|

|

|

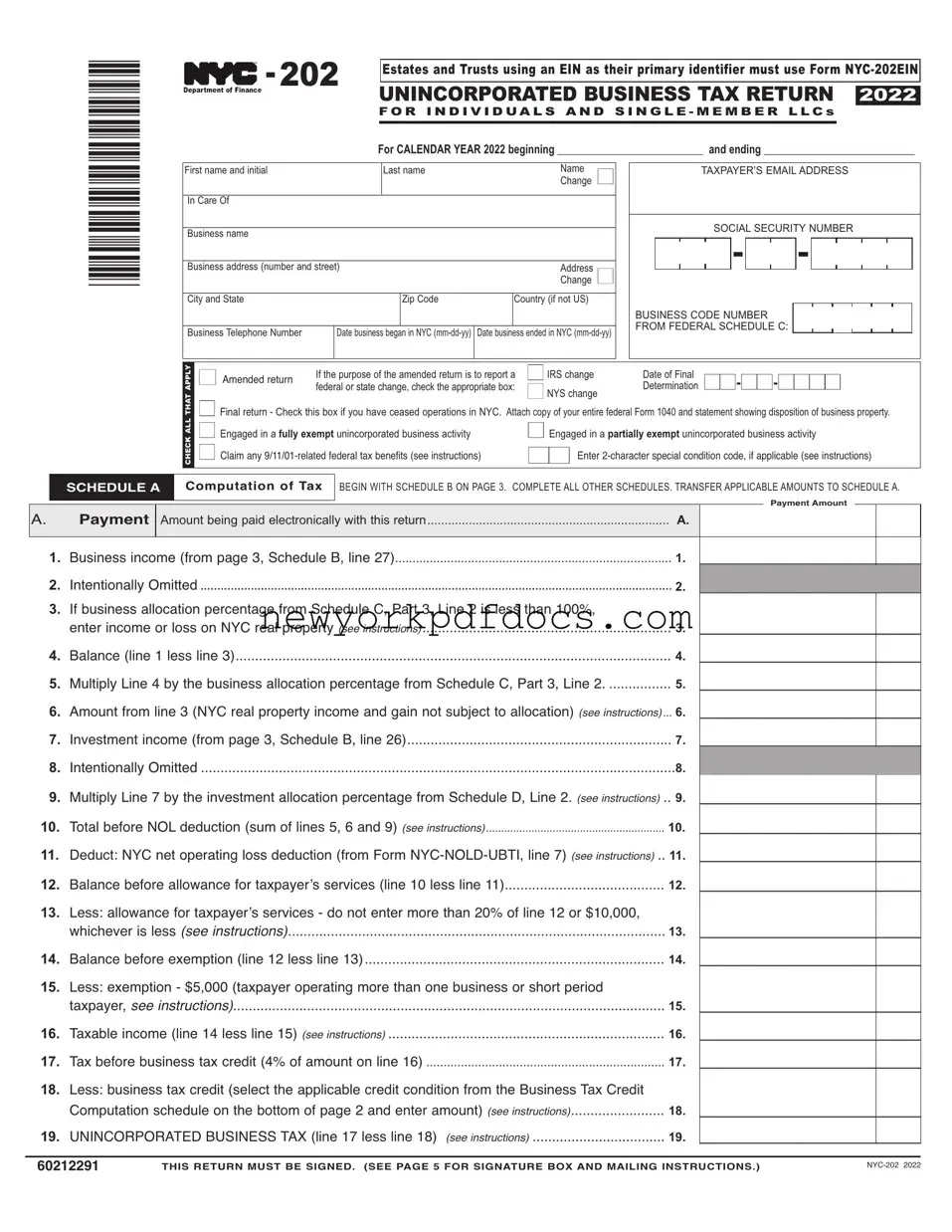

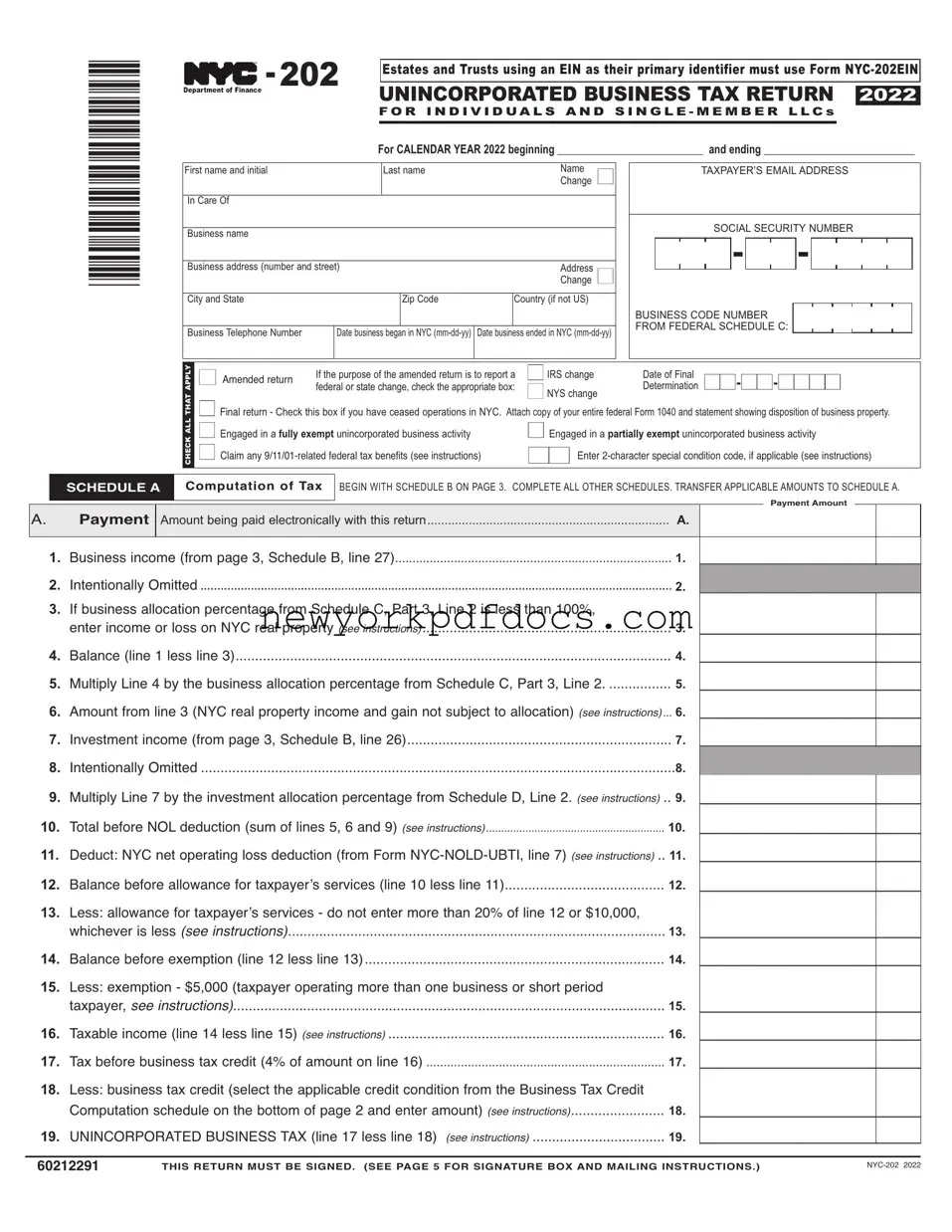

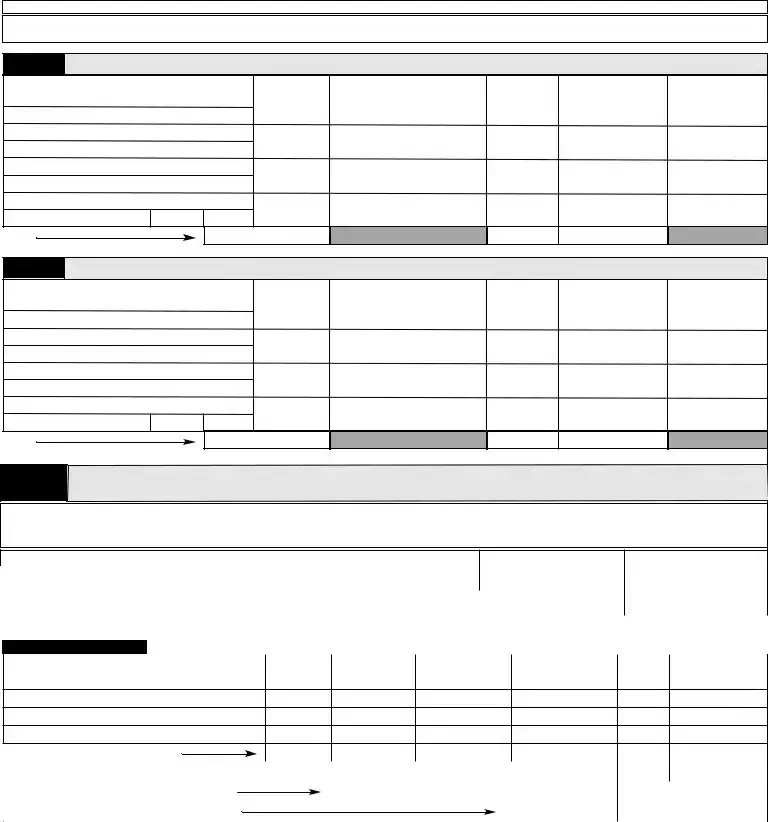

SCHEDULE A |

Computation of Tax |

BEGIN WITH SCHEDULE B ON PAGE 3. COMPLETE ALL OTHER SCHEDULES. TRANSFER APPLICABLE AMOUNTS TO SCHEDULE A. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment |

Amount being paid electronically with this return |

...................................................................... |

|

A. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

sinessincrpageScheduleline |

|

|

|

|

|

1. |

________________________________ |

|

|

|

2. |

ntentinalltted |

|

|

|

|

|

|

2. |

________________________________ |

|

|

3. |

fbusinessallcatinpercentagefrSchedulePartine |

|

islessthan |

|

|

|

|

|

|

|

|

|

|

enterincrlssnNYrealprpert |

|

(see instructions) |

|

|

|

3. |

________________________________ |

|

|

|

4. |

lanceinelessline |

|

|

|

|

|

|

4. |

________________________________ |

|

|

|

5. |

MultiplinebthebusinessallcatinpercentagefrSched |

|

ulePartine |

|

5. |

________________________________ |

|

|

|

6. |

untfrlineYrealprpertincandgainntsubject |

|

|

tallcatin |

(see instructions) |

6. |

________________________________ |

|

|

|

7. |

nvestntincrpageScheduleline |

|

|

|

|

|

7. |

________________________________ |

|

|

|

8. |

ntentinalltted |

|

|

|

|

|

|

8. |

________________________________ |

|

|

9. |

MultiplinebtheinvestntallcatinpercentagefrSch |

|

eduleine |

(see instructions) |

9. |

________________________________ |

|

|

|

10. |

talbefreNdeductinflinesand |

|

(see instructions) |

10. |

________________________________ |

|

|

|

11. |

eductNYnetperatinglssdeductinrrNY |

|

|

|

line |

(see instructions) |

11. |

________________________________ |

|

|

|

12. |

lancebefreallwancefrtaxpar’sservicesinelessline |

|

|

|

12. |

________________________________ |

|

|

|

13. |

essallwancefrtaxpar’sservicesdntenterrethan |

|

fliner$ |

|

|

|

|

|

|

|

|

|

|

whicheverisless |

(see instructions) |

|

|

|

|

|

13. |

________________________________ |

|

|

|

14. |

lancebefreexetininelessline |

|

|

|

|

|

14. |

________________________________ |

|

|

|

15. |

essexetin$axparperatingrethannebusin |

|

|

essrshrtperid |

|

|

|

|

|

|

|

|

|

|

taxpar |

see instructions) |

|

|

|

|

|

15. |

________________________________ |

|

|

|

16. |

axableincinelessline |

(see instructions) |

|

|

|

16. |

________________________________ |

|

|

|

17. |

axbefrebusinesstaxcreditfauntnline |

|

|

|

|

|

17. |

________________________________ |

|

|

|

18. |

essbusinesstaxcreditlecttheapplicablecreditcnditin |

|

frthesinessaxredit |

|

|

|

|

|

|

|

|

|

utatinschedulenthebttfpageandentera |

|

|

unt |

(see instructions) |

|

18. |

________________________________ |

|

|

|

19. |

NNRPRSNinelessline |

|

|

(see instructions) |

|

19. |

________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

60212291 |

|

THIS RETURN MUST BE SIGNED. (SEE PAGE 5 FOR SIGNATURE BOX AND MAILING INSTRUCTIONS.) |

|

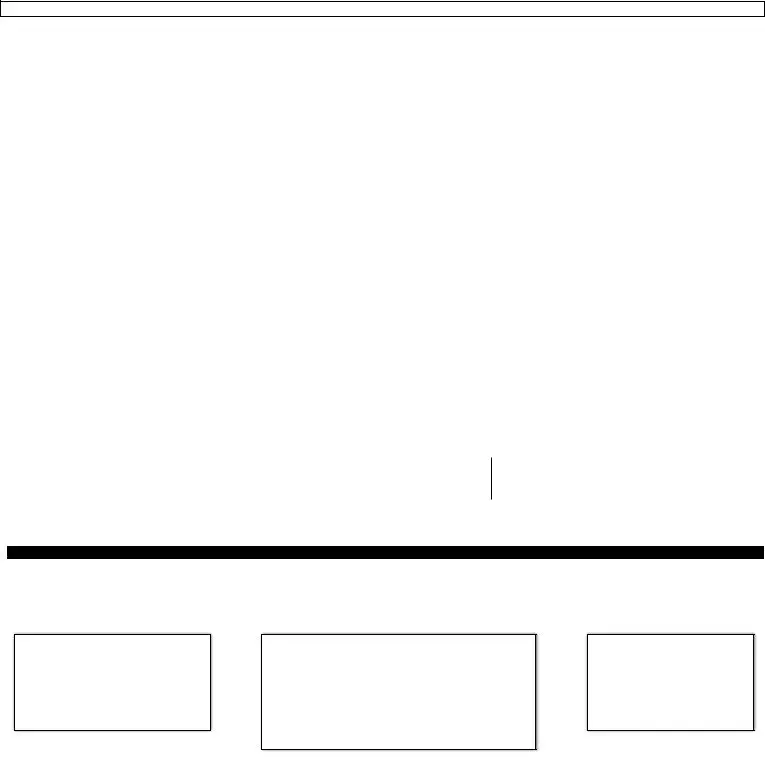

NY |

Locations of Places of Business Inside and Outside New York City

Locations of Places of Business Inside and Outside New York City

The following information must be entered for this return to be complete. (See Instructions)

The following information must be entered for this return to be complete. (See Instructions)