|

● and you and your spouse file a joint |

there are no applicable special condition |

the year, enter on line 1 the amount from |

|

New York State return and were |

codes for tax year 2020. |

Check the |

line 47 of Form IT-360.1 calculated as if |

|

both subject to Section 1127 for the |

Finance website for updated special con- |

the period of employment is the period |

|

same period of time, you and your |

dition codes. If applicable, enter the two |

of NYC residence. |

|

spouse must file a joint Form NYC- |

charactercodeintheboxprovidedonthe |

|

|

1127. |

form. |

|

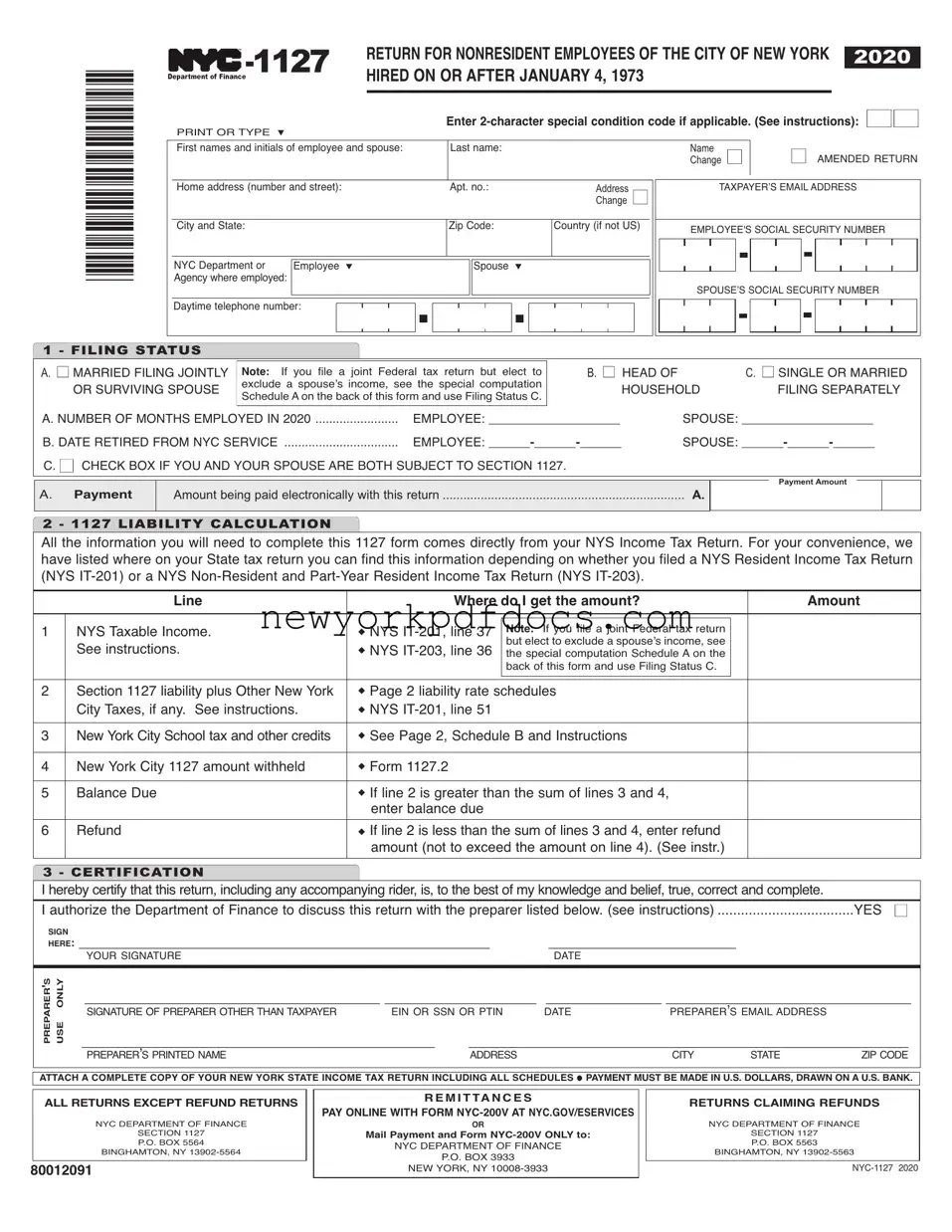

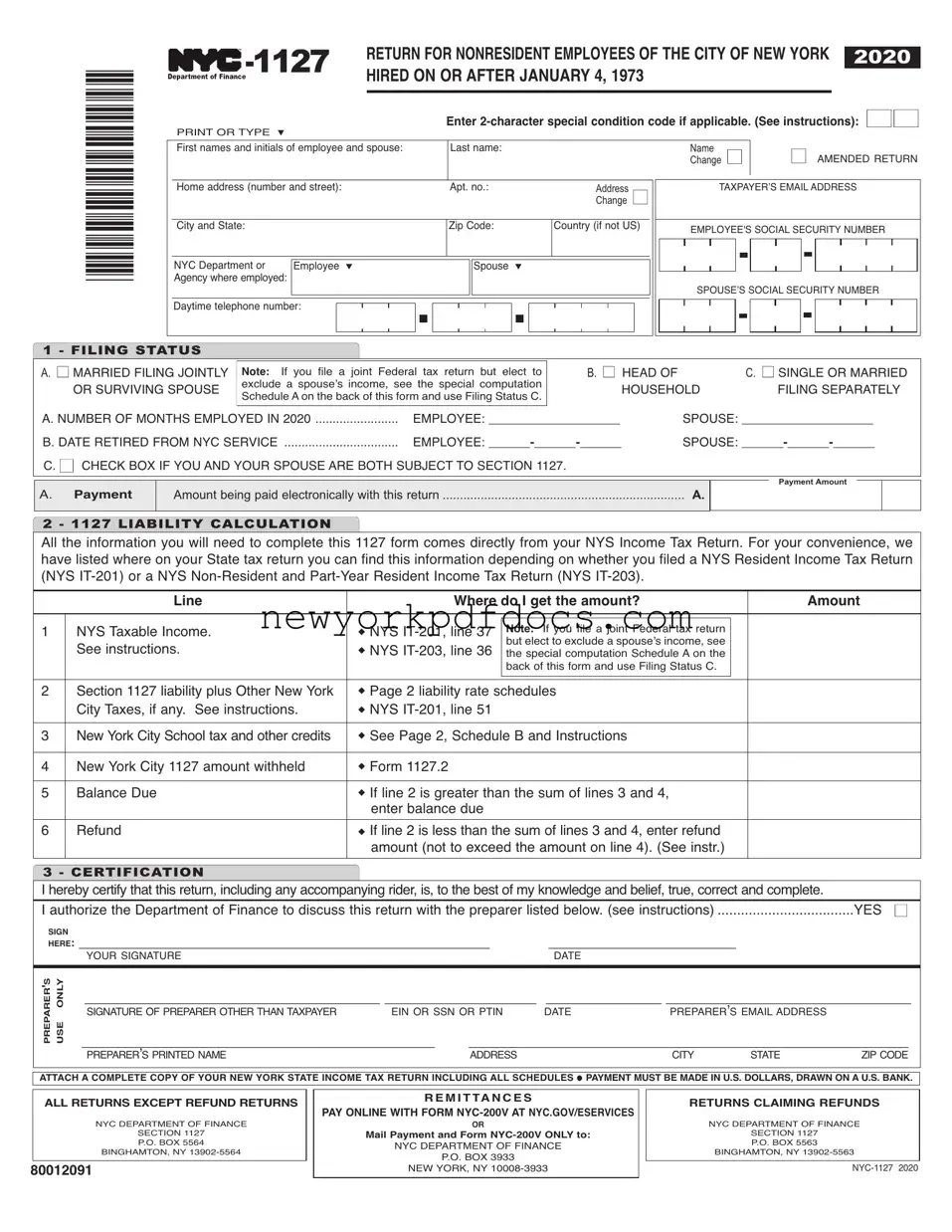

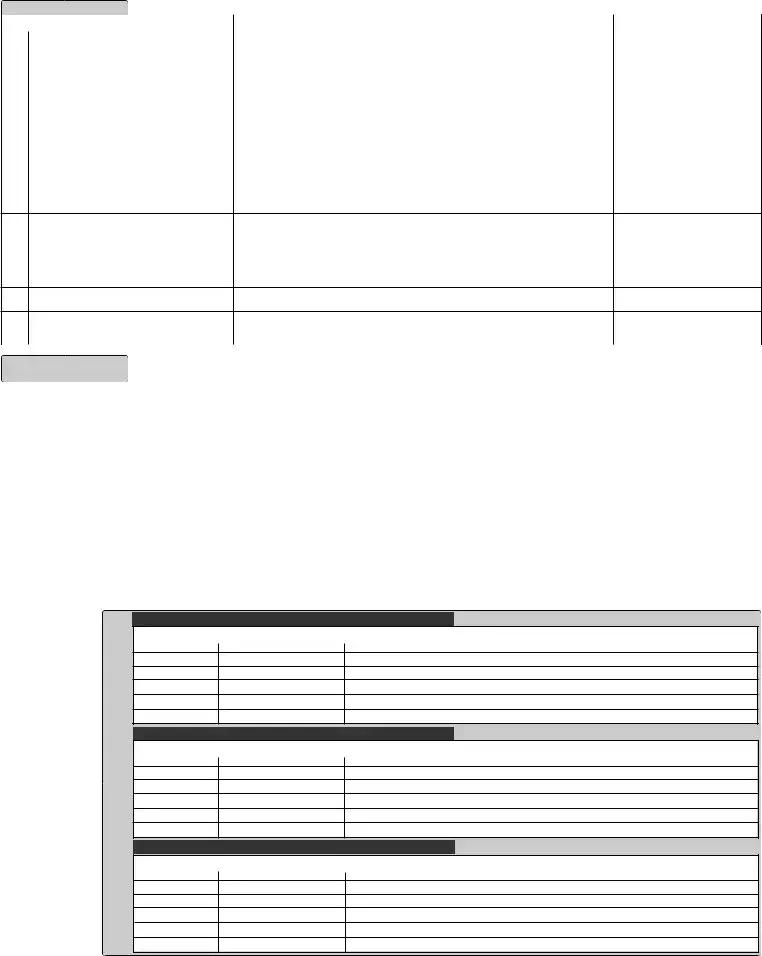

LINE 2 - LIABILITYAMOUNT |

|

|

|

|

Employees who are married and include |

|

PreparerAuthorization: Ifyouwantto |

In order to complete lines 1 through 6 of |

spouse’s income in Form NYC-1127, |

|

allow the Department of Finance to dis- |

Form NYC-1127, it will be necessary for |

use Liability Table A on page 2 to com- |

|

cuss your return with the paid preparer |

you to refer to the instructions for filing |

pute the liability amount. |

|

who signed it, you must check the "yes" |

Form IT-201 (Resident Income Tax |

|

|

box in the signature area of the return. |

Form - State of New York) or Form IT- |

Married employees who choose not to |

|

This authorization applies only to the |

203 (Nonresident and Part--Year |

include their spouse’s income on Form |

|

individual whose signature appears in |

Resident Income Tax Form - State of |

NYC-1127, use Liability Table C to |

|

the "Preparer's Use Only" section of |

NewYork). Booklets IT-201-I or IT-203- |

compute the liability amount. |

|

yourreturn. Itdoesnotapplytothefirm, |

I, issued by the New York State |

|

|

if any, shown in that section. By check- |

Department of Taxation and Finance, |

LIABILITYFOR OTHER NEW |

|

ing the "Yes" box, you are authorizing |

can be obtained from any District Tax |

YORK CITY TAXES |

|

the Department of Finance to call the |

Office of the New York State Income |

Include on line 2 the sum of your 1127 |

|

preparer to answer any questions that |

Tax Bureau. |

|

liability and the total of your liability for |

|

may arise during the processing of your |

|

|

other New York City taxes from New |

|

return. Also,youareauthorizingthepre- |

LINE 1 - NEWYORK STATE |

York State Form IT-201, line 51. |

|

parer to: |

TAXABLE INCOME |

|

|

|

|

If you file NYS Form IT-201, enter the |

LINE 3 - NEWYORK CITY |

|

● Give the Department any informa- |

amount on line 37. If you |

file NYS |

SCHOOLTAX CREDITS |

|

tion missing from your return, |

Form IT-203, enter the amount on line |

Add lines a1 through g on page 2, |

|

|

36. If the amount withheld pursuant to |

Schedule B, to report credits and pay- |

|

● Call the Department for information |

Section 1127 was included in itemized |

ments that would have reduced your |

|

about the processing of your return |

deductions when calculating your New |

New York City resident income tax lia- |

|

or the status of your refund or pay- |

York State Personal IncomeTax liability, |

bility had you been a City resident. No |

|

ment(s), and |

you must add back that amount to the |

amount reported on line 3 is refundable. |

|

|

amount from line 37 of NYS IT-201 or |

Refunds of overpayments of tax and |

|

● Respond to certain notices that you |

line 36 of NYS IT-203, as applicable, on |

refundable credits available to NewYork |

|

have shared with the preparer |

this line. |

|

State residents and part-year New York |

|

aboutmatherrors,offsets,andreturn |

|

|

City residents must be claimed by filing |

|

preparation. The notices will not be |

NOTE: If you file a joint Federal tax |

forms IT-201 or IT-203. |

|

sent to the preparer. |

return but elect to exclude a spouse’s |

|

|

|

income, see the special computation |

LINE 4 - PAYMENTS |

|

You are not authorizing the preparer to |

Schedule A on the back of this form and |

Enter on line 4 the amount withheld by |

|

receive any refund check, bind you to |

use Filing Status C. |

|

theCityfromyourwagesduring2020for |

|

anything(includinganyadditionalliabil- |

|

|

the amount due under Charter Section |

|

ity), or otherwise represent you before |

If you contributed to a New York State |

1127 as shown on your City Wage and |

|

the Department. The authorization can- |

Charitable Gifts Trust Fund, claim a |

Withholding Tax Statements for 2020. |

|

not be revoked, however, the authoriza- |

New York State itemized deduction for |

(Attach a copy of Form NYC-1127.2.) |

|

tion will automatically expire no later |

that contribution, and the period of your |

|

|

than the due date (without regard to any |

NYC employment encompassed the full |

LINE 5 - BALANCE DUE |

|

extensions) for filing next year's return. |

year, enter on line 1 the amount that you |

After completing this return, enter the |

|

Failure to check the box will be |

would have entered on line 47 of Form |

amount of your remittance on line A, |

|

deemed a denial of authority. |

IT-201 (see the instructions to line 47 of |

page 1. Remittances must be made |

|

|

FormIT-201includingtheworksheet).If |

payable to the order of: NYC DEPART- |

|

SPECIFIC INSTRUCTIONS |

you contributed to a New York State |

MENTOFFINANCE |

|

|

Charitable Gifts Trust Fund, claim a |

|

|

Special Condition Codes |

New York State itemized deduction for |

LINE 6 - OVERPAYMENT |

|

that contribution and the period of your |

Ifline2islessthanthesumoflines3and |

|

At the time this form is being published, |

|

NYC employment encompassed part of |

4 you may be entitled to a refund. Note: |

|

|

|

|

|