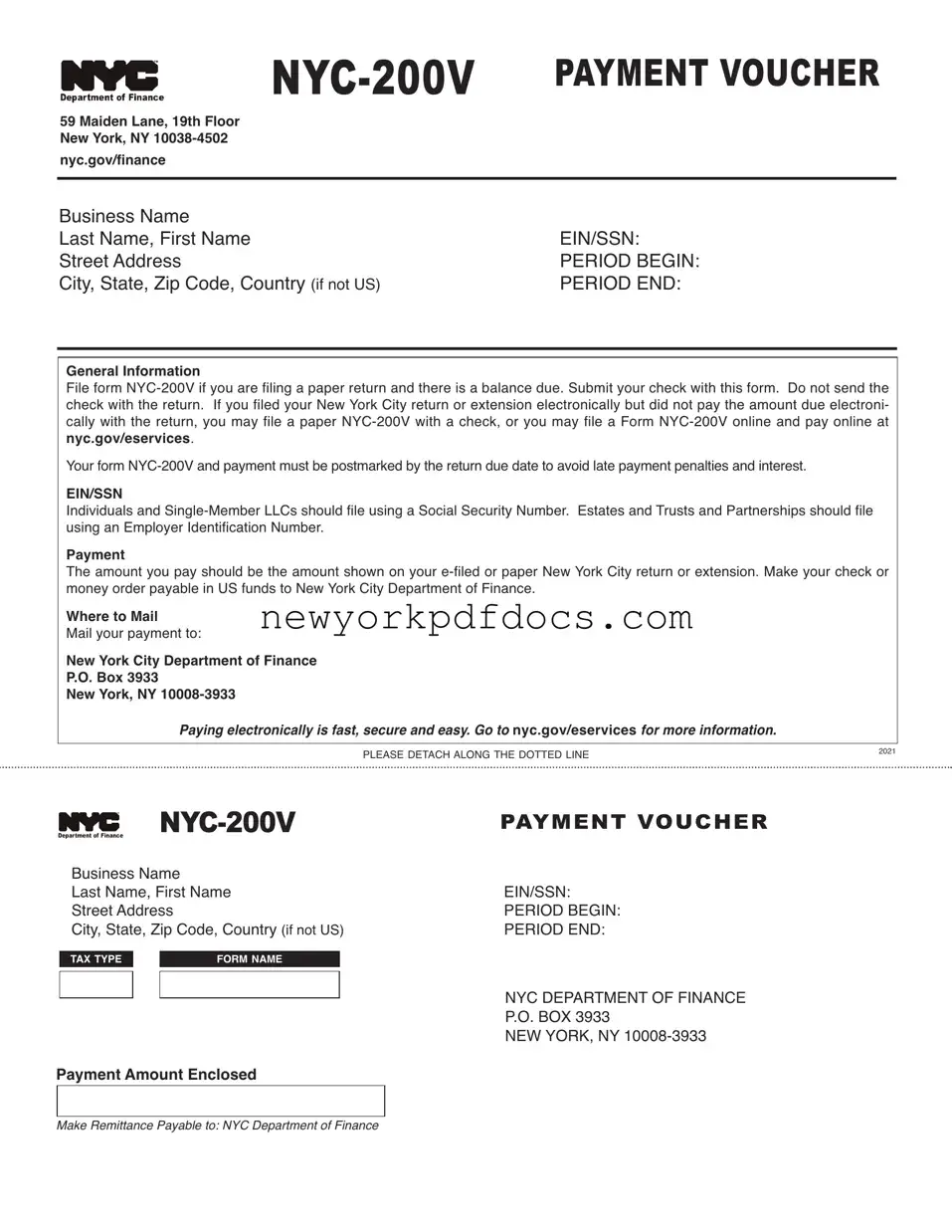

Free Nyc 200V Form

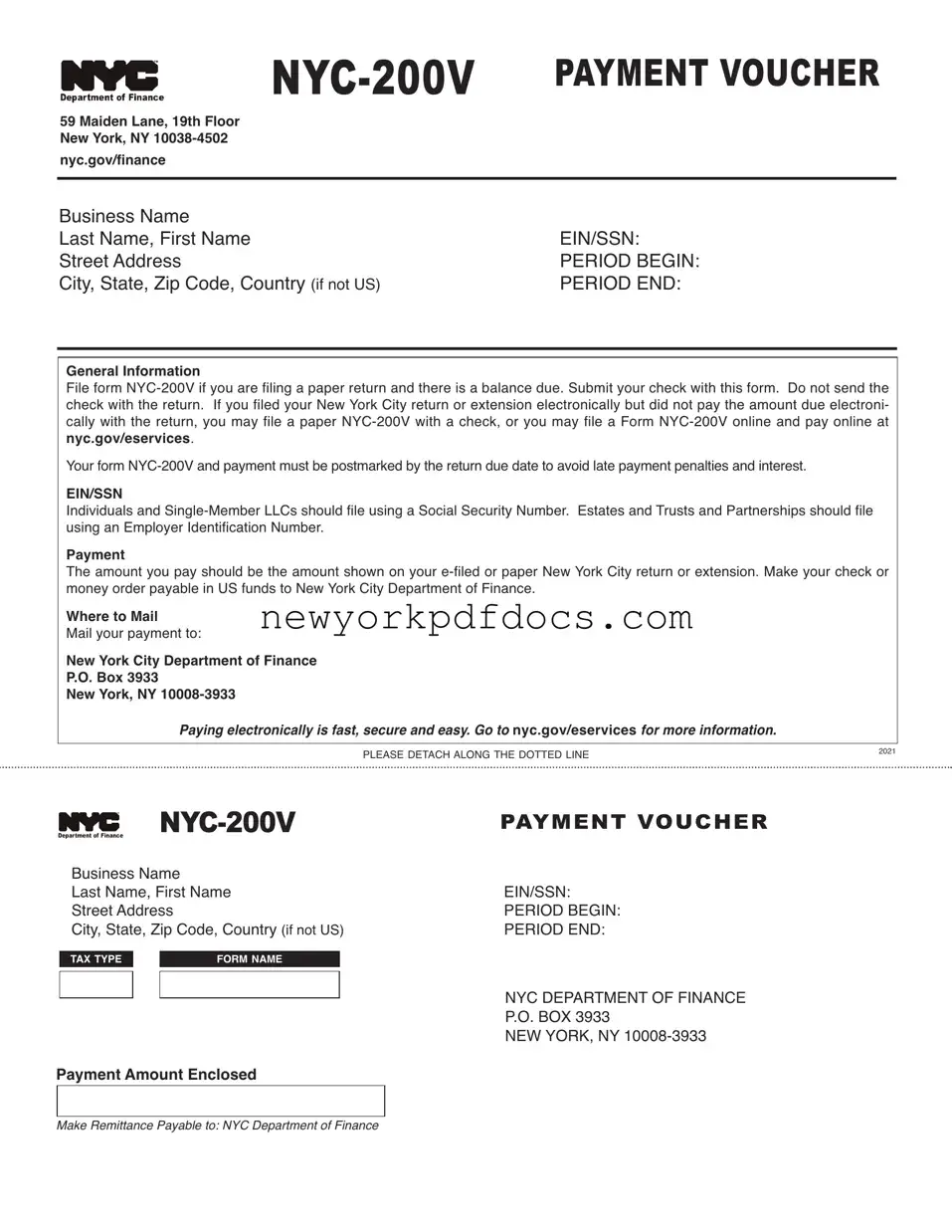

The NYC-200V Payment Voucher is a document used by individuals and businesses in New York City to submit payments for various taxes. This form helps ensure that your payment is processed efficiently and correctly. For those looking to pay electronically, the process is fast, secure, and easy, with more information available at nyc.gov/eservices.

Open My Document Now

Free Nyc 200V Form

Open My Document Now

Your form isn’t finalized yet

Edit, save, and download Nyc 200V online with ease.

Open My Document Now

or

⇓ Nyc 200V PDF