Free Nyc 204 Form

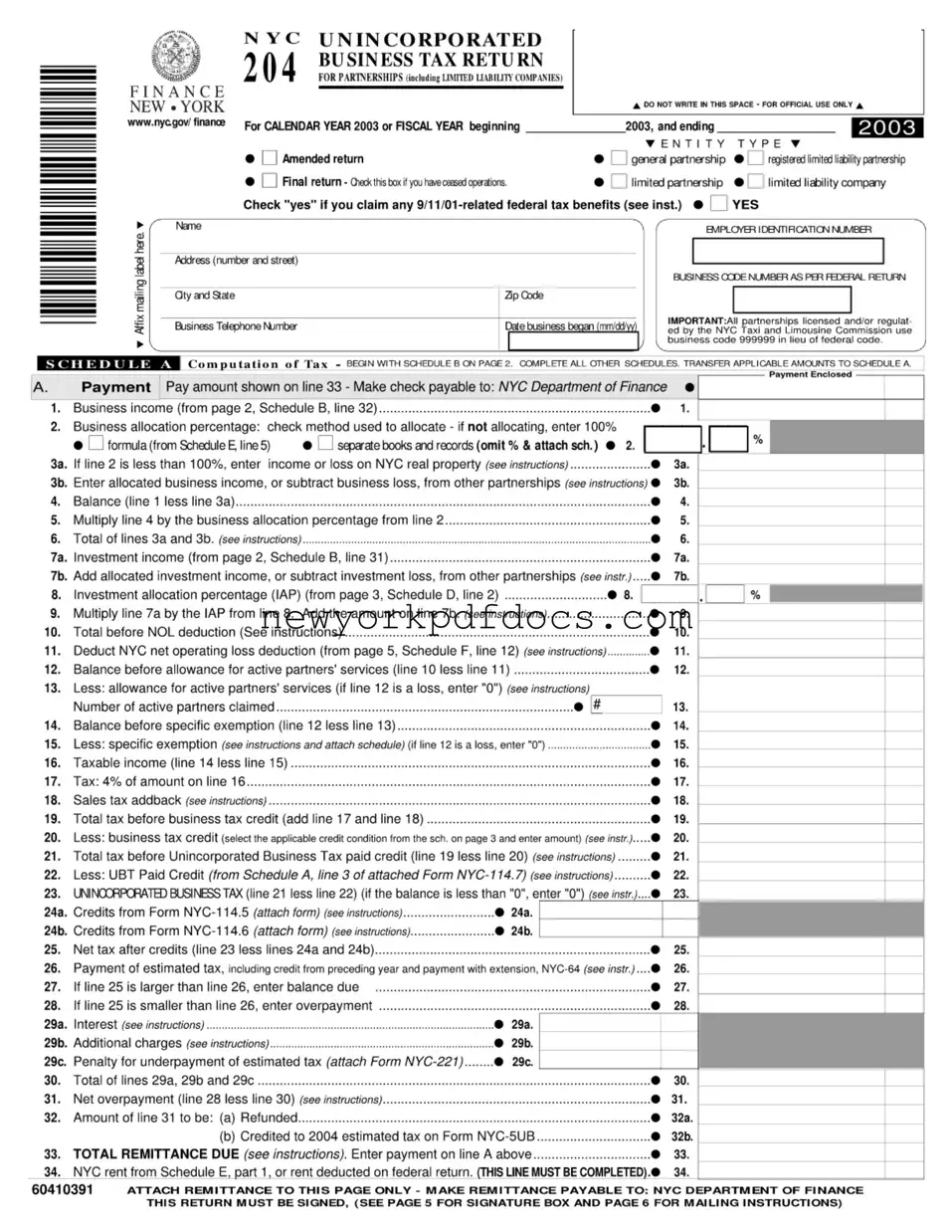

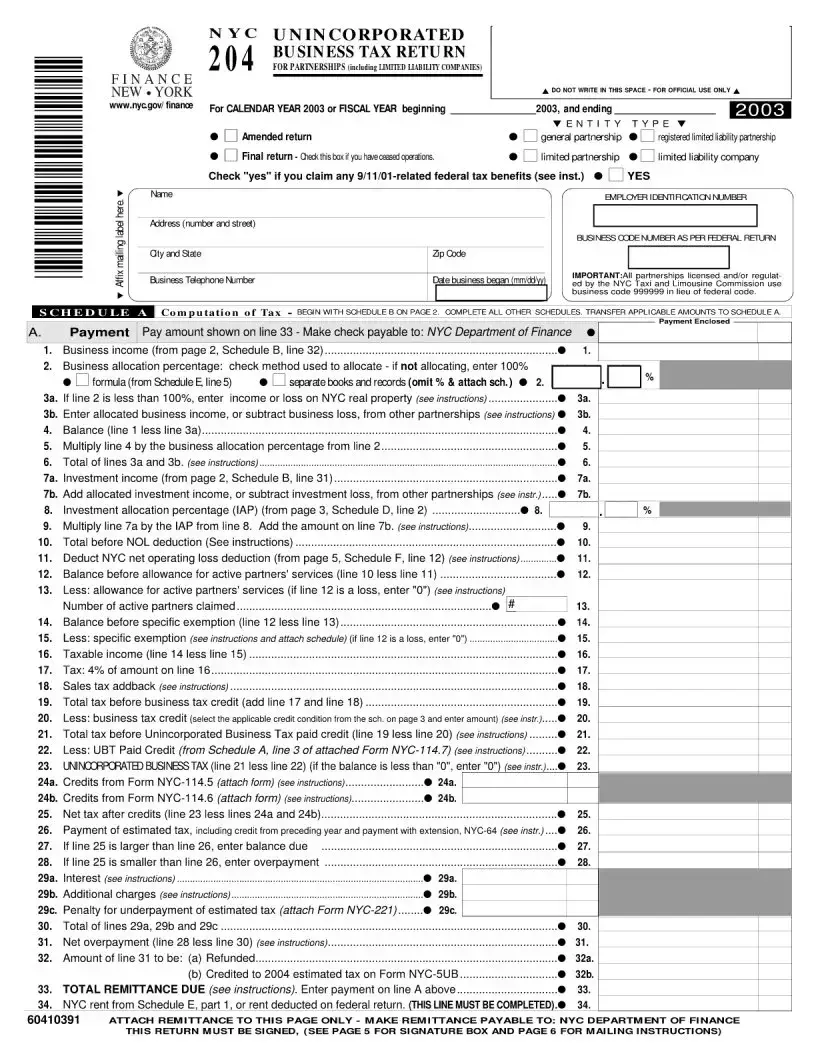

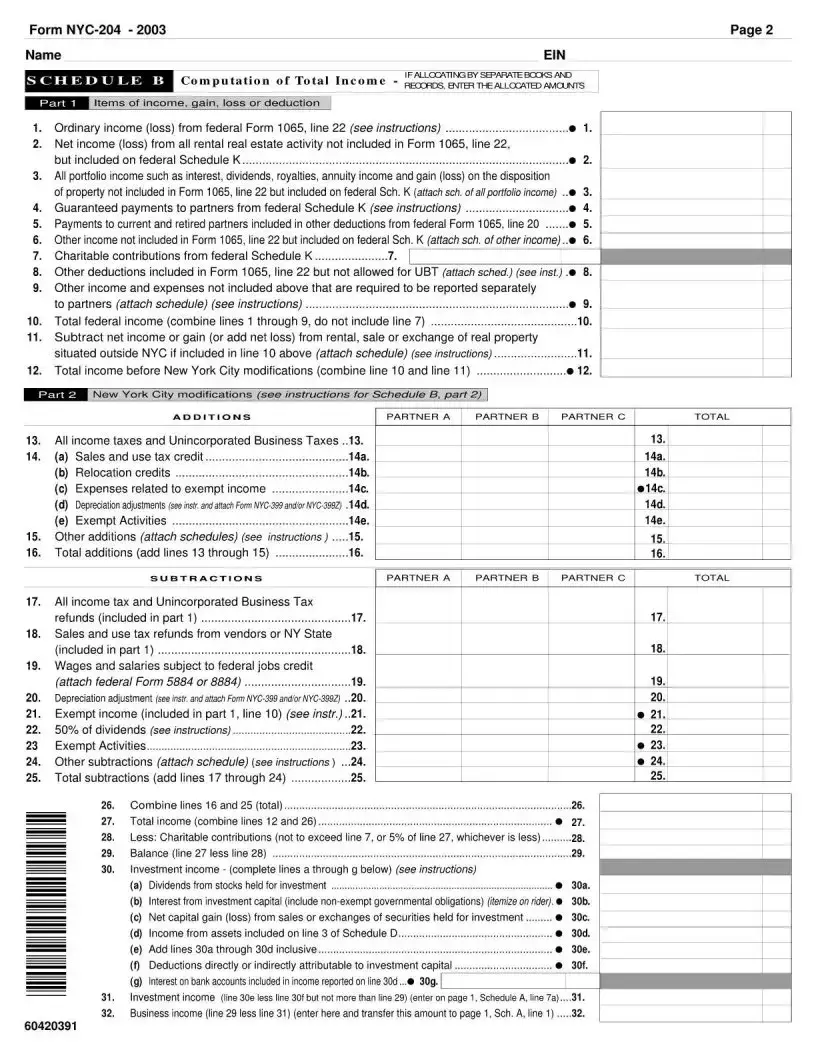

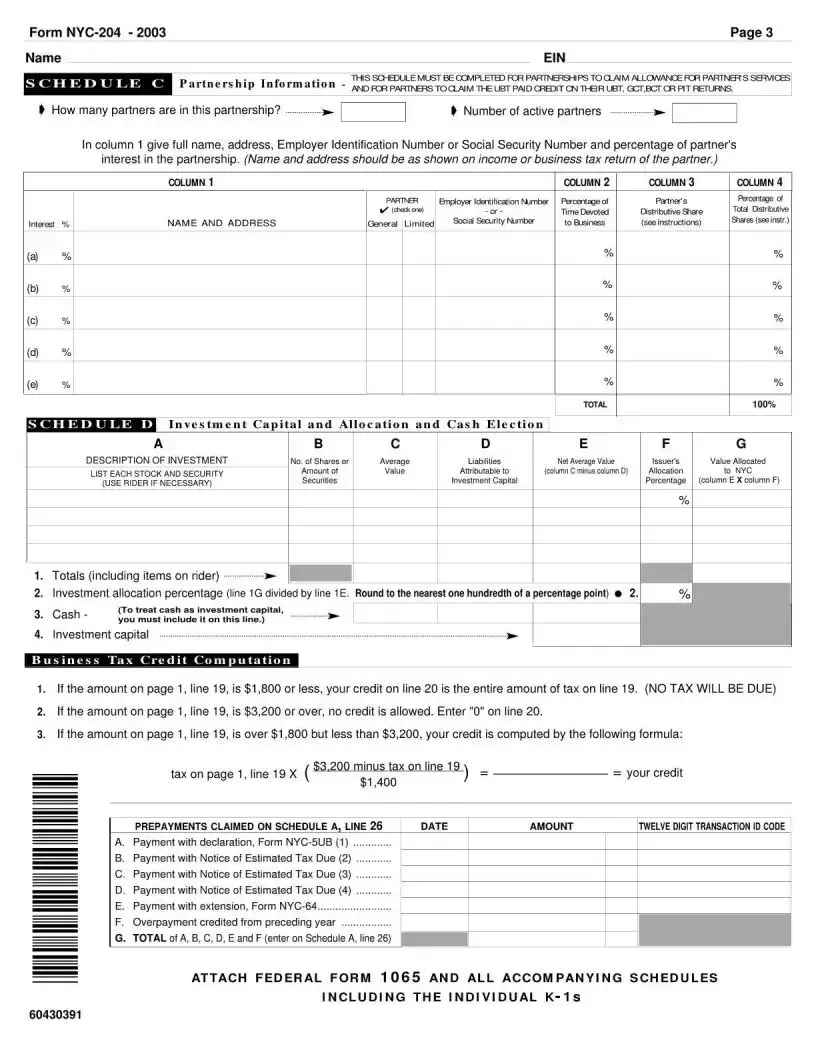

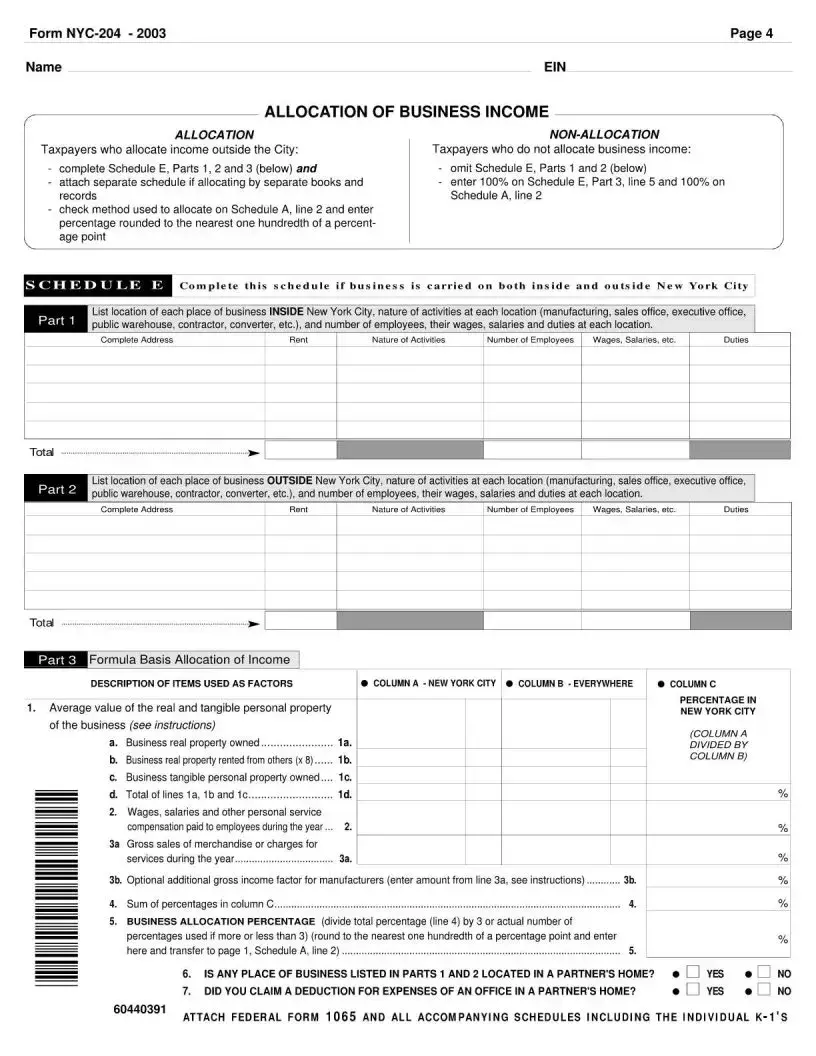

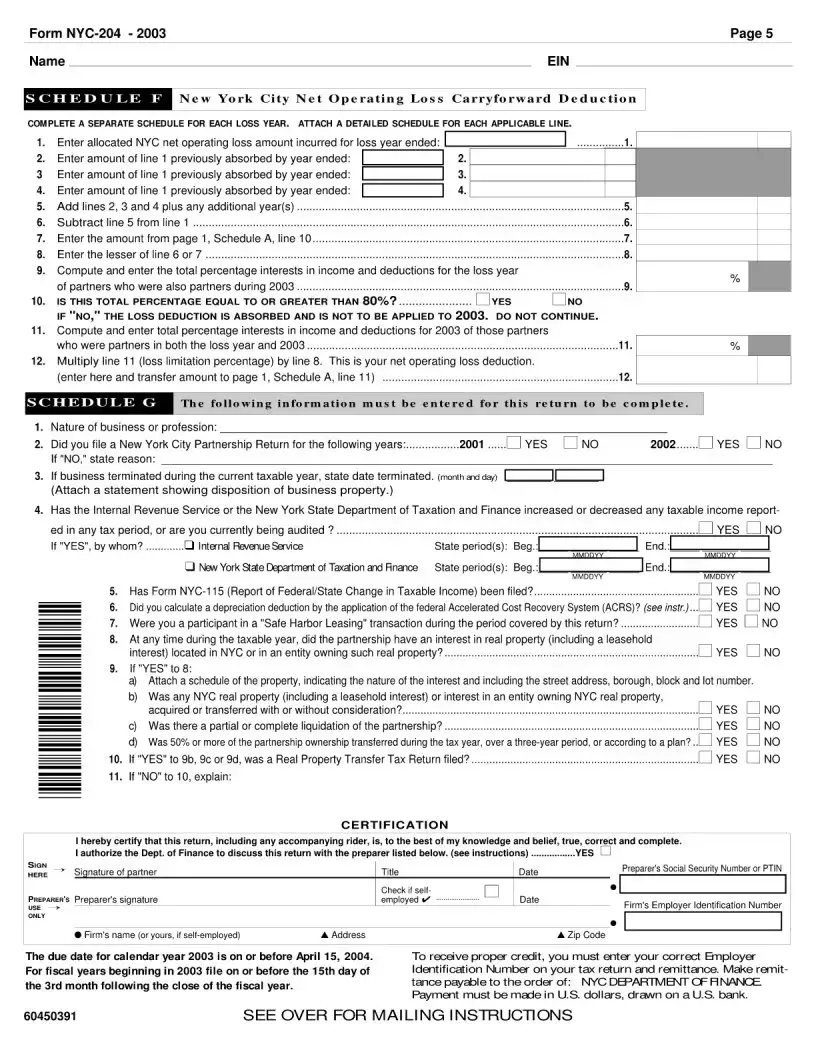

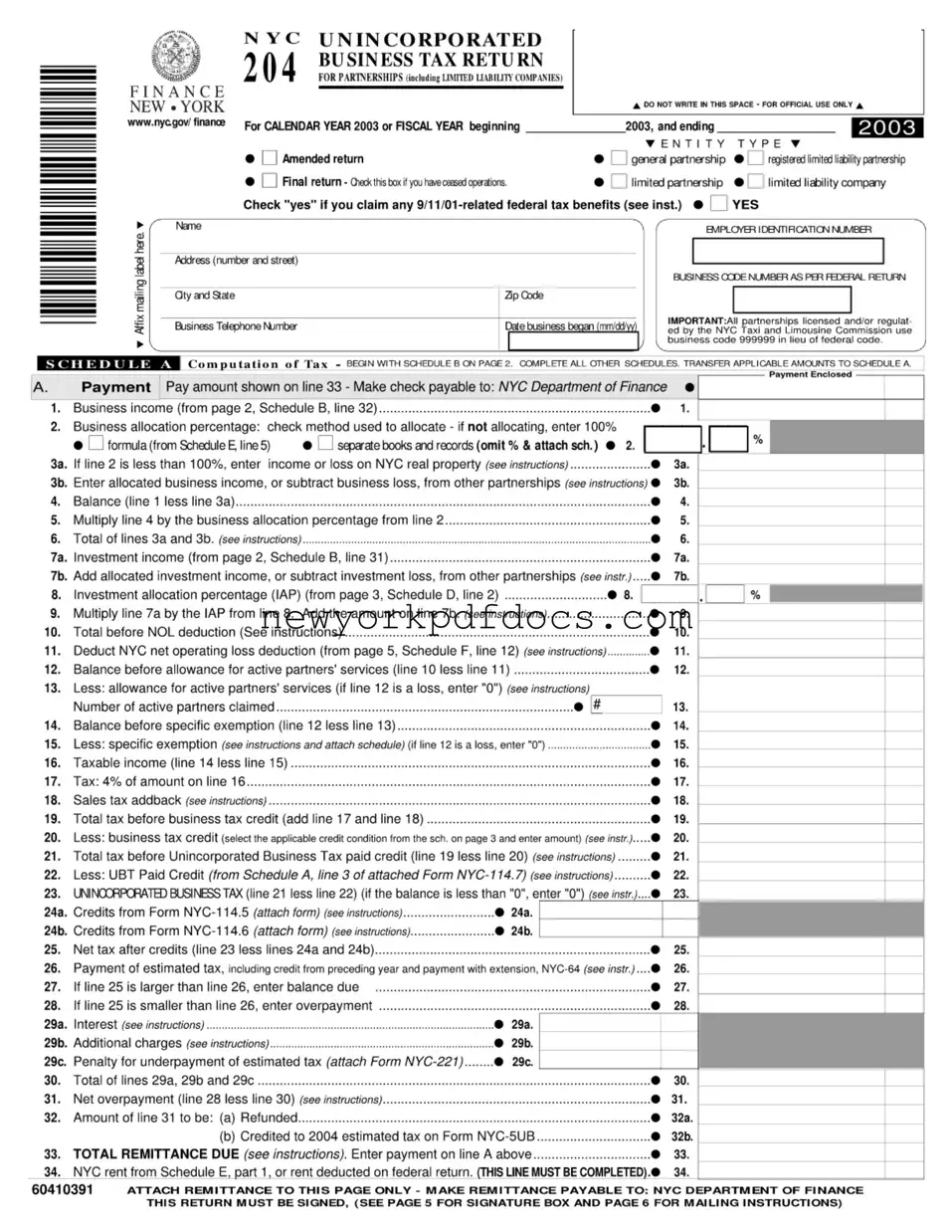

The NYC 204 form is an Unincorporated Business Tax Return specifically designed for partnerships, including limited liability companies, operating in New York City. This form is essential for reporting income, calculating taxes owed, and claiming any applicable credits or deductions. Understanding how to accurately complete the NYC 204 is crucial for compliance and financial management for businesses in the city.

Open My Document Now

Free Nyc 204 Form

Open My Document Now

Your form isn’t finalized yet

Edit, save, and download Nyc 204 online with ease.

Open My Document Now

or

⇓ Nyc 204 PDF