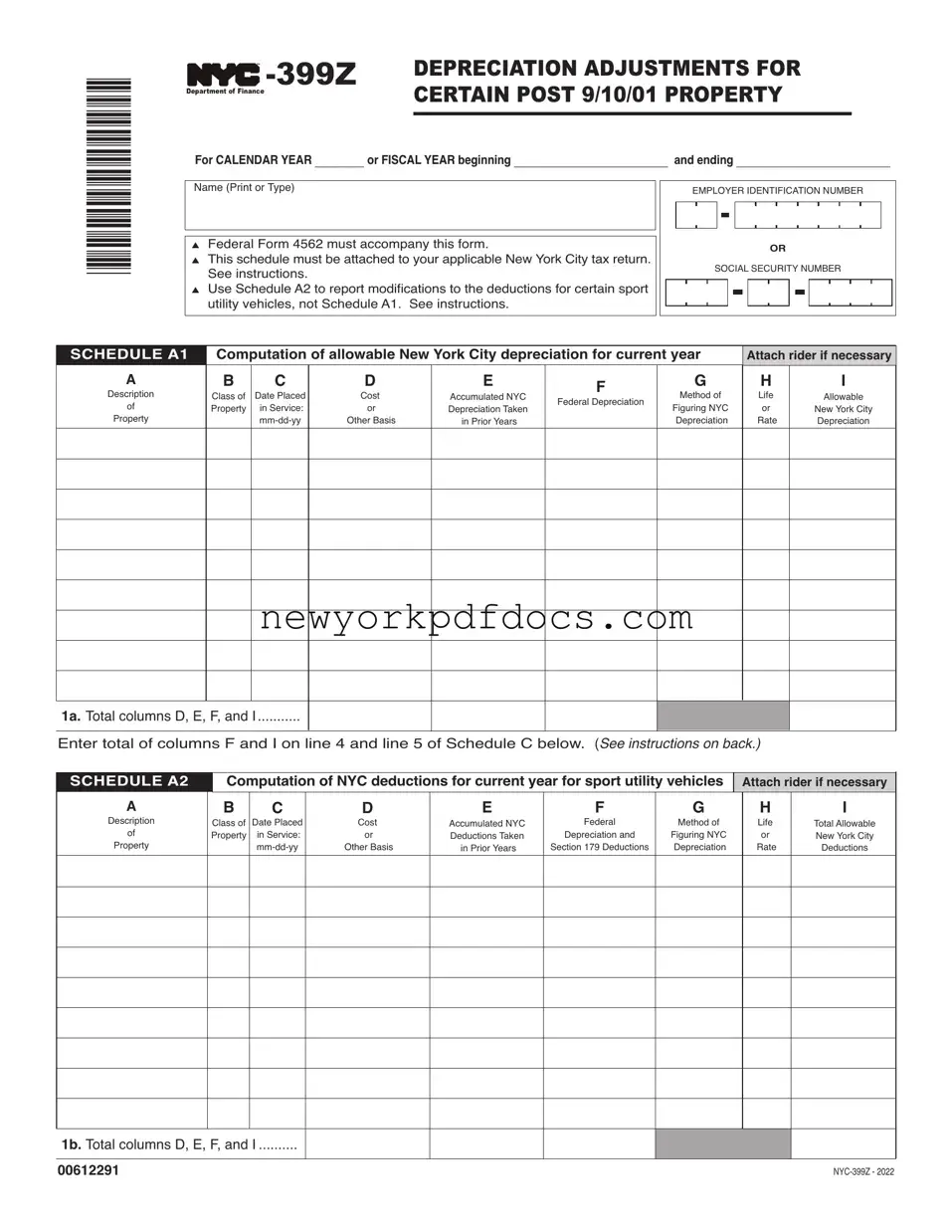

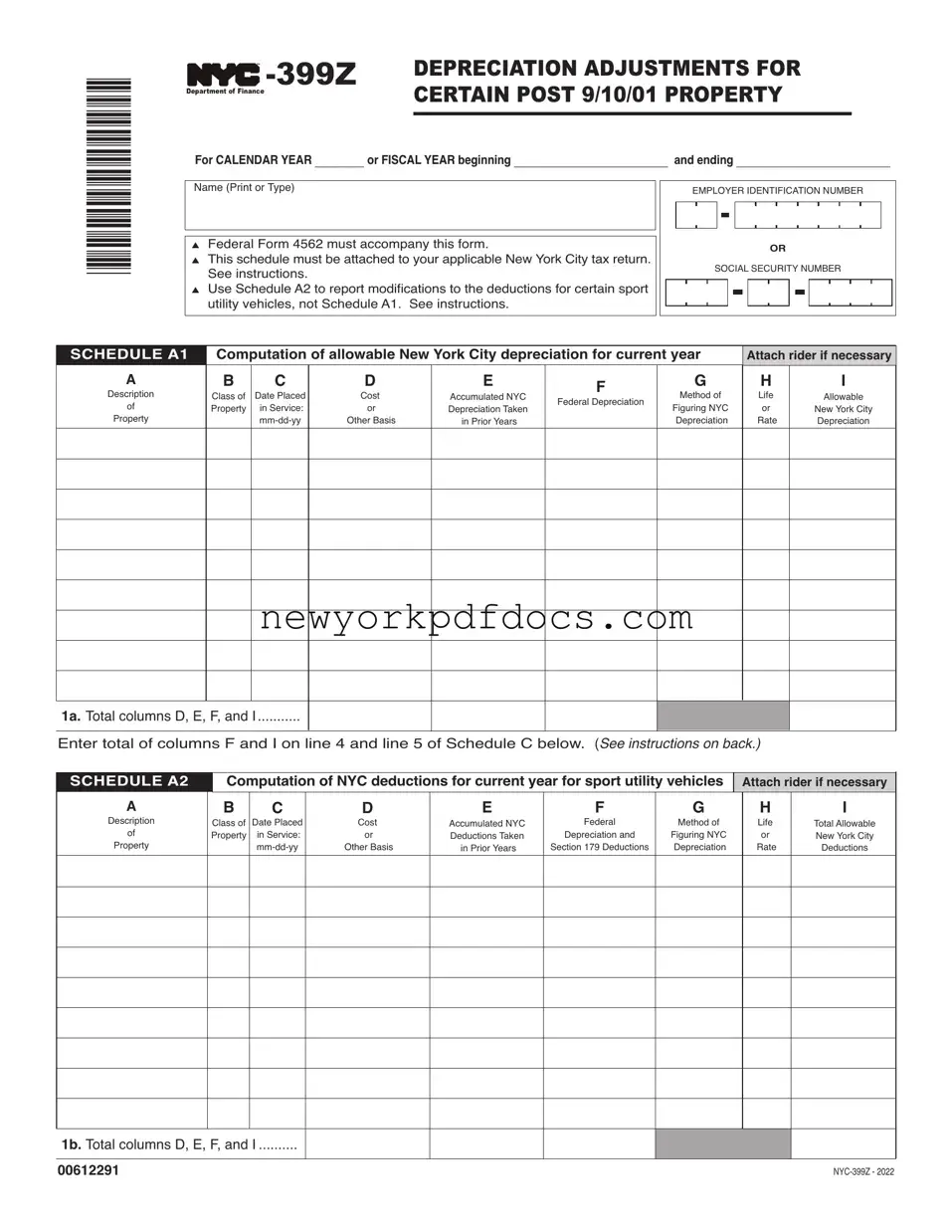

SCHEDULEA2 |

For any item of property, if column D exceeds |

|

column E, subtract column E from column D |

|

|

|

ColumnA |

and enter the excess in this column. |

|

|

|

|

|

|

Enter the year, make and model for each SUV. |

Column G |

|

|

ColumnB |

For any item of property, if column E exceeds |

|

column D, subtract column D from column E |

|

Indicate the property class type used or that |

|

and enter the excess in this column. |

|

would be used in computing federal deprecia- |

|

|

|

|

|

tion for each SUV. |

LINE 2 |

|

|

|

|

|

|

|

|

|

ColumnD |

Add the amounts in column F and enter the |

|

total on line 2 and on Schedule C, line 7a. |

|

The amount entered in this column must be |

|

|

|

|

|

|

equal to the cost or other basis used for federal |

LINE 3 |

|

|

|

|

purposes prior to any special depreciation al- |

Add the amounts in column G and enter the |

|

lowances for qualified property and prior to the |

total on line 3 and on Schedule C, line 7b. |

|

expense in lieu of depreciation deduction al- |

|

|

|

|

|

lowed under section 179 of the Internal Rev- |

SCHEDULE C |

|

enue Code. |

|

|

|

|

|

|

LINE 8 |

|

|

|

|

ColumnE |

Enter the amount on line 8A as an addition on |

|

Enter the total New York City depreciation |

the applicable New York City tax return. Use |

|

taken in prior years including, for years prior |

the following lines. Attach an explanation. |

|

to 2018, the amount of any deduction taken |

|

|

|

|

|

under section 179 of the Internal Revenue |

NYC-3A- Schedule B, line 6c* |

|

Code for New York City purposes. |

NYC-3L - |

Schedule B, line 6c |

|

|

|

ColumnF |

NYC-4S |

- |

Schedule B, line 4 |

|

For each SUV, enter the sum of the amount of |

NYC-202 |

- |

Schedule B, line 10c |

|

the federal depreciation deduction taken and |

NYC-202EIN - Schedule B, line 10c |

|

amount of any federal expense in lieu of de- |

|

preciation deduction taken under section 179 |

NYC-204 |

- |

Schedule B, line 14c |

|

of the Internal Revenue Code for the current |

NYC-1 |

- |

Schedule B, line 8 |

|

tax period. |

NYC-2 |

- |

Schedule B, line 11 |

|

|

|

ColumnI |

NYC-2A - Schedule B, Line 11** |

|

The amount entered in column I should be the |

NYC-2S |

- |

Schedule B, Line 6 |