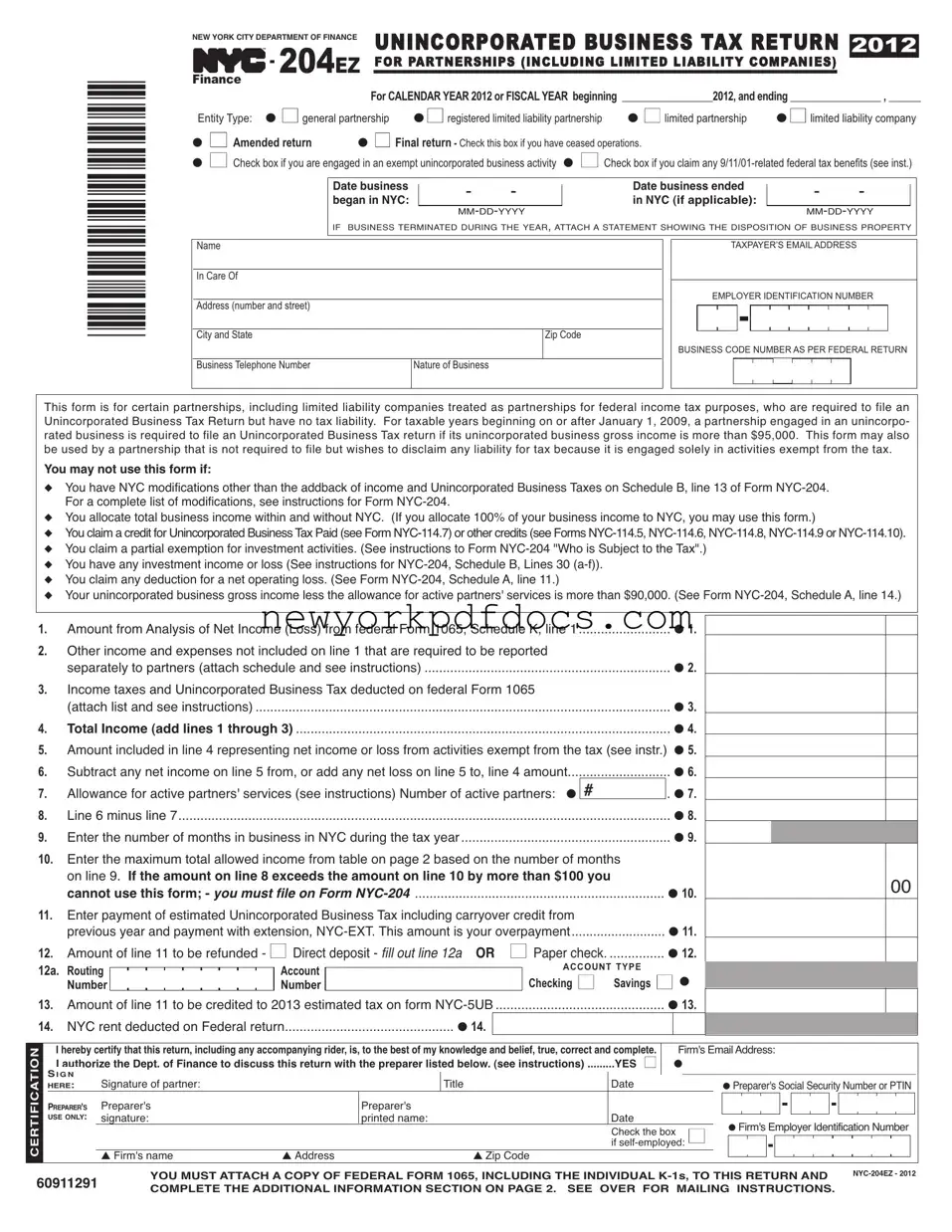

Form NYC-204EZ - 2012 |

|

|

|

|

|

|

Page 2 |

|

|

|

|

|

|

|

|

|

|

|

INSTRUCTIONS |

|

|

|

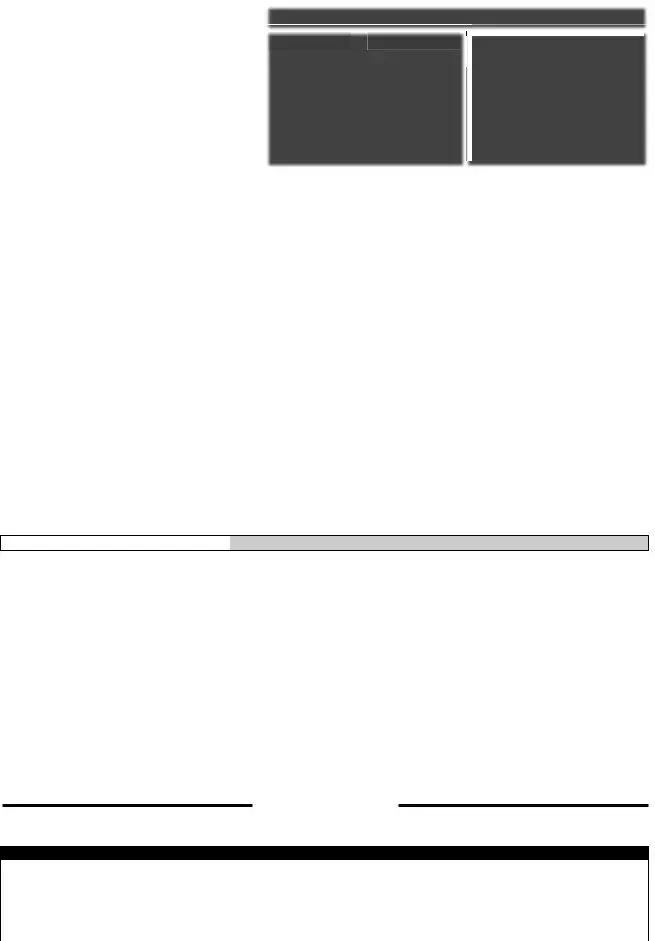

TABLE OF MAXIMUM ALLOWED INCOME FROM BUSINESS |

|

|

|

|

|

|

|

|

|

|

|

Checktheboxmarked"9/11/01-relatedtaxbenefits"onthisformifyouclaimany |

|

NUMBER OF MONTHS |

|

MAXIMUM TOTAL |

|

|

Iftotalincomefrombusiness |

|

IN BUSINESS |

|

INCOME FROM BUSINESS |

|

|

ofthefollowingbenefitsonyourfederalreturn:(i)bonusdepreciationoradeduc- |

|

1 |

$85,416 |

|

|

|

|

|

after deduction for active |

tion under IRC §179 for property in the NY Liberty Zone or Resurgence Zone, |

|

2 |

$85,833 |

|

|

|

3 |

$86,250 |

|

|

partnersʼ services is more |

whether or not you file form NYC-399Z, (ii) IRC §1033 treatment for property |

|

|

|

|

4 |

$86,667 |

|

|

converted due to the attacks on the World Trade Center. Attach Federal forms |

|

|

|

than$90,000,youmustuse |

|

5 |

$87,083 |

|

|

4562, 4684 and 4797 to this return. See instructions for Form NYC 204, Sch. |

|

6 |

$87,500 |

|

|

Form NYC-204 |

B, lines 14d, 19 and 20. |

|

7 |

$87,917 |

|

|

|

|

|

|

|

|

|

|

|

8 |

$88,333 |

|

|

|

|

Line 2. Enter the net amount of the partners' distributive shares of income |

|

9 |

$88,750 |

|

|

FIFTEEN OR MORE CALENDAR |

and deduction items not included in line 1 but required to be reported |

|

10 |

$89,167 |

|

|

|

11 |

$89,583 |

|

|

|

|

separately on federal Form 1065. Attach a schedule. |

|

|

|

DAYSCONSTITUTESONEMONTH |

|

12 |

$90,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Line 3. Enter the amount of income and unincorporated business taxes

imposed by New York City, New York State or any other taxing jurisdiction that was deducted in computing the amounts on lines 1 or 2. Attach a schedule.

Line 5. Enter on this line the amount included in line 4 that represents the net income or net loss from an activity that is not an unincorporated business carried on by the taxpayer wholly or partly in the City. See Instructions for Form NYC-204 "Who is Subject to the Tax." For this purpose:

(i)exclude the income or loss of an entity, other than a dealer as defined in Ad. Code §11-501(1), that, for its own account, engaged solely in the purchase, holding or sale of property, transactions in positions in property, or the acquisition, holding or disposition, other than in the ordinary course of business, of interests in other unincorporated entities that are themselves engaged solely in the foregoing activities. NOTE: entities receiving $25,000 or less of gross receipts from other activities may still be eligible for this exclusion.Ad. Code §11-502(c)(3). However, entities eligible for the partial self-trading exemption under Ad. Code §11-502(c)(4) are not eligible for this exclusion and may not use this form.

(ii)for taxable years beginning on or after July 1, 1994, exclude the income, gain or loss from real property held to produce rental income or from the disposition of such property by an entity, other than a dealer. Also exclude income or loss from a business conducted at the property solely for the benefit of tenants at the property that is not open to the public, and eligible income from parking services rendered to tenants. SeeAd. Code §11-502(d).

(iii)exclude the income or loss from any separate and distinct activity carried on wholly outside of New York City.

(iv)for tax years beginning on or after August 1, 2002, exclude all of the federal taxable income of partnerships that receive 80% or more of their gross receipts from charges for the provision of mobile telecommunications services to customers and exclude a partner's distributive share of income, gains, losses and deductions from any partnership subject to tax underAd. Code Title II, Ch. II as a “utility” as defined inAd. Code section 11-1101(6), including its share of separately reported items.

Line 7. Adeduction may be claimed for reasonable compensation for personal services rendered by the partners. The allowable deduction is the lower of (i) 20% of line 6 (if greater than zero) or (ii) $10,000 for each active partner.

PreparerAuthorization: If you want to allow the Department of Finance to discuss your return with the paid preparer who signed it, you must check the "yes" box in the signature area of the return. This authorization applies only to the individual whose signature appears in the "Preparer's Use Only" section of your return. It does not apply to the firm, if any, shown in that section. By checking the "Yes" box, you are authorizing the Department of Finance to call the preparer to answer any questions that may arise during the processing of your return. Also, you are authorizing the preparer to:

◆Give the Department any information missing from your return,

◆Call the Department for information about the processing of your return or the status of your refund or payment(s), and

◆Respond to certain notices that you have shared with the preparer about math errors, offsets, and return preparation. The notices will not be sent to the preparer.

You are not authorizing the preparer to receive any refund check, bind you to anything (including any additional tax liability), or otherwise represent you before the Department. The authorization cannot be revoked, however, the authorization will automatically expire no later than the due date (without regard to any extensions) for filing next year's return. Failure to check the box will be deemed a denial of authority.

ADDITIONAL REQUIRED INFORMATION

The following information must be entered for this return to be complete.

The following information must be entered for this return to be complete.

The following information must be entered for this return to be complete.

The following information must be entered for this return to be complete.