|

of business from such sources as sales of personal property, services |

of the General Corporation Tax Return (without regard to any |

|

performed, rentals of property and royalties. For taxpayers which have |

extension of time for payment) to the date of payment. (Section 11- |

|

filed an NYC 3L, this receipts amount would be the same as the |

675 of the Administrative Code). The applicable prescribed inter- |

|

amount that would have to be shown on Form NYC-3L, Schedule H, |

est rate or rates are available from the interest rate table set forth on |

|

Column A, Line 2g. For taxpayers which are part of a combined |

the Finance website at nyc.gov/finance. |

|

group in tax years beginning in 2014 or 2013, this amount would be: |

Effective September 1, 1983, interest is compounded on a daily |

|

(i) for the reporting corporation, the amount on Form NYC-3A, Sched- |

|

ule H, Column A, Line 2g(A); and (ii) for corporations other than the |

basis at the applicable rate. |

|

reporting corporation (“subsidiaries”), the amount on Form NYC- |

For the rate of interest on overpayments, for a rate of interest not |

|

3A/B, Schedule H, Line 2g(A) in the column for that subsidiary, |

shown on the website and for interest calculations, call 311. If call- |

|

except if there is only one subsidiary, in which case the amount |

ing from outside of the five NYC boroughs, please call 212-NEW- |

|

entered on form NYC-3A, Schedule H, Column B, Line 2g(A). |

YORK (212-639-9675). |

|

|

|

|

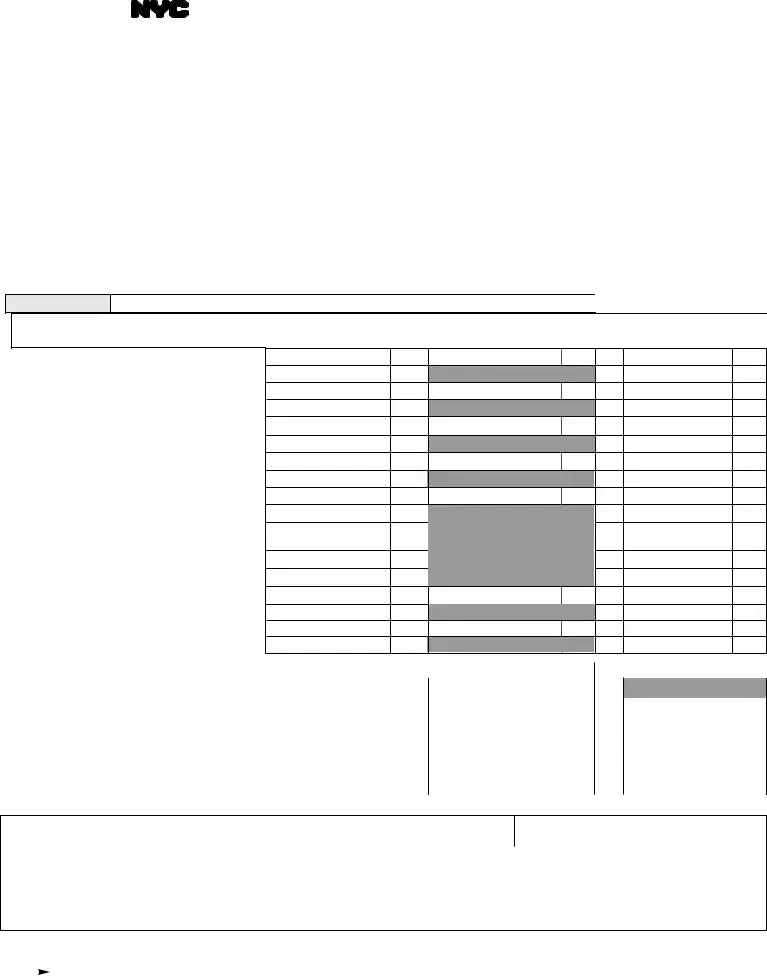

TABLE - FIXED DOLLAR MINIMUM TAX |

|

LINE 19 - ADDITIONAL CHARGES |

|

For a corporation with New York City receipts of: |

|

|

|

a) A late filing penalty is assessed if you fail to file this form |

|

Not more than $100,000: |

$ 25 |

|

More than $100,000 but not over $250,000: |

$ 75 |

when due, unless the failure is due to reasonable cause. For |

|

every month or partial month that this form is late, add to the |

|

More than $250,000 but not over $500,000: |

$ 175 |

|

tax (less any payments made on or before the due date) 5%, up |

|

More than $500,000 but not over $1,000,000: |

$ 500 |

|

to a total of 25%. |

|

More than $1,000,000 but not over $5,000,000: |

$1,500 |

|

|

|

More than $5,000,000 but not over $25,000,000: |

$3,500 |

b) If this form is filed more than 60 days late, the above late filing |

|

Over $25,000,000: |

$5,000 |

penalty cannot be less than the lesser of (1) $100 or (2)100% of the |

|

|

|

|

Short periods - fixed dollar minimum tax. Compute the New York |

amount required to be shown on the form (less any payments made |

|

by the due date or credits claimed on the return). |

|

City receipts for short periods (tax periods of less than 12 months) |

|

|

|

by dividing the amount of New York receipts by the number of |

c) A late payment penalty is assessed if you fail to pay the tax |

|

months in the short period and multiplying the result by 12. The |

shown on this form by the prescribed filing date, unless the fail- |

|

fixed dollar minimum tax may be reduced for short periods: |

ure is due to reasonable cause. For every month or partial |

|

|

|

month that your payment is late, add to the tax (less any pay- |

|

Period Reduction |

|

ments made) 1/2%, up to a total of 25%. |

|

|

|

|

l Not more than 6 months |

50% |

d) The total of the additional charges in a and c may not exceed |

|

l More than 6 months but not more than 9 months |

25% |

|

5% for any one month except as provided for in b. |

|

l More than 9 months |

None |

|

|

|

If this form is being filed with respect to a corporation filing a com- |

If you claim not to be liable for these additional charges, attach a state- |

|

ment to your return explaining the delay in filing, payment or both. |

|

bined report, enter on line 10 the sum of the fixed dollar minimum |

|

|

tax amounts for each corporation (other than the reporting corpora- |

SIGNATURE |

|

tion) included in the combined report, except for any corporation |

This report must be signed by an officer authorized to certify that |

|

not otherwise subject to tax. To determine the fixed dollar mini- |

the statements contained herein are true. If the taxpayer is a pub- |

|

mum tax for each such corporation, use the above table. |

|

licly-traded partnership or another unincorporated entity taxed as a |

|

|

|

|

LINE 12 - UBT PAID CREDIT |

|

corporation, this return must be signed by a person duly authorized |

|

|

to act on behalf of the taxpayer. |

|

Enter on line 12, column 1 the total amounts from Form NYC-3L or |

|

|

|

NYC-3A, UBT Paid Credit. Attach Form NYC-9.7. Enter in column 2 |

Preparer Authorization: If you want to allow the Department of |

|

allchangestothisamountandenterthecorrectedamountincolumn3. |

Finance to discuss your return with the paid preparer who signed it, |

|

|

|

you must check the "yes" box in the signature area of the return. |

|

LINE 14 - |

|

This authorization applies only to the individual whose signature |

|

All applicable credits should be taken into account when computing |

appears in the "Preparer's Use Only" section of your return. It does |

|

the tax. Attach schedule of credits claimed. Attach Forms NYC- |

not apply to the firm, if any, shown in that section. By checking the |

|

9.5, NYC-9.6, NYC-9.8, NYC-9.9 and NYC-9.10, if applicable. |

"Yes" box, you are authorizing the Department of Finance to call |

|

Enter in column 2 all changes to these amounts and enter the cor- |

the preparer to answer any questions that may arise during the pro- |

|

rected amount in column 3. |

|

cessing of your return. Also, you are authorizing the preparer to: |

|

LINE 17 - CLAIM FOR REFUND |

|

l Give the Department any information missing from your return, |

|

|

l Call the Department for information about the processing of |

|

Where the federal or New York State change would result in a |

|

refund, Form NYC-3360 may be used as a claim for refund, provided |

your return or the status of your refund or payment(s), and |

|

l Respond to certain notices that you have shared with the |

|

it is accompanied by a complete copy of the federal and/or New |

preparer about math errors, offsets, and return preparation. |

|

York State Audit Report or Statement of Adjustment. |

|

|

|

The notices will not be sent to the preparer. |

|

|

|

|

Effective for taxable years beginning on or after January 1, 1989, if |

You are not authorizing the preparer to receive any refund check, |

|

this report is not filed within 90 days after the notice of the final |

bind you to anything (including any additional tax liability), or oth- |

|

federal (or New York State) determination, no interest on the |

erwise represent you before the Department. The authorization |

|

resulting refund will be paid. |

|

cannot be revoked, however, the authorization will automatically |

|

|

|

|

LINE 18 - INTEREST |

|

expire no later than the due date (without regard to any extensions) |

|

|

for filing next year's return. Failure to check the box will be |

|

Enter at Line 18, Column A, interest owed on the additional tax due |

|

deemed a denial of authority. |

|

at the applicable prescribed interest rate or rates from the due date |

|